The certain studying of the bulls and bears indicator means that the associated fee may build up.

Ethereum’s community was once overrated and may impede the prospective upswing.

The cost of Ethereum [ETH] may have reduced through 7.30% within the remaining 24 hours, however an overview of a key indicator steered that the decline may quickly finish.

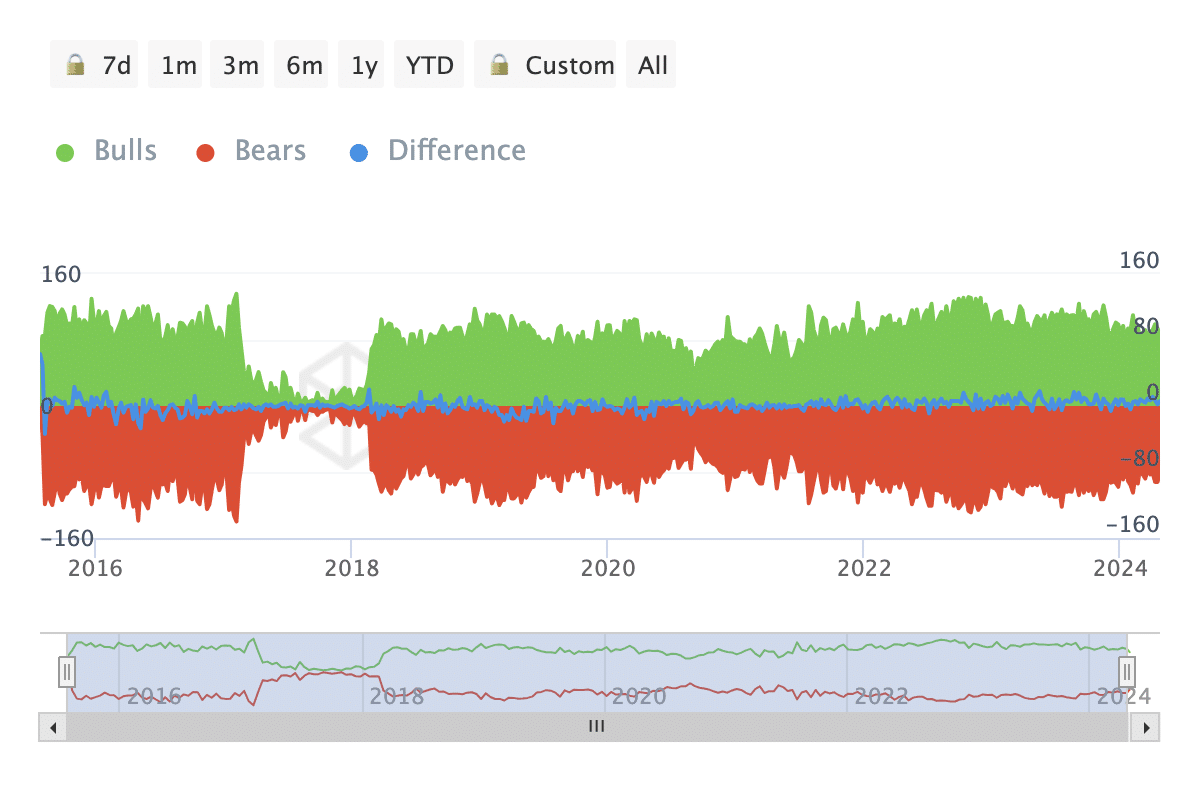

The indicator mentioned here’s the Bulls And Bears metric supplied through IntoTheBlock. This indicator can also be measured in addresses or quantity.

Then again, the point of interest is most often on huge consumers or dealers, as they’ve a large affect on value actions.

The 1% need to stay the religion

A web detrimental of the Bulls and Bears indicator suggests extra huge promote orders than buys. On this example, the cost of the asset concerned may lower.

However for Ethereum, knowledge confirmed that the studying was once certain, indicating bullish self belief in the associated fee pattern. Will have to this metric deal with its place over the approaching days, then ETH may be able to upward thrust towards $3,100.

Supply: IntoTheBlock

Supply: IntoTheBlock

Then again, failure to maintain the established order or enhance on it will ship the cost of the altcoin under $2,800. When AMBCrypto checked out Ethereum’s STH-NUPL, we seen that marketplace members weren’t precisely assured within the cryptocurrency.

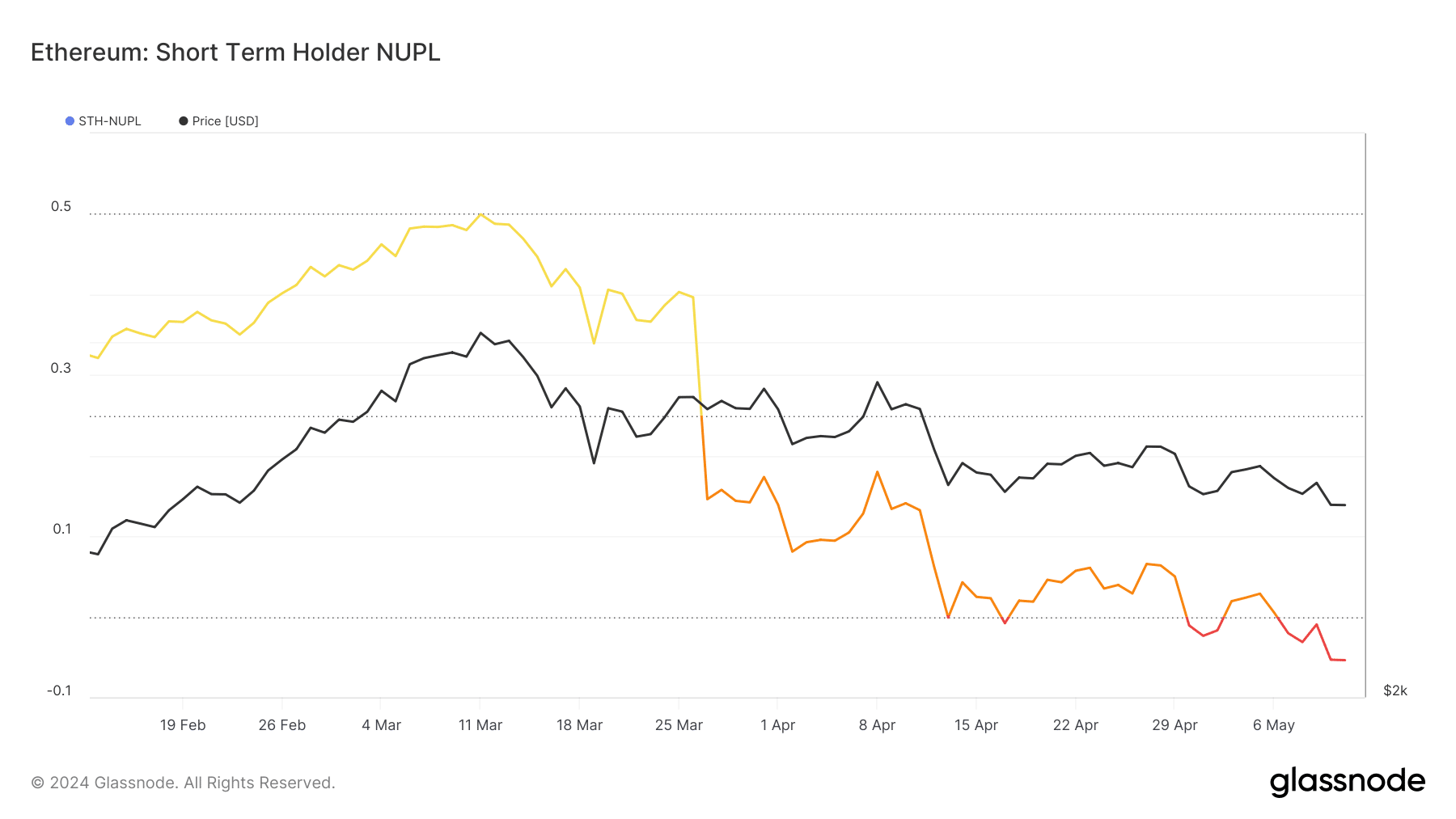

STH-NUPL stands for Quick Time period Holder — Internet Unrealized Benefit/Loss. With this metric, one could have an concept of the conduct of non permanent traders.

Buyers panic, however ETH might come to their help

From our research, ETH’s underwhelming value motion has modified the sentiment traders have towards the coin. In March, the metric was once within the optimism (yellow) area.

At that time, holders have been assured in ETH’s value motion. However as of this writing, that studying has reached the capitulation (crimson) area, indicating that marketplace members are in concern.

Supply: Glassnode

Supply: Glassnode

Then again, concern can act as gas for a leap. If the STH-NUPL continues to fall, ETH’s value may additionally lower.

Shifting, on, a turnaround may happen as intense concern may cause a more difficult upswing if purchasing drive will increase.

On this example, Ethereum may goal a upward thrust towards $3,500. But even so this metric, AMBCrypto discovered any other indicator suggesting that ETH may quickly get better.

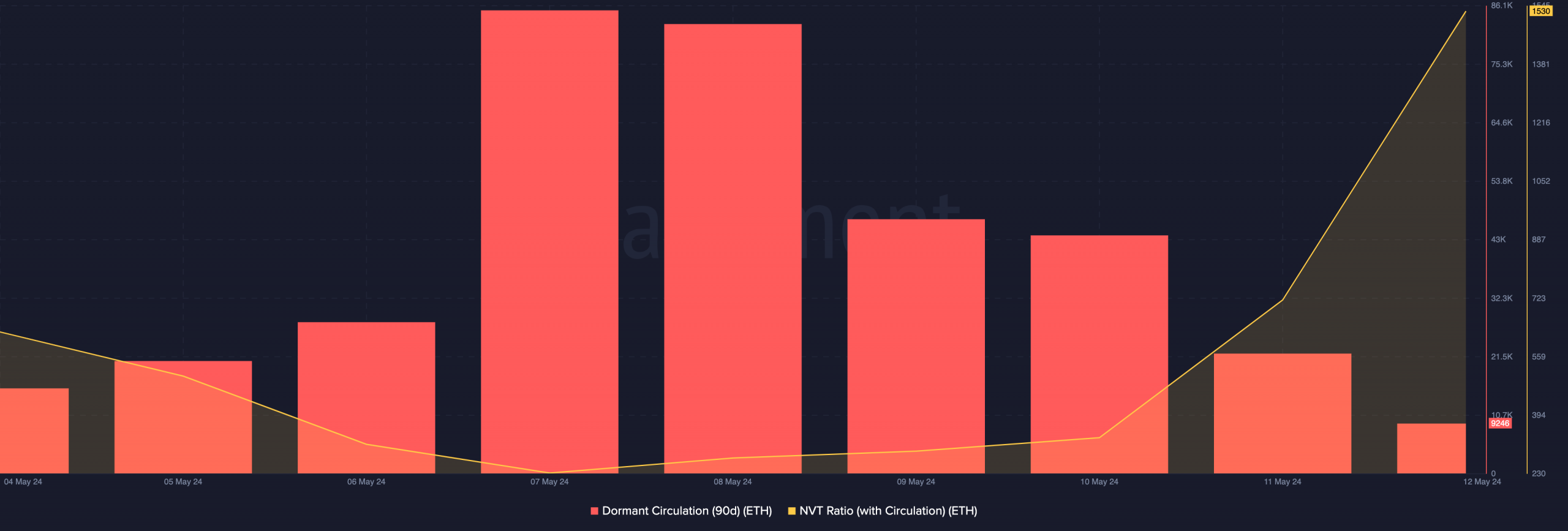

This time, we appeared to the dormant movement. In keeping with on-chain knowledge from Santiment, the 90-day dormant movement had dropped to 9246.

If the metric will increase, it implies that cash that experience no longer moved for an extended whilst are beginning to alternate wallets. On occasion, this implies previous palms are promoting.

Supply: Santiment

Supply: Santiment

Thus, the new decline implied that long-term Ethereum traders weren’t promoting up to they did across the seventh and eighth of Might.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

Then again, the Community Price to Transaction (NVT) ratio steered that ETH may nonetheless be overrated. Low values of the NVT recommend undervalued.

However for Ethereum, the metric spiked, indicating that the community is overrated relative to transactions.