Everyone knows the historical past of the past due 90s tech bubble, when enthusiasm for the then-new virtual financial system inflated the dot.com firms to an abnormal stage – after which the bubble burst. The explosion of AI onto these days’s tech scene brings that previous bubble to thoughts.

However there are variations in these days’s scenario, vital variations that counsel these days’s enthusiasm for AI tech is a extra enduring phenomenon. Initially, call for for AI is proving constant around the tech global, and for any other, the adjustments that AI is ushering in are nearly sure to be longer-lasting.

In a contemporary observation, Wedbush analyst Daniel Ives, a well known tech skilled, emphasised those variations, declaring, “We’ve got coated tech at the Boulevard because the past due 90’s and that is NOT a bubble however as an alternative the beginning of a 4th Business Revolution now at the doorstep that can have primary expansion ramifications for the tech sector led via the instrument/use case segment in movement… In our opinion taking a step again that is simply the highest of the primary inning of a $1 trillion + AI marketplace alternative coming to the shores of the tech sector over the following couple of years led via the venture marketplace and adopted via the patron use circumstances (Apple, Meta, Google, Amazon) set to be deployed over the approaching years.”

Unsurprisingly, Ives has taken those ideas to their logical conclusion, making explicit suggestions. In Ives’ view, C3.ai (NYSE:AI) and Palantir (NYSE:PLTR) are among the finest AI shares to shop for presently. Right here’s a more in-depth have a look at the main points.

C3.ai

We’ll get started with C3.ai, a instrument company that has constructed itself as a pacesetter in enterprise-scale AI programs. The corporate’s product line comprises quite a lot of AI-powered instrument and equipment, to be had via its AI Programs, AI Utility Platform, and AI Building Gear. C3.ai’s instrument is used throughout a large number of financial sectors, from buyer engagement to fraud detection to predictive upkeep to provide chain optimization. The corporate markets its AI merchandise to consumers massive and small, together with primary names just like the oilfield products and services company Baker Hughes, the software corporate ConEdison, or even america Military and Air Pressure.

C3.ai isn’t simply an trade chief in venture AI, it’s often referred to as an innovator, and a mover within the ongoing virtual transformation of the worldwide financial system. The corporate supplies its AI apps and instrument with a mix of potency and value advantages that deliver price whilst supporting consumer operations, a legitimate aggregate for any tech supplier. C3.ai’s consumers notice advantages in advanced engagement with their very own consumers, cleaner financial pathways, and smoother provide chains. In brief, C3.ai has put itself on the middle of the adjustments that AI generation is bringing to the sector, and to the tactics we paintings in it.

Stocks in C3.ai were unstable this yr, starting from a excessive of $37 to a low of $20. On the other hand, the inventory gained an important spice up after the discharge of its fiscal 4Q24 monetary effects on Would possibly 29.

The surge got here after C3.ai beat the expectancies on each the fiscal This fall effects and the steerage for fiscal 2025. The corporate reported a most sensible line for the quarter of $86.6 million, beating the forecast via $2.2 million and rising nearly 20% year-over-year. The base line got here to a internet lack of 11 cents in keeping with proportion, via non-GAAP measures. Whilst damaging, this EPS beat the estimates via 19 cents in keeping with proportion.

Taking a look forward, the corporate equipped income steerage for fiscal yr 2025 that was once effectively above the consensus. Control predicts a most sensible line within the differ of $370 million to $395 million for fiscal 2025, in comparison to the $367.53 million that have been anticipated.

Checking in with Wedbush’s Daniel Ives, we discover that he’s upbeat on C3.ai’s efficiency, and at the corporate’s potentialities to continue to grow.

“C3 delivered its FY4Q24 (April) effects that includes most sensible and bottom-line beats whilst increasing its marketplace proportion throughout a myriad of industries pointing to its expanding marketplace proportion on this early degree of the AI Revolution… The corporate additionally famous that during FY4Q24, C3 witnessed 50k inquiries for its Generative AI answers throughout 15 other industries as the corporate continues to deepen into new verticals and reinforce its diversification throughout industries. This was once a step in the proper path,” Ives opined.

Ives is going on to provide the inventory an Outperform (i.e. Purchase) score, accompanied via a $40 worth goal that presentations his self assurance in a 28% upside at the 12-month horizon. (To look at Ives’ observe file, click on right here)

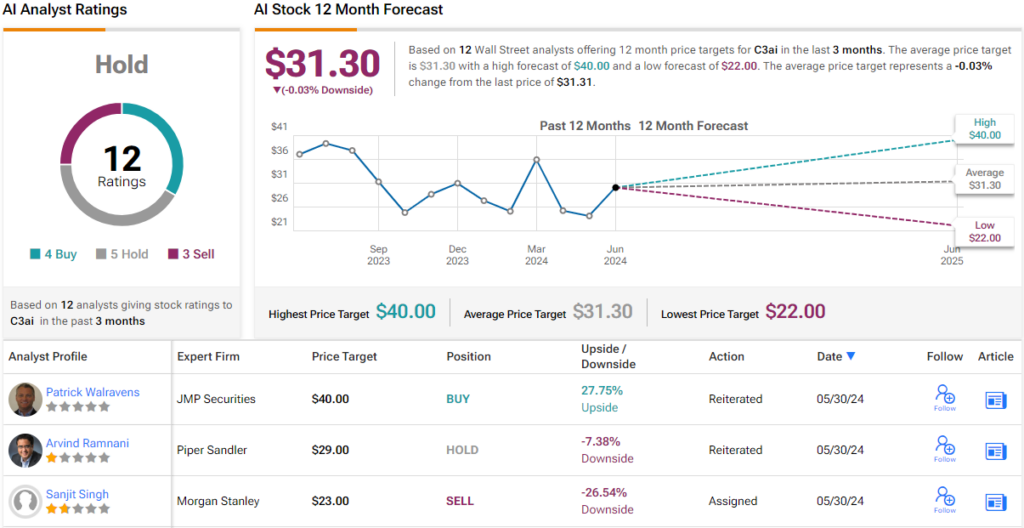

Whilst Ives is bullish, the entire view on Wall Boulevard is much less so. The inventory has 12 fresh analyst critiques on record, that spoil right down to 4 Buys, 5 Holds, and three Sells, for a Grasp consensus score. The analysts wait for stocks to stick range-bound for the foreseeable long run, because the $31.30 moderate worth goal signifies. (See AI inventory forecast)

Palantir

Subsequent up is Palantir, a tech company based via billionaire and prolific mission capitalist Peter Thiel. Palantir was once based in 2003 to make use of state-of-the-art knowledge analytics generation to supply usable insights. The company was once named after the paranormal seeing-stones from Tolkien’s Lord of the Rings; the stones are ‘the ones which glance some distance means,’ and that sums up Palantir’s venture. The corporate’s complicated knowledge analytics and AI instrument permit its consumers to view the underlying patterns of occasions in actual time.

AI lies on the middle of all it does, however Palantir does no longer forget about or pass over the human issue. The corporate sees AI tech as some way of augmenting human intelligence, no longer changing it, and works to mix each to harvest the original advantages that each and every can be offering. Palantir’s subscribers have get entry to to a spread of AI platforms, together with the flagship AIP (AI platform), designed on that premise, the usage of herbal language processing to permit advanced interactions with human customers. The corporate’s merchandise and equipment can perceive advanced consumer questions, and provides detailed, nuanced solutions in reaction, an ability in line with the style of human interplay. The methods are designed to steer clear of the usage of advanced computing codes and scripts, and to steer clear of programming languages and statistical fashions; Palantir’s purpose is to make high-end knowledge research simply available to the non-expert.

AI and information research are turning into ever extra worthwhile throughout quite a lot of sectors, and for all kinds of consumers. Palantir’s products and services are in excessive call for, in particular within the Division of Protection. On Would possibly 30, the corporate introduced it had gained a $153 million preliminary contract with the Division of Protection, with further awards imaginable as much as $480 million over the following 5 years.

This contract win made a pleasant cherry on most sensible of Palantir’s remaining quarterly profits record, launched early in Would possibly for 1Q24. The corporate reported its most sensible line at $634 million, for a year-over-year achieve of just about 21%. This was once over $16 million higher than have been expected. The base line, an 8 cents in keeping with proportion non-GAAP EPS, was once consistent with expectancies. By means of GAAP measures, Palantir’s Q1 was once its 6th winning quarter in a row. The forged monetary effects got here on most sensible of a robust achieve within the buyer rely; Palantir grew its buyer base via 42% year-over-year.

Daniel Ives is inspired via this AI corporate, in particular its rising capability for expansion. He writes of Palantir, “We proceed to peer greater momentum within the PLTR expansion tale with AIP main the price in producing vital call for throughout each industrial and govt landscapes whilst well-positioned to achieve a bigger proportion of this $1 trillion alternative happening with AI use circumstances exploding globally.”

Seeing a marketplace like that forward of Palantir, it’s no marvel that Ives charges the inventory as Outperform (i.e. Purchase). He units his worth goal at $35, implying an upside of ~47% over the following three hundred and sixty five days.

As soon as once more, we’re taking a look at a inventory with a Boulevard consensus considerably much less positive than the Wedbush view. The Grasp consensus this is in line with 12 analyst critiques, with best 2 Buys overbalanced via 7 Holds and three Sells. The stocks are priced at $23.85, and their $22.11 moderate goal worth suggests a 7% drawback from that stage. (See PLTR inventory forecast)

To seek out excellent concepts for AI shares buying and selling at sexy valuations, seek advice from TipRanks’ Easiest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions best. You will need to to do your personal research ahead of making any funding.