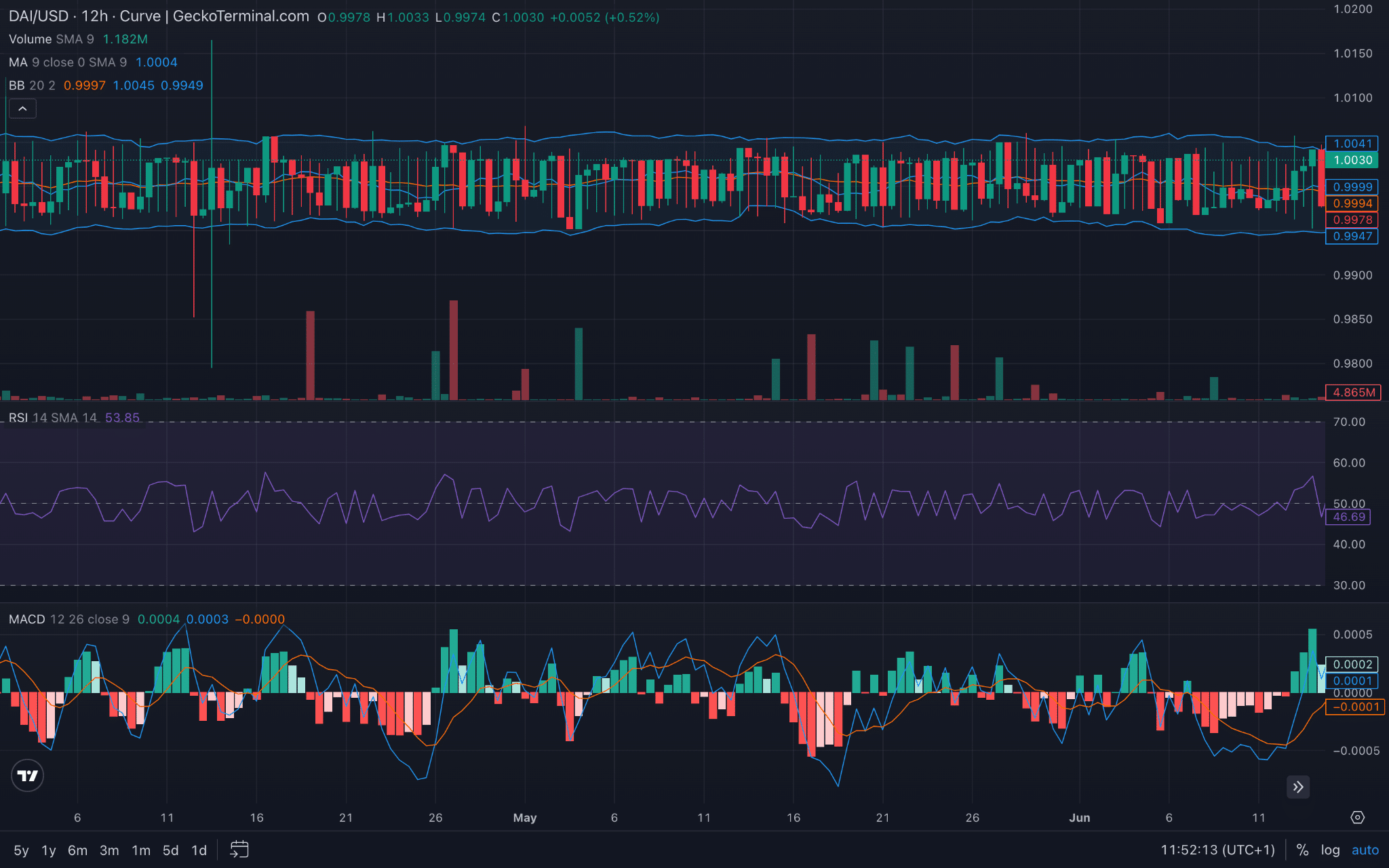

DAI struggled to take care of its buck peg, with buying and selling confined inside of a slim vary of the Bollinger Bands.

Blended signs signaled ongoing balance struggles, with out robust traits pushing clear of the peg.

For the previous month, DAI has been suffering to take care of its buck peg, dealing with important demanding situations in protecting stable at $1.00.

Contemporary fluctuations have observed DAI’s value deviate between highs of $1.001 and lows of $0.98.

In spite of the fluctuations, DAI’s value motion has been in large part contained inside the Bollinger Bands, indicating reasonably strong volatility ranges.

The candles staying close to the higher and heart band steered an try to take care of the peg at $1.00.

Supply: TradingView

Supply: TradingView

Assessing DAI’s long run

The quantity has been variable however no longer excessively top, suggesting that there haven’t been huge sell-offs or buys, which might differently destabilize the peg much more.

The RSI used to be round 53.85 at press time, indicating a steadiness between purchasing and promoting pressures.

This degree of RSI steered that whilst the asset is neither overbought nor oversold, it’s quite strong round its meant peg.

The MACD line used to be close to 0, and the sign line displays small fluctuations across the 0 mark.

This aligned with the battle to settle definitively at $1.00, appearing minor fluctuations however no robust pattern clear of the peg.

Supply: Maker Burn

Supply: Maker Burn

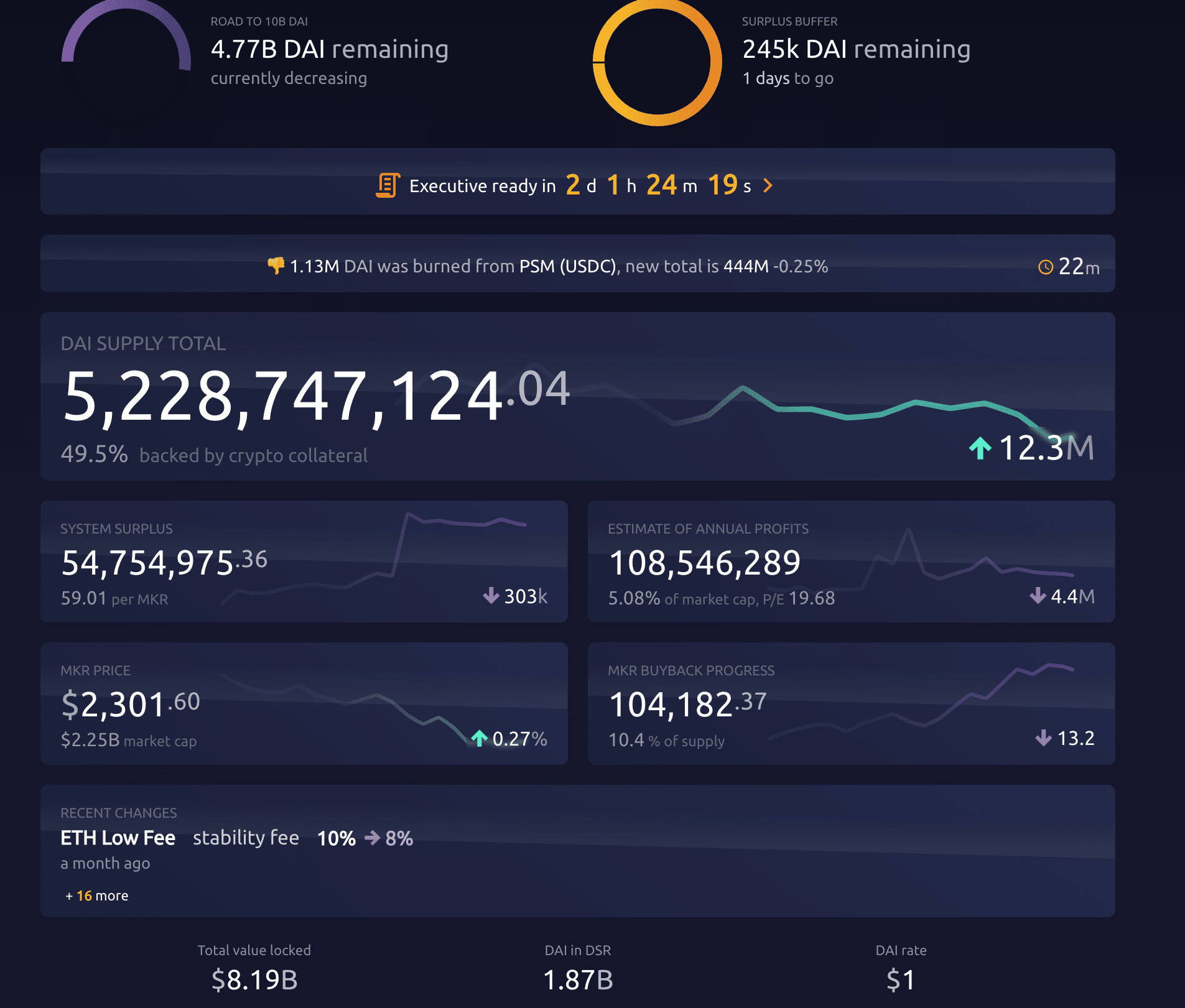

49.5% of the entire DAI provide is subsidized by way of cryptocurrency collateral.

This indicated that just about part of the DAI issued is secured by way of different cryptos. They may be able to have an effect on its balance and trustworthiness as a stablecoin if their costs are plunging, which, at the present time, they’re.

An important 67% of DAI holders had been out of the cash at press time, indicating that the majority holders bought DAI at charges diverging from its present degree.

Supply: IntoTheBlock

Supply: IntoTheBlock

Sensible or no longer, right here’s MKR’s marketplace cap in BTC phrases

With 56% of DAI held by way of massive holders, there’s a substantial focus of regulate. So, liquidity and value balance are closely swayed by way of the movements of a couple of holders.

Change inflows and outflows display $18.97 million entering exchanges and $21.03 million transferring out. This web outflow may just reasonably relieve promoting power on DAI, serving to it edge nearer to its peg.