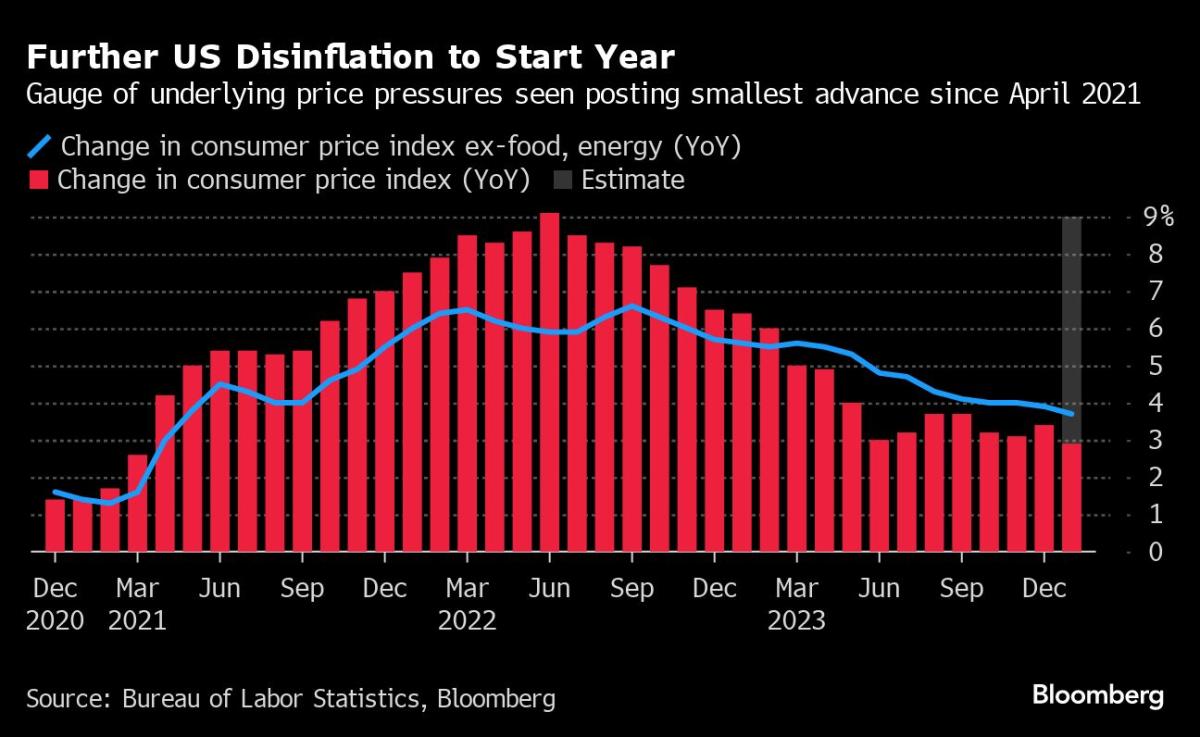

(Bloomberg) — Investors paused for breath after optimism about eventual Federal Reserve interest-rate cuts and easing inflation driven the S&P 500 to a brand new file.Maximum Learn from BloombergThe rally in Giant Tech that lifted the S&P 500 above 5,000 for the primary time on Friday seemed set to increase, as Amazon.com Inc. Nvidia Corp. and Tesla Inc. ticked upper in premarket buying and selling. Strikes past the ones standouts have been muted, in S&P 500 and Nasdaq 100 futures buying and selling in addition to for US Treasuries and the greenback.The following drive level for markets is Tuesday’s shopper value index document. The once a year US inflation charge is forecast to have dropped to two.9% in January from 3.4% the prior month, consistent with consensus estimates of economists surveyed through Bloomberg.That will be the first studying underneath 3% since March 2021, supporting a disinflationary pattern that may resolve the scope and timing of Federal Reserve charge cuts.“So long as we see this sluggish development down, they will have to be able the place they may be able to really feel assured of short of to chop,” stated Pooja Sriram, US economist at Barclays, relating to Fed policymakers. “It nonetheless looks as if we’re at a spot the place rates of interest are increased, they might chew into the economic system and possibly there’s scope for the ones to begin to be pared. There in point of fact isn’t any reason why to stay charges at those ranges for extraordinarily lengthy,” she added in an interview with Bloomberg TV.Swaps markets counsel the Fed will perform simply 4 charge cuts in 2024, down from seven forecast on the finish of closing yr, and simplest somewhat greater than the 3 penciled in through policymakers.“Marketplace pricing is making an attempt to inspire central banks to get going and get started slicing charges. Arguably, the marketplace has been overexuberant in its encouragement just lately,” Iain Stealey, global leader funding officer for fastened source of revenue at J.P. Morgan Asset Control, wrote in a observe to shoppers. “Employment has remained sturdy, buying managers’ surveys are wholesome and financial enlargement is powerful.”Tale continuesThe yen held close to a two-month low reached on Friday following feedback from central bankers that the Financial institution of Japan will take its time elevating charges. Japan’s forex has weakened towards all its Workforce-of-10 friends this yr.Company HighlightsShares in Italian luxurious logo Tod SpA stocks rose up to 18% after the founding circle of relatives stated it had enlisted buyout company L Catterton in a brand new try to take the corporate non-public.Diamondback Power Inc. reached an settlement to shop for fellow Texas oil-and-gas manufacturer Enterprise Power thru a $26 billion deal that may create the biggest pure-play operator within the prolific Permian Basin.PepsiCo stocks received after the beverage and snack corporate was once upgraded to shop for from impartial at Citi, which stated decreased expectancies for natural gross sales enlargement has created a “excellent set-up.”Key occasions this week:India CPI, MondayMinneapolis Fed President Neel Kashkari, Fed Governor Michelle Bowman, Fed President Tom Barkin talk, MondayECB government board member Piero Cipollone, leader economist Philip Lane talk, MondayUS CPI, TuesdayUK unemployment, TuesdayJapan manufacturer costs, TuesdayUK inflation, WednesdayEurozone GDP, business manufacturing, WednesdayIndonesia presidential election, WednesdayBank of England Governor Andrew Bailey speaks, WednesdayECB governing council member Boris Vujcic and vp Luis de Guindos speakChicago Fed President Austan Goolsbee speaks, WednesdayAustralia jobs, ThursdayJapan GDP, ThursdayUK GDP, ThursdayUS preliminary jobless claims, retail gross sales, ThursdayPhilippine central financial institution assembly on rates of interest, ThursdayECB President Christine Lagarde speaks, ThursdayFed Governor Christopher Waller speaks, ThursdayBank of England coverage makers Catherine Mann, Megan Inexperienced talk, ThursdayUS housing begins, manufacturer costs, FridaySan Francisco Fed President Mary Daly, Fed Vice Chair for Supervision Michael Barr talk, FridaySome of the principle strikes in markets:StocksS&P 500 futures have been little modified as of seven:10 a.m. New York timeNasdaq 100 futures have been little changedFutures at the Dow Jones Commercial Moderate have been little changedThe Stoxx Europe 600 rose 0.3p.cThe MSCI Global index was once little changedCurrenciesThe Bloomberg Buck Spot Index was once little changedThe euro fell 0.1% to $1.0769The British pound was once little modified at $1.2616The Jap yen rose 0.2% to 149.00 in step with dollarCryptocurrenciesBitcoin fell 0.4% to $47,926.7Ether fell 0.7% to $2,487.5BondsThe yield on 10-year Treasuries declined two foundation issues to 4.15p.cGermany’s 10-year yield declined 4 foundation issues to two.34p.cBritain’s 10-year yield declined 5 foundation issues to 4.04p.cCommoditiesThis tale was once produced with the help of Bloomberg Automation.–With the help of Robert Logo, Sagarika Jaisinghani and Richard Henderson.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Ecu Shares Push Upper on Coattails of S&P: Markets Wrap