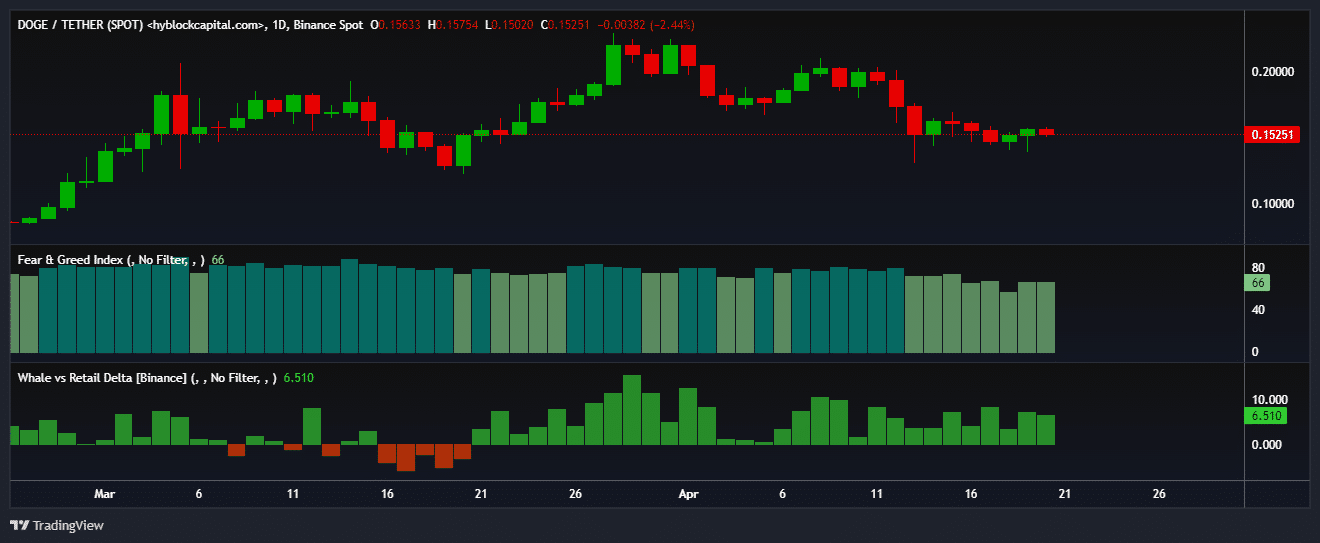

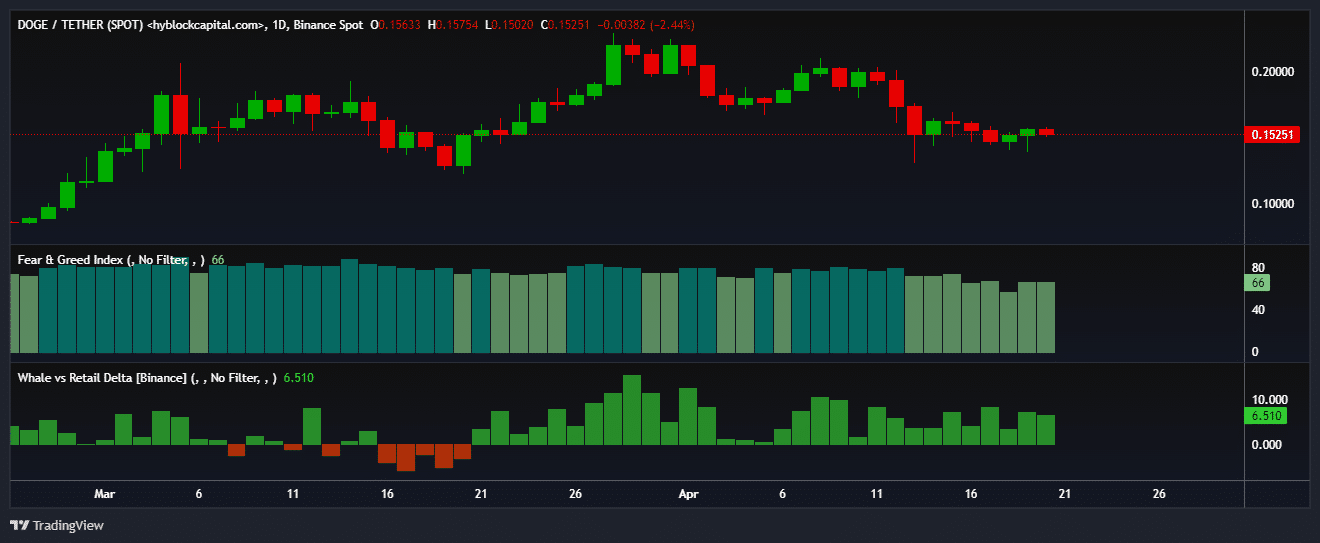

DOGE rose 3% to $0.157 within the hours following the Bitcoin halving.

Whales had been taking lengthy positions for DOGE within the futures marketplace.

The crypto business witnessed considered one of its maximum celebrated occasions — the Bitcoin halving — and instantly, the focal point shifted to how the wider marketplace reacted.

DOGE’s historic dating with halving

Dogecoin [DOGE], the biggest memecoin by way of marketplace cap, rose 3% to $0.157 within the hours following the incidence, information from CoinMarketCap confirmed.

Whilst it retraced to $0.152 at press time because of profit-taking, it was transparent that DOGE speculators had been linking the coin’s expansion potentialities with the halving.

DOGE existed right through the closing two halvings of Bitcoin [BTC].

Whilst the only in 2016 did not have an effect on DOGE decisively, the 2020 tournament ended in a 4% decline within the meme coin’s value in every week, and just about 6% in a month, AMBCrypto tested.

Then again, the cost began to upward thrust six months after the halving. Via the tip of 2020, DOGE hit $0.004592, up 75% since halving.

The marketplace then received bullish momentum, and DOGE exploded to its all-time prime (ATH), almost about a 12 months since halving.

Supply: CoinMarketCap

Supply: CoinMarketCap

A sooner adventure in opposition to ATH this time?

DOGE military would need a repeat of that feat. To their pleasure, DOGE may succeed in it a lot faster this time round.

Well-liked crypto dealer Kevin C. aka Yomi made a daring prediction that DOGE may hit or get on the subject of its ATH of $0.73 by way of July/August. Yomi got here to the belief by way of averaging out historic information from earlier cycles.

Practical or no longer, right here’s DOGE’s marketplace cap in BTC phrases

Sentiment biased in opposition to the bullish facet

Whale buyers seemed bullish at the coin’s potentialities. In line with AMBCrypto’s research of Hyblock Capital’s information, whales had upper lengthy publicity than retail on Binance [BNB] as of this writing.

Supply: Hyblock Capital

Supply: Hyblock Capital

Additionally, the marketplace sentiment tilted in opposition to greed, suggesting an building up in purchasing power within the days forward.

Subsequent: Has Cardano’s rally began? Exploring if ADA will succeed in $1 this time

![Curve [CRV] eyes alt= Curve [CRV] eyes alt=](https://ambcrypto.com/wp-content/uploads/2025/03/PP-2-CRV-weekly.png)

![Is Chainlink [LINK] able for a bullish breakout? Insights printed Is Chainlink [LINK] able for a bullish breakout? Insights printed](https://ambcrypto.com/wp-content/uploads/2025/03/Gmq-L80WwAAS1zT-scaled.jpg)