DOGE’s Investment Charge went decrease, suggesting a drop in investors’ optimism.

The associated fee would possibly business between $0.15 and $0.18 within the quick time period.

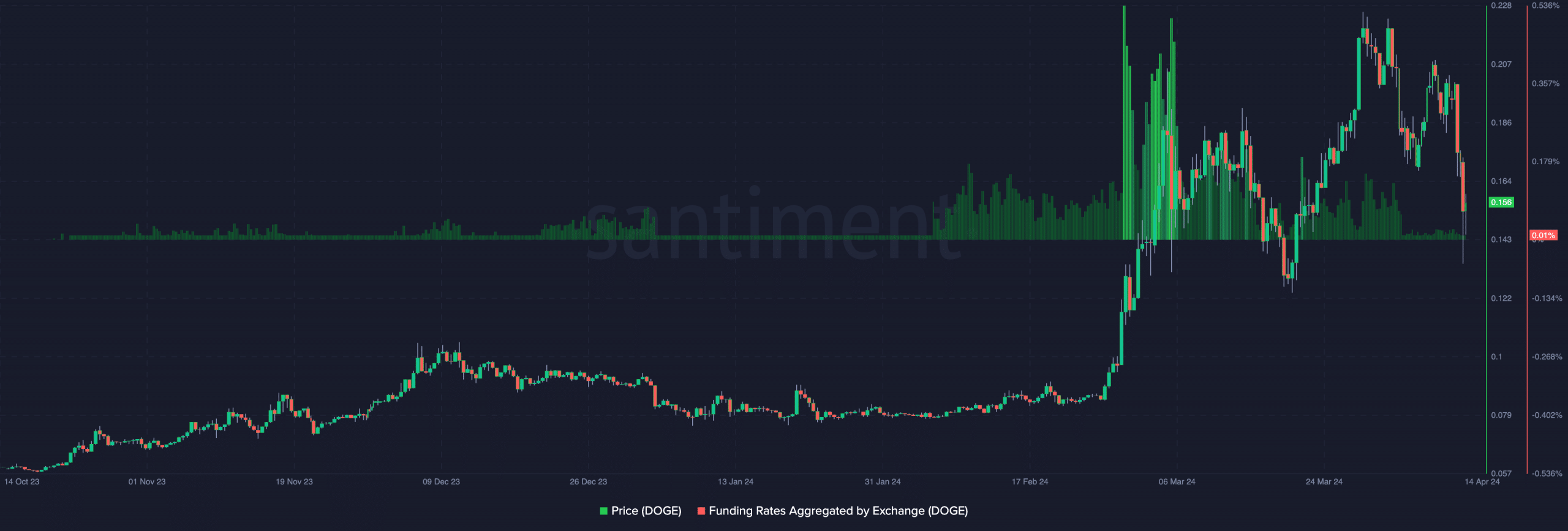

Because the 2d of April, Dogecoin’s [DOGE] Investment Charge has remained at a particularly low spot. The closing time, the metric was once on the mentioned stage was once across the first of February.

For the ones unfamiliar, Investment Charge is the price of preserving a perp place open. If investment is sure, then it signifies a powerful hobby in long-leverage trades.

But when the studying is detrimental, it signifies that investors’ sentiment is bearish and quick positions are dominant.

Self assurance drops as DOGE falls

In Dogecoin’s case, investment was once now not detrimental.

On the other hand, having an overly low sure studying steered that the bullish bets had been delicate, and investors didn’t be expecting the coin’s price to hit astronomical issues within the quick time period.

At press time, DOGE modified fingers at $0.15, due to the associated fee crash that came about during the last two days. If investment continues to drop, whilst DOGE’s worth additionally follows, longs would possibly fail to get rewards.

Supply: Santiment

Supply: Santiment

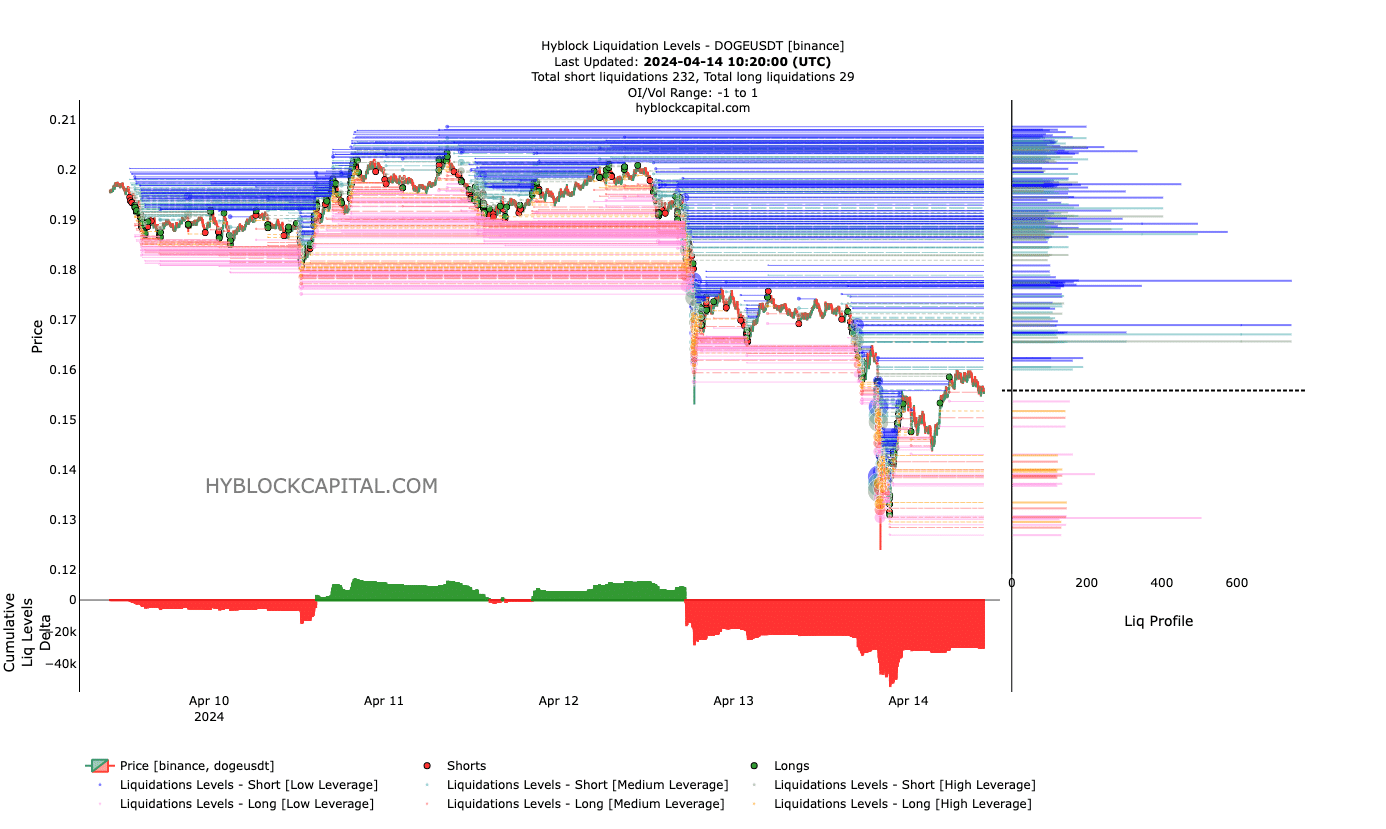

Relating to the associated fee, this pattern may well be bearish, and the coin would possibly see extra drawback. Excluding this metric, AMBCrypto analyzed the liquidation ranges.

Liquidation ranges give estimated worth issues the place huge liquidation occasions would possibly happen.

Liquidation happens when a dealer’s place is forcefully closed as a result of he can not meet the necessities to stay a place open.

This may well be because of an inadequate margin steadiness. In different circumstances, the wipeout may well be because of prime leverage use amid prime volatility available in the market.

DOGE to watch for Bitcoin

At press time, Dogecoin lacked prime liquidity between $0.15 and $0.18. This indicated that the cost of the coin would possibly now not transfer in that course but.

Due to this fact, investors who come to a decision to open lengthy positions at this level may well be susceptible to liquidation. On the other hand, the Cumulative Liquidation Ranges Delta (CLLD) displayed a distinct sign.

For context, a good CCLD signifies that there are extra lengthy liquidation ranges. Alternatively, a detrimental one suggests an build up in brief liquidation ranges.

Supply: Hyblock

Supply: Hyblock

As of this writing, DOGE’s CLLD was once detrimental. However for the associated fee, this studying provides a bullish bias. The fad proven via the indicator published that overdue shorts are getting punished whilst seeking to catch the dip once more.

Therefore, the associated fee would possibly dip quite. However a jump will not be some distance off in desire of longs. In spite of the thesis, investors would possibly want to observe warning.

Learn Dogecoin’s [DOGE] Value Prediction 2024-2025

As an example, the fourth Bitcoin [BTC] halving would occur inside of six to seven days. Historical past presentations that costs range so much within the lead-up to the development.

As such, Bitcoin will not be the one cryptocurrency which may be affected. DOGE, and others, may just additionally face critical swings.