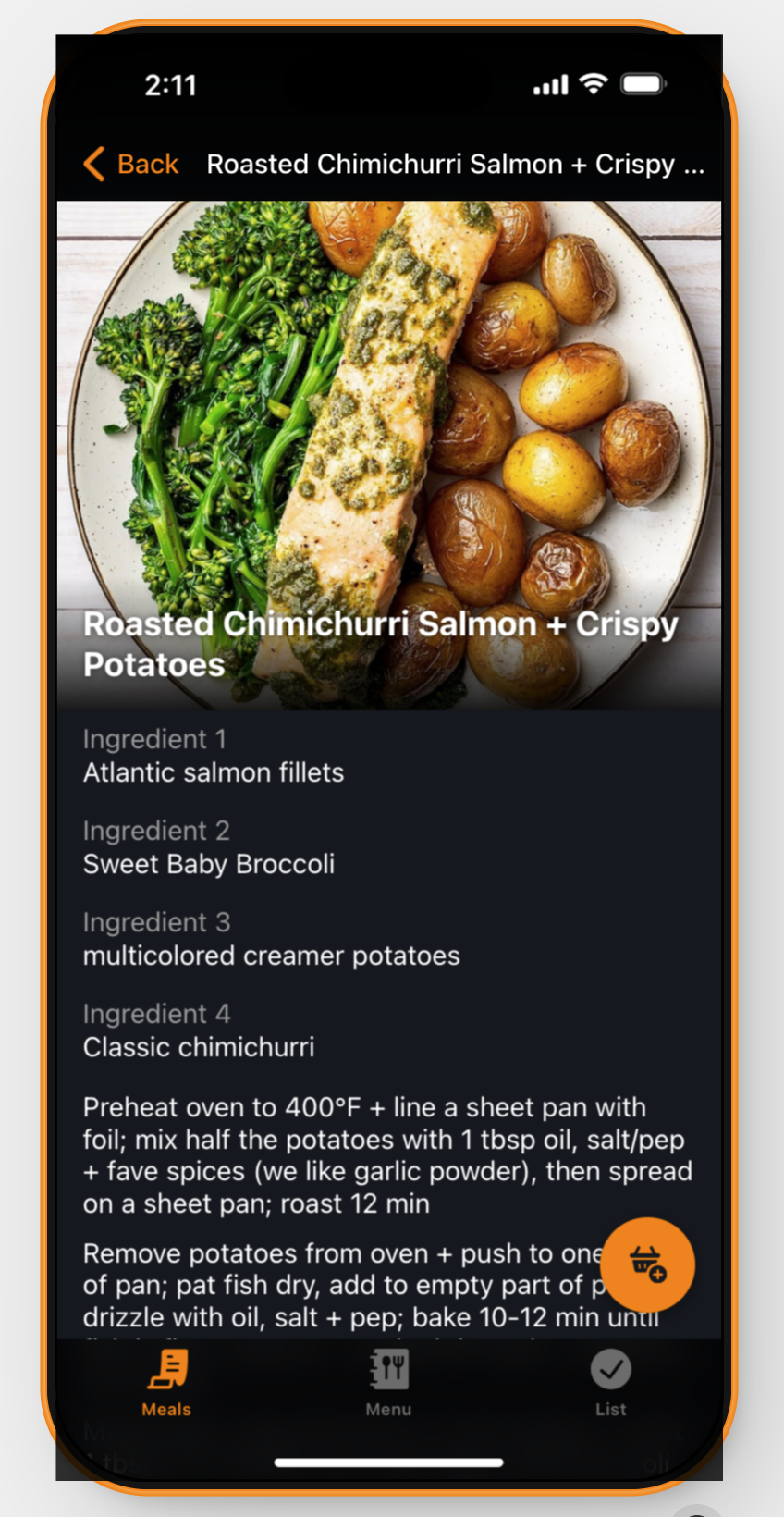

Buyers paintings at the ground of the New York Inventory Alternate (NYSE) in New York, U.S., on Monday, June 27, 2022.Michael Nagle | Bloomberg | Getty ImagesBanks kick off income

4 of Wall Side road’s Giant Banks reported income Friday. JPMorgan Chase kicked issues off with decrease fourth-quarter benefit because it paid a $2.9 billion rate connected to the federal government’s take over of a few regional banks final 12 months. Citigroup reported a $1.8 billion quarterly loss, whilst additionally saying that it could slash 10% of its staff. Financial institution of The united states’s fourth quarter internet source of revenue fell greater than 50% from a 12 months in the past, whilst Wells Fargo reported upper quarterly income however warned about decrease pastime source of revenue this 12 months. Sure inflation sign?

An surprising decline in wholesale costs indicated inflation might be declining for excellent. The Exertions Division’s manufacturer value index fell 0.1% in December, versus a nil.1% upward push noticed by way of economists surveyed by way of Dow Jones. PPI knowledge measures inflation from the manufacturer or producer’s viewpoint. Markets rose for the week

The blue-chip Dow Jones Commercial Moderate shed over 100 issues on Friday however closed 0.3% upper for the week. The S&P 500 and the Nasdaq closed the day just about flat, whilst additionally finishing upper for the week. Markets digested the beginning of the income season and an surprising decline in manufacturer costs. Eu shares ended upper, however stocks of British luxurious company Burberry fell 7% after a benefit caution. China skeptic wins Taiwan elections

Taiwan’s Lai Ching-te gained the island’s presidential election on Saturday. This used to be the Democratic Modern Celebration’s 3rd directly win. Lai, who’s noticed as a powerful China skeptic, gained by way of greater than 40% of the preferred vote. He mentioned he used to be “made up our minds to safeguard Taiwan from threats and intimidation from China.” Beijing pushed aside his victory.[PRO] Buffett’s view on airways

Wall Side road legend Warren Buffett will in all probability by no means upload airline shares to his portfolio once more. The “Oracle of Omaha” has been swift in unloading $4 billion value of airline shares within the pandemic and just lately with disappointing benefit forecast, extra airplane groundings and midair emergencies, he’s going to no longer give such shares an opportunity once more.Fourth-quarter income have formally begun with 4 of Wall Side road’s best six banks reporting slightly bleak effects.JPMorgan Chase, the largest U.S. financial institution by way of belongings, paid a sizeable rate connected to the federal government seizures related to regional banking disaster final March, which impacted its income.CEO Jamie Dimon mentioned: “the U.S. financial system remains to be resilient, with customers nonetheless spending, and markets recently be expecting a cushy touchdown.”However he added that deficit spending and provide chain changes “would possibly lead inflation to be stickier and charges to be upper than markets be expecting.”Citigroup used to be additionally hit by way of final 12 months’s regional banking disaster however focal point used to be most commonly on CEO Jane Fraser’s large overhaul plan aimed toward lifting sentiment across the financial institution’s monetary well being and in addition its inventory value.The 3rd greatest U.S. financial institution by way of belongings mentioned it’ll slash about 20,000 jobs over the “medium time period,” however didn’t make it in an instant transparent at the actual length. Citigroup has lagged its Wall Side road friends for the reason that 2008 monetary disaster and stays the bottom valued a number of the best six banks.Outlook from Wall Side road’s largest lenders used to be wary in opposition to the backdrop of markets pricing in rate of interest cuts by way of the Federal Reserve as early as March. Decrease charges harm the web pastime source of revenue generated by way of banks.One after the other, knowledge appearing a decline in wholesale costs got here as a favorable marvel. It got here an afternoon after costs customers pay for items and services and products rose 0.3% in December and have been up 3.4% at the 12 months. Nonetheless last a lot above the Fed’s 2% goal for the 12 months.”What inflation dangers stay within the U.S. financial system obviously can’t be sourced to any upward force in manufacturers’ prices,” mentioned Kurt Rankin, senior economist at PNC.”Whether or not surveying from manufacturers’ intermediate or ultimate call for viewpoint, there may be little to no pricing force headed into the U.S. financial system from the availability aspect coming into 2024.”

CNBC Day-to-day Open: Giant Financial institution income sign downbeat quarter