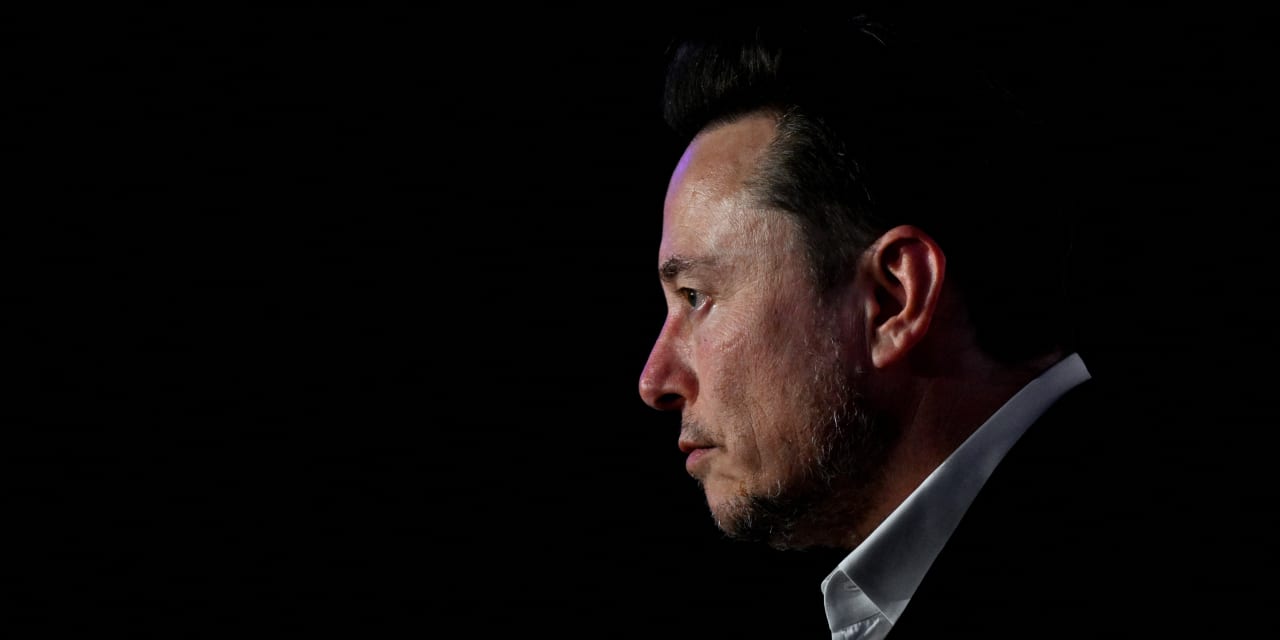

During the recent Tesla earnings conference call, Elon Musk gave investors a disingenuous response when he stated that he does not truly desire voting control of Tesla Inc. After indicating that the company may experience slower growth next year, Musk was questioned by an investor about his previous statements regarding voting control and whether retail shareholders should be concerned. Musk’s recent comments on X, his former Twitter account, where he expressed his discomfort with growing Tesla as a leader in AI and robotics unless he has 25% of the company’s voting power, were revisited in the conference call. Musk reiterated his desire to be influential and mentioned that he is not seeking additional economics but rather aiming to be an effective steward of powerful technology. He expressed the desire for a dual-class stock, which he believes would be ideal, and specified that he wants a strong influence, but not control.

Musk acknowledged the idea of a dual-class structure in subsequent comments on the same tweet, admitting that he would be open to this structure, but was informed that it would be impossible to achieve post-IPO in Delaware. This suggestion of a dual-class stock reveals Musk’s true intentions, as such shares are typically issued to allow founders to retain voting control of the company, particularly at the time of its IPO. He mentioned examples of other companies with controlling shares through dual-class stock, such as Meta Platforms Inc., controlled by co-founder Mark Zuckerberg, and Snapchat parent Snap Inc., controlled by co-founders Evan Spiegel and Robert Murphy.

Stephen Diamond, an associate professor at Santa Clara University’s School of Law, commented that dual-class stock is fundamentally about control. He stated that implementing a dual-class share structure post-IPO would be highly unusual and unprecedented in his experience. It is likely that any change like this would require shareholder approval, excluding Musk’s shares. Tesla, with Musk as CEO, went public in 2010, and he currently holds 12.93% of Tesla’s shares, according to FactSet.

In 2022, Musk had to sell billions of dollars worth of Tesla shares to partially fund his purchase of Twitter. In late 2021, he sold about $16 billion in shares to pay a tax bill, which was about 10% of his stake in Tesla at the time. It is possible that Musk’s comments are indicative of a potential disagreement with Tesla’s board over his compensation, particularly in relation to his $55 billion pay package that is the subject of ongoing litigation following a shareholder lawsuit.

Musk’s comments about wanting more control may also be tied to discussions at the board level about Tesla’s vision for the future of AI and its integration into its products, similar to discussions that occurred on the board of OpenAI last November. Investors will stay tuned to see if Musk’s desires for increased control over Tesla materialize or remain just a wishful thinking.

Elon Musk desires voting control of Tesla’s stock, but he is not open about it with investors