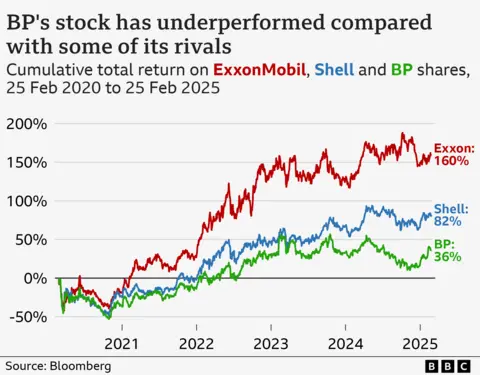

Simon JackBusiness editor, BBC Information Getty ImagesBP is anticipated to announce it’s going to slash its renewable power investments and as an alternative center of attention on expanding oil and gasoline manufacturing.The power massive will define its technique later following drive from some traders unsatisfied its earnings and proportion worth had been a lot less than its competitors.Shell and Norwegian corporate Equinor have already scaled again their plans to put money into inexperienced power. In the meantime US President Donald Trump’s “drill child drill” feedback have inspired funding in fossil fuels and a transfer clear of low carbon initiatives.Some shareholders and environmental teams have voiced issues over any possible ramping up on manufacturing of fossil fuels.5 years in the past, BP set one of the vital maximum formidable goals amongst huge oil corporations to chop manufacturing of oil and gasoline by way of 40% by way of 2030, whilst considerably ramping up funding in renewables.In 2023, the corporate diminished this oil and gasoline relief goal to twenty-five%. It’s now anticipated to desert it altogether whilst confirming it’s reducing investments in renewable power by way of greater than part in what leader govt Murray Auchincloss referred to as a “basic reset”.Mr Auchincloss is underneath drive to spice up earnings from some shareholders together with the influential activist workforce Elliot Control, which took a close to £4bn stake within the £70bn corporate to push for extra funding in oil and gasoline.In 2024, BP’s internet source of revenue fell to $8.9bn (£7.2bn), down from $13.8bn the former 12 months.Since 2020 when former leader govt Bernard Looney first unveiled his technique, shareholders have won general returns together with dividends of 36% during the last 5 years. Against this, shareholders in competitors Shell and Exxon have observed returns of 82% and 160% respectively.BP’s underneath efficiency has brought about hypothesis that it can be a takeover goal or would possibly imagine transferring its major inventory marketplace checklist to the United States the place oil and gasoline corporations command upper valuations.Now not all shareholders need the corporate to switch direction so radically.Ultimate week, a bunch of 48 traders referred to as at the corporate to permit them a vote on any possible plans to transport clear of its earlier commitments to renewables.A spokesperson for one of the most signatories, Royal London Asset Control, stated: “As long-term shareholders, we recognise BP’s previous efforts towards power transition however stay involved in regards to the corporate’s endured funding in fossil gasoline enlargement.”

Getty ImagesBP is anticipated to announce it’s going to slash its renewable power investments and as an alternative center of attention on expanding oil and gasoline manufacturing.The power massive will define its technique later following drive from some traders unsatisfied its earnings and proportion worth had been a lot less than its competitors.Shell and Norwegian corporate Equinor have already scaled again their plans to put money into inexperienced power. In the meantime US President Donald Trump’s “drill child drill” feedback have inspired funding in fossil fuels and a transfer clear of low carbon initiatives.Some shareholders and environmental teams have voiced issues over any possible ramping up on manufacturing of fossil fuels.5 years in the past, BP set one of the vital maximum formidable goals amongst huge oil corporations to chop manufacturing of oil and gasoline by way of 40% by way of 2030, whilst considerably ramping up funding in renewables.In 2023, the corporate diminished this oil and gasoline relief goal to twenty-five%. It’s now anticipated to desert it altogether whilst confirming it’s reducing investments in renewable power by way of greater than part in what leader govt Murray Auchincloss referred to as a “basic reset”.Mr Auchincloss is underneath drive to spice up earnings from some shareholders together with the influential activist workforce Elliot Control, which took a close to £4bn stake within the £70bn corporate to push for extra funding in oil and gasoline.In 2024, BP’s internet source of revenue fell to $8.9bn (£7.2bn), down from $13.8bn the former 12 months.Since 2020 when former leader govt Bernard Looney first unveiled his technique, shareholders have won general returns together with dividends of 36% during the last 5 years. Against this, shareholders in competitors Shell and Exxon have observed returns of 82% and 160% respectively.BP’s underneath efficiency has brought about hypothesis that it can be a takeover goal or would possibly imagine transferring its major inventory marketplace checklist to the United States the place oil and gasoline corporations command upper valuations.Now not all shareholders need the corporate to switch direction so radically.Ultimate week, a bunch of 48 traders referred to as at the corporate to permit them a vote on any possible plans to transport clear of its earlier commitments to renewables.A spokesperson for one of the most signatories, Royal London Asset Control, stated: “As long-term shareholders, we recognise BP’s previous efforts towards power transition however stay involved in regards to the corporate’s endured funding in fossil gasoline enlargement.” The environmental workforce Greenpeace UK has warned BP may be expecting “pushback and problem at each flip if it doubles down on fossil fuels – now not simply from inexperienced campaigners however from its personal shareholders”.Senior local weather adviser Charlie Kronick stated: “Executive insurance policies can even wish to prioritise renewable energy, and as excessive climate places drive on insurance coverage fashions – policymakers shall be taking a look to fossil gasoline earnings so as to fund excessive climate restoration. BP may wish to severely put the brakes in this U-turn.”‘Science hasn’t modified'”I do wonder if this type of determination will glance proper in 10 years,” added Sir Ian Cheshire, who has held many govt roles at corporations reminiscent of B&Q proprietor Kingfisher and Barclays financial institution.He instructed the BBC’s These days programme that the “total power transition” to renewables was once “nonetheless going to return”. “The local weather exchange factor has now not long gone away, the science hasn’t modified,” he stated. AJ Bell analyst Russ Mildew stated this was once one of the important moments for BP within the closing 4 or 5 years.”Different power corporations had been clearer about their intentions so far than BP,” he stated.”They wish to end up to other people that when a hard operational and proportion worth efficiency in comparison to their friends, that they are taking a look to do something positive about it, now not simply let issues go with the flow alongside, he added.BP has already positioned its offshore wind trade in a three way partnership with Jap corporate Jera and is taking a look to discover a spouse to do the similar with its sun trade. The refocus on oil and gasoline may additionally see gross sales of different companies to be able to get “non-core stuff off the books” as insiders describe it. It’s over two decades since former leader govt Lord John Browne stated BP may stand for “Past Petroleum” as he introduced the corporate’s first tentative strikes clear of oil and gasoline. These days’s technique shift might be dubbed “Again to Petroleum” – to the satisfaction of a few shareholders and to the dismay of others. Each BP and Elliott control declined to remark.

The environmental workforce Greenpeace UK has warned BP may be expecting “pushback and problem at each flip if it doubles down on fossil fuels – now not simply from inexperienced campaigners however from its personal shareholders”.Senior local weather adviser Charlie Kronick stated: “Executive insurance policies can even wish to prioritise renewable energy, and as excessive climate places drive on insurance coverage fashions – policymakers shall be taking a look to fossil gasoline earnings so as to fund excessive climate restoration. BP may wish to severely put the brakes in this U-turn.”‘Science hasn’t modified'”I do wonder if this type of determination will glance proper in 10 years,” added Sir Ian Cheshire, who has held many govt roles at corporations reminiscent of B&Q proprietor Kingfisher and Barclays financial institution.He instructed the BBC’s These days programme that the “total power transition” to renewables was once “nonetheless going to return”. “The local weather exchange factor has now not long gone away, the science hasn’t modified,” he stated. AJ Bell analyst Russ Mildew stated this was once one of the important moments for BP within the closing 4 or 5 years.”Different power corporations had been clearer about their intentions so far than BP,” he stated.”They wish to end up to other people that when a hard operational and proportion worth efficiency in comparison to their friends, that they are taking a look to do something positive about it, now not simply let issues go with the flow alongside, he added.BP has already positioned its offshore wind trade in a three way partnership with Jap corporate Jera and is taking a look to discover a spouse to do the similar with its sun trade. The refocus on oil and gasoline may additionally see gross sales of different companies to be able to get “non-core stuff off the books” as insiders describe it. It’s over two decades since former leader govt Lord John Browne stated BP may stand for “Past Petroleum” as he introduced the corporate’s first tentative strikes clear of oil and gasoline. These days’s technique shift might be dubbed “Again to Petroleum” – to the satisfaction of a few shareholders and to the dismay of others. Each BP and Elliott control declined to remark.

BP to slash renewables funding and ramp up gasoline and oil manufacturing.