WIF declines by way of 35% on weekly charts amidst declining open passion.

Analysts expect an extra decline to $1.

The cryptocurrency marketplace has skilled excessive volatility over the last months. Over the past seven days, the marketplace has noticed all cryptocurrencies revel in a large decline.

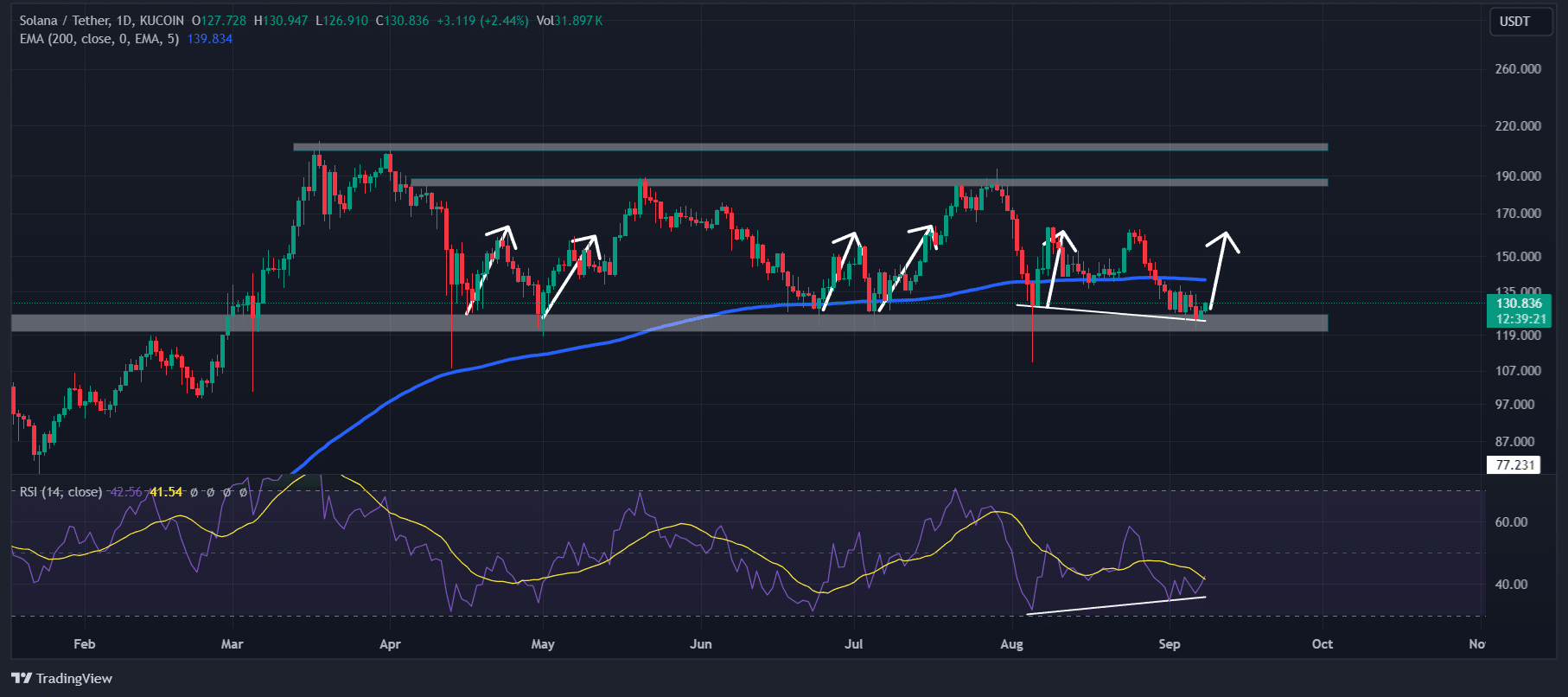

For starters, Bitcoin has declined 9.84% to $60,780. BTC’s decline has driven altcoins to large sell-off, with Ethereum declining by way of 9.36% on weekly charts and Solana shedding by way of 21.09% to $141.

This volatility has hit dogwifhat [WIF] essentially the most, declining by way of 36% on weekly charts.

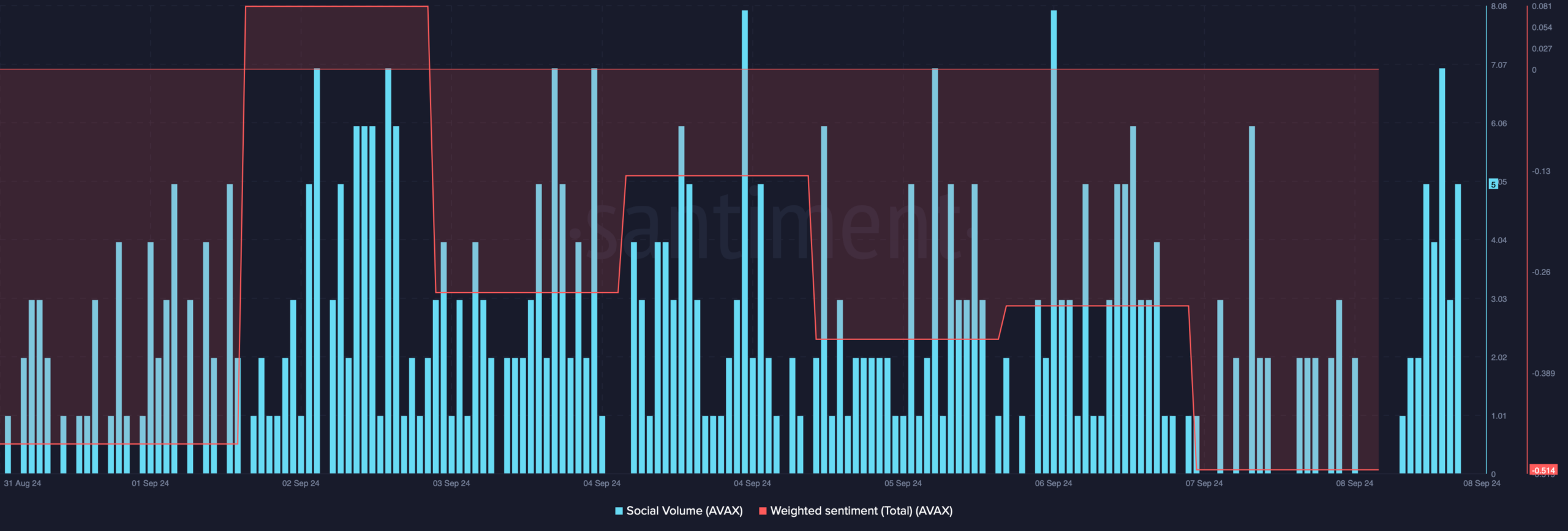

Dogwifhat’s marketplace sentiment

Amid the WIF’s decline, the marketplace sentiment is strongly bearish. The analysts have proven their pessimism concerning the conceivable reversal, predicting an extra decline. As an example, Rehan Rao shared his prediction on X, noting that,

“Dogwifhat (WIF) would possibly drop to $1: Main property are down, and a whale simply offered 14.53M WIF tokens. WIF is recently $1.71 and may fall to $1.40 or $0.90.. Wait for key ranges at $1.58 and $1.76.”

In keeping with this analyst, since all primary crypto property are declining, WIF will drop beneath $1, hitting $0.90. Any such decline would solidify the month-long decline of WIFs.

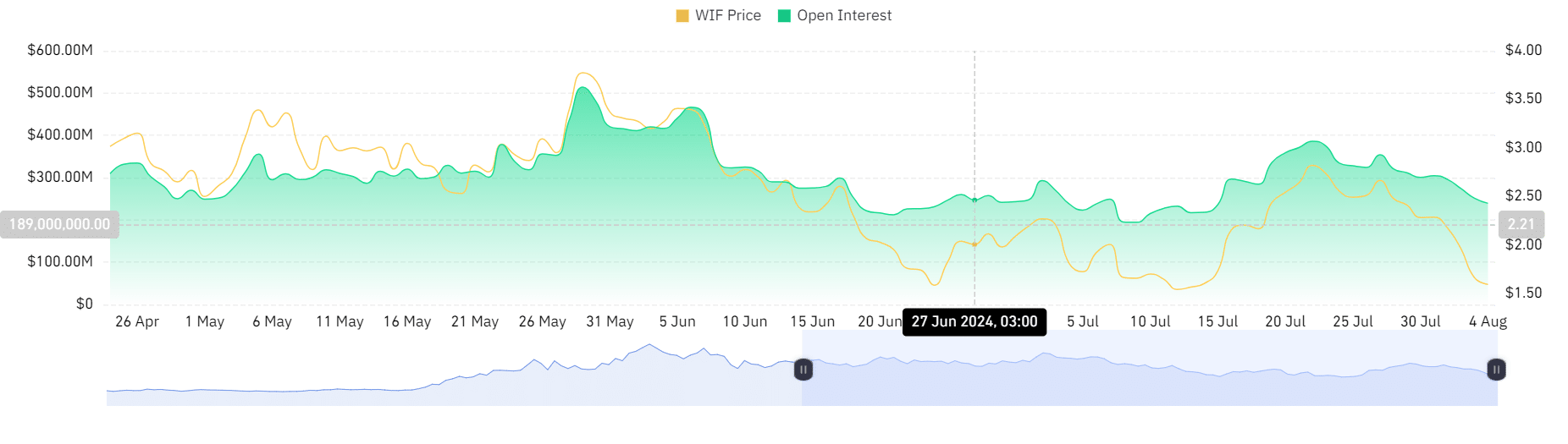

Supply: Marketplace Prophit

Supply: Marketplace Prophit

Such research displays the existing marketplace sentiment, with AMBCrypto’s research of Marketplace Prophit appearing that the marketplace sentiment is bearish.

In keeping with the marketplace prophit, the Crowd Z Rating is beneath 0 at -1.05, and the marketplace prophit sentiment is beneath 0 at -0.0118.

WIF Decline amidst low open passion and better liquidation

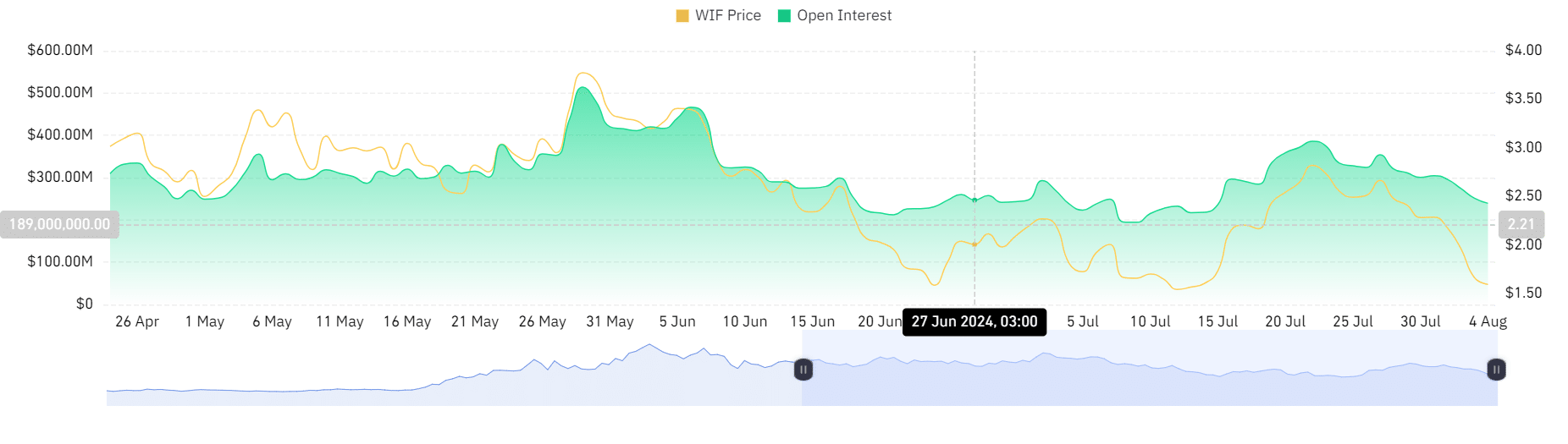

Supply: Coinglass

Supply: Coinglass

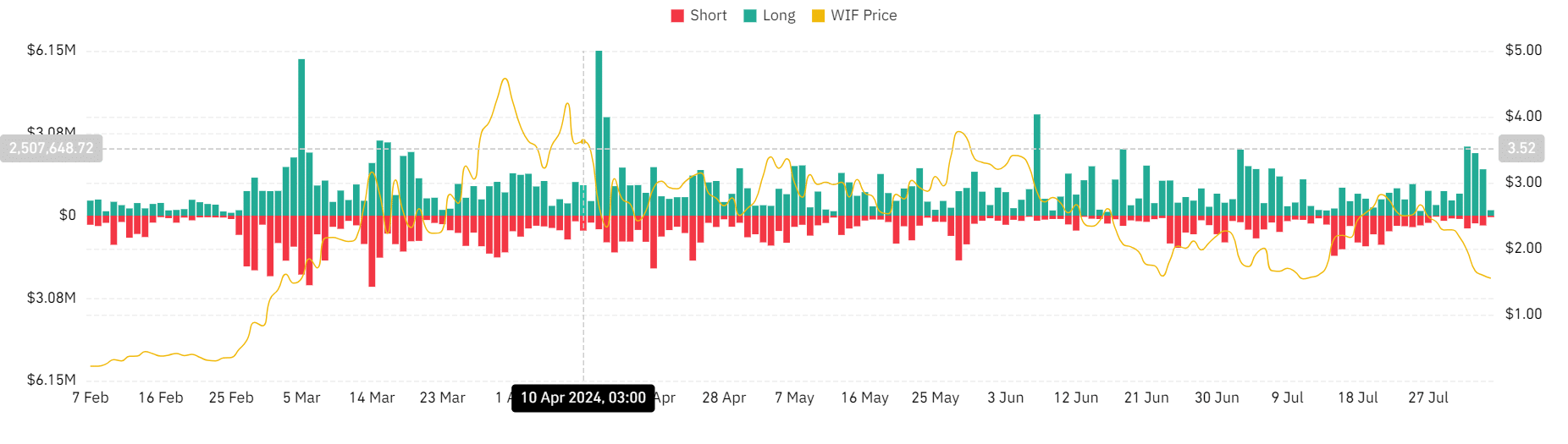

Dofwifhat sustained decline arises from greater liquidation for lengthy positions and declining open passion. AMBCrypto’s research of Coinglass displays WIF open passion has declined over the last 7 days.

In keeping with Coinglass, WIF’s open passion has declined from $385.98M to $239.2M over the last week. This decline displays buyers are final their positions with out opening new ones.

LookonChain reported such an incident with a whale promoting WIF after 8 months. They reported that,

“5 wallets(would possibly belong to the similar individual) offered 14.53M $WIF($24M) .”

Supply: X

Supply: X

Moreover, WIF has skilled huge liquidation for lengthy positions, in step with Coinglass. Over the last week, lengthy place liquidation has surged from a low of $176k to $2.85M.

When lengthy place liquidation soars, buyers are compelled out in their positions, thus promoting at a loss as they lack the conviction to pay premiums and hang their positions.

Supply: Coinglass

Supply: Coinglass

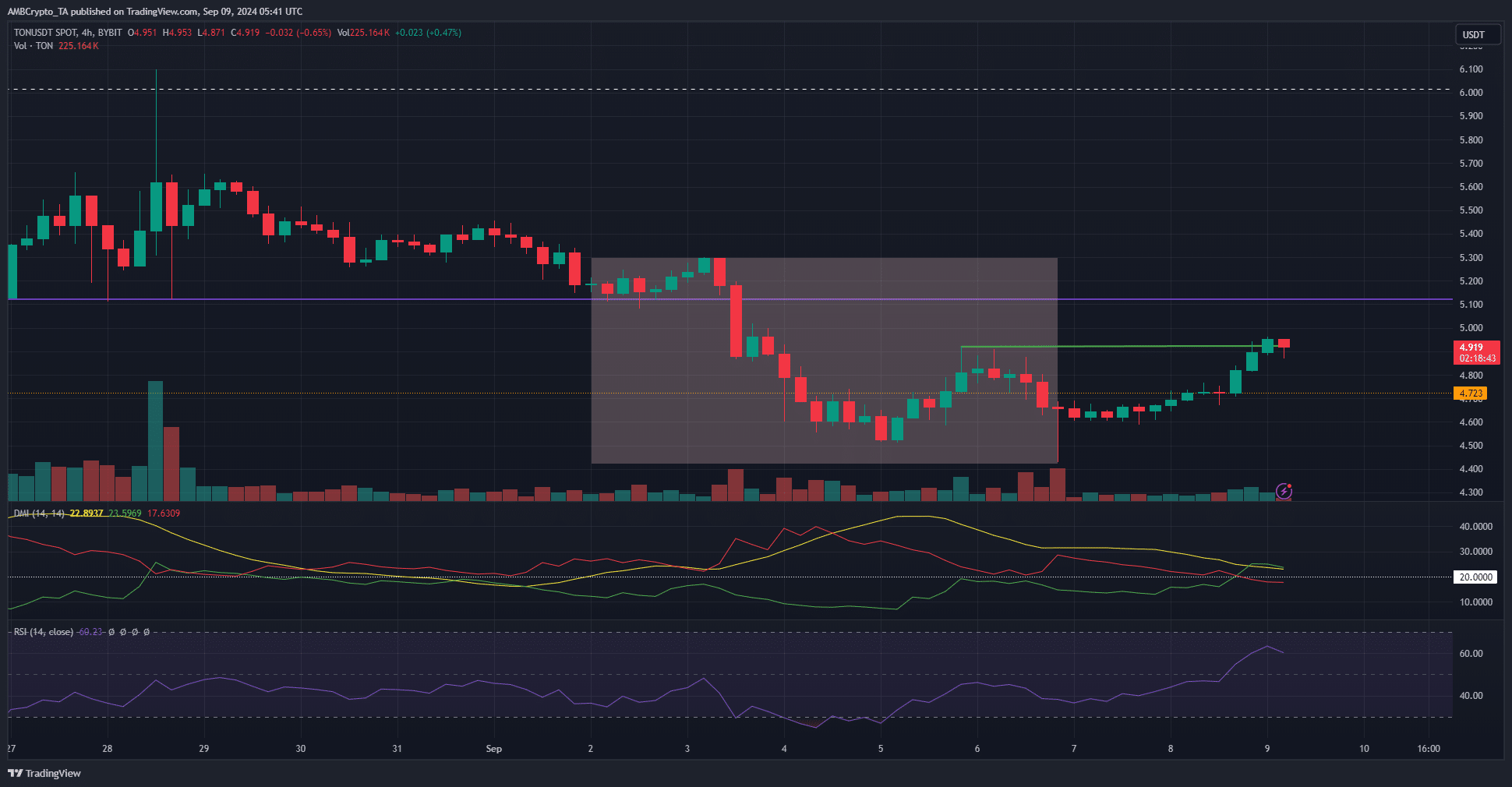

What value charts point out

As of this writing, WIF was once buying and selling at $1.55 after an 8.84% decline on day-to-day charts. Amidst the associated fee drop, WIF’s buying and selling quantity has additionally declined by way of 32.93% to $353.5 million during the last 24 hours.

Supply: Tradingview

Supply: Tradingview

Due to this fact, our research displays WIF is experiencing a robust downward momentum. As an example, RVGI is beneath 0 at -0.3794, suggesting that final costs are less than the hole procedure.

This confirms that the marketplace is in a downtrend and dealers are dominating the markets, thus leading to upper promoting force.

Supply: Tradingview

Supply: Tradingview

The Superior Oscillator (AO) was once beneath 0 at -0.244, indicating that momentary momentum is weaker than long-term.

Thus, the marketplace is experiencing a strongly bearish development, and AO confirms the craze is in all probability to proceed. Similarly, the MACD additional proves this because it’s beneath 0 at -0.109.

Will WIF drop beneath $1?

On per month charts, WIF has skilled a robust downward momentum. Over the last seven days, the memecoin has declined by way of 35%, and thus, if those stipulations be triumphant, WIF will decline additional.

Life like or now not, right here’s WIF’s marketplace cap in BTC’s phrases

If WIF day-to-day candlesticks are intently beneath the crucial reinforce stage at $0.50, the altcoin will decline to the following reinforce stage at $1.0.

Then again, if it retests this stage and bounces again, it’ll repeat the ancient cycle from 12 July, when it retested the similar reinforce stage and surged to $2.82.

Subsequent: Solana’s $1000 goal: Analyst sounds alarm on SOL’s inflation possibility