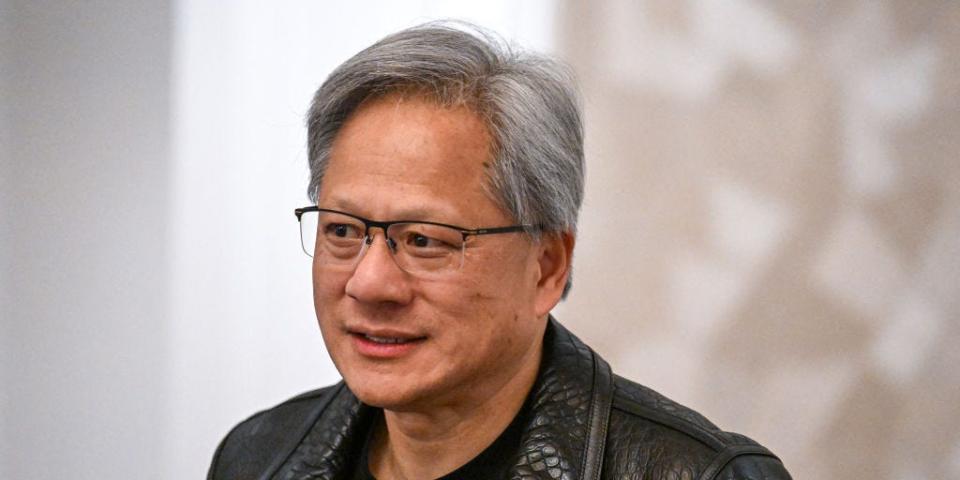

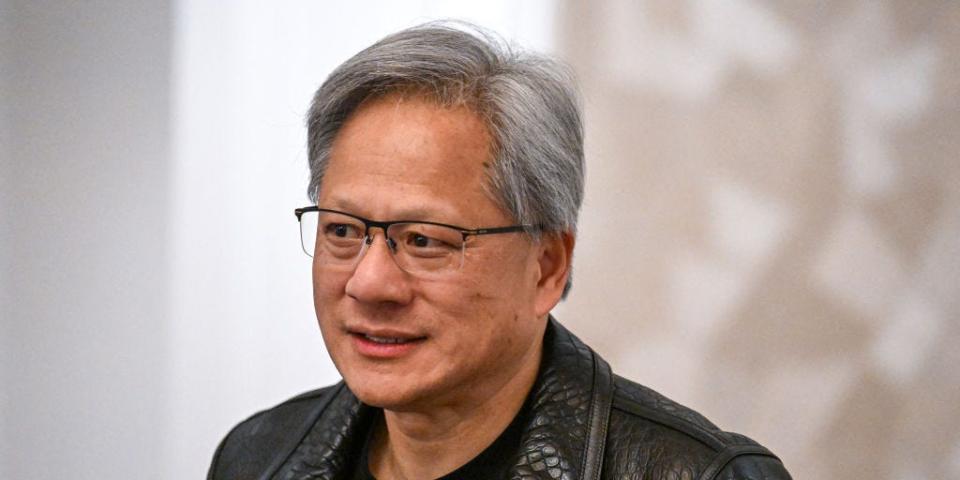

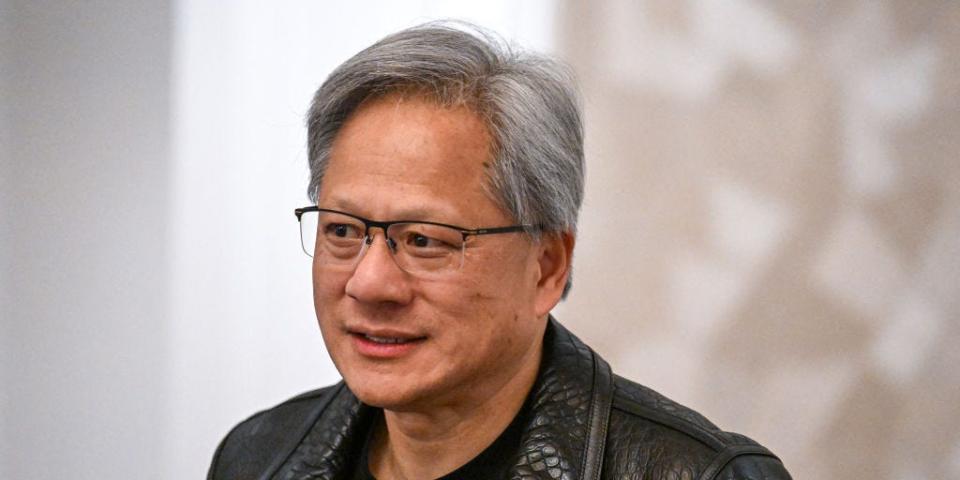

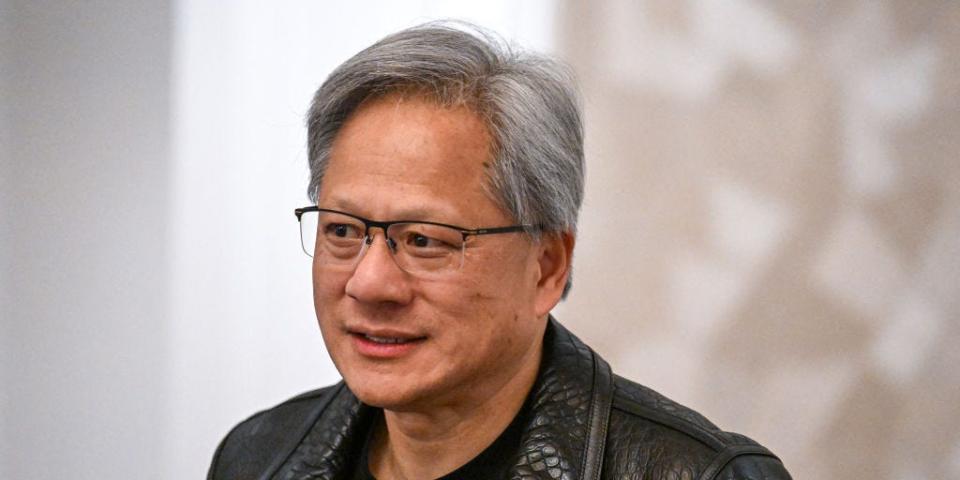

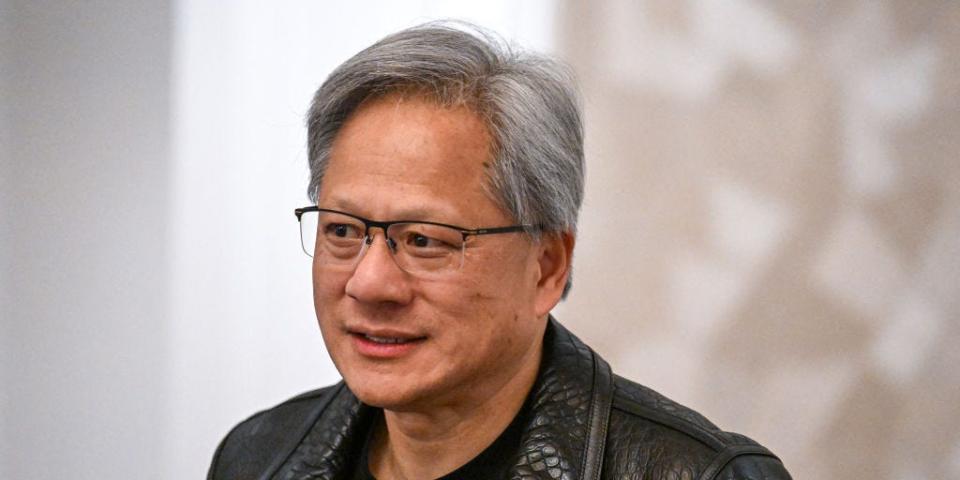

Nvidia CEO Jensen Huang.Mohd Rasfan/AFP/Getty ImagesNvidia inventory has slid since overdue March, correcting via over 10% from all-time highs.BofA analysts say there is not anything to fret about, and the corporate will nonetheless dominate within the AI chip area.Not one of the components at the back of the sell-off meaningfully alternate the narrative for Nvidia, they mentioned.Nvidia inventory has tumbled lately, with the proportion value correcting via greater than 10% from the newest all-time top, however Financial institution of The united states is telling buyers to not fear concerning the fresh slide because the chip titan remains to be in high place to dominate.BofA analysts led via Vivek Arya mentioned in a observe Wednesday that in spite of the 11% plunge since overdue March, they continue to be bullish on Nvidia and expect the corporate will dangle onto its most sensible spot because the trade’s main manufacturer of the chips that energy the booming synthetic intelligence area.The analysts observe that the newest rout is the 9th time the inventory has fallen greater than 10% since ChatGPT debuted in November of 2022.The financial institution maintained its value goal of $1,100 in line with proportion, representing upside of 26% from the place the inventory was once buying and selling all through Wednesday’s consultation. Stocks modified fingers at $867.62 round 12:45 p.m. Wednesday.”Whilst there’s at all times the potential of near-term summer season consolidation in NVDA inventory (equivalent to we noticed from Aug-Dec closing yr), we consider the basics are solidly not off course and sessions of consolidation (buying and selling sideways) have a tendency to set the refill for robust strikes later,” analysts wrote within the observe.They upload that Nvidia’s fresh inventory decline may also be attributed to a large number of components equivalent to inflation choosing again up, emerging festival from different chip makers, marketplace volatility, AI inventory fatigue, a rotation towards cyclical sectors, and possible pruning of a few positions forward of profits season. But, those components have not shifted the narrative for the company.Nvidia’s newest Blackwell chip provides a fivefold AI efficiency spice up, which objectives to chop AI inference prices and effort use via as much as 25 occasions. This, blended with Nvidia’s robust undertaking foothold, makes the BofA analysts extra assured within the corporate’s talent to handle and achieve marketplace proportion within the chip area.Tale continuesWhile Nvidia faces festival from Google and Intel, the financial institution believes their processors pose restricted danger to Nvidia’s dominance.Google simply introduced its ARM-based server CPU, Axion, whilst Nvidia has its personal known as Grace. On the other hand, since Nvidia does not promote their CPUs to Google, the financial institution mentioned Google’s new release has no have an effect on on Nvidia.In the meantime, Intel additionally unveiled its Gaudi 3 accelerator this week, which it says will boast 50% higher inference efficiency in comparison to Nvidia’s two-year-old H100 chip. On the other hand, Financial institution of The united states expects Gaudi 3 to seize lower than 1% of the AI accelerator marketplace proportion.Learn the unique article on Trade Insider

Nvidia CEO Jensen Huang.Mohd Rasfan/AFP/Getty ImagesNvidia inventory has slid since overdue March, correcting via over 10% from all-time highs.BofA analysts say there is not anything to fret about, and the corporate will nonetheless dominate within the AI chip area.Not one of the components at the back of the sell-off meaningfully alternate the narrative for Nvidia, they mentioned.Nvidia inventory has tumbled lately, with the proportion value correcting via greater than 10% from the newest all-time top, however Financial institution of The united states is telling buyers to not fear concerning the fresh slide because the chip titan remains to be in high place to dominate.BofA analysts led via Vivek Arya mentioned in a observe Wednesday that in spite of the 11% plunge since overdue March, they continue to be bullish on Nvidia and expect the corporate will dangle onto its most sensible spot because the trade’s main manufacturer of the chips that energy the booming synthetic intelligence area.The analysts observe that the newest rout is the 9th time the inventory has fallen greater than 10% since ChatGPT debuted in November of 2022.The financial institution maintained its value goal of $1,100 in line with proportion, representing upside of 26% from the place the inventory was once buying and selling all through Wednesday’s consultation. Stocks modified fingers at $867.62 round 12:45 p.m. Wednesday.”Whilst there’s at all times the potential of near-term summer season consolidation in NVDA inventory (equivalent to we noticed from Aug-Dec closing yr), we consider the basics are solidly not off course and sessions of consolidation (buying and selling sideways) have a tendency to set the refill for robust strikes later,” analysts wrote within the observe.They upload that Nvidia’s fresh inventory decline may also be attributed to a large number of components equivalent to inflation choosing again up, emerging festival from different chip makers, marketplace volatility, AI inventory fatigue, a rotation towards cyclical sectors, and possible pruning of a few positions forward of profits season. But, those components have not shifted the narrative for the company.Nvidia’s newest Blackwell chip provides a fivefold AI efficiency spice up, which objectives to chop AI inference prices and effort use via as much as 25 occasions. This, blended with Nvidia’s robust undertaking foothold, makes the BofA analysts extra assured within the corporate’s talent to handle and achieve marketplace proportion within the chip area.Tale continuesWhile Nvidia faces festival from Google and Intel, the financial institution believes their processors pose restricted danger to Nvidia’s dominance.Google simply introduced its ARM-based server CPU, Axion, whilst Nvidia has its personal known as Grace. On the other hand, since Nvidia does not promote their CPUs to Google, the financial institution mentioned Google’s new release has no have an effect on on Nvidia.In the meantime, Intel additionally unveiled its Gaudi 3 accelerator this week, which it says will boast 50% higher inference efficiency in comparison to Nvidia’s two-year-old H100 chip. On the other hand, Financial institution of The united states expects Gaudi 3 to seize lower than 1% of the AI accelerator marketplace proportion.Learn the unique article on Trade Insider