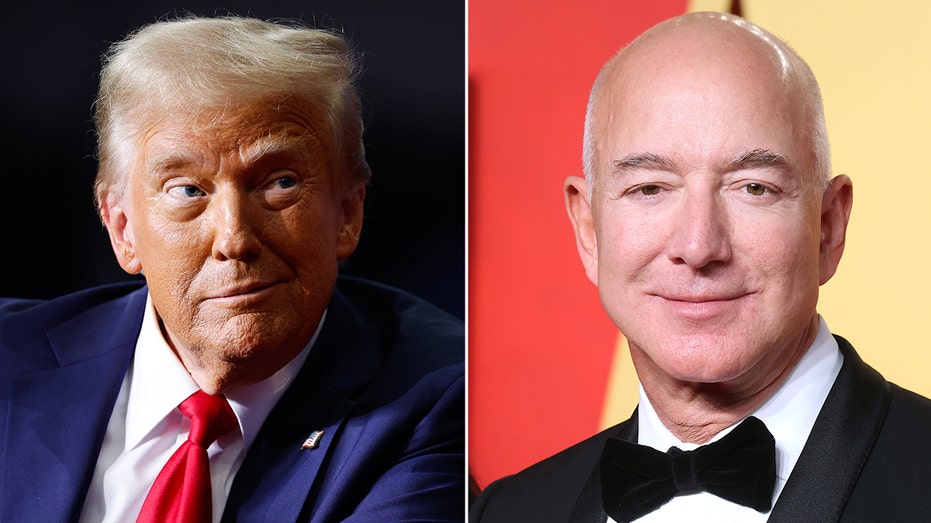

Trump Media & Generation Workforce inventory (DJT) surged up to 25% in early buying and selling on Wednesday as Donald Trump clinched victory over Kamala Harris within the presidential election. Stocks pared positive factors to only beneath 10% about an hour after the outlet bell. With a win in Wisconsin, Trump secured the 270 electoral school votes had to win, in step with the Related Press. The Republican is now set to have the honor of being the forty fifth and the forty seventh US president. Trump maintains a more or less 60% passion in DJT. At present ranges of round $37 a proportion, Trump Media boasts a marketplace cap of about $7.4 billion, giving the previous president a stake value round $4.4 billion and making him more or less $500 million richer in comparison to the place stocks closed on Tuesday. Stocks within the corporate — the house of Trump’s social media platform, Reality Social — rose round 25% in after-hours strikes past due Tuesday as Harris’s path to victory narrowed, after which jumped once more after the win was once declared within the early morning on Wednesday. The inventory had a wild consultation all the way through marketplace hours on Tuesday as buying and selling was once halted a number of instances because of volatility, with stocks briefly erasing 15% positive factors and reversing Monday’s double-digit proportion upward push to kick off the week. Regardless of a restoration from steeper losses, stocks nonetheless closed down just a little over 1% on Tuesday to business close to $34. Strategists had categorised the inventory as a binary guess at the election. Matthew Tuttle, CEO of funding fund Tuttle Capital Control, just lately informed Yahoo Finance’s Catalysts that the trajectory of stocks has hinged on “a purchase the rumor, promote the truth” buying and selling technique. Learn extra: Trump vs. Harris: 4 techniques the following president may just affect your financial institution accounts “I’d consider that the day after him successful, you’ll see this come down,” he surmised. “If he loses, I feel it is going to 0.” Interactive Agents’ leader strategist Steve Sosnick mentioned DJT has taken on a meme-stock “lifetime of its personal.” “It was once unstable at the means up, and when a inventory is that unstable in a single route, it tends to be that unstable within the different route,” he mentioned on a choice with Yahoo Finance final week. In September, stocks in Trump Media traded at their lowest stage for the reason that corporate’s debut following the expiration of its extremely publicized lockup length. Stocks had bounced again from their lows, even though, as each home and in a foreign country having a bet markets shifted in prefer of a Trump victory. Trump based Reality Social after he was once kicked off primary social media apps like Fb (META) and Twitter, now X, following the Jan. 6, 2021, Capitol riots. Trump has since been reinstated on the ones platforms. He formally returned to posting on X in mid-August after a few yr’s hiatus. Tale Continues Republican presidential nominee former President Donald Trump is pictured at an election night time watch celebration, Wednesday, Nov. 6, 2024, in West Palm Seaside, Fla. (AP Picture/Alex Brandon) · ASSOCIATED PRESS As Reality Social makes an attempt to tackle social media incumbents, the basics of the corporate have lengthy been in query. On Tuesday, DJT dropped 3rd quarter effects after the marketplace shut that exposed a web lack of $19.25 million for the quarter finishing Sept. 30. This was once narrower than the $26.03 million the corporate reported within the year-ago length. DJT additionally reported income of $1.01 million, a slight year-over-year drop in comparison to the $1.07 million it reported within the 3rd quarter of 2023. During the last 9 months finishing Sept. 30, income has fallen 23% from the prior-year length. Final month, the corporate printed that its COO had stepped down in September.

StockStory goals to assist person traders beat the marketplace. Alexandra Canal is a Senior Reporter at Yahoo Finance. Observe her on X @allie_canal, LinkedIn, and e mail her at alexandra.canal@yahoofinance.com. Click on right here for the most recent inventory marketplace information and in-depth research, together with occasions that transfer shares Learn the most recent monetary and trade information from Yahoo Finance.