The rise indicated emerging call for, suggesting that DOGE may start some other rally.

The 90-day MCA and move published that promoting power had diminished.

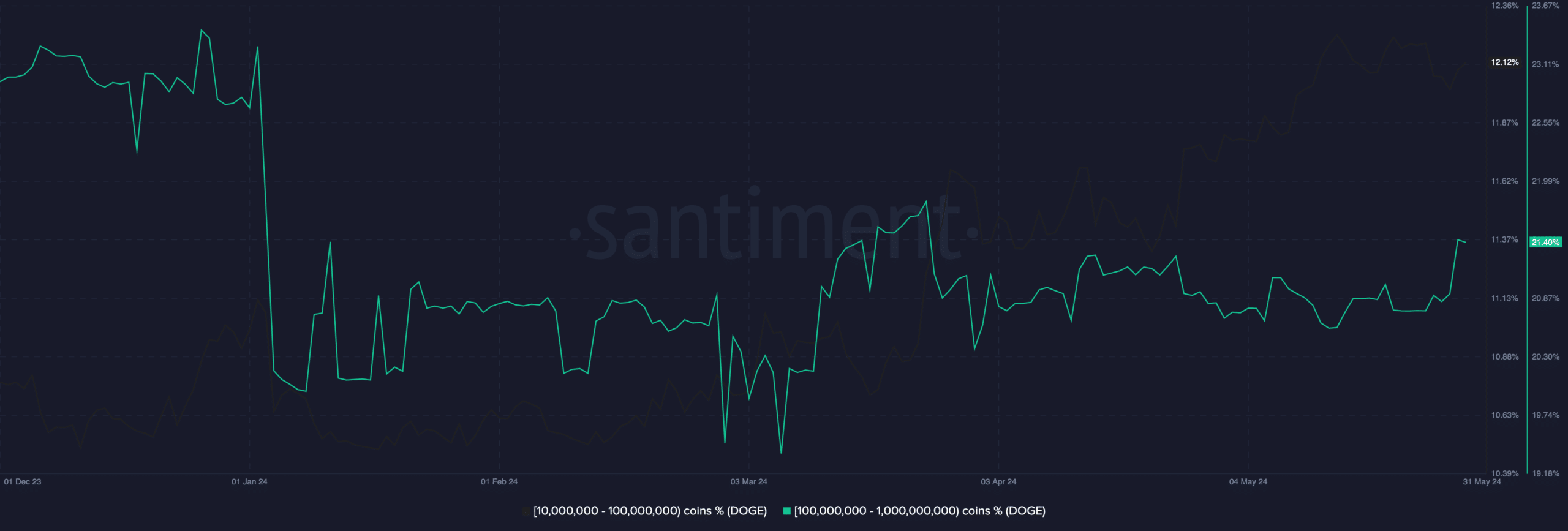

Dogecoin [DOGE] whales, particularly those that grasp 100 million to one billion cash had been amassing for the reason that twenty eighth of Would possibly. In keeping with knowledge AMBCrypto bought from Santiment, the entire acquire was once value over $100 million.

Consequently, the provision held through this cohort rose from 20.69% to 21.40%. This was once mirrored within the steadiness of addresses. The surge in purchasing job may well be just right for DOGE’s value.

DOGE is in a position: For what?

It is because it indicators a rising call for for the coin, and a worth building up may apply swimsuit. At press time, Dogecoin’s value was once $0.15, indicating that the associated fee has swung sideways within the remaining seven days.

On the other hand, the upward thrust in whale accumulation may exchange issues for DOGE. If sustained, the cryptocurrency may escape, and a upward thrust above $0.20 because it did in March may well be subsequent.

Supply: Santiment

Supply: Santiment

However Dogecoin would wish different metrics to validate this bullish prediction. Must the metrics align, the associated fee may head within the course discussed previous.

On the other hand, failure to do this may ship DOGE plunging as little as $0.12. AMBCrypto analyzed the coin’s value attainable through having a look on the Imply Coin Age (MCA).

When the Imply Coin Age will increase it implies that outdated cash are transferring wallets. Normally, this means distribution whilst resulting in decrease costs.

Outdated cash are again to base

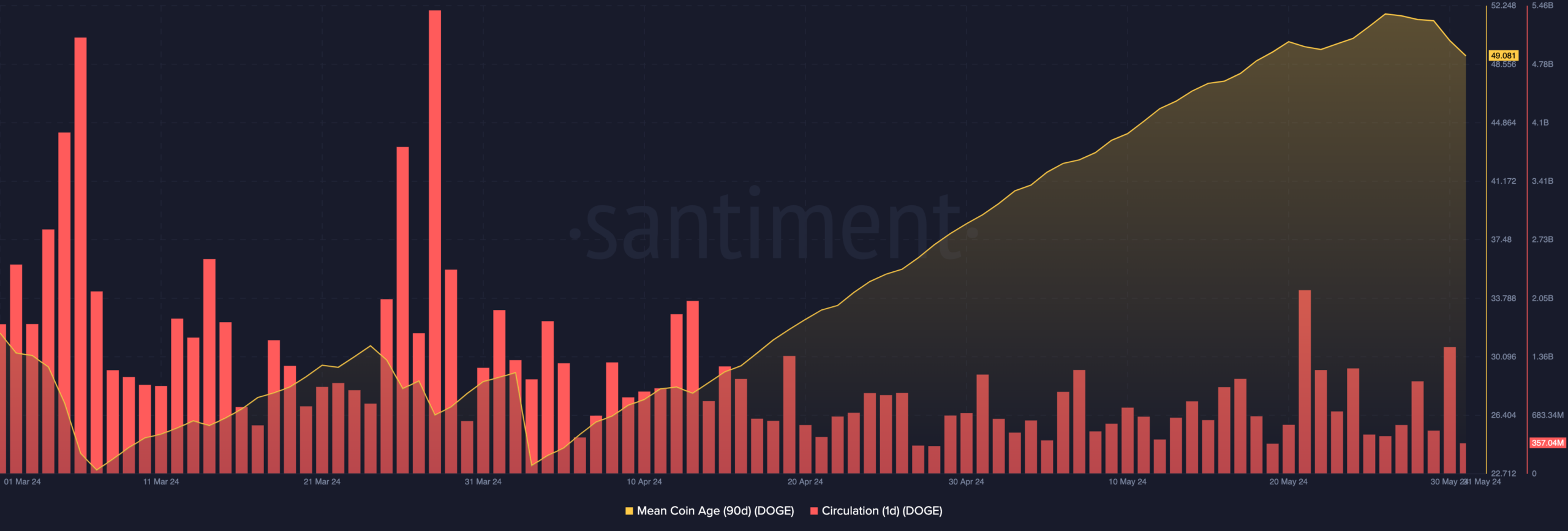

From the chart underneath, the 90-day MCA has been expanding for the reason that first week in April up till the twenty ninth of Would possibly. As such, one can conclude that those sell-offs through long-term holders led to DOGE to stay caught between $0.13 and $0.16 this previous month.

However for the previous 3 days, the metric has been falling. At press time, the studying was once 49.08, suggesting that extra holders are who prefer to stay the coin in self-custody relatively than on exchanges.

If this continues for the following couple of weeks, DOGE may produce a parabolic transfer that would desire bulls. Moreover, on-chain knowledge confirmed that the collection of Dogecoin circulating out there had dropped.

Supply: Santiment

Supply: Santiment

As of this writing, the one-day move was once 357.04 million, indicating fewer collection of cash engaged in transactions. For the associated fee, this lower may be a just right building. It is because low move may counsel low promoting power.

Whilst low promoting power does now not robotically translate to a breakout, the indicators indicated through the opposite metrics counsel {that a} rally may well be shut.

Is your portfolio inexperienced? Test the Dogecoin Benefit Calculator

As well as, Dogecoin holders in benefit had been 83% at press time, consistent with IntoTheBlock.

On the other hand, this proportion may building up as soon as DOGE starts its sluggish transfer up the charts. If or when this occurs, the ratio of holders within the cash may hit 90%.