Choices buying and selling on BlackRock’s spot Bitcoin ETF will start Tuesday, a Nasdaq spokesperson showed to Decrypt, ushering in a brand new type of leveraged Bitcoin publicity on Wall Side road.

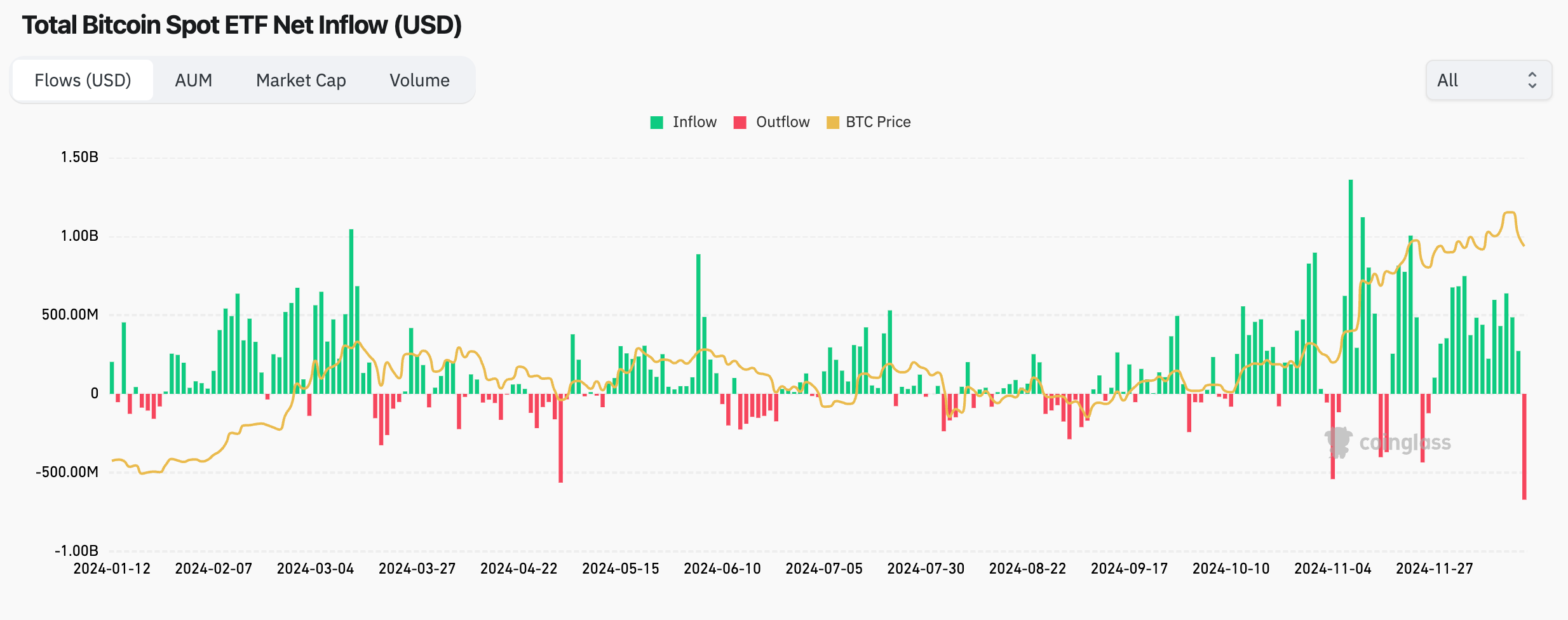

The Choices Clearing Company (OCC) up to date a report on its site Monday for brand new choices listings, with the fairness derivatives clearing group signaling that the iShares Bitcoin Consider ETF (IBIT)—a $43 billion product—would see choices indexed at the Nasdaq.Even if the Securities and Change Fee (SEC) licensed the record of choices for spot Bitcoin ETFs closing month, a memo launched through the OCC on Monday represented the closing main hurdle towards their release, consistent with Bloomberg ETF analyst Eric Balchunas. “That’s a wrap,” Balchunas wrote on Twitter (aka X). “Now it is only a subject of when, now not if.”Nasdaq’s Head of ETP Listings Alison Hennessy informed Balchunas on Bloomberg TV previous Monday that the trade may quickly checklist choices for BlackRock’s spot Bitcoin ETF as smartly.“Our intent at Nasdaq is to checklist and business those choices as early as day after today,” she mentioned. “Getting those choices indexed on IBIT into the marketplace will probably be very thrilling for buyers.”The Nasdaq spokesperson later showed to Decrypt that the choices will certainly be indexed Tuesday.In a one-page report, the OCC mentioned that it’s “making ready for the clearance, agreement, and possibility control” of choices for spot Bitcoin ETFs. The verdict used to be reached following an advisory launched through the Commodities Futures Buying and selling Fee (CFTC), the OCC mentioned.On Friday, the CFTC’s Department of Clearing and Possibility wrote that the record of choices for spot Bitcoin ETFs would now not fall underneath its jurisdiction. Necessarily, it cleared the best way for the OCC to take care of choices on spot Bitcoin ETFs through validating their standing as SEC-regulated derivatives.Along Bitcoin’s upward push to a brand new height above $93,000 this 12 months, spot Bitcoin ETFs have turn out to be a blowout good fortune on Wall Side road, pulling in additional than $27 billion since they had been licensed in January, consistent with CoinGlass knowledge. BlackRock’s IBIT leads amongst a take hold of of eleven such merchandise, pulling in round $29 billion price of inflows thus far this 12 months by itself.Analysts informed Decrypt closing month, following the SEC’s approval, that choices for spot Bitcoin ETFs is usually a game-changer: Whilst it’s an indication of regulatory development, the improvement may additionally yield higher liquidity for spot Bitcoin ETFs along moments of heightened volatility. Total, analysts mentioned that choices would make it more uncomplicated, less expensive, and more secure for buyers to take part within the Bitcoin marketplace via ETFs. As monetary derivatives, choices give a purchaser the precise to shop for or promote an asset at a particular worth inside a given window of time.Based in 1973, the OCC is referred to as the biggest fairness and derivatives clearing group on the planet. Inside the context of SEC-regulated derivatives, the OCC successfully serves as a key middleman for shifting price range and contracts between patrons and dealers.Edited through Andrew HaywardDaily Debrief NewsletterStart on a daily basis with the highest information tales at this time, plus unique options, a podcast, movies and extra.

Choices on BlackRock’s Bitcoin ETF Will Release Tuesday – Decrypt