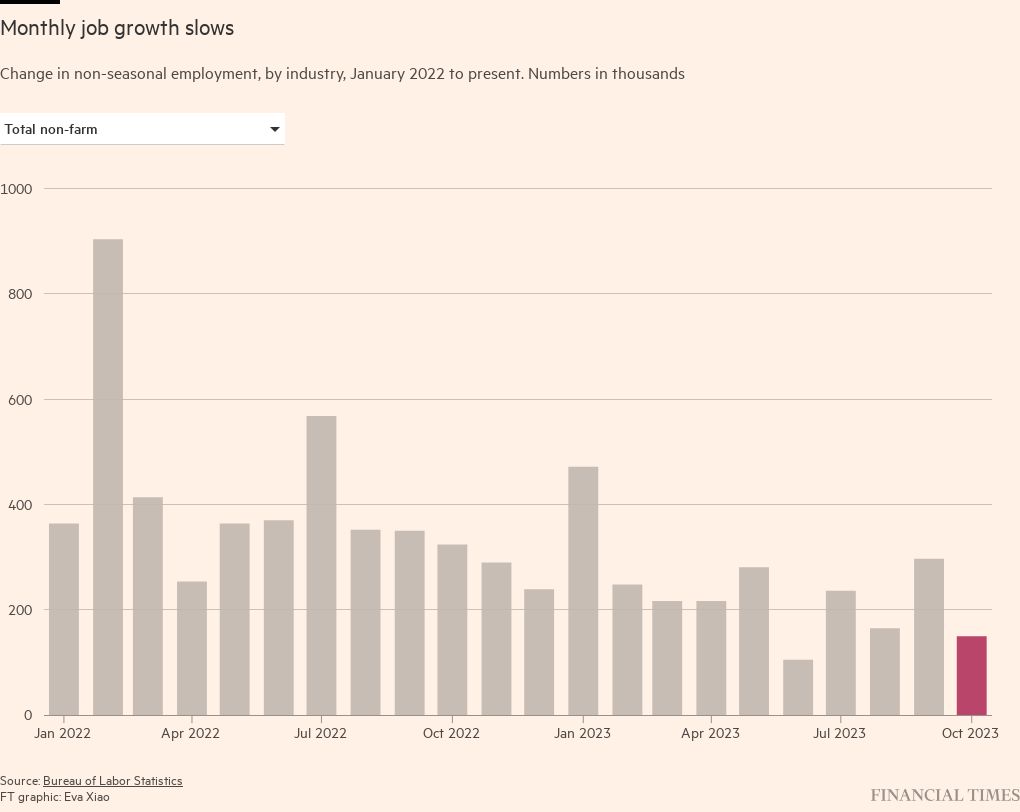

Free up the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.Jobs enlargement in the USA slowed sharply in October in a sign that the arena’s biggest economic system is beginning to cool, reigniting a rally in govt bonds.US employers created 150,000 new posts final month — lower than forecast and rarely part of September’s revised determine of 297,000. Economists surveyed by way of Bloomberg had anticipated a complete of 180,000 new jobs for October.The figures supplied additional gasoline for a rally in US Treasuries, as traders guess that the slowdown within the labour marketplace made it much more likely that the USA Federal Reserve is not going to carry charges additional in coming months.The S&P 500 additionally opened 0.7 in keeping with cent upper in early buying and selling, striking the inventory marketplace index not off course for its absolute best week in a 12 months.“This jobs document is . . . serving to persuade non-believers that that is very a lot the tip of the velocity hike cycle,” stated Kristina Hooper, leader international markets strategist at Invesco. “We’re very a lot in a disinflationary pattern, the economic system is cooling and the Fed does now not must hike charges once more.”After the information liberate, buyers absolutely priced in a price minimize in June final 12 months, in comparison with their earlier expectancies of a minimize in July.The yield at the two-year Treasury word, which strikes inversely to value and tracks rate of interest expectancies, fell to a two-month low of four.85 in keeping with cent.In step with the Bureau of Exertions Statistics information, the USA unemployment price rose to three.9 in keeping with cent in October, from 3.8 in keeping with cent in September. Moderate income edged 0.2 in keeping with cent upper, a slight slowdown from the 0.3 in keeping with cent building up within the earlier month.In an extra revision, activity good points in August have been revised decrease by way of 62,000 to 165,000.You’re seeing a snapshot of an interactive graphic. That is possibly because of being offline or JavaScript being disabled for your browser.

However it held rates of interest secure on Wednesday and in conjunction with different central banks is extensively anticipated to stay borrowing prices at present ranges for a while.Monetary markets have increasingly more priced in bets that the Fed will dangle off additional price will increase, with officers moving the talk in opposition to how lengthy to stay them prime.After Friday’s information liberate, the yield at the 10-year Treasury word, which strikes in step with enlargement expectancies, fell to its lowest degree since mid-October, down 0.12 proportion level to 4.55 in keeping with cent. Bond markets started this week’s rally after Wednesday’s Fed assembly, bringing concerning the greatest two-day fall in 10-year Treasury yields since the USA banking disaster of early March.Traders highlighted remarks by way of Fed leader Jay Powell that the central financial institution used to be “continuing in moderation” with long run price rises, which some took as an indication that borrowing prices have already succeeded in slowing down the USA economic system.

However it held rates of interest secure on Wednesday and in conjunction with different central banks is extensively anticipated to stay borrowing prices at present ranges for a while.Monetary markets have increasingly more priced in bets that the Fed will dangle off additional price will increase, with officers moving the talk in opposition to how lengthy to stay them prime.After Friday’s information liberate, the yield at the 10-year Treasury word, which strikes in step with enlargement expectancies, fell to its lowest degree since mid-October, down 0.12 proportion level to 4.55 in keeping with cent. Bond markets started this week’s rally after Wednesday’s Fed assembly, bringing concerning the greatest two-day fall in 10-year Treasury yields since the USA banking disaster of early March.Traders highlighted remarks by way of Fed leader Jay Powell that the central financial institution used to be “continuing in moderation” with long run price rises, which some took as an indication that borrowing prices have already succeeded in slowing down the USA economic system.

Bonds rally as US jobs enlargement slows greater than forecast