Dogecoin has persevered to peer a good investment price regardless of its decline.

Value has dropped by way of virtually 5% as of this file.

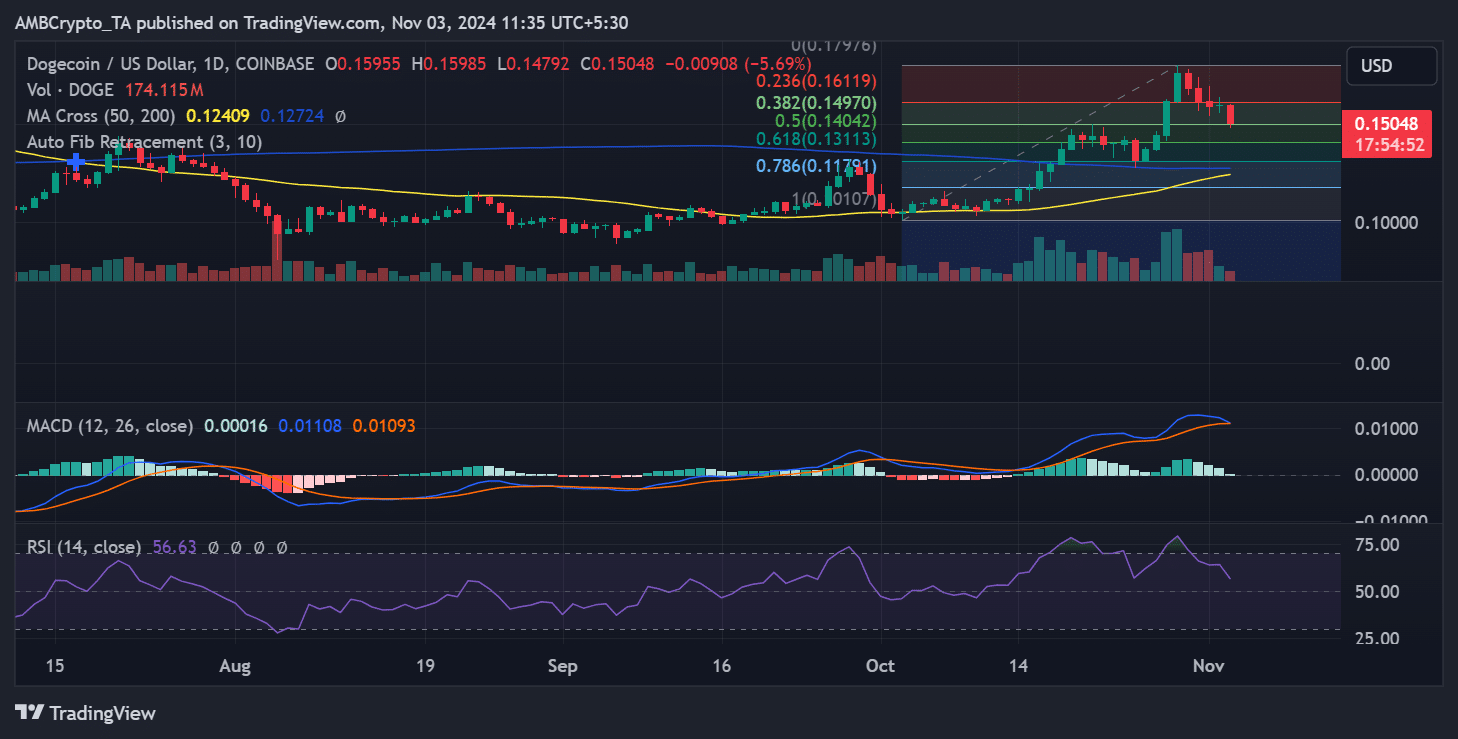

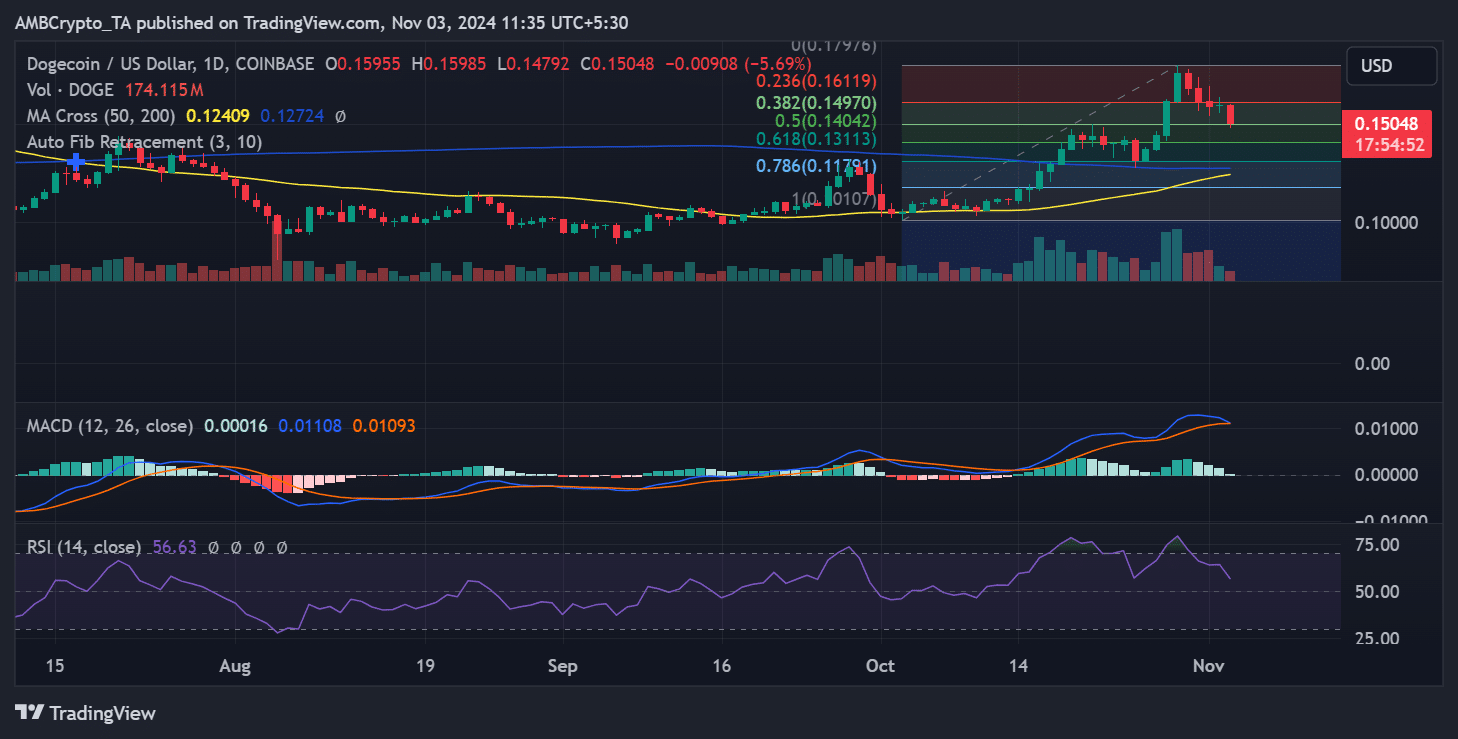

Dogecoin’s fresh worth motion has been dramatic, with the preferred meme coin surging to one among its best possible issues within the remaining month prior to experiencing a pointy reversal. This volatility has left buyers wondering how low the asset may drop if this bearish pattern continues.

Examining DOGE’s worth pattern, the NVT (Community Price to Transaction) ratio, and general marketplace sentiment supplies some perception into the possible path of the coin within the coming days.

Value pattern indicators conceivable downtrend for Dogecoin

Dogecoin’s worth chart displays a noticeable downtrend after its fresh height.

Following the bullish run that driven it to a top of $0.17976, the asset has fallen again, buying and selling close to $0.15048 on the time of writing. This drop is accompanied by way of declining buying and selling quantity, suggesting that purchasing momentum has weakened.

The MACD indicator, which had not too long ago proven bullish momentum, has began to flatten, indicating a possible shift towards bearish dominance.

Supply: TradingView

Supply: TradingView

The RSI additionally hovers close to the 56.63 mark, moving from overbought ranges. If this pattern continues, Dogecoin may check the important thing reinforce ranges on the 0.382 ($0.14970) and zero.5 ($0.14042) Fibonacci retracement ranges.

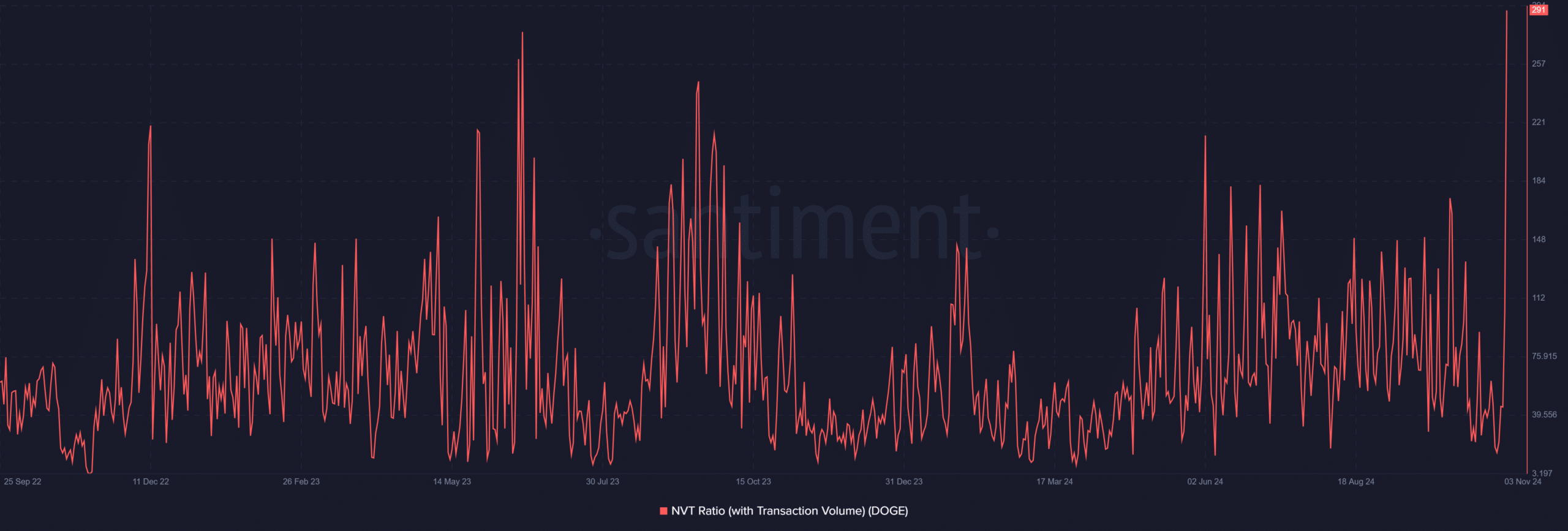

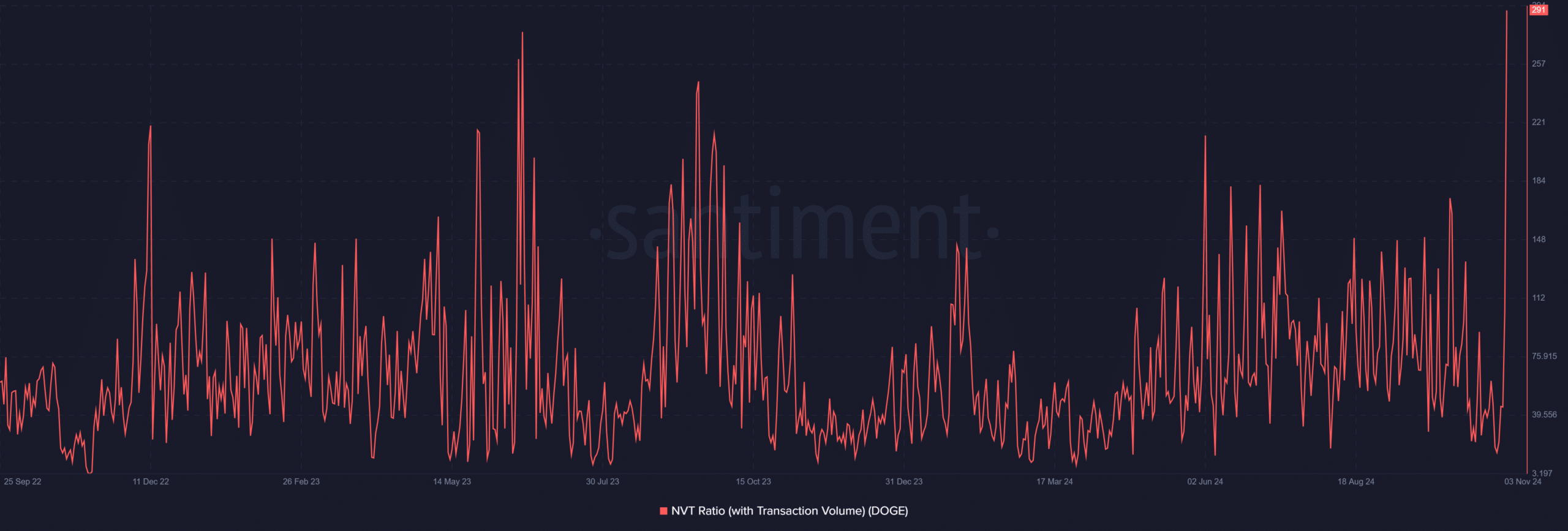

Emerging NVT ratio hints at possible Dogecoin overvaluation

The Community Price to Transaction (NVT) ratio for Dogecoin has additionally been a an important metric to look at. Traditionally, Dogecoin’s NVT ratio has had peaks and valleys, with upper peaks steadily correlating to marketplace sell-offs.

Supply: Santiment

Supply: Santiment

The hot spike within the NVT ratio signifies a conceivable overvaluation relative to the present transaction quantity, which might sign an additional worth correction.

A top NVT ratio can replicate an greater valuation with no corresponding upward push in transaction quantity, probably highlighting investor hypothesis moderately than natural community utilization.

If this indicator continues to upward push, it’s going to counsel additional problem dangers for Dogecoin.

Key ranges to observe amidst bearish sentiment

Along with the reinforce ranges discussed, buyers are most probably retaining a detailed eye at the 50-day and 200-day transferring averages for Dogecoin, which take a seat round $0.12409 and $0.12724, respectively.

A breakdown under those averages may cause further promoting drive, pushing DOGE to revisit the $0.12 vary. Conversely, if DOGE can stabilize across the $0.15 degree, it’s going to sign that the hot downtrend is nearing exhaustion.

Is your portfolio inexperienced? Take a look at the Dogecoin Benefit Calculator

On the other hand, with the present marketplace sentiment and the heightened NVT ratio, the drawback seems much more likely within the quick time period.

Dogecoin’s fresh worth pattern and increased NVT ratio counsel a difficult highway forward. If bearish sentiment persists, Dogecoin might retest decrease reinforce ranges prior to discovering a solid flooring.

Subsequent: May October’s NFT growth sign the beginning of NFT summer time?