Curve DAO token was once far clear of the 2021–2022 highs regardless of its sturdy efficiency in November.

The fast-term momentum was once bullish and a 12% value transfer upper was once anticipated at press time.

Curve [CRV] has won simply over 19% in every week. The bulls had been aiming to problem the $0.55 resistance within the coming days. Then again, the DeFi token has erased many of the beneficial properties it made in November and December 2024.

![Curve [CRV] eyes alt= Curve [CRV] eyes alt=](https://ambcrypto.com/wp-content/uploads/2025/03/PP-2-CRV-weekly.png) Supply: CRV/USDT on TradingView

Supply: CRV/USDT on TradingView

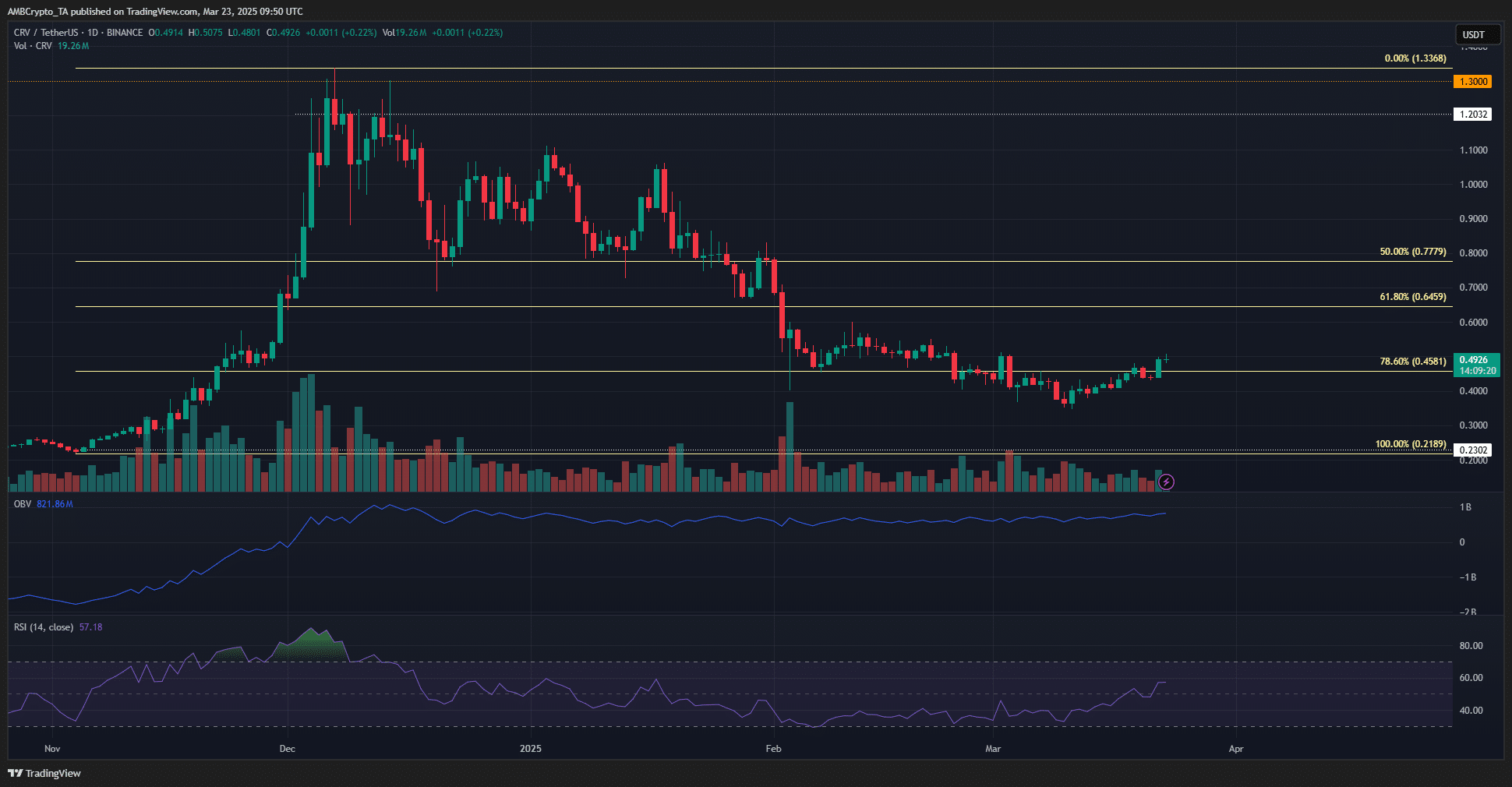

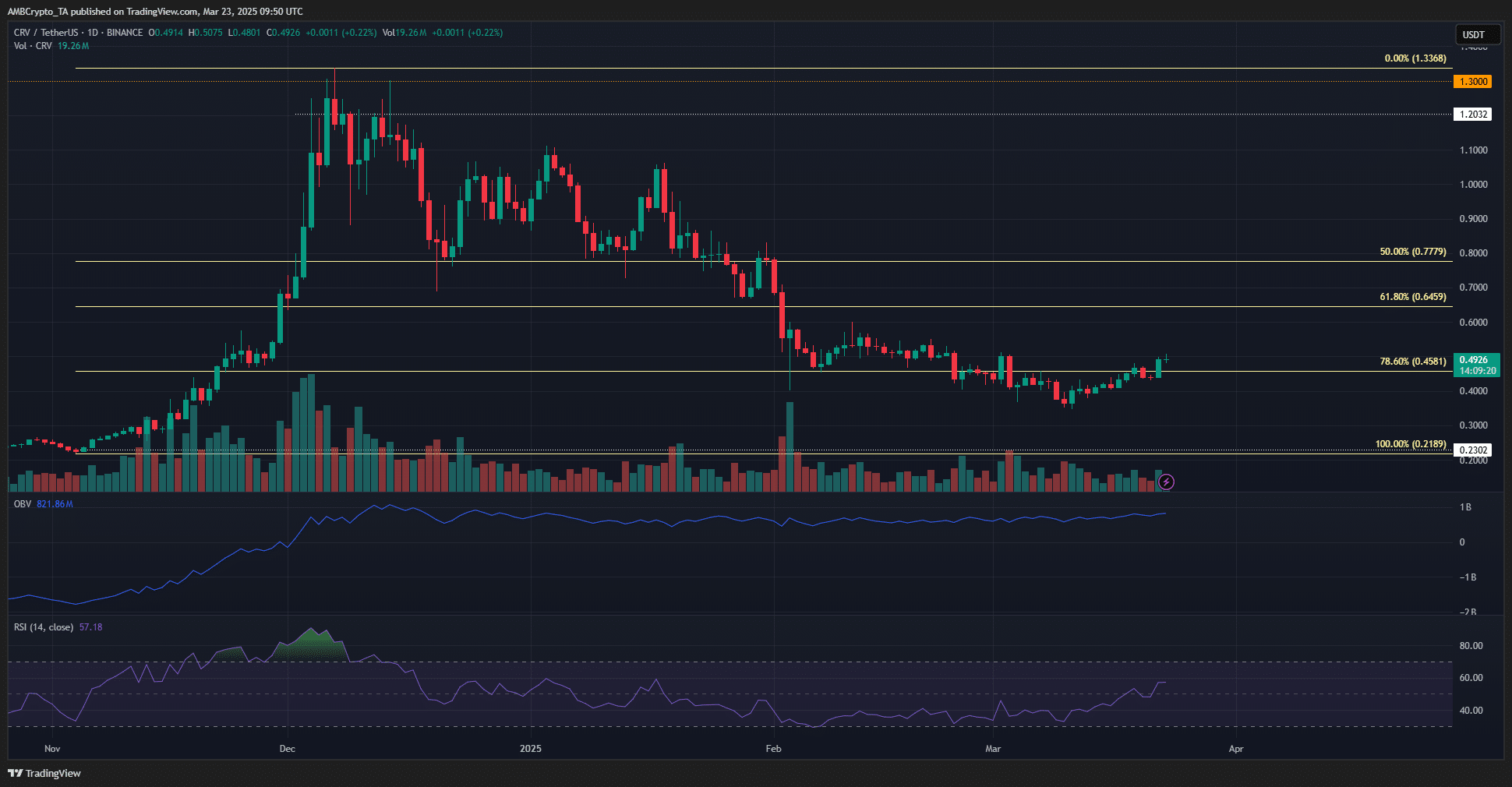

The weekly chart confirmed that although Curve made sturdy beneficial properties in November, the long-term downtrend was once now not utterly overthrown.

Sure, there was once a bullish construction destroy at the weekly chart. This was once an indication of power for the traders.

It may well be too little, too overdue, although. In a bull run, the sturdy, early runners are generally those that maintain their beneficial properties all over the cycle.

Bitcoin [BTC] confronted weak spot in December and fell beneath $92k in February, and CRV has adopted swimsuit much more aggressively to the drawback. This dented the sentiment in the back of CRV.

Decreased promoting drive supposed Curve had a possibility of restoration

Supply: CRV/USDT on TradingView

Supply: CRV/USDT on TradingView

Zooming into the 1-day chart, we will be able to see that the OBV has now not fallen a lot in comparison to its December ranges. It has even made upper lows up to now 3 months.

The gradual push upward was once an indication of a loss of promoting quantity all through the deep retracement. This supposed a restoration may come about briefly.

Regardless of the OBV’s certain signal, the bulls have a large number of paintings forward. The RSI has climbed above impartial 50 to sign a bullish momentum shift. But, the $0.55 native resistance was once nonetheless within the bulls’ means.

The day-to-day marketplace construction was once bearish, and a breach of $0.55 would alternate this.

Additional upper, the Fibonacci retracement ranges will be the key resistances to conquer. BTC’s developments within the coming weeks will have a large affect on CRV’s efficiency.

Supply: Coinglass

Supply: Coinglass

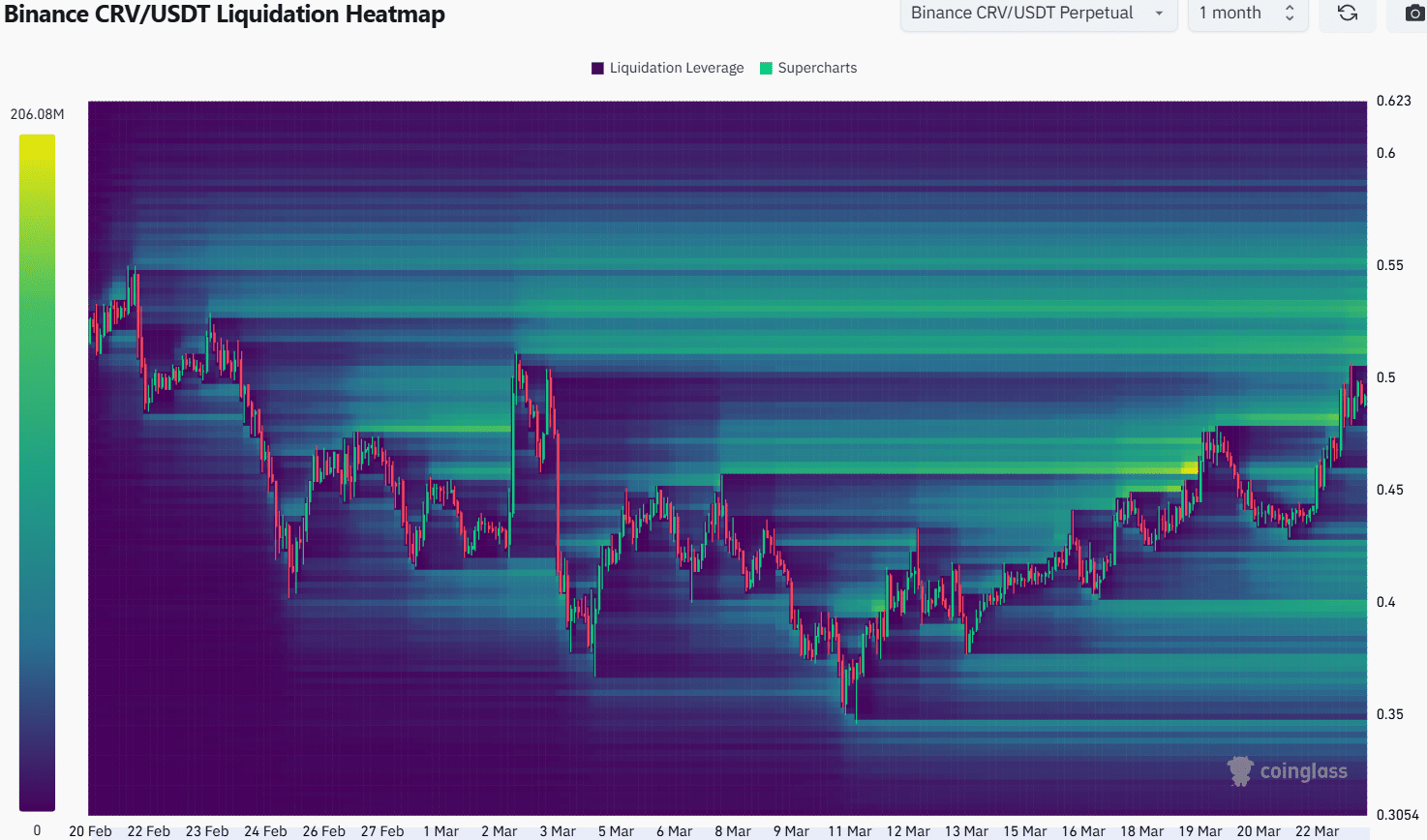

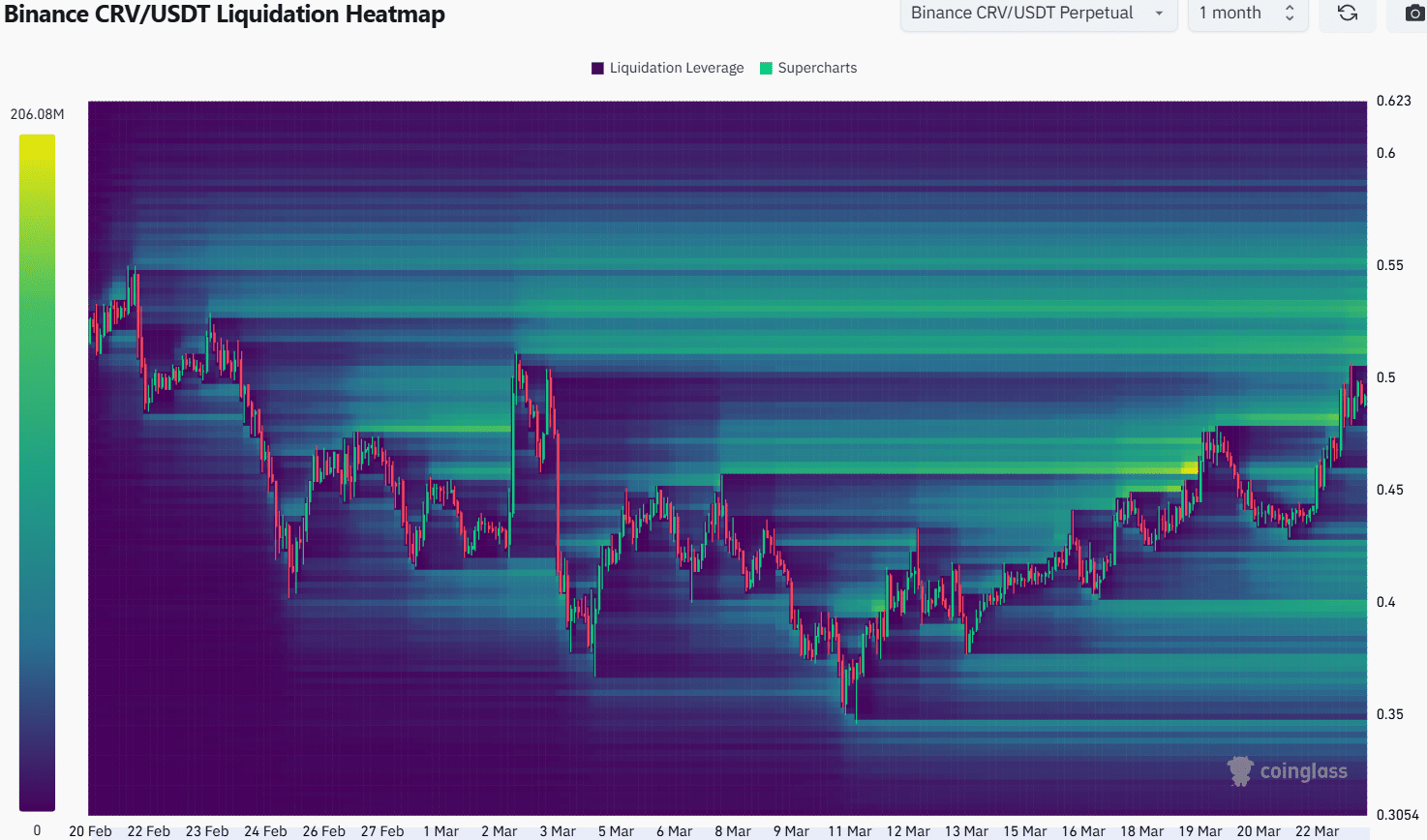

The 1-month liquidation heatmap confirmed that the realm from $0.5-$0.55 was once stuffed with liquidation ranges. They may draw in Curve costs upper within the coming days.

It was once most probably {that a} transfer to $0.55 can be adopted via a minor retracement.

The shorter-period liquidation heatmaps can be price tracking to know how deep this type of dip may pass. According to the proof handy, a transfer to $0.55 would most probably be adopted via a dip towards $0.47.

If the purchasing quantity surges upper, a breakout past $0.55 would grow to be much more likely, and a pullback to $0.47 can be much less most probably.

Disclaimer: The guidelines introduced does now not represent monetary, funding, buying and selling, or different sorts of recommendation and is simply the author’s opinion

Subsequent: Is Chainlink [LINK] able for a bullish breakout? Insights published