LDO is nearing its $1.33 resistance, however low volatility and overbought RSI would possibly restrict positive factors.

Open passion is emerging, however day-to-day lively addresses decline, signaling possible hurdles forward.

Lido DAO [LDO] has been actively riding expansion with its Easy DVT Module now supporting over 2,250 validators and securing 72,000 ETH. Moreover, the platform is lately balloting on vital upgrades, equivalent to integrating Bolt and adorning the Allotted Validator Vote casting (DVV) device.

At press time, LDO was once buying and selling at $1.16, up 4.24% within the final 24 hours. Then again, the query stays: can those upgrades push LDO previous its key resistance stage of $1.33?

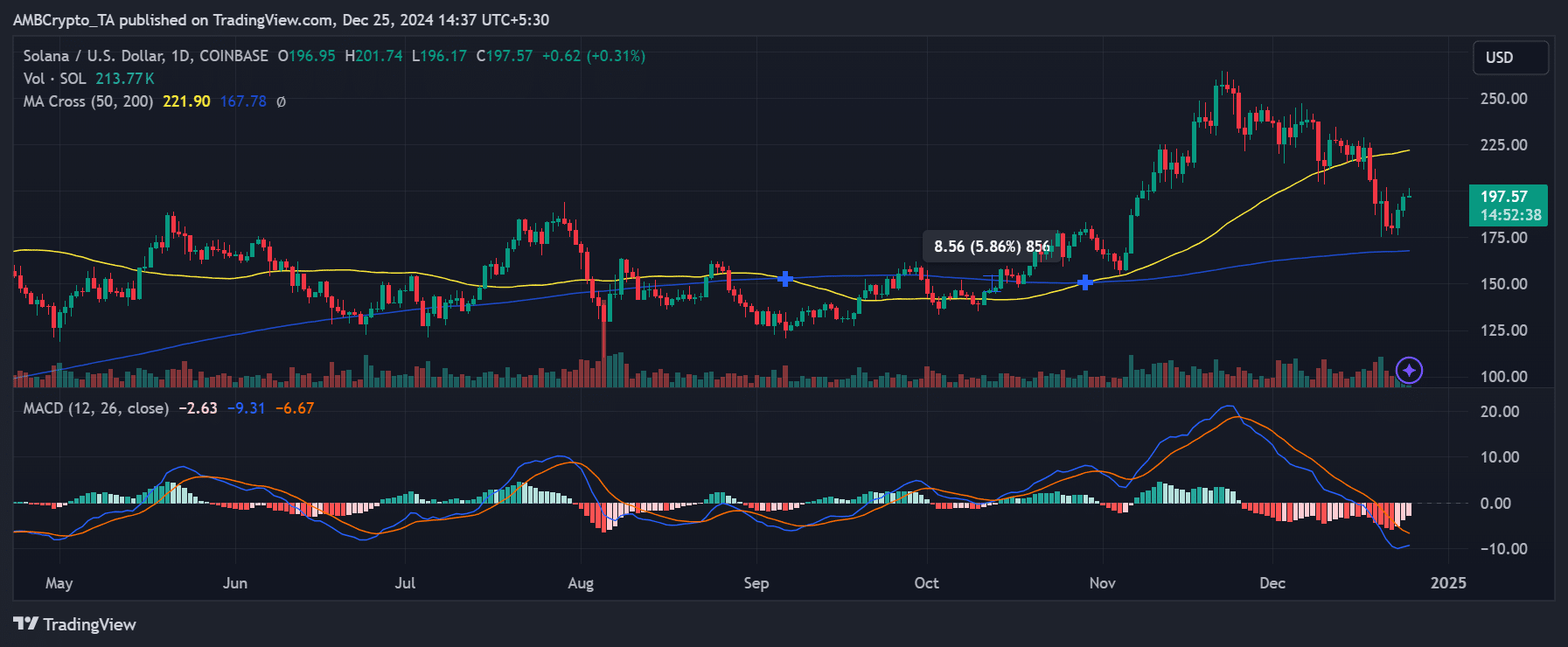

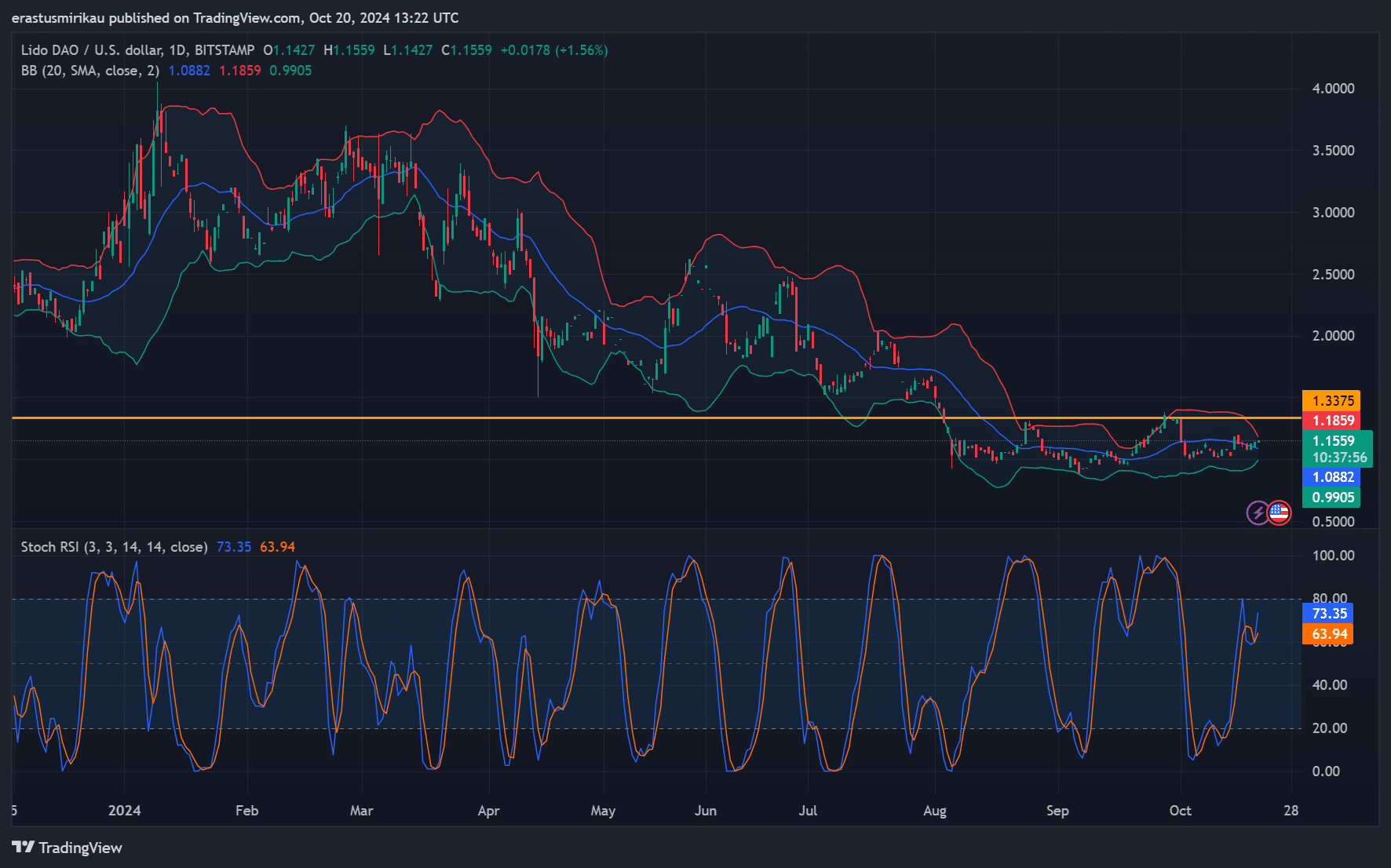

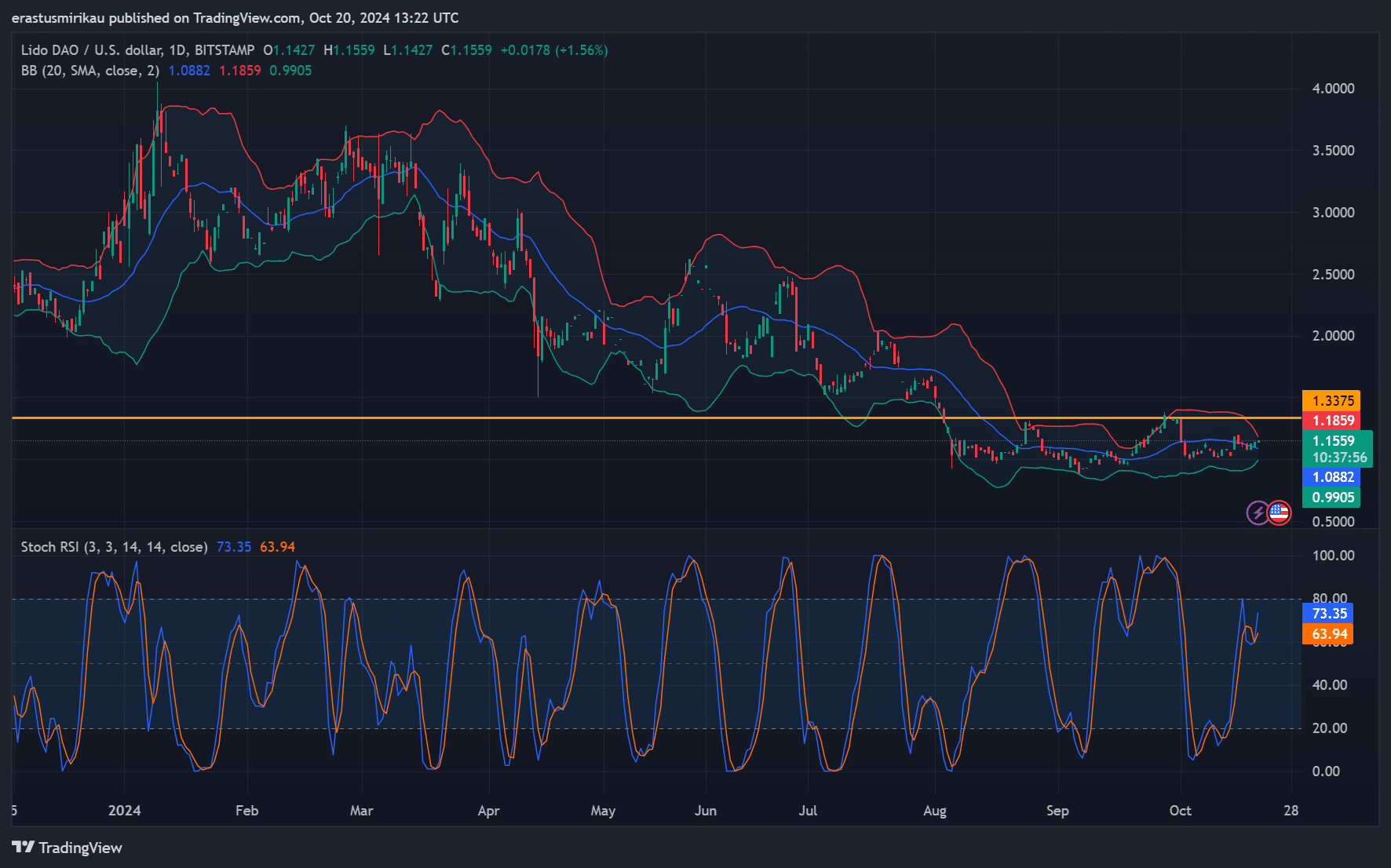

LDO chart research: Will resistance at $1.33 proceed to carry?

Lido DAO is coming near a important resistance stage at $1.33, and the new value actions have sparked passion. The Bollinger Bands counsel that volatility stays low, which signifies a consolidation segment.

Then again, the Stochastic RSI issues to overbought prerequisites, elevating the potential of a near-term pullback. Fortify is clear round $1.08, however Lido DAO will want vital bullish process to wreck thru $1.33.

Due to this fact, buyers are staring at carefully to decide whether or not this resistance will cling or if the token will acquire sufficient momentum to transport upper.

Supply: TradingView

Supply: TradingView

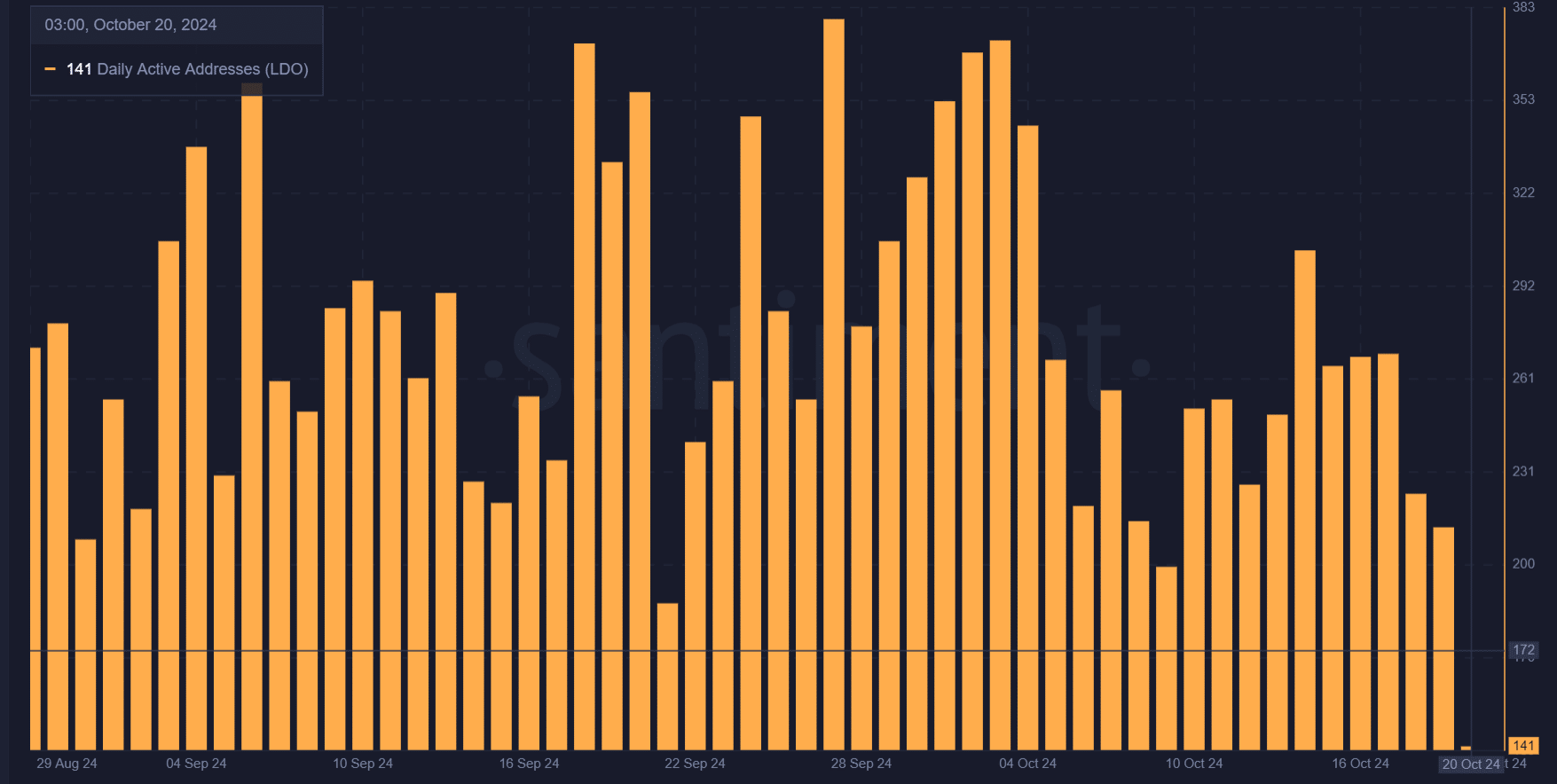

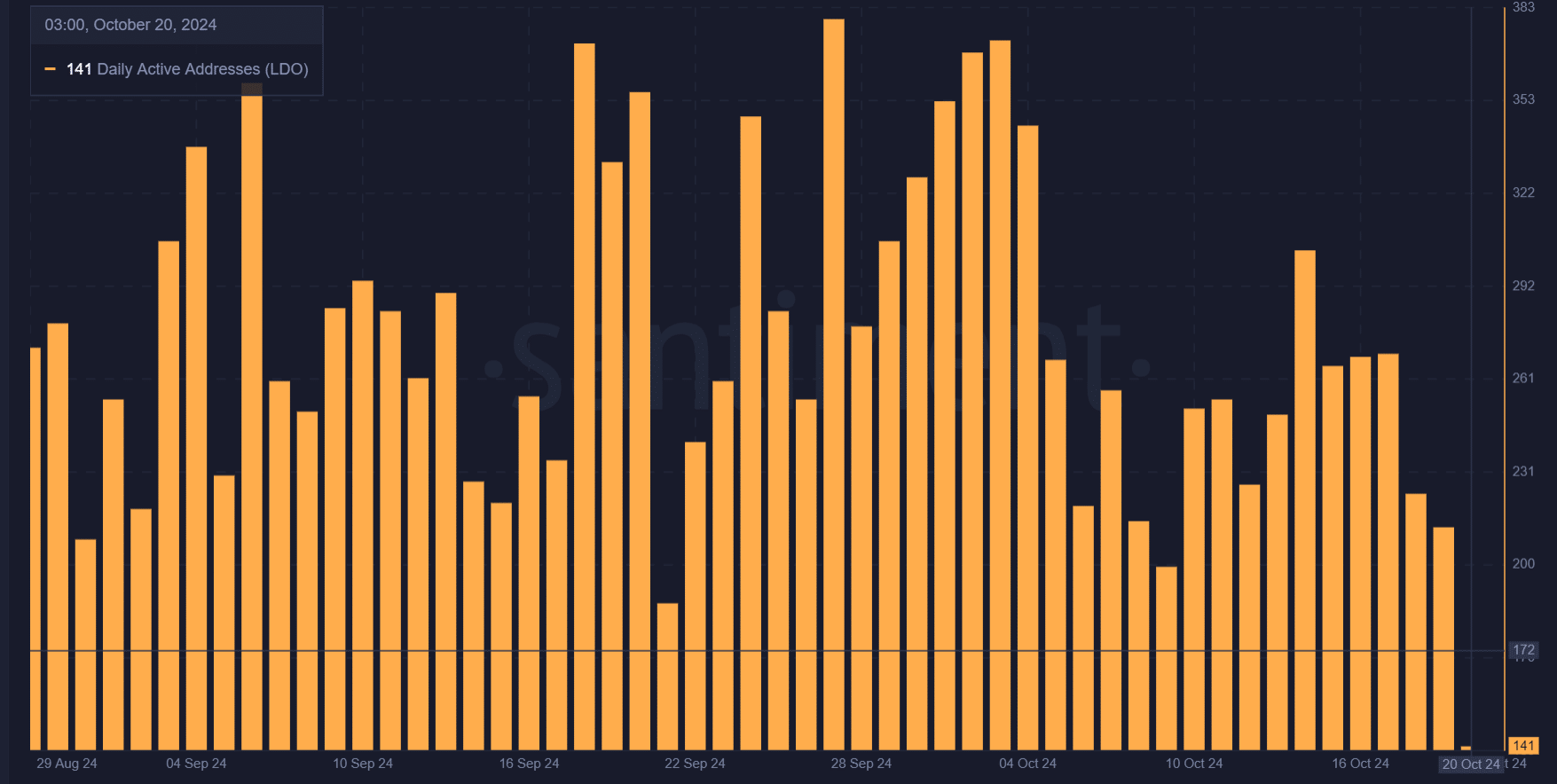

Day-to-day lively addresses decline: A priority for LDO?

Whilst Lido’s technical developments are promising, the new decline in day-to-day lively addresses is a motive for worry. The collection of lively addresses has dropped from 213 to 141, which signifies decreased person engagement.

As a result, this is able to restrict Lido DAO’s talent to wreck during the $1.33 resistance as on-chain process slows. This decline may just sign that Lido’s upgrades have now not but totally captured the eye of the wider marketplace.

Supply: Santiment

Supply: Santiment

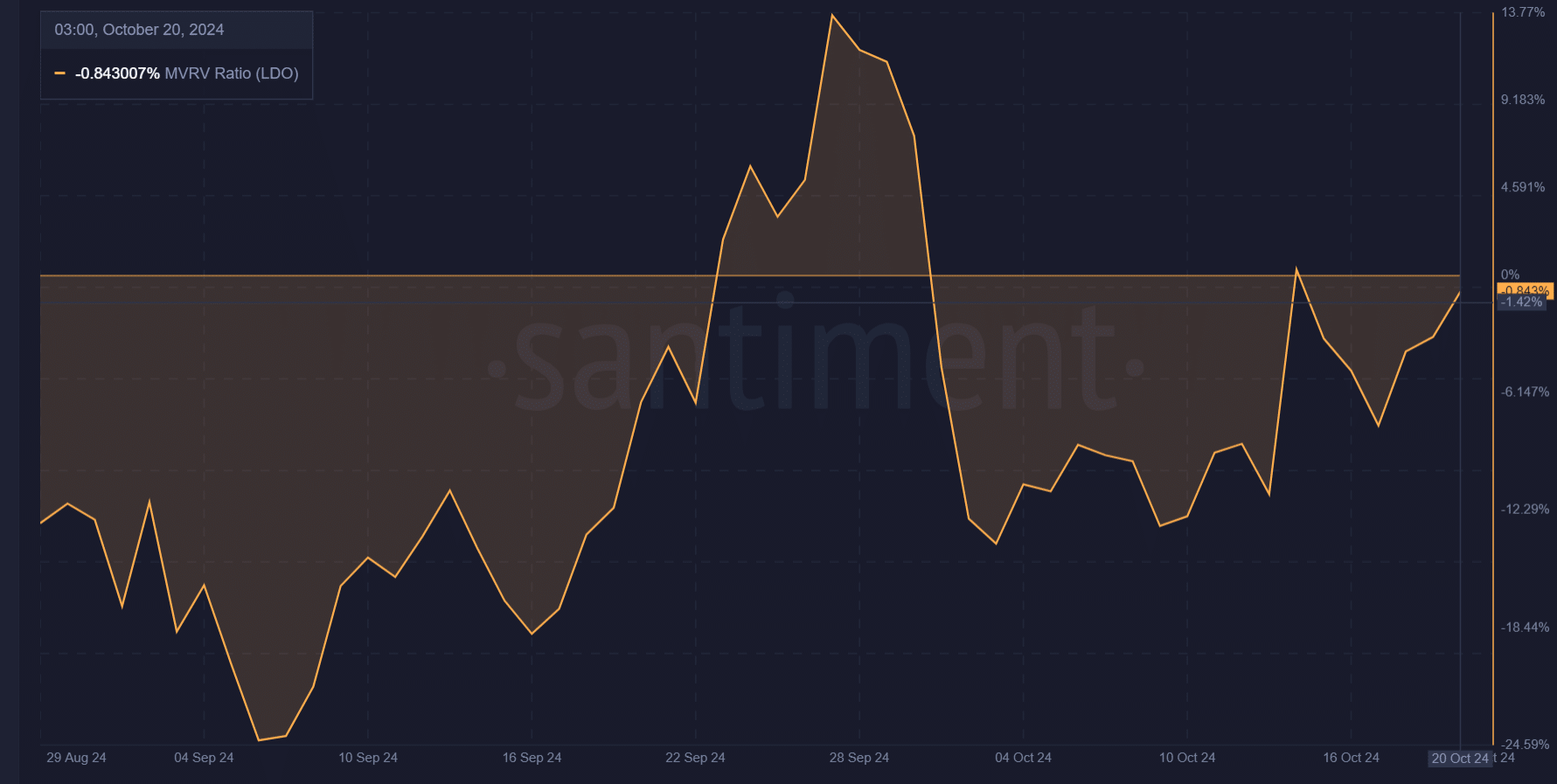

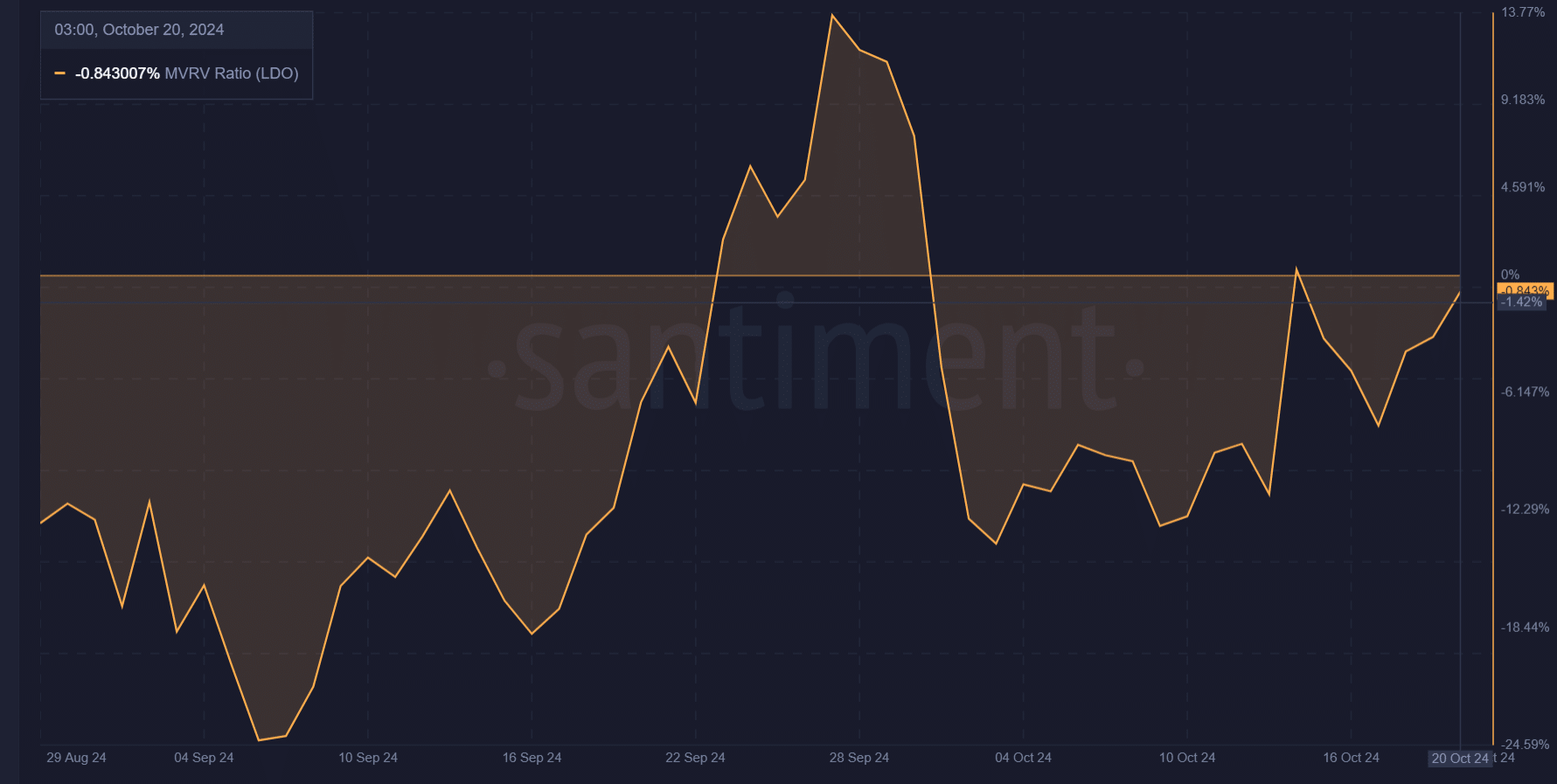

MVRV ratio: What does it imply for LDO‘s value motion?

The MVRV ratio, which lately stands at -0.84%, unearths that almost all traders are retaining LDO at a loss. Due to this fact, there is also much less incentive for holders to promote, doubtlessly supporting the fee within the brief time period.

Then again, if the MVRV ratio turns sure, profit-taking may just build up, hanging downward drive at the token. This dynamic makes the MVRV ratio a important consider figuring out whether or not LDO can maintain its upward momentum and problem the $1.33 resistance.

Supply: Santiment

Supply: Santiment

Open passion rises: Rising dealer self belief

Open passion for Lido DAO has risen via 1.98% to $64.9 million. This build up alerts rising self belief amongst buyers, as extra positions are being opened.

Then again, for this to translate right into a bullish breakout, quantity will wish to observe. As a result, this upward thrust in open passion shall be carefully monitored to peer if it drives LDO towards a breakout or some other rejection at $1.33.

Supply: Coinglass

Supply: Coinglass

Learn Lido DAO’s [LDO] Value Prediction 2023-24

Lido DAO’s traits are promising, however the declining day-to-day lively addresses and overbought Stochastic RSI provide demanding situations.

Even supposing the expanding open passion and MVRV ratio be offering some optimism, breaking during the $1.33 resistance would require sustained engagement and quantity.

Subsequent: Hedera turns bearish: Can HBAR triumph over its 90% drawdown?