Purchasing power, indicated through the spot quantity on exchanges, driven the cost to $4.50.

Indicators from the RSI and Investment Price recommended that CVX may just drop beneath $4 because it used to be overbought.

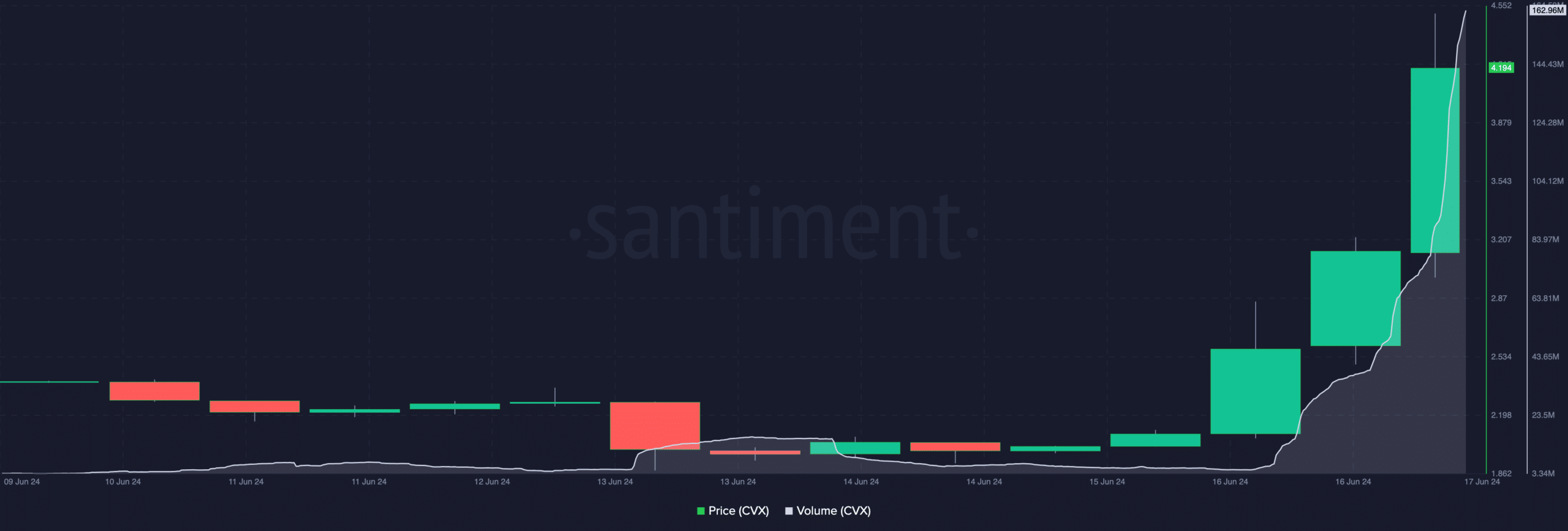

Convex Finance [CVX], the local token of the yield optimizer for various protocols, shocked the marketplace with a 90.85% rally within the final 24 hours. At the sixteenth of June, the CVX crypto traded round $2.14.

However within the early hours of the seventeenth, the price reached $4.50. Afterward, it took a step again to 4.17 which used to be its worth at press time. For the ones unfamiliar, Convex began as a yield optimizer on Curve Finance [CRV] ahead of it prolonged to different protocols.

This time, it gave the impression Curve used to be one of the crucial causes CVX pumped. A couple of days in the past, Michael Egorov, the founding father of Curve Finance put the undertaking and CRV holders in danger.

CVX quantity beats earlier milestone

This used to be as a result of Egorov used to be liquidated to the song of $27 million on his lending positions. As an aftereffect of the development, CRV plunged to an rock bottom of $0.21.

Alternatively, the founder later disclosed that he had paid $10 million out of the debt. The overhang of the CRV collateral opened the way in which for CVX’s fantastic build up.

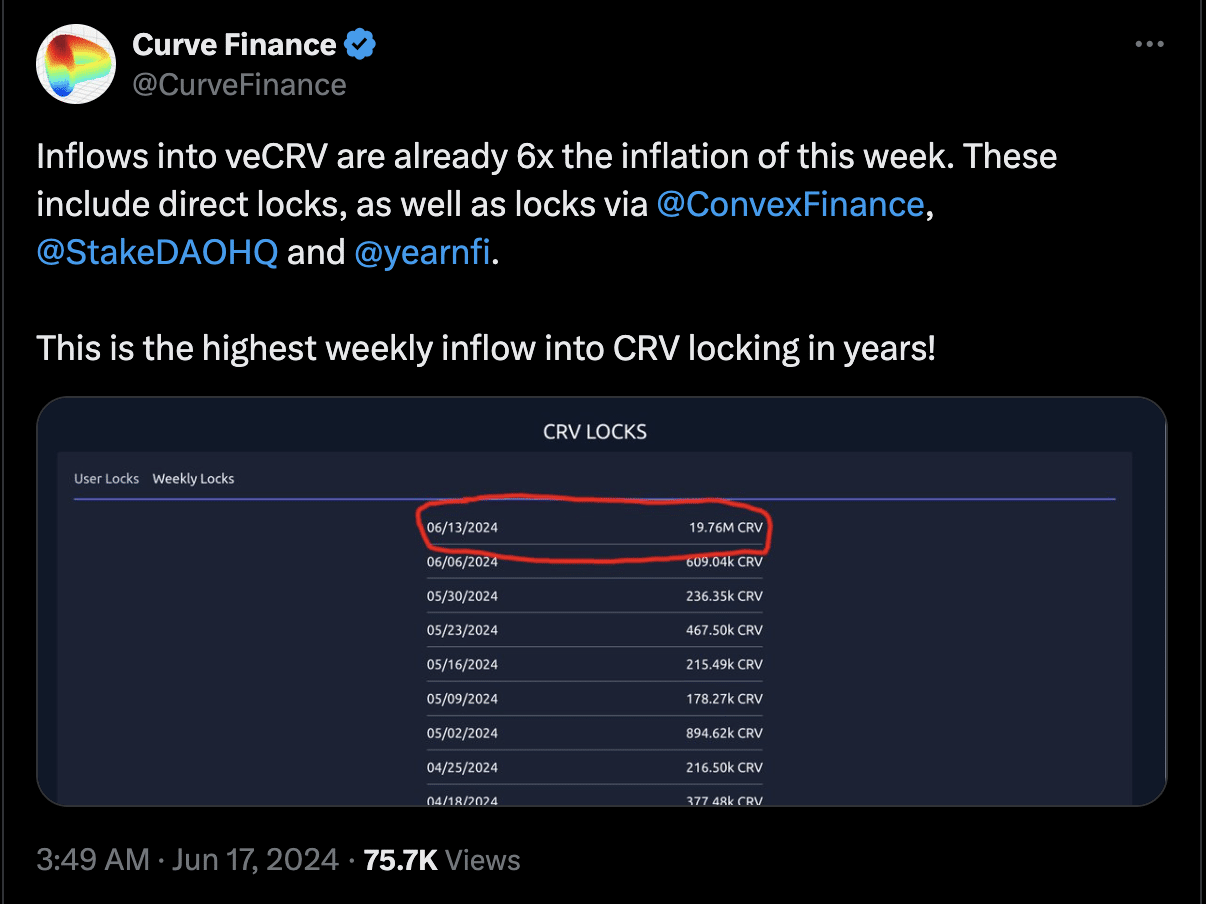

Proof additionally mirrored within the inflows into veCRV, which Convex Finance used to be part of. This build up in inflows implied that numerous customers locked their property on Convex whilst anticipating a just right yield.

Supply: X

Supply: X

In regards to the construction, Jason Hitchcock, an analyst, defined that Convex is probably not performed. Explaining his thesis, Hitchcock famous that,

“Convex has captured curve,frax, f(x)n, Prisma, and others will come. They get a large piece of all their charges and established vital incentive markets for them. Stablecoins and pegged property have discovered a house on Curve and the ones markets are setting out as anticipated.”

In the meantime, the CVX crypto worth used to be now not the one notable surge. In step with Santiment, the quantity of the token jumped through a fantastic 2677% within the final 24 hours.

As of this writing, the entire 24 -hour buying and selling quantity used to be $161.61 million. Furthemore, AMBCrypto discovered proof of higher hobby in CVX crypto.

For instance, the CVX/USD spot quantity on Binance nearly hit $32 million, indicating a brand new single-day prime for the token. Alternatively, buyers within the derivatives marketplace weren’t unnoticed.

Supply: Santiment

Supply: Santiment

Just like the spot quantity, derivatives falls in line

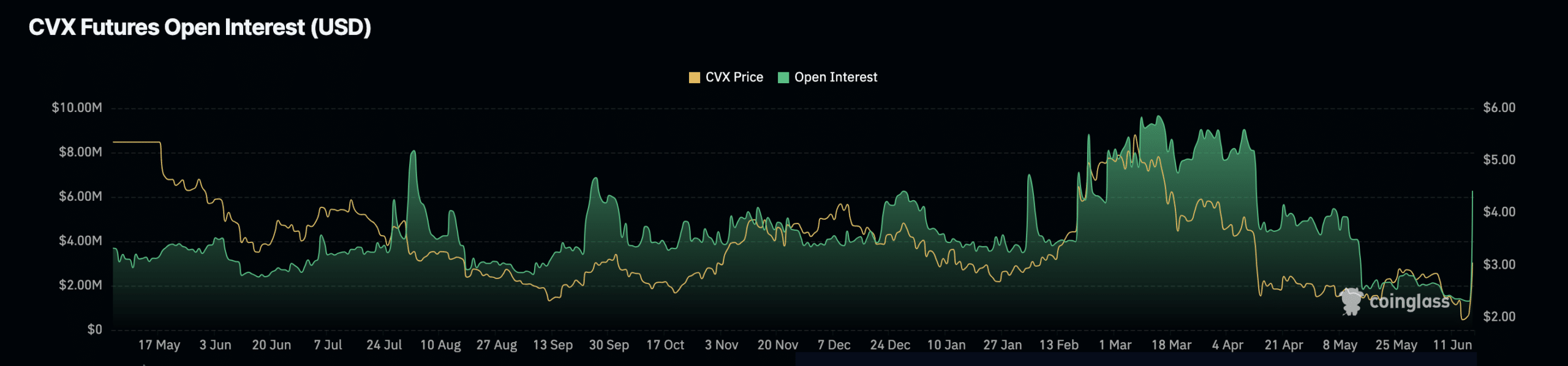

In step with information from Coinglass, Open Passion (OI) jumped through 759.50%. An build up in OI means that new cash is getting into the marketplace. Alternatively, when the OI decreases, it implies that buyers are ultimate their positions available in the market.

At press time, the CVX crypto OI used to be $6.28 million. If the price continues to extend, it would function energy for the cost.

Will have to this occur, the CVX local token may just try to hit $5 within the momentary.

Supply: Coinglass

Supply: Coinglass

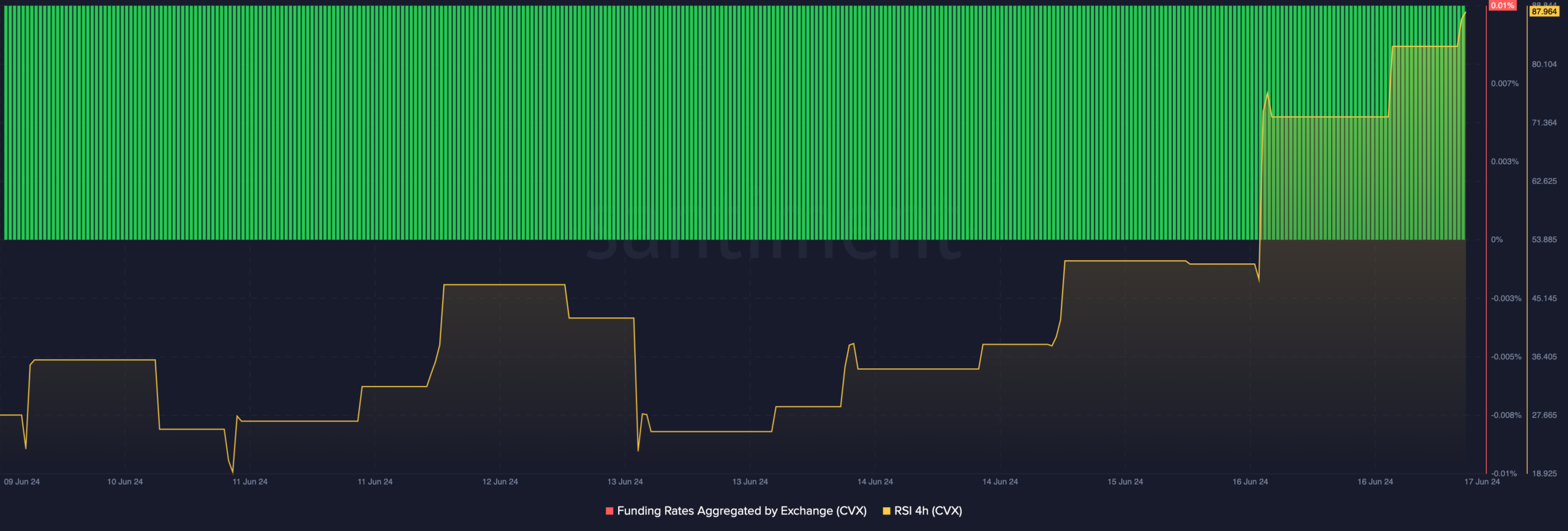

Alternatively, you will need to evaluation different signs. To evaluate CVX’s subsequent course, AMBCrypto analyzed the Investment Price.

CVX worth prediction: Is a decline coming?

Investment Price gauges if the sentiment available in the market is bullish or bearish. In doing this, the metric tracks the associated fee longs and shorts pay.

If investment is certain, it implies that longs are paying shorts an quantity to stay their positions open. On this case, the wider dealer sentiment is bullish.

Conversely, a unfavourable investment means that shorts are paying a price, and sentiment is bullish. At press time, the Investment Price of the CVX crypto used to be certain, indicating that the perp worth used to be at a cut price to the spot worth.

Alternatively, it gave the impression that worth has begun to transport decrease. When this occurs along certain investment, it implies that perp consumers are in disbelief. It additionally means that buyers within the spot marketplace are starting to guide income aggressively.

Will have to this proceed, CVX worth may slide from the highs. Moreover, AMBCrypto tested the Relative Power Index (RSI) at the 4-hour chart. The RSI measures momentum.

Supply: Santiment

Supply: Santiment

When the studying is beneath 30, it implies that a cryptocurrency is oversold. At the flipside, a studying above 70 signifies overbought positions. At press time, the indicator used to be 87.96, suggesting that CVX used to be overbought.

Is your portfolio inexperienced? Test the Convex Finance Benefit Calculator

Taking into account the situation of the each signs above, the token may battle to proceed its hike. By means of the glance of items, if promoting power intensifies, the price of CVX may drop as little as $3.70 over the following few days.

Additionally, the prediction might be invalidated if marketplace members proceed to position purchase orders.