Palantir (NASDAQ:PLTR) stocks had been underneath force for the second one consecutive day on Thursday following a press release that buyers interpreted as dangerous information for the high-flying giant information corporate.Uncover the Highest Shares and Maximize Your Portfolio:

In particular, on Wednesday, the Trump Management introduced a brand new five-year plan to cut back protection spending via 8% consistent with yr (roughly $290 billion). With Palantir’s industry closely reliant on executive contracts, buyers are patently anxious Palantir shall be receiving much less executive paintings over the following few years.

Alternatively, Wedbush analyst and long-time Palantir bull Daniel Ives thinks all of it quantities to a knee-jerk overreaction with the detractors clutching at straws.

“The bears that experience hated Palantir from $12 to $120 within the ultimate 18 months now have discovered their newest ‘silver bullet’ damaging thesis round PLTR being uncovered to those finances cuts and we noticed a pointy sell-off in buying and selling accordingly as soon as this information about DOD hit,” the analyst stated.

Factor is, says Ives, the inside track must be checked out in a completely other gentle. The analyst believes the DoD cuts may have the other impact, as Palantir’s “distinctive instrument method” is more likely to safe extra IT finances allocations on the Pentagon – no longer much less.

“Palantir is so neatly located for this new disciplined spending atmosphere on the Pentagon and this may increasingly in the end be a favorable expansion catalyst because the more than a few systems are scrutinized and as Karp & Co. get a larger seat on the desk within the Beltway,” Ives additional stated.

The higher AI investments underneath the Trump Management, in particular via Venture Stargate, must be really useful for Palantir as extra organizations search to “put into effect strategic AI infrastructure.” Moreover, the corporate’s FedRAMP (Federal Chance and Authorization Control Program) excessive authorization for all its cloud products and services portfolio lets in the corporate to provide its merchandise throughout all the U.S. executive, together with extremely delicate workloads.

As such, with Palantir gaining momentum throughout each federal and industrial sectors, Ives continues to view it as a best inventory to possess in 2025, seeing this sell-off as “some other alternative.” The analyst believes Palantir has the prospective to achieve a trillion-dollar marketplace cap within the years forward, positioning itself as the following Oracle or Salesforce amid the unfolding AI revolution.

“We view this newest fear as noise given the place we see PLTR’s shiny AI pushed long term,” Ives summed up.

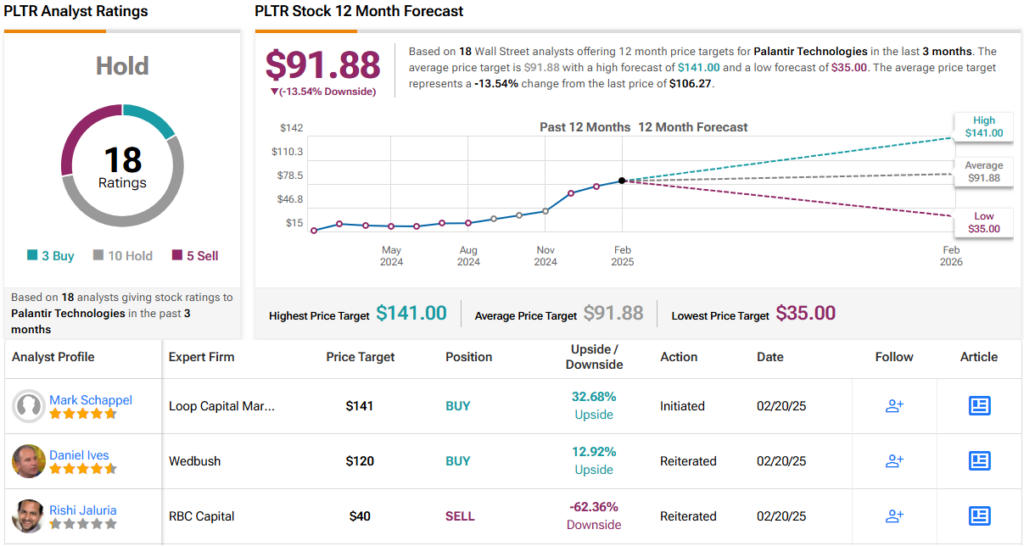

Final analysis, Ives stays on PLTR’s facet, assigning an Outperform (i.e., Purchase) score for the stocks, together with a $120 worth goal. Will have to the determine be met, buyers shall be pocketing returns of 20% a yr from now. (To observe Ives’ monitor file, click on right here)

As an entire, the Boulevard is much less enamored with this title. In keeping with a mixture of 10 Holds, 5 Sells and three Buys, the analyst consensus charges the inventory a Cling (i.e., Impartial). In the meantime, going via the $91.88 reasonable worth goal, stocks are these days hyped up via ~14%. (See PLTR inventory forecast)

To seek out excellent concepts for shares buying and selling at sexy valuations, discuss with TipRanks’ Highest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The critiques expressed on this article are only the ones of the featured analyst. The content material is meant for use for informational functions best. You will need to to do your personal research prior to making any funding.