Circle secures EU regulatory acclaim for its stablecoin underneath MiCA’s crypto framework.

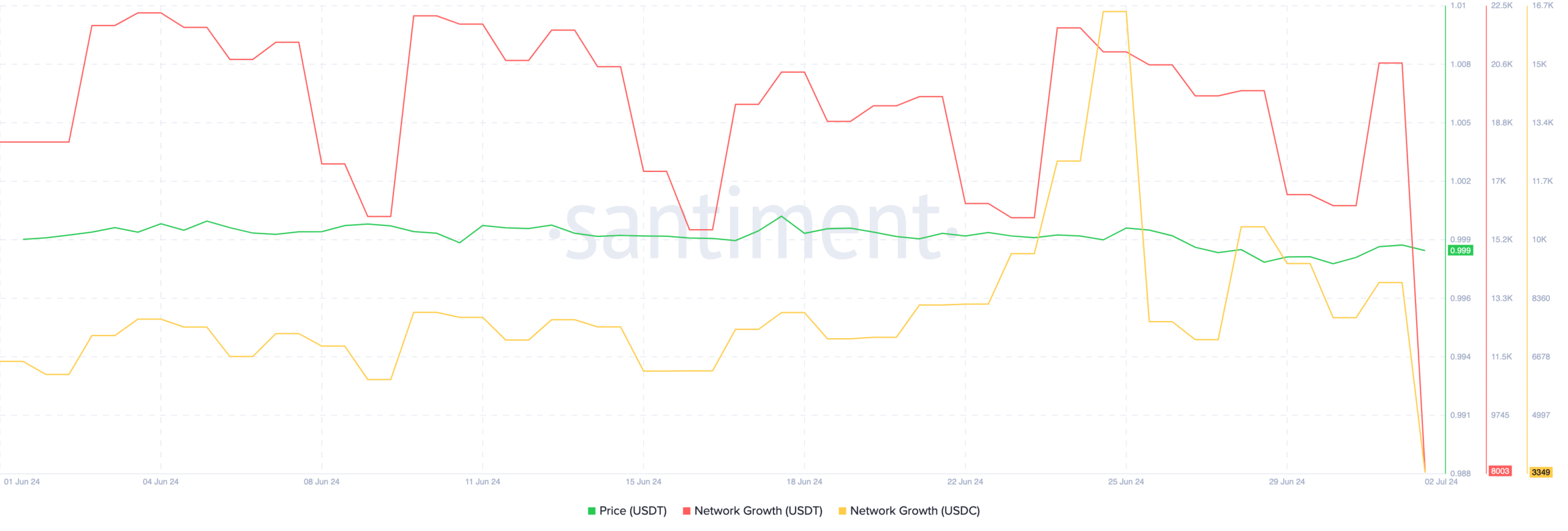

Then again, Community Expansion for each USDC and USDT declined.

Regardless of Circle’s [USDC] expansion over the previous couple of months, it has nonetheless lagged in the back of Tether [USDT] when it comes to marketplace cap. Then again, fresh traits round USDC may assist the stablecoin upward push to the highest.

Circle enters Europe

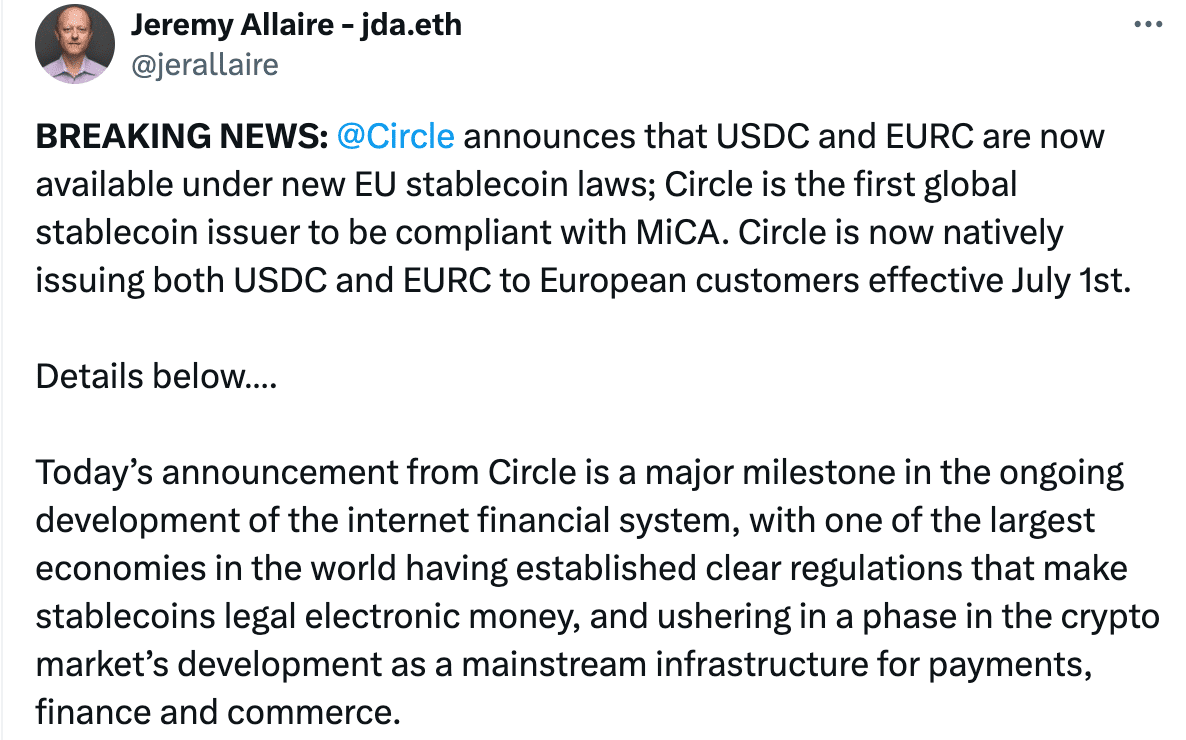

In a big win for regulatory readability within the virtual asset area, Circle secured the primary regulatory acclaim for its stablecoins underneath the Eu Union’s Markets in Crypto-Property (MiCA) framework at the 1st of July.

This announcement via Jeremy Allaire, Circle’s co-founder and CEO, comes as a reduction to traders conserving Circle’s USDC and EURC stablecoins, as they’re now demonstrably compliant with the brand new rules.

This gets rid of issues that traders could be pressured to redeem their holdings or transfer them to different belongings to stick compliant.

Supply: X

Supply: X

Circle additionally introduced its choice of France as its Eu headquarters.

This choice was once influenced via France’s revolutionary way to virtual asset legislation and Circle’s sturdy operating dating with the French Prudential Supervision and Answer Authority (ACPR).

Allaire additionally underscored the ancient importance of MiCA, the primary complete regulatory framework for virtual belongings within the EU.

This, he mentioned, marked an important step ahead for the legitimacy and balance of stablecoins, and a testomony to the maturing virtual asset business.

Will USDC outperform USDT?

Circle’s USDC stablecoin held a good 20% marketplace percentage with a $32 billion marketplace cap at press time.

Then again, Tether nonetheless stays the undisputed stablecoin chief with a whopping 70% marketplace percentage and a $112 billion marketplace cap.

Circle’s regulatory approval in Europe is usually a turning level, boosting call for for USDC and doubtlessly serving to Circle shut the distance on Tether.

This merit comes at a the most important time for Circle, as it’s been incessantly dropping marketplace percentage to Tether.

Via being the primary mover in regulatory compliance, Circle can place USDC as a secure and depended on haven for Eu traders, particularly those that will have been cautious of the unregulated cryptocurrency marketplace.

This is able to result in an important building up in call for for USDC, no longer simply in Europe but in addition globally.

Regardless of this certain construction, AMBCrypto’s research of Santiment’s information published that the community expansion for each tokens had fallen over the previous couple of days.

This indicated that the selection of new addresses in each those stablecoins had declined momentarily.

Supply: Santiment

Supply: Santiment

/cdn.vox-cdn.com/uploads/chorus_asset/file/23954043/VRG_Illo_STK427_Podcasting_playbars.jpg)