Shopify Jumps Extra Than 25% on Profits

36 mins in the past

Shopify (SHOP) stocks soared to their perfect degree in just about 3 years Tuesday because the supplier of on-line products and services for outlets posted better-than-anticipated effects on robust gross sales enlargement.

The corporate reported third-quarter running source of revenue jumped 132% year-over-year to $283 million, with income up 26% to $2.16 billion. Loose money go with the flow climbed 53% to $421 million. All exceeded consensus forecasts of analysts polled by way of Visual Alpha.

The corporate anticipates current-quarter income can be up by way of a mid-to- high-twenties share.

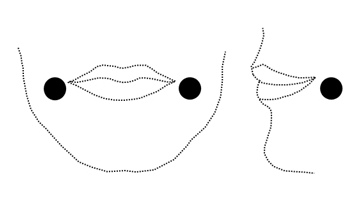

TradingView

Shopify stocks have been up 26% at $113 lately, pushing their year-to-date features to 45%.

-Invoice McColl

Honeywell Rises After Activist Elliott Discloses Stake

1 hr 19 min in the past

Honeywell Global (HON) stocks rose to an all-time excessive Tuesday after Elliott Funding Control stated it has constructed a $5 billion-plus place within the industrials conglomerate and is looking for a breakup of the corporate.

Elliott stated in a remark that it had despatched a letter to Honeywell’s board of administrators in search of separations of the aerospace and automation companies as standalone corporations. The hedge fund stated it believed this sort of cut up out of the 2 corporations would lead to share-price will increase of between 51% and 75% over the following two years as they have the benefit of extra centered control and a simplified construction.

“The conglomerate construction that after suited Honeywell now not does, and the time has come to embody simplification,” Elliott stated, noting that “asymmetric execution, inconsistent monetary effects and an underperforming proportion fee have lowered the Corporate’s robust document of worth introduction during the last 5 years.”

Honeywell is without doubt one of the few business conglomerates that has but to get a divorce, despite the fact that it introduced plans final month to streamline its industry and spin off its complicated fabrics department.

Charlotte, N.C.-based Honeywell final month posted lower-than-estimated quarterly gross sales and diminished its income steerage as call for for its business automation merchandise slumped.

The inventory was once up 2% at round $230 in fresh buying and selling, after hitting a excessive of just below $243 previous within the consultation.

-Nisha Gopalan

Reside Country Stocks Hit Document Top on Q3 Profits Beat

3 hr 5 min in the past

Stocks of Reside Country (LYV) rose Tuesday morning after the Ticketmaster father or mother corporate’s third-quarter income got here in greater than anticipated.

Overdue Monday, the leisure corporate reported $7.7 billion in income, slightly under what analysts had estimated, however benefit of $1.66 in line with proportion for the quarter was once above the consensus estimates of $1.57. Income and EPS have been each down from the similar time final 12 months.

CEO Michael Rapino stated Reside Country is coming off of the corporate’s “maximum energetic summer season live performance season ever,” and stated an “even larger” lineup in 2025 will have to proceed to gasoline its effects.

After effects previous this 12 months have been boosted by way of Taylor Swift’s blockbuster “Eras Excursion,” which can finish with a number of displays in Canada over the following month, the corporate stated it’s having a look forward to stadium excursions from acts like Shakira and Coldplay to power gross sales subsequent 12 months. Reside Country stated it has already bought 20 million tickets for 2025 displays, and stated the sector excursion price ticket gross sales are “handing over double-digit common enlargement in display grosses relative to previous excursions.”

The price ticket dealer and venue proprietor remains to be going through an strive from the Division of Justice to get a divorce Reside Country and Ticketmaster after their 2010 merger. The DOJ accused Reside Country of appearing as a monopoly previous this 12 months in a lawsuit, together with allegations of intimidation and retaliation to get venues to make use of Ticketmaster for his or her price ticket gross sales.

TradingView

Reside Country stocks hit an all-time excessive this morning and have been lately up 4.5%.

-Aaron McDade

Coinbase Value Ranges to Watch Amid Submit-Election Surge

3 hr 54 min in the past

Coinbase (COIN) stocks surged to a three-year excessive Monday as buyers guess that upper buying and selling volumes and a extra favorable regulatory atmosphere beneath the incoming Trump Management may just receive advantages the crypto trade.

The transfer got here as Bitcoin (BTCUSD) set every other document excessive on Monday above $88,000, and Ether (ETHUSD), the local token of the Ethereum blockchain, rose to a multi-year top. Emerging cryptocurrency costs spice up Coinbase by way of producing extra buying and selling process, which in flip boosts the corporate’s revenues via greater charges.

Coinbase stocks have been down moderately at round $322 in early buying and selling Tuesday, as bitcoin got here off its document highs.

Supply: TradingView.com.

The inventory broke out above the highest trendline of a seven-month descending channel final week on above-average quantity, with follow-through purchasing proceeding into this week.

Buyers will have to watch key overhead ranges at the Coinbase chart round $369, $430, and $695, whilst tracking a very powerful toughen space close to $220.

Learn the overall technical research piece right here.

-Timothy Smith

Primary Index Inventory Futures Reasonably Decrease

5 hr 8 min in the past

Futures tied to the Dow Jones Business Moderate have been down 0.1%.

TradingView

S&P 500 futures have been down 0.1%.

TradingView

Nasdaq 100 futures have been additionally off 0.1%.

TradingView

:max_bytes(150000):strip_icc()/GettyImages-2184363400-9dd579eafbbb4cfda55babfe90119d98.jpg)

/Jen-Hsun%20Huan%20NVIDIA%27s%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)