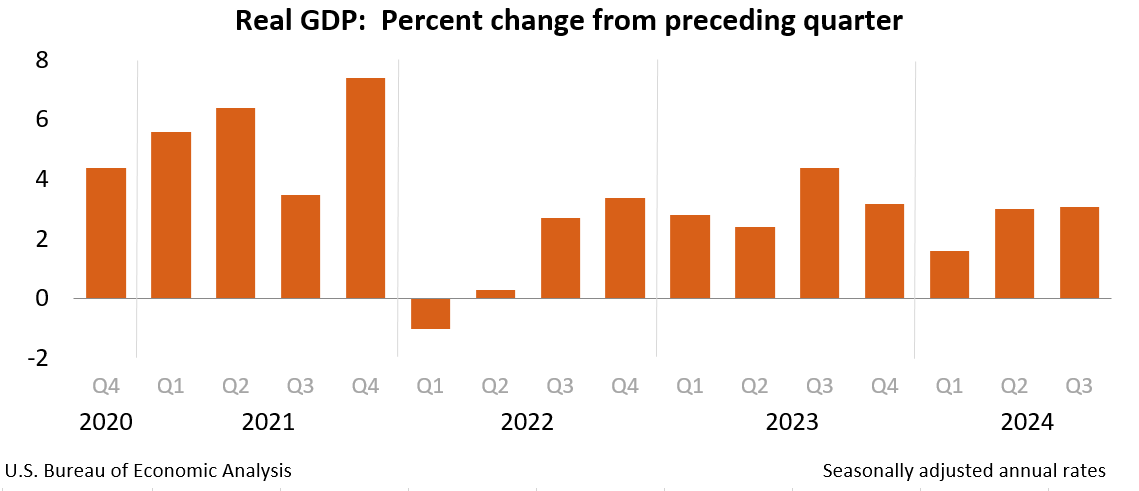

A RC Willey house furniture retailer in Draper, Utah, on Aug. 28, 2023.George Frey/Bloomberg by way of Getty ImagesDemand for items soared early within the Covid-19 pandemic, as customers have been confined to their houses and could not spend on such things as go back and forth or live shows. The well being disaster additionally tangled up international delivery chains, which means quantity could not stay tempo with call for for the ones items. Such supply-and-demand dynamics drove up costs.Now, they are falling again to earth.So-called “core” items inflation — which exclude meals and effort costs, which can also be unstable — used to be unfavorable 0.3% in January 2024 relative to a 12 months previous, consistent with the most recent shopper value index knowledge issued Tuesday by way of the U.S. Bureau of Hard work Statistics.”Provide chains are going again to commonplace,” stated Jay Bryson, leader economist for Wells Fargo Economics. “And at the call for aspect, there may be been quite of a rotation from items spending again towards services and products spending.””We are roughly reverting again to the pre-Covid technology,” he added.Reasonable costs have deflated for those bodily items, amongst others, from January 2023 to January 2024: furnishings and bedding (costs have fallen by way of 2.9%); primary family home equipment (-7.3%); males’s fits, recreation coats and outerwear (-5.3%); ladies’ attire (-9%); video and audio merchandise (-5.8%); wearing items (-1.1%); toys (-4.2%); and school textbooks (-5.7%), consistent with CPI knowledge.Costs for used automobiles and vehicles have additionally deflated over the last 12 months, by way of 3.5%, consistent with CPI knowledge.Used and new car costs have been some of the first to surge when the U.S. financial system reopened widely early in 2021, amid a scarcity of semiconductor chips crucial for production.”A large number of elements have come in combination to push items costs down,” stated Mark Zandi, leader economist at Moody’s Analytics.Along with normalizing supply-demand dynamics, a traditionally sturdy U.S. buck relative to different international currencies has additionally helped rein in items costs, Zandi stated. This makes it less expensive for U.S. corporations to import items from in another country, because the buck can purchase extra.The Nominal Large U.S. Buck Index is upper than at any pre-pandemic level courting to a minimum of 2006, consistent with U.S. Federal Reserve knowledge. The index gauges the buck’s appreciation relative to currencies of the U.S.′ primary buying and selling companions such because the euro, Canadian buck, British pound, Mexican peso and Jap yen.Falling calories costs have additionally put downward drive on items costs, because of decrease transportation and energy-intensive production prices, economists stated. Total calories prices have fallen by way of 4.6% prior to now 12 months.Alternatively, economists worry that assaults by way of Houthi militias on service provider vessels within the Crimson Sea — a significant business direction — may motive transport disruptions and a reversal of a few items deflation.Decrease calories costs additionally put downward drive at the transportation of meals to retailer cabinets.Amongst grocery pieces, egg and lettuce costs declined considerably from January 2023 to January 2024 (by way of 28.6% and 11.7%, respectively) after having soared in 2022. A few of the causes for the ones preliminary shocks: a ancient outbreak of avian influenza within the U.S., which is terribly deadly amongst chickens and different birds, and an insect-borne virus that raged during the Salinas Valley rising area in California, which accounts for roughly part of U.S. lettuce manufacturing.Egg costs have began to climb once more in fresh months, then again, because of a comeback of avian flu.Total grocery costs rose at a 1.2% tempo prior to now 12 months, consistent with CPI knowledge.The typical American allocates maximum in their price range — about two-thirds of it — to services and products as an alternative of products.The services and products sector of the U.S. financial system has observed disinflation, however hasn’t sunk into deflation like core items. Services and products inflation (minus calories) continues to be up 5.4% since January 2023, consistent with CPI knowledge.Extra from Non-public Finance:

Here is the inflation breakdown for January 2024 — in a single chart

Why the ‘closing mile’ of the inflation combat is also more difficult

Why disinflation is ‘extra perfect’ than deflationServices companies are extra delicate to exertions prices, economists stated.A sizzling task marketplace because the financial system reopened in 2021 led employees’ salary expansion to balloon to its perfect in a long time. Reasonable income have cooled along side the wider exertions marketplace however stay increased relative to their pre-pandemic baseline, they stated.”The latest [Employment Cost Index] salary expansion numbers for This fall 2023 got here in beneath 4% annualized (first time since Q2 2021), which displays the easier stability between exertions call for and provide that has been accomplished by way of rebalancing,” consistent with a contemporary outlook authored by way of J.P. Morgan’s International Funding Technique Team.Some services and products classes have deflated, even though.Airline fares, as an example, have fallen by way of 6.4% prior to now 12 months. That is because of elements like decrease jet-fuel prices for airways and an build up in seat capability (i.e., to be had seat delivery for passengers because of larger flight quantity) on home and global flights, consistent with Hopper.In other places, some deflationary dynamics are going down most effective on paper.As an example, within the CPI knowledge, the Bureau of Hard work Statistics controls for high quality enhancements over the years. Electronics equivalent to televisions, mobile phones and computer systems frequently get well. Shoppers get extra for kind of the similar amount of cash, which displays up as a worth decline within the CPI knowledge. Medical insurance, which falls within the services and products aspect of the U.S. financial system, is identical.The Bureau of Hard work Statistics does not assess medical health insurance inflation in response to shopper premiums. It does so not directly by way of measuring insurers’ income. It is because insurance coverage high quality varies a great deal from individual to individual. One particular person’s premiums might purchase high-value insurance coverage advantages, whilst some other’s buys meager protection.The ones variations in high quality make it tough to gauge adjustments in medical health insurance costs with accuracy.Medical insurance costs declined by way of 23.3% over the last 12 months. That decline displays smaller insurer income in 2021 relative to 2020.Those kinds of high quality changes imply customers do not essentially see costs drop on the retailer, however simply on paper.

Deflation: Right here's the place costs fell in January 2024, in a single chart