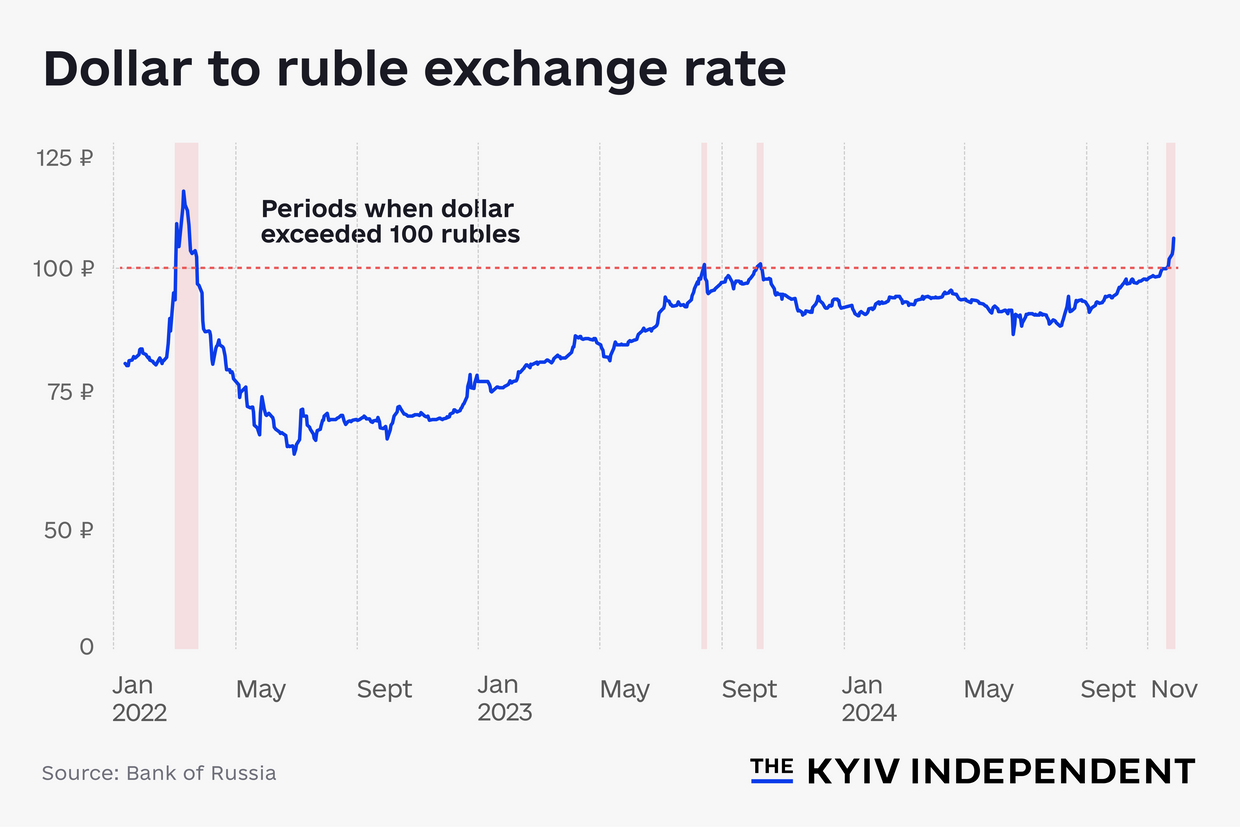

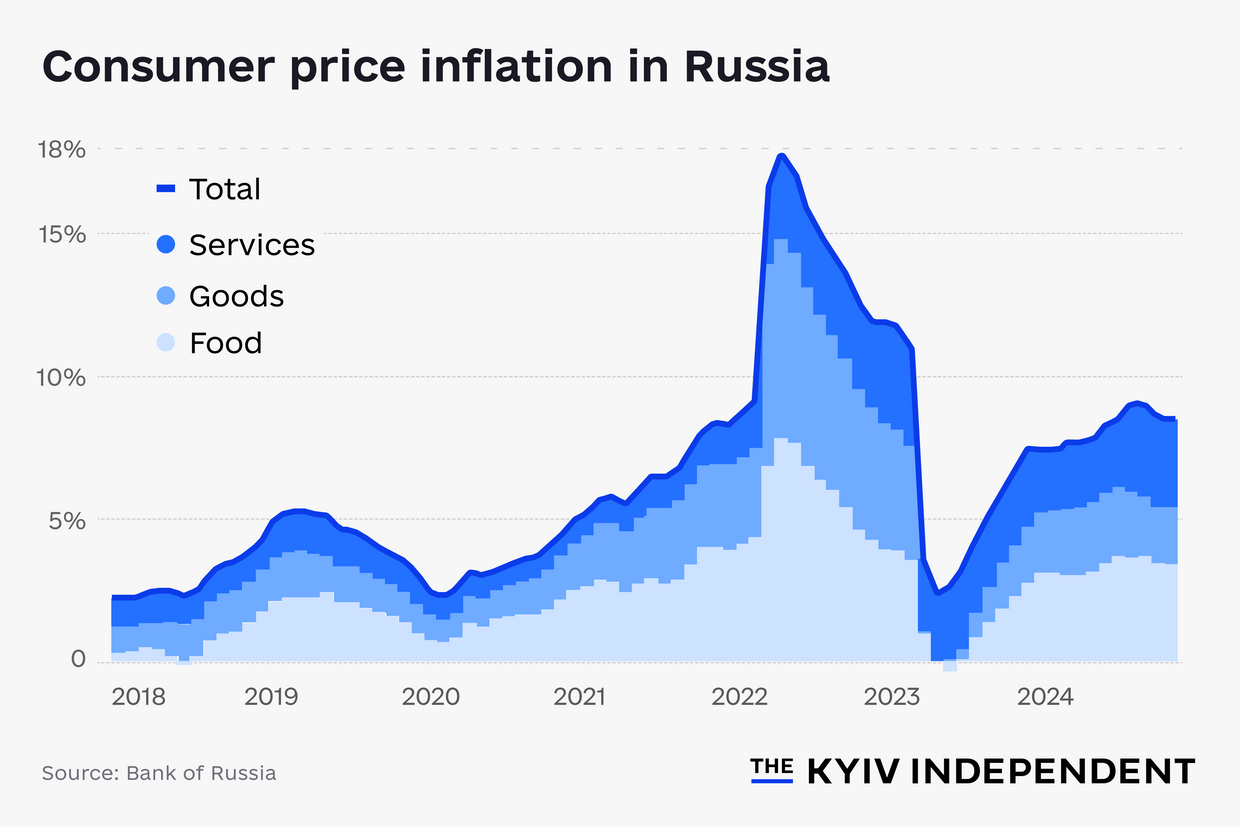

With the buying energy of the Russian ruble hitting the bottom level since March 2022, the commercial toll of the full-scale invasion of Ukraine turns into obtrusive.Russia’s increasing spending at the battle has fueled inflation, prompting Russia’s Central Financial institution to hike its rate of interest to the best possible stage because the early 2000s — 21 % — to rein in shopper costs. Inflation remained excessive irrespective of the velocity hike, rushing as much as over 1 % within the first 3 weeks of November and pushing the year-to-year numbers to over 8 %.Within the wake of the commercial demanding situations the rustic has confronted over the last 12 months, the U.S. executive’s Nov. 21 choice to impose new sanctions on dozens of Russian banks has confirmed laborious for the rustic’s financial system to swallow.”Russia is these days dealing with an unattainable financial conundrum as a result of the fast build up in navy expenditures and the Western sanctions,” Anders Aslund, a Swedish economist focusing on post-Soviet nations, instructed the Kyiv Impartial.On the other hand, economists and analysts are divided on how a lot of an have an effect on Russia’s financial issues can have on its battle effort.Some argue that it’s turning into increasingly more tricky for Russia to finance its battle.”Undaunted by means of financial fact, (Russian President Vladimir) Putin is elevating protection and safety prices to formally $176 billion in 2025, 41 % of the federal finances expenditures,” Aslund stated.”But, Russia can best finance 2 % of GDP in finances deficit a 12 months ($40 billion) as a result of its best reserve is the Nationwide Wealth Fund,” he stated.”On the finish of March 2024, its liquid assets amounted to an insignificant $55 billion. No one lends cash to Russia.”However others say that, in spite of the entire financial difficulties, the Kremlin can have sufficient assets to finance the battle for a very long time on the expense of slicing spending at the nation’s civilian sector.Sergei Aleksashenko, a Russian-born economist primarily based within the U.S., stated that “Putin’s financial issues should not be hyped up.””He’ll spend as a lot cash at the battle as essential,” he stated.Even so, U.S. President-elect Donald Trump’s group has proven openness to a possible plan to dramatically build up oil output and power down oil costs, on which Russia’s financial system is closely dependent. Because of this, the Kremlin is also in for a bumpy journey.”2025 shall be a second of reality,” Vladimir Milov, a Russian opposition baby-kisser who used to be an financial marketing consultant for the Russian executive within the early 2000s, instructed the Kyiv Impartial. Central Financial institution between rock and difficult placeDue to consistent will increase in navy spending, Russia’s finances deficit amounted to three.2 trillion rubles ($30 billion) in 2023 and is predicted to quantity to three.1 trillion rubles ($29 billion) in 2024.Since 2023, inflation has been rushing up because of the similar reason why — from 2.3 % year-on-year in April 2023 to eight.2 % in November 2024.Inflation contributed to the lowering buying energy of the ruble, which fell to 108 according to greenback on Nov. 28, the bottom stage since March 2022.One of the crucial newest blows to the ruble’s worth used to be the U.S. executive’s Nov. 21 choice to sanction dozens of Russian banks, together with Gazprombank, which handles oil and fuel bills.To rein in accelerating inflation, Russia’s Central Financial institution has been elevating its rate of interest — from 7.5 % in July 2023 to 21 % in October 2024.The tight financial coverage of Elvira Nabiullina, the central financial institution’s leader, has caused a backlash from companies, together with the ones concerned within the navy commercial complicated.Sergei Chemezov, CEO of state-owned protection conglomerate Rostec, has lashed out on the Central Financial institution time and again.”If we proceed running this fashion, maximum enterprises will necessarily move bankrupt,” he stated in October. “The query these days is that this: both we stop all high-tech exports — airplanes, air protection programs, ships, and so forth, which require manufacturing timelines of a 12 months or extra — or we wish to take some measures.”

Central Financial institution between rock and difficult placeDue to consistent will increase in navy spending, Russia’s finances deficit amounted to three.2 trillion rubles ($30 billion) in 2023 and is predicted to quantity to three.1 trillion rubles ($29 billion) in 2024.Since 2023, inflation has been rushing up because of the similar reason why — from 2.3 % year-on-year in April 2023 to eight.2 % in November 2024.Inflation contributed to the lowering buying energy of the ruble, which fell to 108 according to greenback on Nov. 28, the bottom stage since March 2022.One of the crucial newest blows to the ruble’s worth used to be the U.S. executive’s Nov. 21 choice to sanction dozens of Russian banks, together with Gazprombank, which handles oil and fuel bills.To rein in accelerating inflation, Russia’s Central Financial institution has been elevating its rate of interest — from 7.5 % in July 2023 to 21 % in October 2024.The tight financial coverage of Elvira Nabiullina, the central financial institution’s leader, has caused a backlash from companies, together with the ones concerned within the navy commercial complicated.Sergei Chemezov, CEO of state-owned protection conglomerate Rostec, has lashed out on the Central Financial institution time and again.”If we proceed running this fashion, maximum enterprises will necessarily move bankrupt,” he stated in October. “The query these days is that this: both we stop all high-tech exports — airplanes, air protection programs, ships, and so forth, which require manufacturing timelines of a 12 months or extra — or we wish to take some measures.” Elvira Nabiullina, head of the rustic’s Central Financial institution, in Saint Petersburg, Russia on July 5, 2024. (Maksim Konstantinov/SOPA Photographs/LightRocket by the use of Getty Photographs)

Elvira Nabiullina, head of the rustic’s Central Financial institution, in Saint Petersburg, Russia on July 5, 2024. (Maksim Konstantinov/SOPA Photographs/LightRocket by the use of Getty Photographs) A person walks previous the Russian Central Financial institution headquarters in downtown Moscow, Russia on Sep. 6, 2023. (Alexander Nemenov/AFP by the use of Getty Photographs)Opposition baby-kisser Milov stated that Chemezov and Nabiullina “are each proper” in their very own means.”Chemezov is true that companies must close down at any such (excessive hobby) charge,” he instructed the Kyiv Impartial, “Nabiullina is true that the velocity can’t be lower as a result of if so there shall be hyperinflation like in Turkey.”He endured that “there is just one means out — end the battle and withdraw Russian troops” from Ukraine.”Nabiullina is in a tricky spot as a result of the spending at the battle,” Torbjörn Becker, director of the Stockholm Institute of Transition Economics and a co-author of a up to date document at the Russian wartime financial system, instructed the Kyiv Impartial. “The entire battle effort is making a headache for Nabiullina. The army-industrial complicated desires to spend more cash. The army guys do not care about macroeconomic balance.”

A person walks previous the Russian Central Financial institution headquarters in downtown Moscow, Russia on Sep. 6, 2023. (Alexander Nemenov/AFP by the use of Getty Photographs)Opposition baby-kisser Milov stated that Chemezov and Nabiullina “are each proper” in their very own means.”Chemezov is true that companies must close down at any such (excessive hobby) charge,” he instructed the Kyiv Impartial, “Nabiullina is true that the velocity can’t be lower as a result of if so there shall be hyperinflation like in Turkey.”He endured that “there is just one means out — end the battle and withdraw Russian troops” from Ukraine.”Nabiullina is in a tricky spot as a result of the spending at the battle,” Torbjörn Becker, director of the Stockholm Institute of Transition Economics and a co-author of a up to date document at the Russian wartime financial system, instructed the Kyiv Impartial. “The entire battle effort is making a headache for Nabiullina. The army-industrial complicated desires to spend more cash. The army guys do not care about macroeconomic balance.” Is Russia headed for stagflation?The Central Financial institution’s coverage of constructing credit score dearer is also contributing to a slowdown in financial enlargement.Russia’s gross home product rose 3.6 % in 2023 amid a growth fueled by means of navy spending, consistent with the State Statistics Carrier (RosStat). Russia’s financial system is predicted to develop by means of 3.5-4 % in 2024, however the enlargement is predicted to decelerate to 0.5-1.5 % in 2025, consistent with Russia’s Central Financial institution.”There are not any new investments, and the effectiveness of the fiscal stimulus is lowering,” Milov stated. “(Financial enlargement) could also be being killed by means of excessive inflation and the Central Financial institution’s excessive charge. Credit score is unbelievably dear.”Milov believes that Russia’s GDP would possibly fall in 2025, and the rustic would possibly revel in stagflation — a mix of stagnation and excessive inflation.Alexandra Prokopenko, an financial skilled on the Carnegie Russia Eurasia Middle, argued that “it isn’t stagflation but, however Russia is shut.””Fresh knowledge means that the overheated Russian financial system is beginning to cool,” she instructed the Kyiv Impartial. “This features a fall in retail lending, slowing salary will increase, and losing commercial enlargement. On the other hand, it should not be overstated. Regardless of the indicators of cooling, the elemental drivers of overheating stay in position — rising navy manufacturing and an intense exertions scarcity.”

Is Russia headed for stagflation?The Central Financial institution’s coverage of constructing credit score dearer is also contributing to a slowdown in financial enlargement.Russia’s gross home product rose 3.6 % in 2023 amid a growth fueled by means of navy spending, consistent with the State Statistics Carrier (RosStat). Russia’s financial system is predicted to develop by means of 3.5-4 % in 2024, however the enlargement is predicted to decelerate to 0.5-1.5 % in 2025, consistent with Russia’s Central Financial institution.”There are not any new investments, and the effectiveness of the fiscal stimulus is lowering,” Milov stated. “(Financial enlargement) could also be being killed by means of excessive inflation and the Central Financial institution’s excessive charge. Credit score is unbelievably dear.”Milov believes that Russia’s GDP would possibly fall in 2025, and the rustic would possibly revel in stagflation — a mix of stagnation and excessive inflation.Alexandra Prokopenko, an financial skilled on the Carnegie Russia Eurasia Middle, argued that “it isn’t stagflation but, however Russia is shut.””Fresh knowledge means that the overheated Russian financial system is beginning to cool,” she instructed the Kyiv Impartial. “This features a fall in retail lending, slowing salary will increase, and losing commercial enlargement. On the other hand, it should not be overstated. Regardless of the indicators of cooling, the elemental drivers of overheating stay in position — rising navy manufacturing and an intense exertions scarcity.”

“Fresh knowledge means that the overheated Russian financial system is beginning to cool.”

She added that “in some sectors associated with the army (like, as an example, completed steel merchandise and optics and computer systems), there’s no signal of any cooling.” Russian President Vladimir Putin visits Uralvagonzavod, a Russian tank manufacturing unit, in Nizhny Tagil, Russia on Feb. 15, 2024. (Alexander Kazakov / POOL / AFP by the use of Getty Photographs)Yulia Pavytska, an financial skilled on the Kyiv Faculty of Economics’ think-tank, KSE Institute, instructed the Kyiv Impartial that “the present coverage of the Russian Central Financial institution will both result in stagnation — the absence of monetary enlargement — or the regulator will fail, through which case inflation will proceed to upward thrust.”She added, on the other hand, that “a mix of stagnation and inflation is these days an not likely situation, given the ongoing fiscal stimulus within the type of war-related expenditures and the numerous exertions marketplace deficit.”Aleksashenko stated that he didn’t be expecting a drop in Russia’s GDP in 2025. He instructed the Kyiv Impartial that exertions marketplace shortages have been slowing down financial enlargement however their have an effect on used to be quite small.

Russian President Vladimir Putin visits Uralvagonzavod, a Russian tank manufacturing unit, in Nizhny Tagil, Russia on Feb. 15, 2024. (Alexander Kazakov / POOL / AFP by the use of Getty Photographs)Yulia Pavytska, an financial skilled on the Kyiv Faculty of Economics’ think-tank, KSE Institute, instructed the Kyiv Impartial that “the present coverage of the Russian Central Financial institution will both result in stagnation — the absence of monetary enlargement — or the regulator will fail, through which case inflation will proceed to upward thrust.”She added, on the other hand, that “a mix of stagnation and inflation is these days an not likely situation, given the ongoing fiscal stimulus within the type of war-related expenditures and the numerous exertions marketplace deficit.”Aleksashenko stated that he didn’t be expecting a drop in Russia’s GDP in 2025. He instructed the Kyiv Impartial that exertions marketplace shortages have been slowing down financial enlargement however their have an effect on used to be quite small. Upper inflation at the horizon?Some analysts are expecting that drive from business, together with the military-industrial complicated, will result in Nabiullina’s downfall.”Putin understands that Nabiullina turns out to be useful however there’s an increasing number of drive from safety forces,” Russian political analyst Dmitry Oreshkin instructed the Kyiv Impartial. “On this battle, the military-industrial complicated will inevitably win as a result of Putin is waging a battle.”Aslund agreed, pronouncing that “Chemezov and different industrialists will oust her very quickly and make the proper level that top rates of interest resolve not one of the (Central Financial institution’s) duties, which might be proper, however they are going to push for decrease rates of interest, which can worsen the location.””Inflation will upward thrust, the capital outflow will boost up, and the trade charge will fall,” he instructed the Kyiv Impartial.Aslund additionally stated that he “would now not counsel hyperinflation (over 50 % build up a month) however a considerable build up in inflation, which can reason standard dissatisfaction.”Andrei Movchan, a Russian-born economist and founding father of Movchan’s Crew, instructed the Kyiv Impartial that, if the Central Financial institution adjustments its coverage and cuts its charge by means of a number of share issues, inflation may just upward thrust to 20-25 % however it could now not result in a “disaster” or “destruction of the financial system.”New Protection Minister Belousov to position Russia’s financial system on battle footingRussian President Vladimir Putin’s appointment of a brand new protection minister, Andrey Belousov, is observed as an try to streamline Russia’s financial system and mobilize it for the battle effort. Russia’s navy has confronted a lot of provide and logistics issues that thwarted its all-out battle towards Ukraine from t…

Upper inflation at the horizon?Some analysts are expecting that drive from business, together with the military-industrial complicated, will result in Nabiullina’s downfall.”Putin understands that Nabiullina turns out to be useful however there’s an increasing number of drive from safety forces,” Russian political analyst Dmitry Oreshkin instructed the Kyiv Impartial. “On this battle, the military-industrial complicated will inevitably win as a result of Putin is waging a battle.”Aslund agreed, pronouncing that “Chemezov and different industrialists will oust her very quickly and make the proper level that top rates of interest resolve not one of the (Central Financial institution’s) duties, which might be proper, however they are going to push for decrease rates of interest, which can worsen the location.””Inflation will upward thrust, the capital outflow will boost up, and the trade charge will fall,” he instructed the Kyiv Impartial.Aslund additionally stated that he “would now not counsel hyperinflation (over 50 % build up a month) however a considerable build up in inflation, which can reason standard dissatisfaction.”Andrei Movchan, a Russian-born economist and founding father of Movchan’s Crew, instructed the Kyiv Impartial that, if the Central Financial institution adjustments its coverage and cuts its charge by means of a number of share issues, inflation may just upward thrust to 20-25 % however it could now not result in a “disaster” or “destruction of the financial system.”New Protection Minister Belousov to position Russia’s financial system on battle footingRussian President Vladimir Putin’s appointment of a brand new protection minister, Andrey Belousov, is observed as an try to streamline Russia’s financial system and mobilize it for the battle effort. Russia’s navy has confronted a lot of provide and logistics issues that thwarted its all-out battle towards Ukraine from t…

Keep heat with Ukrainian traditions this iciness.

Store our seasonal merch assortment.

![]()

store now

Warfare effort unsustainable?Even if economists agree that Russia is experiencing financial difficulties, they’re cut up on whether or not they are going to make its battle effort unsustainable.Aslund stated that “Russia’s macroeconomic disasters will transform a vital issue subsequent 12 months, in all probability somewhat quickly, despite the fact that this stuff are at all times tricky to time.”Anders Olofsgård, a deputy director on the Stockholm Institute of Transition Economics, stocks those ideas.He instructed the Kyiv Impartial that “it’s turning into increasingly more dear for Russia to finance the battle, with home navy manufacturing at capability, inflation and wages surging, and them increasingly more turning to allies comparable to Iran and North Korea for navy apparatus or even squaddies.””They’re additionally regularly depleting the exterior reserves they have got, and the more severe the commercial scenario, the extra they wish to flip to these reserves to manage to pay for the growth in navy expenditures,” he stated. “Sadly, this does not imply that they are going to run out of cash the next day, however relying on oil and fuel costs, the effectiveness and enforcement of sanctions, and the competence and credibility in their macroeconomic insurance policies, that day is coming.”Milov stated that there’s much less and no more cash at Russia’s Federal Wealth Fund, and it is tricky for the federal government to borrow at any such excessive rate of interest.The federal government has attempted to boost cash by means of expanding taxes however the “tax hikes will boost up the slowing down of the financial system and cut back the tax base,” Milov endured.”They will need to make a decision one thing as a result of they may be able to’t salary any such high-intensity battle anymore,” he added. Milov stated that the manufacturing of extra primitive navy merchandise — comparable to drones, bombs, and artillery shells — is increasing. On the other hand, it is tougher for Russia to supply extra complicated apparatus — tanks, armored cars and plane, he added.

“They will need to make a decision one thing as a result of they may be able to’t salary any such high-intensity battle anymore.”

Different economists are extra wary.”Russia is these days now not dealing with critical fiscal demanding situations,” Pavytska stated. “It’s most likely that the Finance Ministry will be capable of execute this 12 months’s finances as deliberate.”She stated that home borrowing can be “pricey,” however the executive would take this step if wanted as a result of “the regime wishes cash for the battle now, now not in some summary long term.””In trendy Russian realities, the important thing rate of interest is, de facto, beside the point to the regime,” Pavytska added. “Budget for the battle shall be discovered finally, together with by means of slicing different expenditures, as evidenced by means of the draft finances for subsequent 12 months, or thru financial issuance.”Movchan and Aleksashenko stated that the protection sector will get direct investment from the finances, now not loans, and it could be funded irrespective of excessive rates of interest. They argued that Russia’s financial difficulties weren’t affecting its battle effort.Movchan stated that Russia would get started experiencing issues of investment the battle provided that oil costs fell considerably, resulting in a significant drop within the executive’s foreign exchange profits. He added, on the other hand, that he believed {that a} main fall in oil costs used to be not likely within the close to long term.The hope for a drop in oil costs used to be boosted just lately by means of Trump’s plan to factor extra lets in to enormously build up U.S. oil and liquefied herbal fuel manufacturing. Reuters reported on Nov. 25 that Trump’s transition group used to be running at the plan and would roll it out inside days of him taking place of business in January.Oreshkin stated that Russia’s present financial turmoil is not likely to improve Ukraine’s hand in possible peace talks. However, if Trump manages to power down oil costs and cracks down on Russia’s evasion of oil sanctions, Ukraine can have a more potent place, he added.Russia struggles to keep watch over budget as Ukraine invasion spending soarsSince the full-scale invasion of Ukraine started in 2022, the Russian executive has centered all of its monetary assets on investment the battle. Because the battle is the Kremlin’s primary precedence, all equipment at its disposal had been used: higher taxation, sovereign budget, home borrowing, and the p…