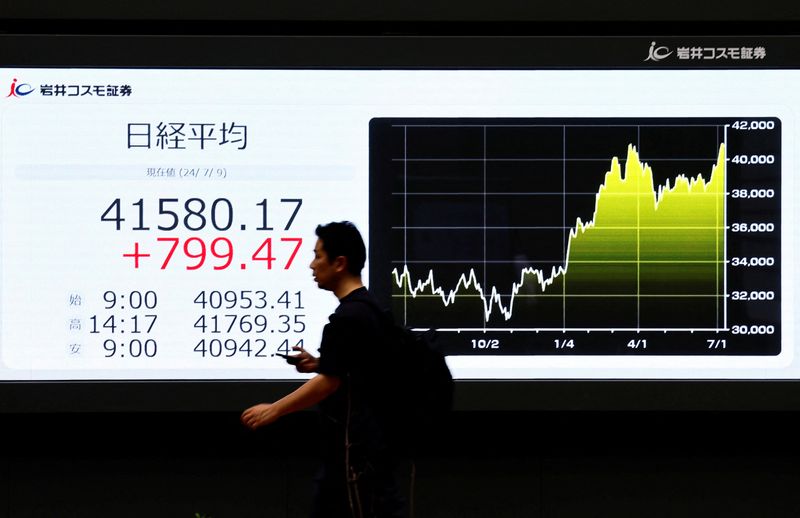

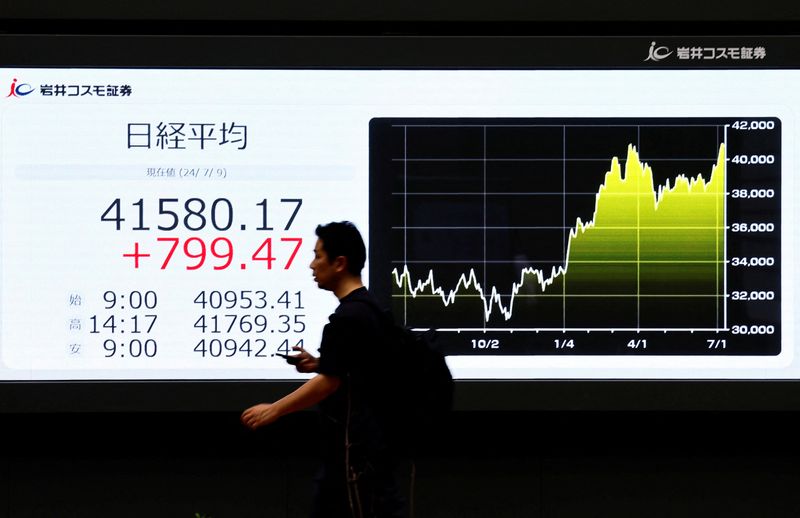

By means of Yoruk Bahceli and Tom Westbrook (Reuters) – Global markets steadied on Tuesday as buyers appeared past Joe Biden’s go out from the U.S. presidential race, turning their center of attention to company income and financial knowledge. Biden’s go out from the race has solid some doubt over a Republican victory underneath Donald Trump and may just see buyers unwind trades making a bet that this sort of win would upload to U.S. fiscal and inflationary pressures. Vice President Kamala Harris will marketing campaign within the battleground state of Wisconsin on Tuesday because the Democrats’s presumed nominee. The pan-Eu STOXX index was once up 0.1% whilst U.S. futures had been down 0.2% following a 1.1% upward push within the on Monday.[.N] The U.S. greenback, which had edged upper on Monday, was once unchanged in opposition to a basket of currencies on Tuesday. “Markets seem to be in a little bit of a keeping development this morning having now digested the weekend information glide of Biden quitting the presidential race,” stated Michael Brown, senior strategist at dealer Pepperstone in London. Traders will now center of attention on whether or not the polls display a better race in opposition to Trump than when Biden was once the Democratic candidate, Brown stated. “You’ll be expecting that, had been polls to slender, and the race be observed as a better contest, volatility to tick upper, and most likely some problem creep into the fairness area too,” he added. Nonetheless, Asian markets remained supported on Tuesday, with Taiwan’s benchmark snapping 5 classes of losses, emerging over 2%. That tracked a broader rebound in chipmaking stocks convalescing one of the most $100 billion in marketplace price that was once wiped off Taiwan’s TSMC, the sector’s greatest contract chipmaker, over the previous couple of classes. () The inventory had come underneath force following Trump’s feedback that Taiwan will have to pay to be defended and accusing the island of stealing American chip trade Focal point was once firmly on income on Tuesday, with Tesla (NASDAQ:) and Alphabet (NASDAQ:) because of document after the consultation shut in New York, starting the season for the “Magnificent Seven” megacap staff of shares. The tech sector is projected to extend year-over-year income through 17%, whilst benefit for the communique products and services sector is observed emerging about 22%, in line with LSEG IBES, however richly valued shares also are susceptible to sadness. Others reporting come with France’s LVMH, which shall be closely-watched as sliding call for from China has pummelled the sphere. DATA WATCH In forex markets the principle mover was once the yen, which was once ultimate up 0.6% in opposition to the greenback at 156.04. Feedback shape a senior Eastern baby-kisser on Monday added to the force at the Financial institution of Japan, which meets on July 31, to stay mountaineering charges to lend a hand spice up its forex, which Tokyo has intervened to prop up this month. Australia and New Zealand’s currencies, continuously observed as liquid proxies for , additionally dropped following China’s wonder rate of interest cuts on Monday, which has additionally put a focus on weak spot on this planet’s 2d greatest economic system. The euro was once down 0.2% at $1.0873. Focal point remained on central banks. Markets have priced in two U.S. fee cuts this 12 months with the primary in September, however expectancies may well be ruffled through expansion and shopper value knowledge due later within the week. Having moved upper on Monday, benchmark 10-year Treasury yields inched two foundation issues decrease to 4.24% and two-year yields, delicate to rate of interest expectancies, had been down 2 bp to 4.51%. Advance U.S. gross home product is forecast to turn expansion selecting as much as an annualised 2% in the second one quarter, whilst the heavily watched Atlanta Fed GDPNow indicator issues to expansion of two.7%, suggesting some possibility to the upside. The core non-public intake expenditures index, the Fed’s most popular inflation measure, is observed emerging 0.1% in June, pulling the once a year tempo down a tick to two.5%.

Gold costs had been pinned round $2,400 after peaking above $2,450 ultimate week. futures, which hit a one-month low on Monday, had been up 0.1% at $82.48 a barrel. , which has rallied on bets a Trump management would take a light-touch technique to cryptocurrency law, was once down 1.8% to $66,920.

Digesting Biden go out, markets center of attention on income, knowledge By means of Reuters