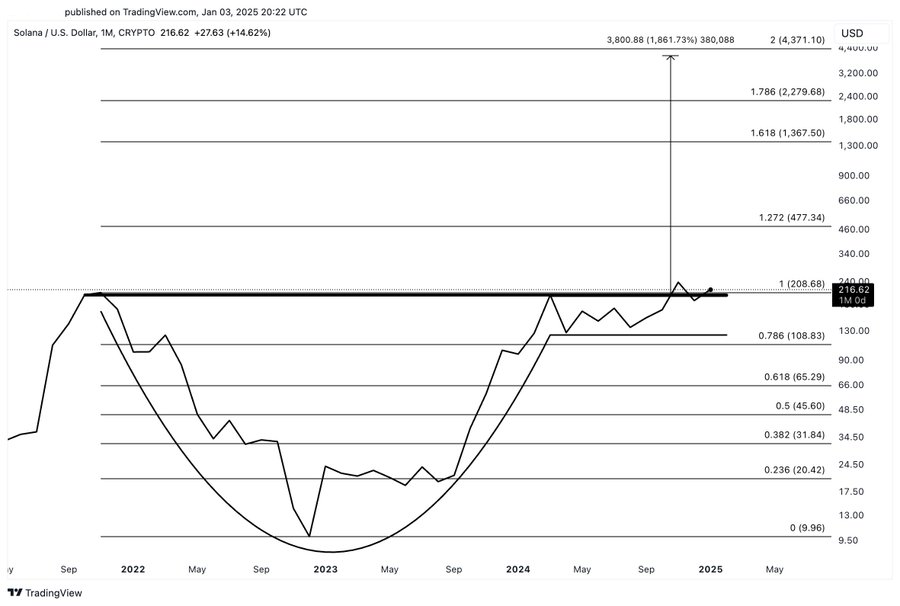

Investors paintings on the New York Inventory Alternate on Dec. 31, 2024.NYSECrypto trades leaping. Roaring Kitty boosting meme shares. Broader marketplace ripping on no obvious catalysts.Animal spirits are at the run on the morning time of 2025 buying and selling.Many speculative wallet of the inventory marketplace surged on Thursday, the primary consultation of the brand new 12 months, proper after the S&P 500 closed out the most productive two-year run since 1998.Shares tied to the cost of bitcoin jumped because the cryptocurrency climbed again over $96,000. Microstrategy added 3% after hiking greater than 360% in 2024. Crypto-related firms Coinbase, Robinhood, Mara Holdings and Rise up Platforms additionally traded upper after a large 2024. A crypto token known as “fartcoin” skyrocketed 45% and now has $1.38 billion marketplace price.In different places, retail buyers energetic on social media have been busy taking part in a guessing sport after on-line persona Roaring Kitty posted some other cryptic message on X of a brief clip of the overdue musician Rick James. Some imagine the meme inventory chief, AKA Keith Gill, used to be relating to Harmony Device, whose inventory soared 11%, whilst others assume he is again touting his authentic favourite GameStop, whose stocks additionally stuck a bid.In the meantime, semiconductor shares — 2024’s giant winners — helped lead the marketplace once more after the synthetic intelligence industry misplaced some steam on the finish of remaining 12 months. Broadcom jumped 2% Thursday, whilst Nvidia received 1.6%.What is extra, golfing inventory Topgolf Callaway Manufacturers jumped 8.5% at the again of an improve at Jefferies to shop for from grasp. The funding financial institution stated stocks of the golfing apparatus maker seemed oversold and raised its value goal to 65% above the place the inventory closed the 12 months.With a pickup in marketplace hypothesis, wide inventory indexes have been on the upward thrust to kick off 2025. The Dow Commercial Reasonable complicated greater than 300 issues. The S&P 500 and the Nasdaq Composite each received 0.7%.Thursday’s dramatic strikes resembled the preliminary rallies at the again of Donald Trump’s election victory in November, as traders wager his pro-business insurance policies would pressure firms and the financial system to robust enlargement. The ones good points slowed towards the tip of 2024 as fear grew that the president-elect’s protectionist insurance policies may stir inflation or disrupt chains, and because the Federal Reserve signaled fewer rate of interest cuts in 2025.”Many traders think that the incoming management’s push for deregulation will unharness ‘animal spirits,'” Lisa Shalett, leader funding officer of Morgan Stanley Wealth Control, stated in a up to date observe to purchasers. “However what if it most effective speeds up the focus of monopoly energy within the fingers of a couple of, diluting the efficacy of wide financial measures and leaving at the back of even higher swaths of the populace?”

Crypto, Roaring Kitty and Fartcoin: Marketplace hypothesis alternatives as much as get started 2025