Liberate the Editor’s Digest for freeRoula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.The Ecu Central Financial institution held rates of interest at all-time highs on Thursday however signalled it was once taking into account a lower at its subsequent assembly in June.The ECB mentioned after its governing council met in Frankfurt that its benchmark deposit charge would keep at 4 in line with cent till rate-setters had been certain worth pressures had stabilised. However some policymakers favoured a direct lower.In a shift from earlier language, the ECB mentioned it “can be suitable” to chop charges if underlying worth pressures, its up to date forecasts and the affect of earlier charge rises larger its self assurance that inflation was once remaining in on its 2 in line with cent goal “in a sustained way”.Eurozone inflation has fallen from a 2022 height of 10.6 in line with cent to two.4 in line with cent in March — tantalisingly on the subject of the financial institution’s goal.“Even though the coverage announcement does no longer explicitly point out June as the instant for a primary charge lower, we predict that nowadays’s assembly will have to mark the general prevent sooner than the lower,” mentioned Carsten Brzeski, head of world macro analysis at Dutch financial institution ING.ECB president Christine Lagarde advised journalists that inflation was once anticipated to “range” in coming months sooner than falling to its goal via mid-2025, however pointed to indicators of slowing salary enlargement, including: “Dangers to financial enlargement stay tilted to the drawback.”Requested if Thursday’s determination to stay charges on dangle was once unanimous, she mentioned “a couple of participants felt sufficiently assured” to argue in favour of a lower. However she added they “agreed to rally to the consensus of the very, very huge majority of participants” who sought after to attend a minimum of till June.The euro, interest-sensitive two-year German Bund yields, and the Stoxx Europe 600 index had been all more or less flat at the day after the central financial institution’s observation.On the other hand, investors in swaps markets relatively downgraded the possibility that the ECB will start slicing charges in June to round 70 in line with cent, from 75 in line with cent previous within the day.Markets’ charge lower expectancies were shaken via records this week appearing US inflation rose greater than anticipated in March.  Buyers have replied via slashing their bets on Federal Reserve charge cuts, to which they now ascribe just a 50 in line with cent probability sooner than September. The marketplace strikes in the USA have additionally led investors to reduce their expectancies of what number of charge cuts the ECB and Financial institution of England will make over the process the 12 months.Some eurozone policymakers, as in the United Kingdom, might need to steer clear of slicing charges a lot more aggressively than their opposite numbers in the USA, partially out of worry of weakening their currencies and so additional stoking inflation.However Lagarde driven again towards the recommendation that the ECB would no longer be ready to chop charges sooner than the Fed. “We’re data-dependent, no longer Fed-dependent,” she mentioned.Peter Schaffrik, a strategist at RBC Capital Markets, added: “The ECB has nailed its colors to the mast and transferring the steerage at this degree when exact inflation numbers are lately round the corner from their very own forecasts turns out tough to consider.”ECB shifts tone from March April 2024“ . . . the important thing ECB rates of interest are at ranges which are making a considerable contribution to the continued disinflation procedure . . . If the Governing Council’s up to date evaluate of the inflation outlook, the dynamics of underlying inflation and the energy of financial coverage transmission had been to additional build up its self assurance that inflation is converging to the objective in a sustained way, it might be suitable to cut back the present stage of financial coverage restriction.”March 2024“ . . . the important thing ECB rates of interest are at ranges that, maintained for a sufficiently lengthy period, will make a considerable contribution to this [2 per cent inflation] objective . . . The Governing Council will proceed to practice a data-dependent technique to figuring out the proper stage and period of restriction.”

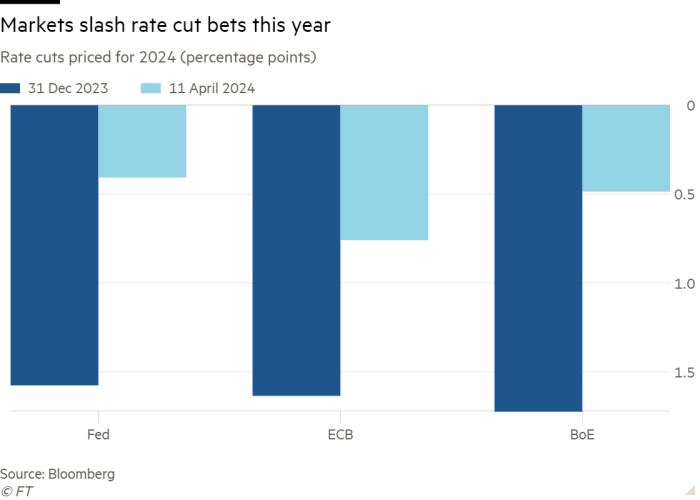

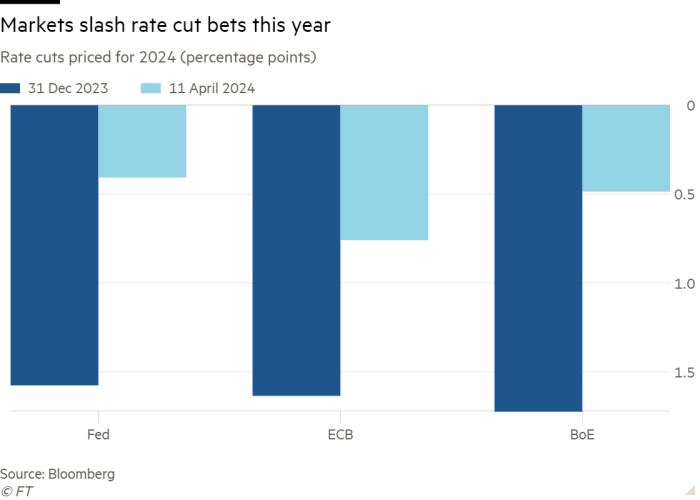

Buyers have replied via slashing their bets on Federal Reserve charge cuts, to which they now ascribe just a 50 in line with cent probability sooner than September. The marketplace strikes in the USA have additionally led investors to reduce their expectancies of what number of charge cuts the ECB and Financial institution of England will make over the process the 12 months.Some eurozone policymakers, as in the United Kingdom, might need to steer clear of slicing charges a lot more aggressively than their opposite numbers in the USA, partially out of worry of weakening their currencies and so additional stoking inflation.However Lagarde driven again towards the recommendation that the ECB would no longer be ready to chop charges sooner than the Fed. “We’re data-dependent, no longer Fed-dependent,” she mentioned.Peter Schaffrik, a strategist at RBC Capital Markets, added: “The ECB has nailed its colors to the mast and transferring the steerage at this degree when exact inflation numbers are lately round the corner from their very own forecasts turns out tough to consider.”ECB shifts tone from March April 2024“ . . . the important thing ECB rates of interest are at ranges which are making a considerable contribution to the continued disinflation procedure . . . If the Governing Council’s up to date evaluate of the inflation outlook, the dynamics of underlying inflation and the energy of financial coverage transmission had been to additional build up its self assurance that inflation is converging to the objective in a sustained way, it might be suitable to cut back the present stage of financial coverage restriction.”March 2024“ . . . the important thing ECB rates of interest are at ranges that, maintained for a sufficiently lengthy period, will make a considerable contribution to this [2 per cent inflation] objective . . . The Governing Council will proceed to practice a data-dependent technique to figuring out the proper stage and period of restriction.”

Ecu Central Financial institution holds rates of interest at 4% in cut up determination