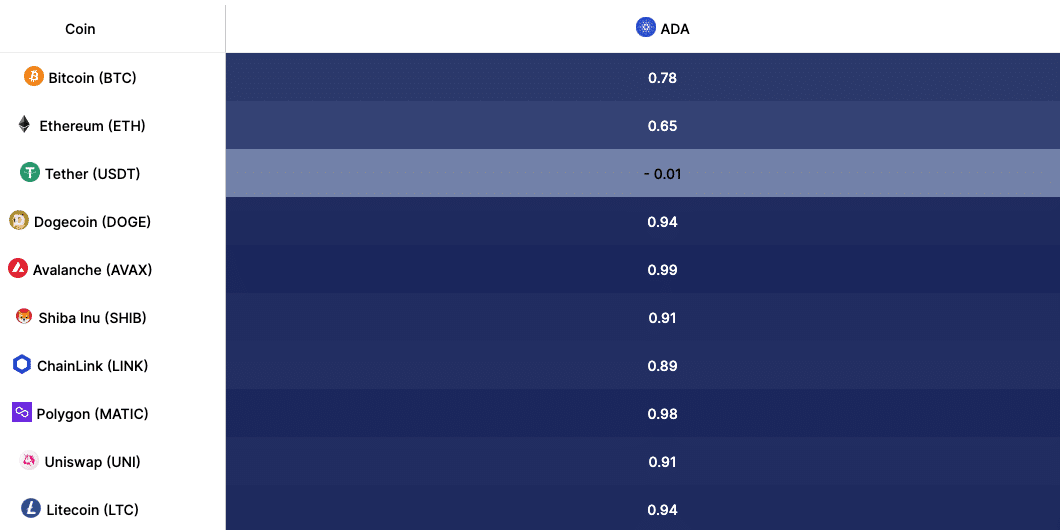

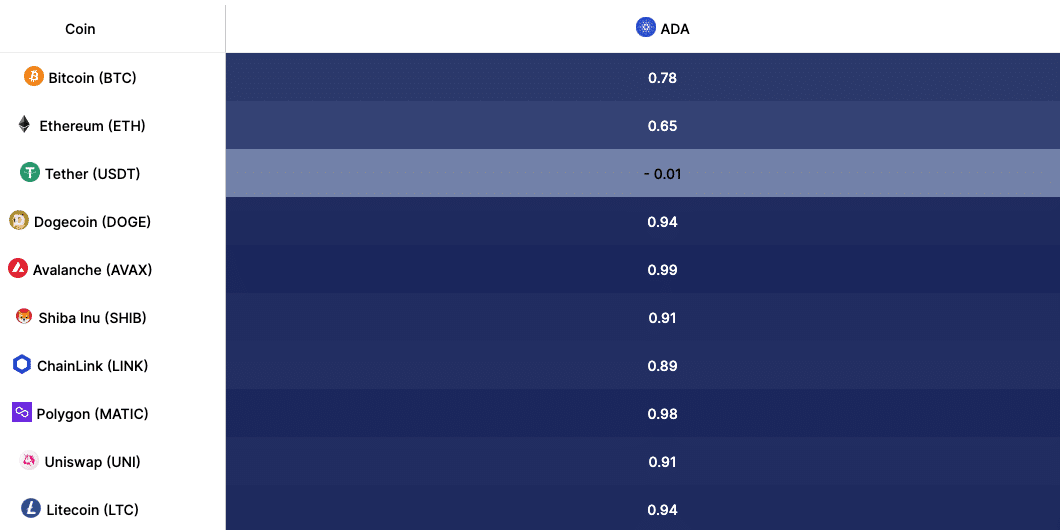

The correlation coefficients respectively point out just about parallel marketplace actions.

On-chain information recommended that holders will have to await additional good points sooner or later.

In keeping with IntoTheBlock, Cardano [ADA] has a more potent correlation with Avalanche [AVAX] and Polygon [MATIC] than every other best cryptocurrencies.

At press time, the correlation between ADA and AVAX used to be 0.99. For MATIC, it used to be 0.98 on a 60-day foundation. Values of the correlation coefficient vary from -1 to +1 the place the previous implies important divergence.

Alternatively, a studying with reference to +1 suggests sturdy path motion which used to be the case with Cardano and the opposite two. As of this writing, ADA’s value used to be $0.45, which used to be a 26.40% lower on a Yr-To-Date (YTD) foundation.

Supply: IntoTheBlock

Supply: IntoTheBlock

A trio in deep waters

For AVAX, its price used to be $36.94— a 11.73% lower inside of the similar duration. Finally, MATIC modified palms at $0.71, marking a 29.21% slide.

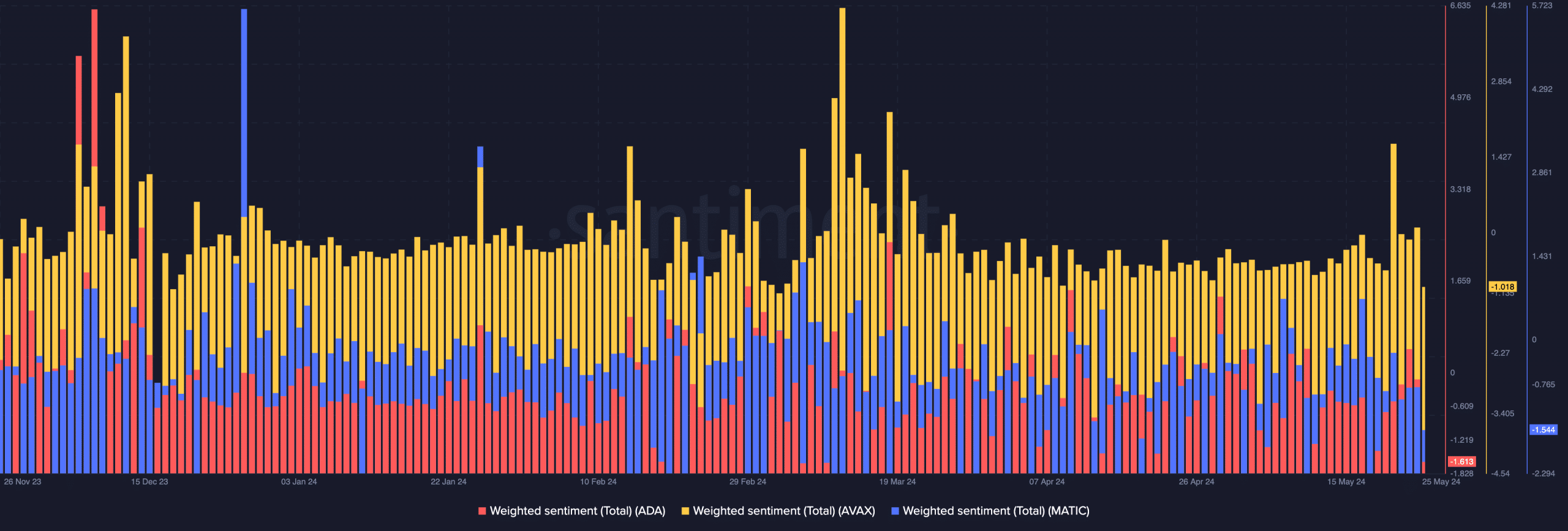

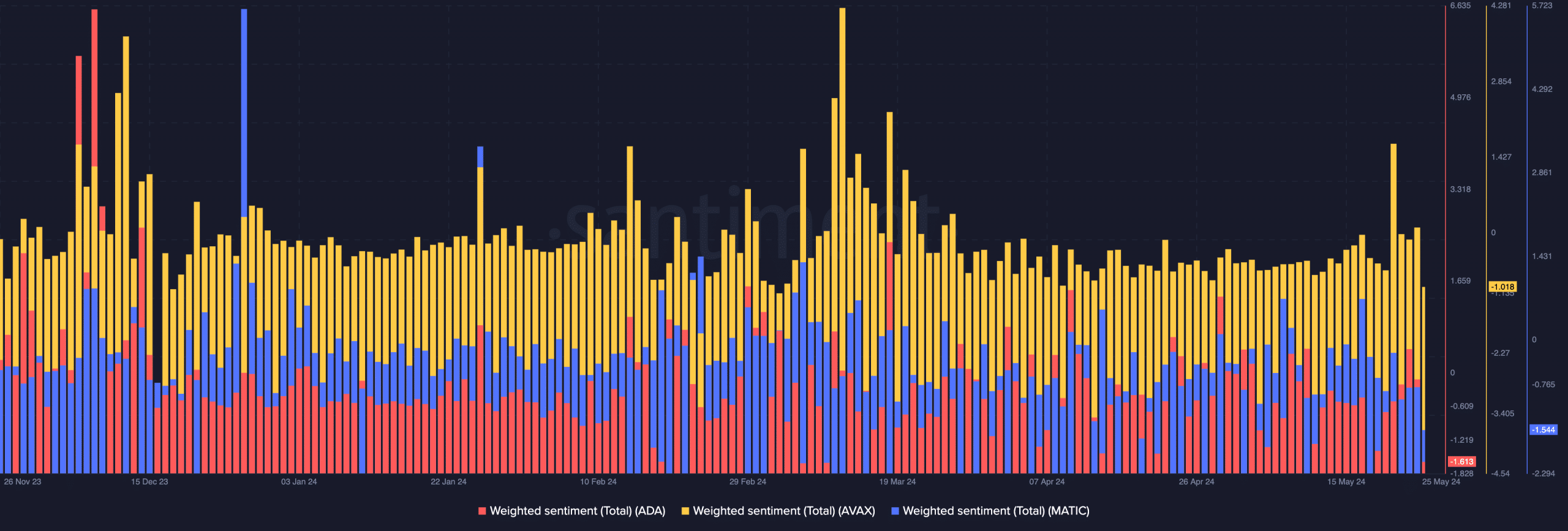

To determine if Cardano would proceed to apply in the similar path as AVAX and MATIC, AMBCrypto appeared on the sentiment across the tasks.

A have a look at the Weighted Sentiment metric supplied by means of Santiment that the studying used to be -1.613 for ADA. In AVAX’s case, the studying used to be -1.018 whilst MATIC’s used to be -1.544.

Weighted Sentiment presentations the original social quantity, measured by means of feedback about an asset. If the metric is sure, it means that marketplace members are bullish, and insist for the property concerned would possibly building up.

Then again, because the studying used to be detrimental for all 3, it signifies low self belief within the possible. With this pattern, there’s a probability that ADA, AVAX, and MATIC costs would possibly lower once more.

Supply: Santiment

Supply: Santiment

On the similar time, a extremely detrimental sentiment of this nature may point out a excellent duration to amass ahead of a significant surge seems.

The tokens would possibly quickly get again to the bull segment

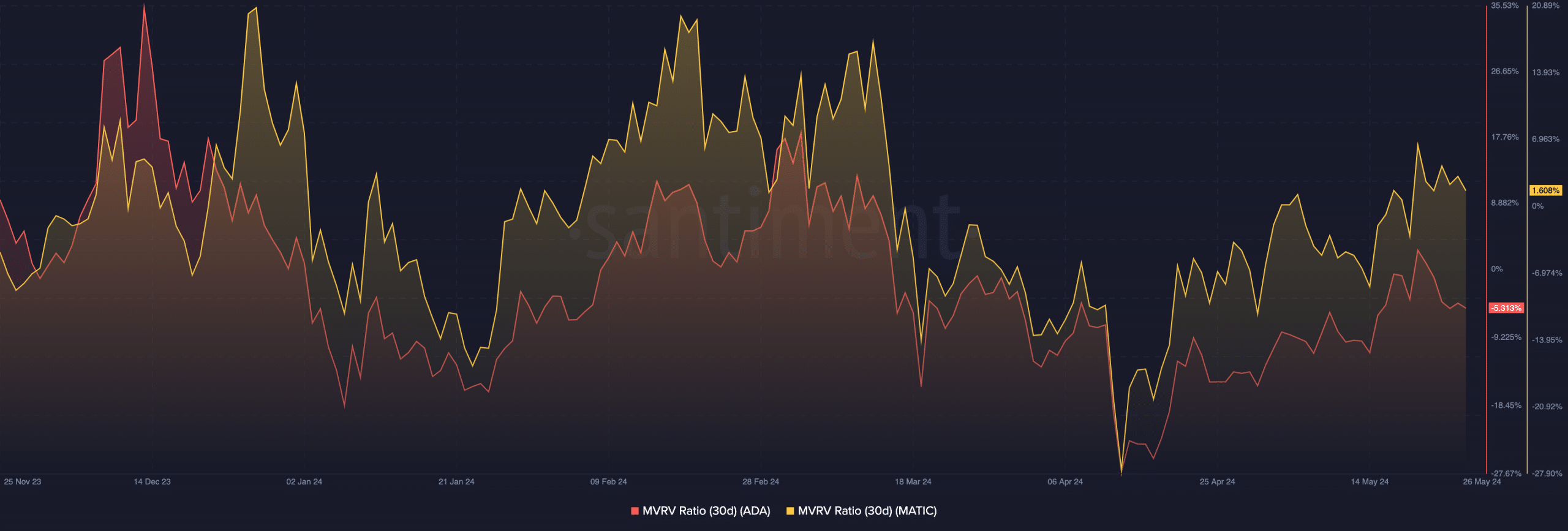

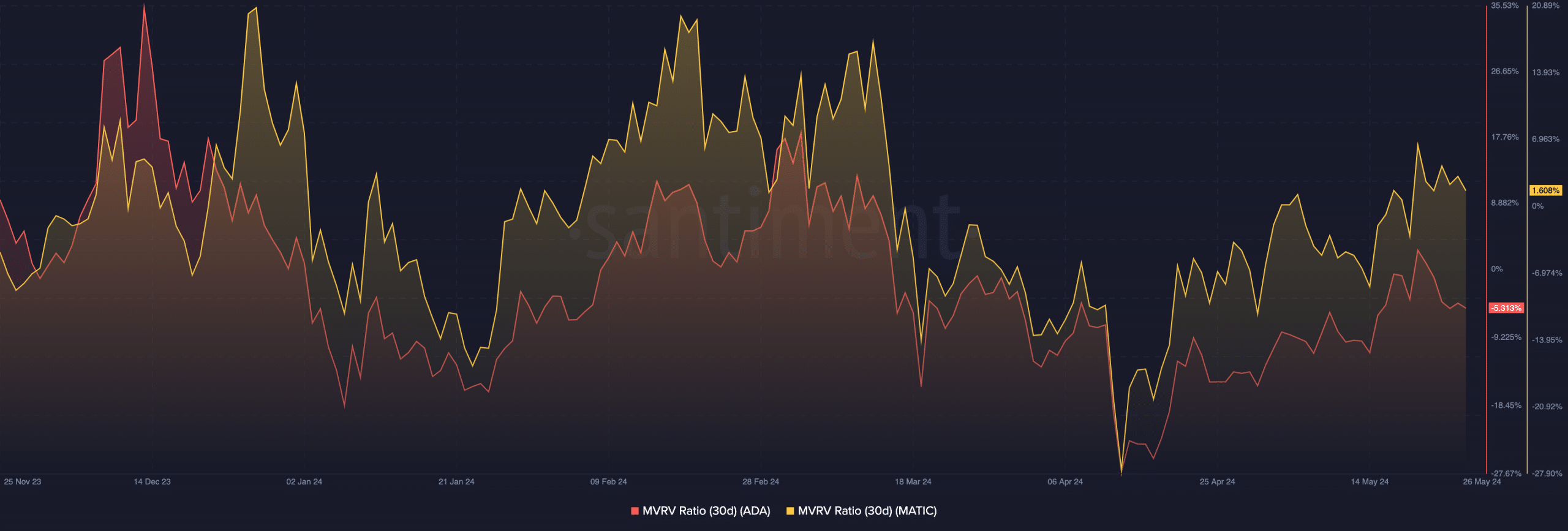

However to verify that, we want to analyze the Marketplace Price to Notice Price (MVRV) ratio. This metric tells if a cryptocurrency is undervalued or in a different way.

The extra the MVRV ratio will increase, the extra earnings holders have, and the extra they’re keen to promote. Alternatively, a lower within the metric means that extra holders are shifting into unrealized losses.

On this case, maximum will come to a decision to HODL. At press time, Cardano’s 30-day MVRV ratio used to be -5.313%. Which means if each and every ADA holder who gathered throughout the final 30 days bought, they’d be making an unrealized loss.

In MATIC’s case, the metric used to be 1.608%. However something AMBCrypto spotted used to be that the ratios diminished. Subsequently, one can think that the tokens have been undervalued within the context of the bull marketplace.

Supply: Santiment

Supply: Santiment

Sensible or no longer, right here’s AVAX’s marketplace cap in ADA phrases

Must the costs start to get well, ADA may rally again to $0.67. If it’s the similar for AVAX, the token may make a transfer to $50.35.

As well as, a leap for MATIC may ship the cost within the $1.06 path.

Earlier: Bitcoin to stand altcoin onslaught? Right here’s what to anticipate in June

Subsequent: Bitcoin inches towards $69K: Is BTC poised for a brand new top?