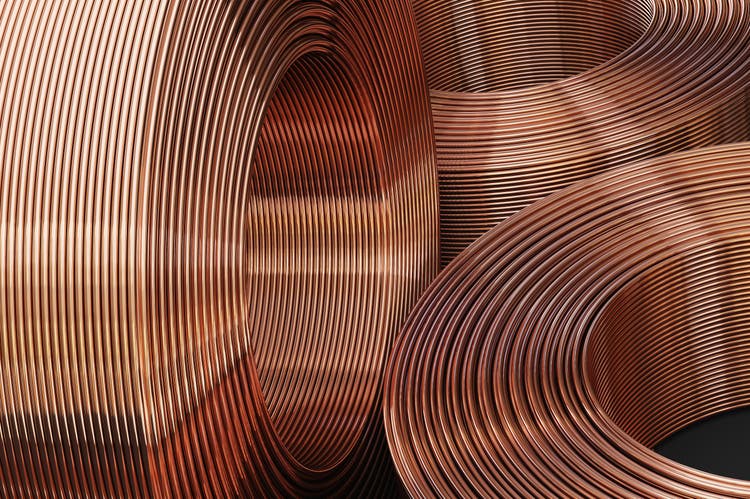

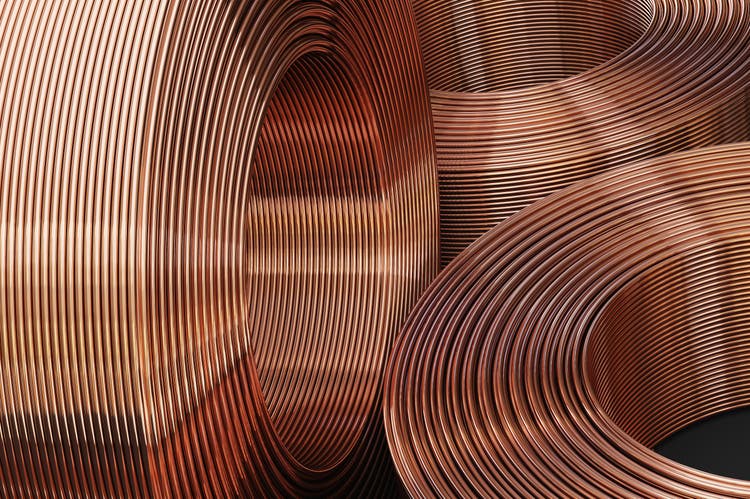

SimoneN/iStock by the use of Getty Photographs Hedge fund supervisor Pierre Andurand, one of the most global’s best-known commodity investors, thinks the copper worth rally has a lot farther to run and may just just about quadruple to $40K/metric ton in the following few years, as provide struggles to stay alongside of surging call for. The French fund supervisor instructed the Monetary Instances on Friday that he believes call for for copper, which is about to play a core section within the international power transition, will outstrip provide on this decade’s H2, inflicting costs to increase its 28% YTD surge to an all-time top of $11,104.50/metric ton previous this week. “We’re shifting against a doubling of call for expansion for copper because of the electrification of the arena, together with electrical automobiles, sun panels, wind farms, but in addition army utilization and knowledge facilities,” Andurand instructed FT. Andurand additionally has a bullish view on different commodities, together with aluminum, which he thinks will stay emerging in worth for identical causes to copper, as it may be substituted for the purple steel, however he not expects a big run-up in crude oil costs. “The geopolitical dangers comparable to Russia and Gaza have now not had an have an effect on on provide, so I believe this is why the oil worth has been rather solid, and I be expecting it to stay that approach,” he mentioned. U.S. copper futures fell this week for the primary time after an eight-week successful streak, with the front-month Would possibly Comex contract (HG1:COM) -5.5% for the week to $4.7785/MMBtu. Additionally, front-month Would possibly Comex gold (XAUUSD:CUR) ended -3.3% to $2,332.50/ouncesthis week, and Would possibly Comex silver (XAGUSD:CUR) closed -2.3% to $30.330/ounces. ETFs: (NYSEARCA:CPER), (NYSEARCA:COPX), (OTC:JJCTF), (GLD), (GDX), (GDXJ), (IAU), (NUGT), (PHYS), (GLDM), (AAAU), (SGOL), (BAR), (OUNZ), (SLV), (PSLV), (SIVR), (SIL), (SILJ) Macquarie analysts say greater call for for copper globally is being offset via slower call for expansion in China, which in flip is converting investor sentiment against copper. “Given present elementary signs, the transfer seems overdone and the danger of a pointy correction could be very top, if now not already underneath approach,” the company says. Extra on copper and copper miners

SimoneN/iStock by the use of Getty Photographs Hedge fund supervisor Pierre Andurand, one of the most global’s best-known commodity investors, thinks the copper worth rally has a lot farther to run and may just just about quadruple to $40K/metric ton in the following few years, as provide struggles to stay alongside of surging call for. The French fund supervisor instructed the Monetary Instances on Friday that he believes call for for copper, which is about to play a core section within the international power transition, will outstrip provide on this decade’s H2, inflicting costs to increase its 28% YTD surge to an all-time top of $11,104.50/metric ton previous this week. “We’re shifting against a doubling of call for expansion for copper because of the electrification of the arena, together with electrical automobiles, sun panels, wind farms, but in addition army utilization and knowledge facilities,” Andurand instructed FT. Andurand additionally has a bullish view on different commodities, together with aluminum, which he thinks will stay emerging in worth for identical causes to copper, as it may be substituted for the purple steel, however he not expects a big run-up in crude oil costs. “The geopolitical dangers comparable to Russia and Gaza have now not had an have an effect on on provide, so I believe this is why the oil worth has been rather solid, and I be expecting it to stay that approach,” he mentioned. U.S. copper futures fell this week for the primary time after an eight-week successful streak, with the front-month Would possibly Comex contract (HG1:COM) -5.5% for the week to $4.7785/MMBtu. Additionally, front-month Would possibly Comex gold (XAUUSD:CUR) ended -3.3% to $2,332.50/ouncesthis week, and Would possibly Comex silver (XAGUSD:CUR) closed -2.3% to $30.330/ounces. ETFs: (NYSEARCA:CPER), (NYSEARCA:COPX), (OTC:JJCTF), (GLD), (GDX), (GDXJ), (IAU), (NUGT), (PHYS), (GLDM), (AAAU), (SGOL), (BAR), (OUNZ), (SLV), (PSLV), (SIVR), (SIL), (SILJ) Macquarie analysts say greater call for for copper globally is being offset via slower call for expansion in China, which in flip is converting investor sentiment against copper. “Given present elementary signs, the transfer seems overdone and the danger of a pointy correction could be very top, if now not already underneath approach,” the company says. Extra on copper and copper miners

Copper costs to quadruple on hovering call for, most sensible commodity dealer Andurand says