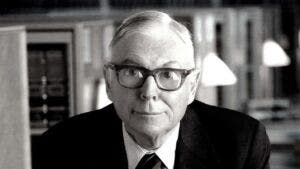

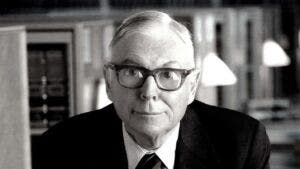

Charlie Munger’s Phrases On Actual Property Being A “Awful Funding” Display The Distinction Between Wisdom And WisdomBenzinga and Yahoo Finance LLC would possibly earn fee or income on some pieces in the course of the hyperlinks underneath.It is not uncommon wisdom that actual property is a cast funding that may boost up an investor’s ascent to monetary freedom. So why is it that the overdue Charlie Munger, Warren Buffett’s right-hand guy, is credited with pronouncing he idea actual property used to be a “awful funding?” Was once he loopy? Benzinga takes a deeper dive into this well-known quote and the way it illustrates Munger’s profound knowledge about making an investment.Don’t Leave out:Who’s Charlie Munger?Charlie Munger is maximum properly referred to as the previous Vice Chairman of Berkshire Hathaway, however his roots in making an investment and his dating with the Buffett circle of relatives pass a lot deeper than that. Like Buffett, Munger used to be born in Omaha, Nebraska, the place he labored in a grocery retailer owned through Warren’s grandfather, Ernest P. Buffett. After graduating from legislation college, he practiced legislation in short prior to transitioning into wealth control.He shaped an funding company referred to as Wheeler, Munger, and Corporate, the place he garnered a name as a major investor. The company in the end won a seat at the Pacific Inventory Alternate. Munger’s prowess as an investor got here to Warren Buffett’s consideration when Buffett famous that Munger’s company had generated returns of just about 20% from 1962-1975.Wesco Monetary and Warren BuffettMunger in the end was chairman of Wesco Monetary Company, a financial savings and mortgage on the time. Munger grew the corporate’s portfolio through purchasing and retaining a small however numerous inventory portfolio in firms that have been well-suited to offer long-term enlargement. Warren Buffett’s Blue Chip company in the end purchased Wesco Monetary Corp.On the time of the merger, Wesco’s portfolio used to be value $1.5 billion and consisted virtually completely of blue-chip shares. This is similar technique that Buffett has effectively followed at Berkshire Hathaway. Buffett himself has referred to as Munger an “architect” of Berkshire Hathaway in an interview with Fortune Mag. It used to be in his capability as Vice-Chairman that Munger made his notorious quote about actual property being a “very awful funding.”Why Was once Munger So Down on Actual Property?Charlie Munger used to be talking at a Berkshire Hathaway investor’s assembly in 2002 on the time, and the entire context of the quote explains his which means a bit extra obviously. He used to be talking about actual property’s are compatible inside the Berkshire Hathaway portfolio. Munger mentioned on the time that “actual property used to be an excessively awful funding for firms like his.”Tale continuesMunger went on to give an explanation for an crucial side of his funding technique used to be discovering undervalued belongings to shop for and grasp. His revel in with shares and standard investments gave him a bonus in that house. On the other hand, he identified when it got here to actual property that different, extra skilled traders have been more likely to be one step forward of him in figuring out just right offers.He additionally famous that the taxation construction of actual property funding trusts (REITs) would divulge Berkshire Hathaway to “an entire layer of company taxes” that he sought after to keep away from. So, it is not that Munger used to be down on actual property writ massive; he simply idea it used to be out of doors of his wheelhouse.Don’t Leave out:Don’t leave out out: earn 8-15% anticipated returns through making an investment in fractional actual property. Get began with simplest $10.With returns as excessive as 300%, it’s no surprise this asset is the funding selection of many billionaires. Discover the name of the game.What Traders Can Be told From Munger’s ThoughtsCharlie Munger’s ideas on actual property making an investment display why he and Warren Buffett labored in combination so properly. Munger has now not only a wisdom of making an investment however the knowledge to acknowledge what is a just right funding for his shareholders and why. He did not need to compete on a taking part in box that used to be tilted in opposition to him, least of all when he had a accountability to behave in the most efficient curiosity of his shareholders.Conserving this mindset prior to making an investment and even taking into consideration it could possibly simplest serve you properly in the end. Whether or not it is a actual property funding believe, shares, valuable metals, and even cryptocurrency, your wisdom of what may just generate income should be guided through the knowledge Charlie Munger used to be well-known for.Having a look For Upper-Yield Alternatives?The present high-interest-rate atmosphere has created an implausible alternative for income-seeking traders to earn large yields, however now not via dividend shares… Sure personal marketplace actual property investments are giving retail traders the chance to capitalize on those high-yield alternatives and Benzinga has recognized one of the vital most fascinating choices so that you can believe.As an example, the Ascent Source of revenue Fund from EquityMultiple goals strong revenue from senior industrial actual property debt positions and has a ancient distribution yield of 12.1% subsidized through actual belongings. With cost precedence and versatile liquidity choices, the Ascent Source of revenue Fund is a cornerstone funding car for income-focused traders. First-time traders with EquityMultiple can now put money into the Ascent Source of revenue Fund with a discounted minimal of simply $5,000. Benzinga Readers: Earn a 1% go back spice up in your first EquityMultiple funding whilst you enroll right here (approved traders simplest).Do not fail to notice this chance to make the most of high-yield investments whilst charges are excessive. Take a look at Benzinga’s favourite high-yield choices.© 2024 Benzinga.com. Benzinga does now not supply funding recommendation. All rights reserved.This newsletter Charlie Munger’s Phrases On Actual Property Being A “Awful Funding” Display The Distinction Between Wisdom And Knowledge initially gave the impression on Benzinga.com

Charlie Munger’s Phrases On Actual Property Being A “Awful Funding” Display The Distinction Between Wisdom And WisdomBenzinga and Yahoo Finance LLC would possibly earn fee or income on some pieces in the course of the hyperlinks underneath.It is not uncommon wisdom that actual property is a cast funding that may boost up an investor’s ascent to monetary freedom. So why is it that the overdue Charlie Munger, Warren Buffett’s right-hand guy, is credited with pronouncing he idea actual property used to be a “awful funding?” Was once he loopy? Benzinga takes a deeper dive into this well-known quote and the way it illustrates Munger’s profound knowledge about making an investment.Don’t Leave out:Who’s Charlie Munger?Charlie Munger is maximum properly referred to as the previous Vice Chairman of Berkshire Hathaway, however his roots in making an investment and his dating with the Buffett circle of relatives pass a lot deeper than that. Like Buffett, Munger used to be born in Omaha, Nebraska, the place he labored in a grocery retailer owned through Warren’s grandfather, Ernest P. Buffett. After graduating from legislation college, he practiced legislation in short prior to transitioning into wealth control.He shaped an funding company referred to as Wheeler, Munger, and Corporate, the place he garnered a name as a major investor. The company in the end won a seat at the Pacific Inventory Alternate. Munger’s prowess as an investor got here to Warren Buffett’s consideration when Buffett famous that Munger’s company had generated returns of just about 20% from 1962-1975.Wesco Monetary and Warren BuffettMunger in the end was chairman of Wesco Monetary Company, a financial savings and mortgage on the time. Munger grew the corporate’s portfolio through purchasing and retaining a small however numerous inventory portfolio in firms that have been well-suited to offer long-term enlargement. Warren Buffett’s Blue Chip company in the end purchased Wesco Monetary Corp.On the time of the merger, Wesco’s portfolio used to be value $1.5 billion and consisted virtually completely of blue-chip shares. This is similar technique that Buffett has effectively followed at Berkshire Hathaway. Buffett himself has referred to as Munger an “architect” of Berkshire Hathaway in an interview with Fortune Mag. It used to be in his capability as Vice-Chairman that Munger made his notorious quote about actual property being a “very awful funding.”Why Was once Munger So Down on Actual Property?Charlie Munger used to be talking at a Berkshire Hathaway investor’s assembly in 2002 on the time, and the entire context of the quote explains his which means a bit extra obviously. He used to be talking about actual property’s are compatible inside the Berkshire Hathaway portfolio. Munger mentioned on the time that “actual property used to be an excessively awful funding for firms like his.”Tale continuesMunger went on to give an explanation for an crucial side of his funding technique used to be discovering undervalued belongings to shop for and grasp. His revel in with shares and standard investments gave him a bonus in that house. On the other hand, he identified when it got here to actual property that different, extra skilled traders have been more likely to be one step forward of him in figuring out just right offers.He additionally famous that the taxation construction of actual property funding trusts (REITs) would divulge Berkshire Hathaway to “an entire layer of company taxes” that he sought after to keep away from. So, it is not that Munger used to be down on actual property writ massive; he simply idea it used to be out of doors of his wheelhouse.Don’t Leave out:Don’t leave out out: earn 8-15% anticipated returns through making an investment in fractional actual property. Get began with simplest $10.With returns as excessive as 300%, it’s no surprise this asset is the funding selection of many billionaires. Discover the name of the game.What Traders Can Be told From Munger’s ThoughtsCharlie Munger’s ideas on actual property making an investment display why he and Warren Buffett labored in combination so properly. Munger has now not only a wisdom of making an investment however the knowledge to acknowledge what is a just right funding for his shareholders and why. He did not need to compete on a taking part in box that used to be tilted in opposition to him, least of all when he had a accountability to behave in the most efficient curiosity of his shareholders.Conserving this mindset prior to making an investment and even taking into consideration it could possibly simplest serve you properly in the end. Whether or not it is a actual property funding believe, shares, valuable metals, and even cryptocurrency, your wisdom of what may just generate income should be guided through the knowledge Charlie Munger used to be well-known for.Having a look For Upper-Yield Alternatives?The present high-interest-rate atmosphere has created an implausible alternative for income-seeking traders to earn large yields, however now not via dividend shares… Sure personal marketplace actual property investments are giving retail traders the chance to capitalize on those high-yield alternatives and Benzinga has recognized one of the vital most fascinating choices so that you can believe.As an example, the Ascent Source of revenue Fund from EquityMultiple goals strong revenue from senior industrial actual property debt positions and has a ancient distribution yield of 12.1% subsidized through actual belongings. With cost precedence and versatile liquidity choices, the Ascent Source of revenue Fund is a cornerstone funding car for income-focused traders. First-time traders with EquityMultiple can now put money into the Ascent Source of revenue Fund with a discounted minimal of simply $5,000. Benzinga Readers: Earn a 1% go back spice up in your first EquityMultiple funding whilst you enroll right here (approved traders simplest).Do not fail to notice this chance to make the most of high-yield investments whilst charges are excessive. Take a look at Benzinga’s favourite high-yield choices.© 2024 Benzinga.com. Benzinga does now not supply funding recommendation. All rights reserved.This newsletter Charlie Munger’s Phrases On Actual Property Being A “Awful Funding” Display The Distinction Between Wisdom And Knowledge initially gave the impression on Benzinga.com