Bitcoin demonstrated resistance in opposition to the disadvantage regardless of leveraged longs liquidations.

The display of energy continues as Bitcoin ETFs acquire, elevating possibilities of a $70,000 worth.

Bitcoin [BTC] is at the verge of pushing above $70,000. Whilst this may increasingly appear daring to state. It was once only a few weeks that the cryptocurrency struggled to stick above $60,000.

A transparent shift has passed off out there, making it more straightforward for the bulls to push upper.

Bitcoin demonstrated tough call for within the final six days, an indication that the bulls are again in regulate as soon as once more, after cooling off within the first 10 days of October.

In different phrases, it sounds as if that BTC is as soon as once more development at the identical momentum that was once found in September.

There are a couple of the reason why a $70,000 Bitcoin price ticket would possibly happen in an issue of days or perhaps weeks.

Bitcoin demonstrated a large number of volatility within the final 24 hours, together with a wave of promote power, pulling it again simply shy of the $68,000 worth degree.

On the other hand, this was once adopted through a requirement resurgence, pushing worth again up and heading off extra problem.

Bitcoin snaps again regardless of leverage shake off

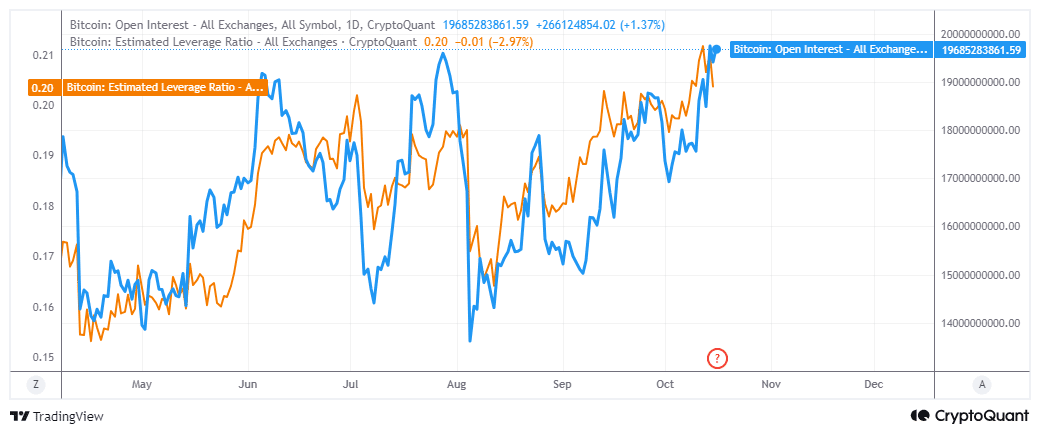

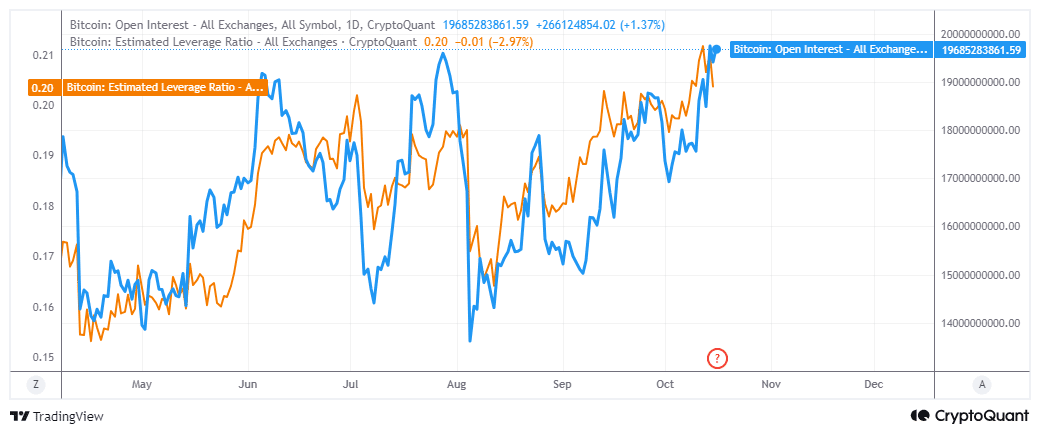

BTC’s excessive volatility right through Tuesday’s buying and selling consultation had the makings of a leverage shake-off. It’s because its Open Passion was once the very best that it’s been in historical past.

On most sensible of that, the estimated leverage ratio additionally soared to a brand new native prime.

Supply: CryptoQuant

Supply: CryptoQuant

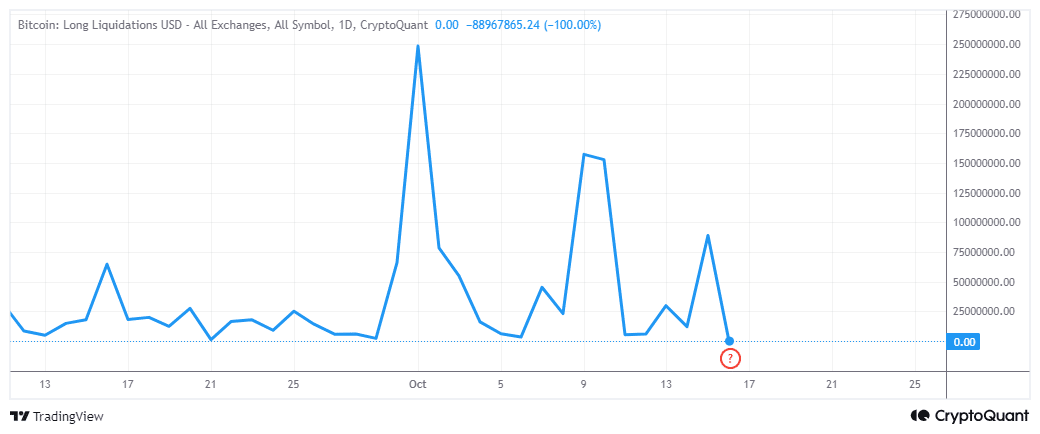

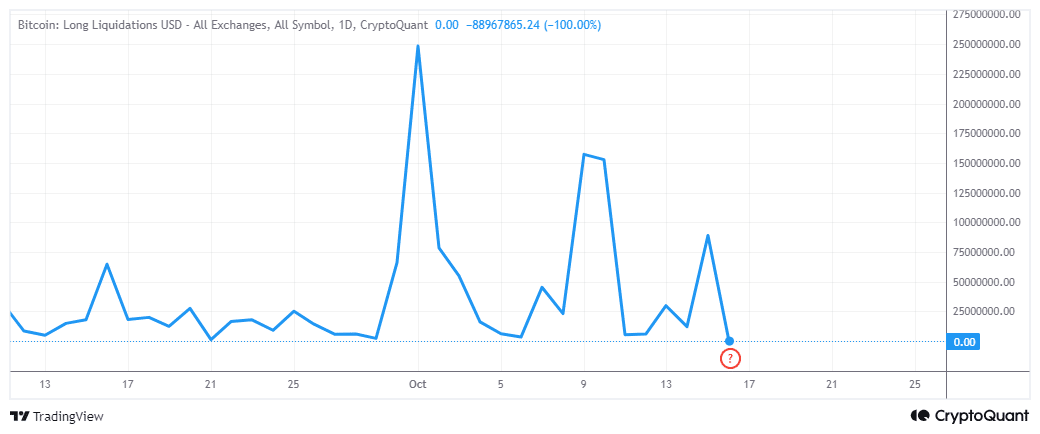

Top leverage with corresponding open hobby are generally a set-up for liquidations. Particularly right through occasions of maximum optimism and as soon as the pullback happens, it dents the sentiment most often.

On the other hand, that was once no longer the result that performed out right through Tuesday’s buying and selling consultation.

Lengthy liquidations peaked at $88.9 million on 15 September. On the other hand, call for briefly snapped again, pushing worth again above $67,000.

Supply: CryptoQuant

Supply: CryptoQuant

The above end result showed the rising optimism in Bitcoin’s skill to seize extra beneficial properties. On most sensible of that, the new call for resurgence was once characterised through heavy accumulation through Bitcoin ETFs.

Fresh reviews printed that Bitcoin ETFs gathered over $500 million value of BTC within the final 24 hours.

In a similar fashion, ETFs gathered over $500 million value of BTC at the 14 of October. Those findings indicated that institutional call for was once additionally leaning at the bullish aspect.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

This additional explains why the cryptocurrency is now resisting the disadvantage. It additionally backs the expectancies that the bullish will most likely push above $70,000 very quickly.

On most sensible of that, a big catalyst (the U.S. elections) would possibly upload extra gas to the rocketing BTC costs relying at the end result.

Subsequent: Crypto liquidations surge to $300 million – THIS crew hit toughest