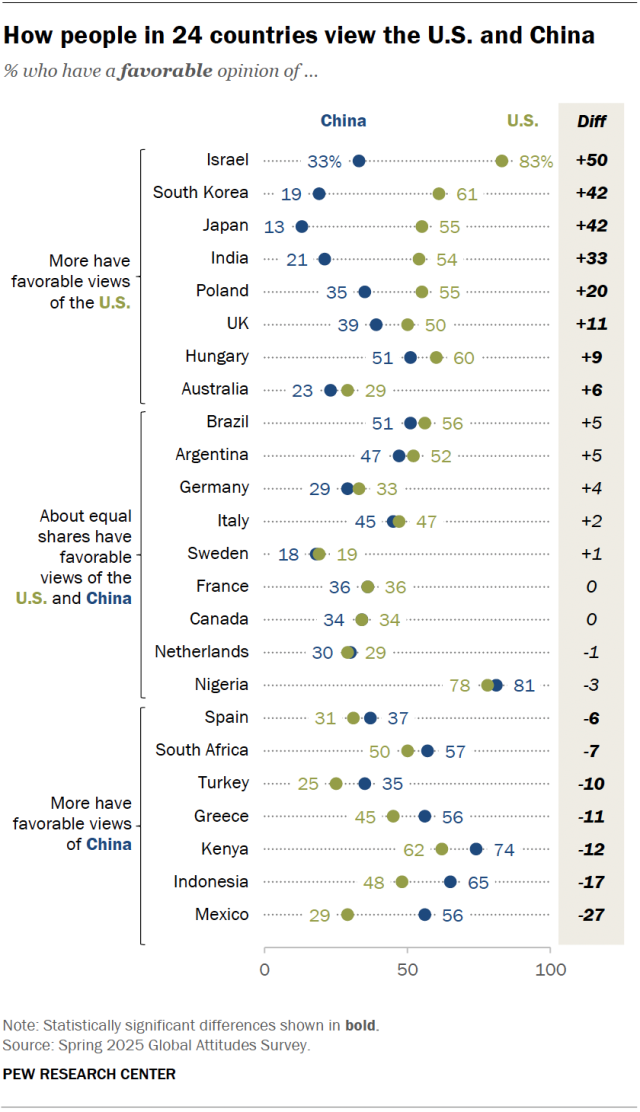

ECB officers claimed that BTC’s rally will make non-holders and latecomers deficient.

The crypto group criticized the file that known as for a coverage in opposition to BTC.

Over the weekend, the Eu Central Financial institution (ECB) hit the headlines following its best officers’ anti-Bitcoin [BTC] file and requires its ‘disappearance.’

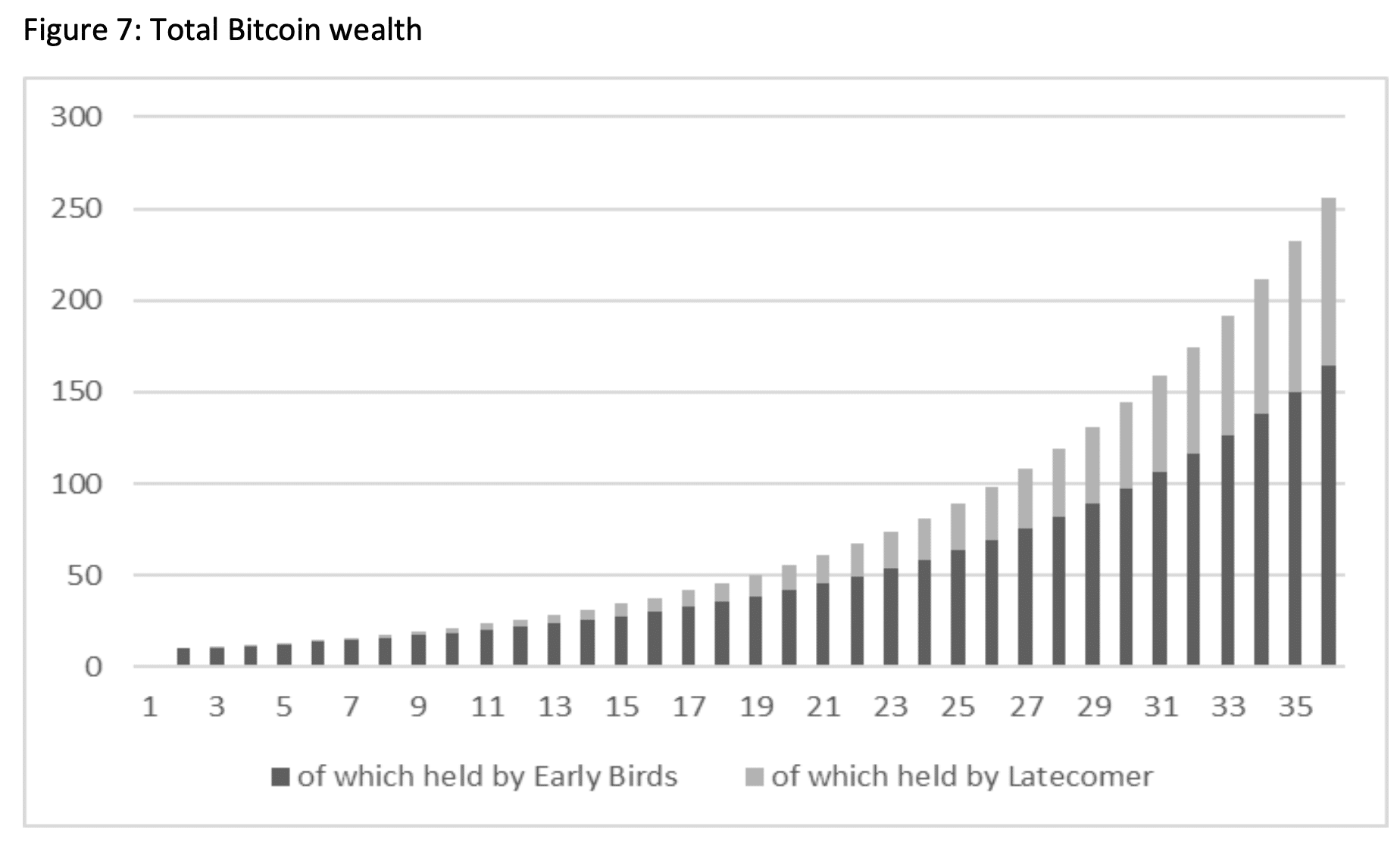

They claimed the BTC value surge would result in wealth redistribution from latecomers and non-holders to early adopters.

In keeping with the file, this could impoverish latecomers and holders, as early adopters would dominate holdings and wealth.

Supply: SSRN

Supply: SSRN

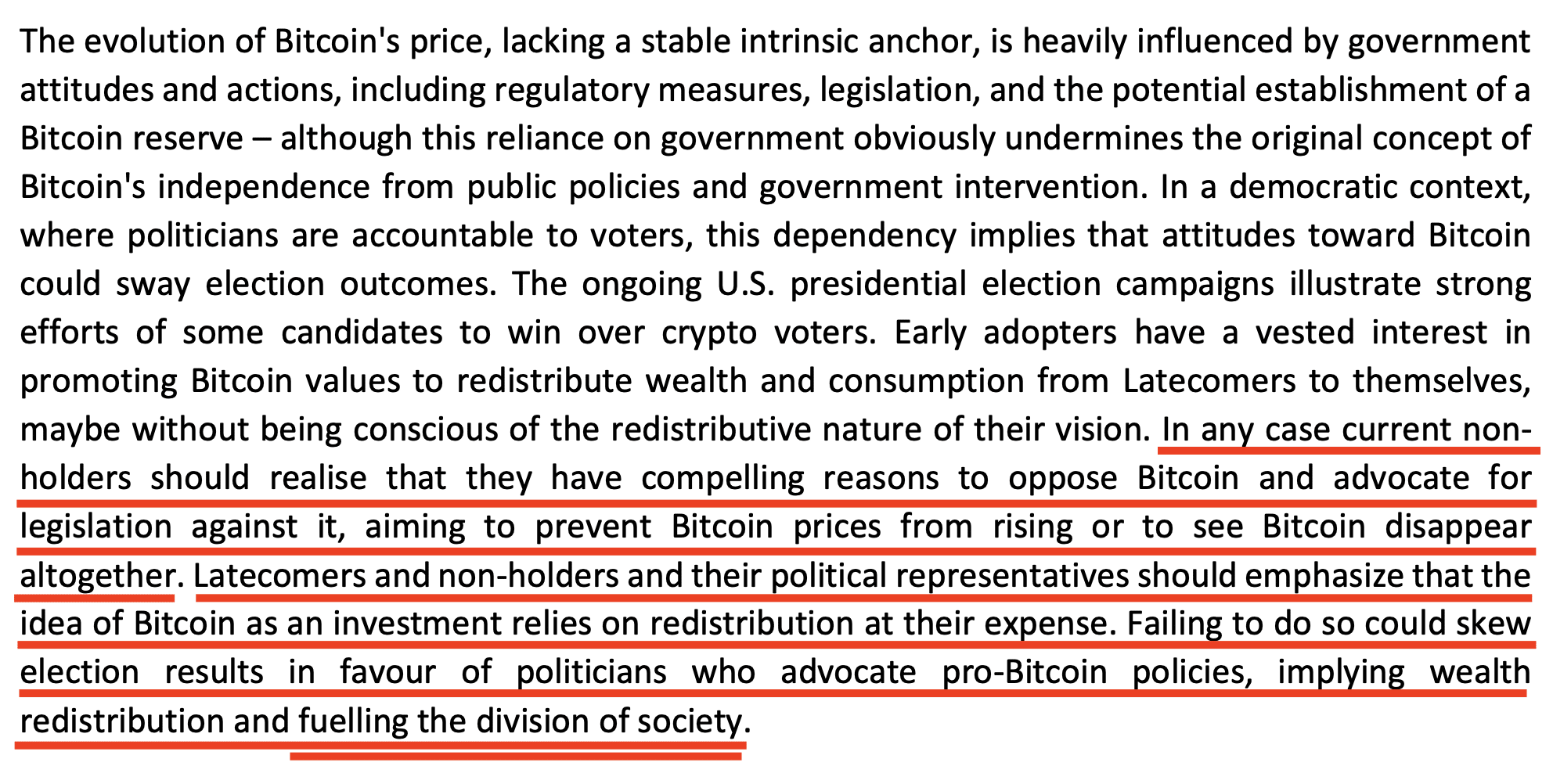

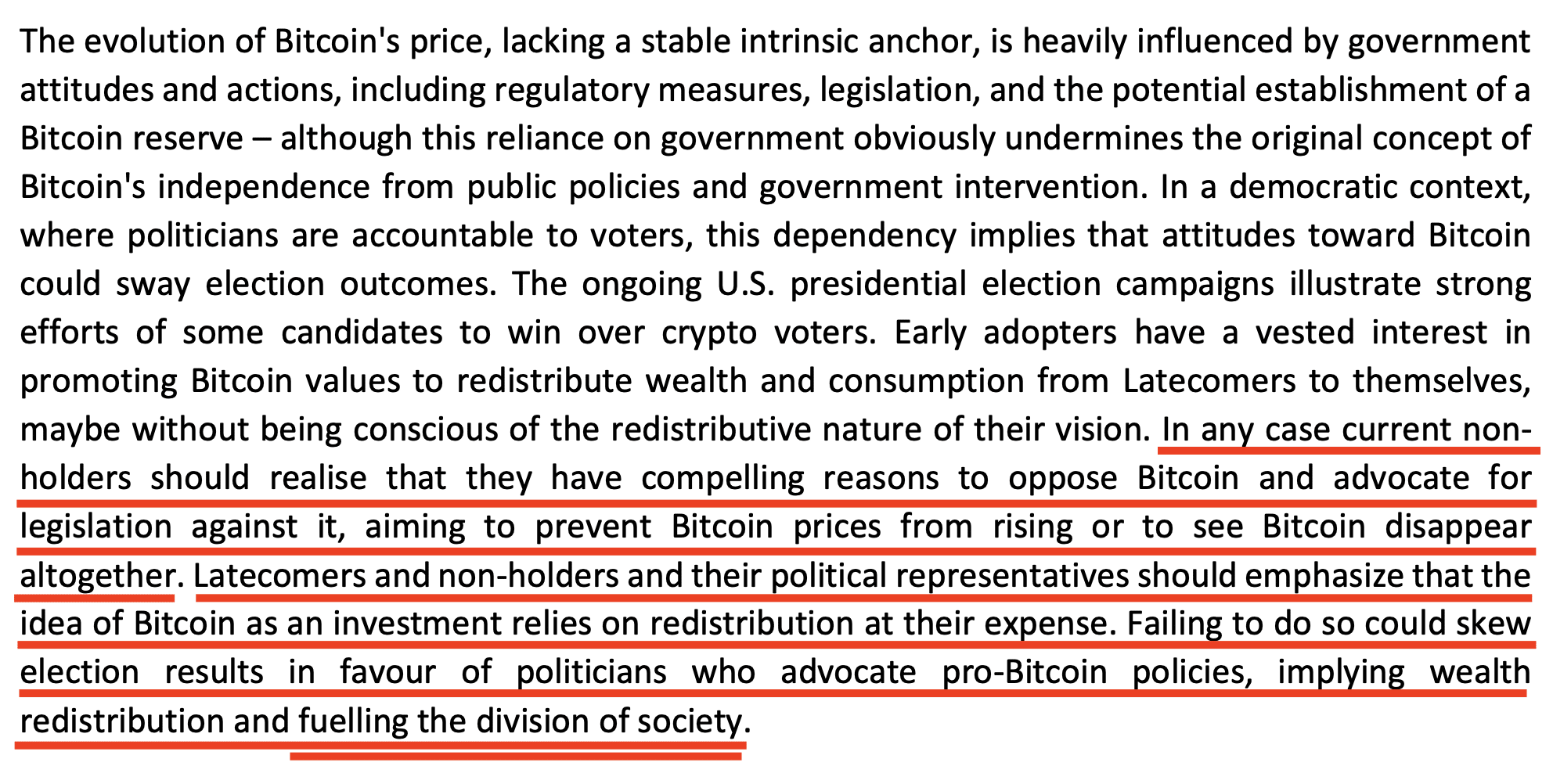

In keeping with ECB officers Jurgen Schaff and Ulrich Bindseil, non-holders will have to suggest for anti-BTC insurance policies or marketing campaign for it to ‘disappear’ altogether. A part of their analysis learn,

“In the end, present non-holders will have to realise that they’ve compelling causes to oppose Bitcoin and suggest for law in opposition to it, aiming to stop Bitcoin costs from emerging or to look Bitcoin disappear altogether.”

Is the ECB pointing out conflict on BTC?

The crypto group slammed the file, whilst some warned it might sign the ECB’s conflict on BTC.

Tuur Demeester, a BTC analyst, claimed that the analysis used to be ECB’s declaration of conflict at the virtual asset. He said,

“This new paper is a real declaration of conflict: the ECB claims that early #bitcoin adopters thieve financial price from latecomers. I strongly imagine government will use this luddite argument to enact harsh taxes or bans.”

Demeester cited the rush through the authors for law as one of the most compelling causes for his projection.

“Then they pass directly to overtly suggest for law … “to stop bitcoin costs from emerging or to look bitcoin disappear altogether” with the intention to save you “the department of society.”

Supply: SSRN

Supply: SSRN

On his phase, Max Keiser, a BTC maximalist and senior marketing consultant to El Salvador’s president Nayib Bukele on all issues Bitcoin, referred to the file because the ECB’s ‘failed IQ check’ at the virtual asset.

“Bitcoin is an IQ check. The ECB failed.”

Neatly, this wasn’t the primary time the regulator has criticized BTC. In February 2024, it said that the asset had no intrinsic price and used to be a bubble that will sooner or later burst and purpose huge social injury.

Later in June, Fabio Panetta, a former ECB government and present Governor of the Financial institution of Italy, known as for different banks to dam crypto because it used to be certain to fail.

In truth, the regulator even criticized the USA transfer to approve spot BTC ETFs in Q1 2024.

That mentioned, some considered the regulator’s anti-BTC thesis as an acknowledgment of the asset’s long run explosive run.

In keeping with Plan C, a marketplace analyst, BTC used to be the option to the regulator’s cash printing (inflation) as a world easing cycle starts.

“This new ECB paper additionally incorporates a hidden sign: ECB is aware of for a undeniable fact that “Bitcoin will upward thrust for just right” as a result of ECB is aware of for a undeniable fact that central banks must get started printing ungodly quantities of cash quickly, and without end.”

Subsequent: Aave sees 675% surge in Optimism customers: What’s happening?