Ethereum Basis moved 35,000 ETH to an change

ETH has answered definitely to the improvement, with extra of it leaving exchanges

Not too long ago, the Ethereum Basis made a notable switch of a vital quantity of its ETH holdings to an change. Such an motion is one who most often raises issues about doable sell-offs and downward drive at the asset’s value.

Then again, the reaction from ETH used to be somewhat surprising, defying the standard marketplace response to such transfers.

Ethereum Basis sells a bit of its holdings

In step with knowledge from Spot On Chain, the Ethereum Basis transferred 35,000 ETH to Kraken on 23 August. This transaction, valued at just about $94 million, is the most important switch the Basis has made this yr. Earlier than this, the Basis had bought roughly 2,516 ETH, unfold throughout more than a few smaller transactions.

Given the continuing volatility in ETH’s value, this crucial transfer may just have an effect on the asset’s marketplace dynamics. Huge transfers like this regularly elevate issues about doable sell-offs, which may end up in downward drive at the value.

Then again, the marketplace response might range relying on a number of components, together with total marketplace sentiment.

Ethereum change flows display a extra sure development

The new switch of 35,000 ETH by way of the Ethereum Basis to Kraken used to be certainly a vital transaction, main many to await a corresponding have an effect on on change flows.

Unusually, then again, an research of the change float on 23 August published that extra ETH left exchanges that day than entered them.

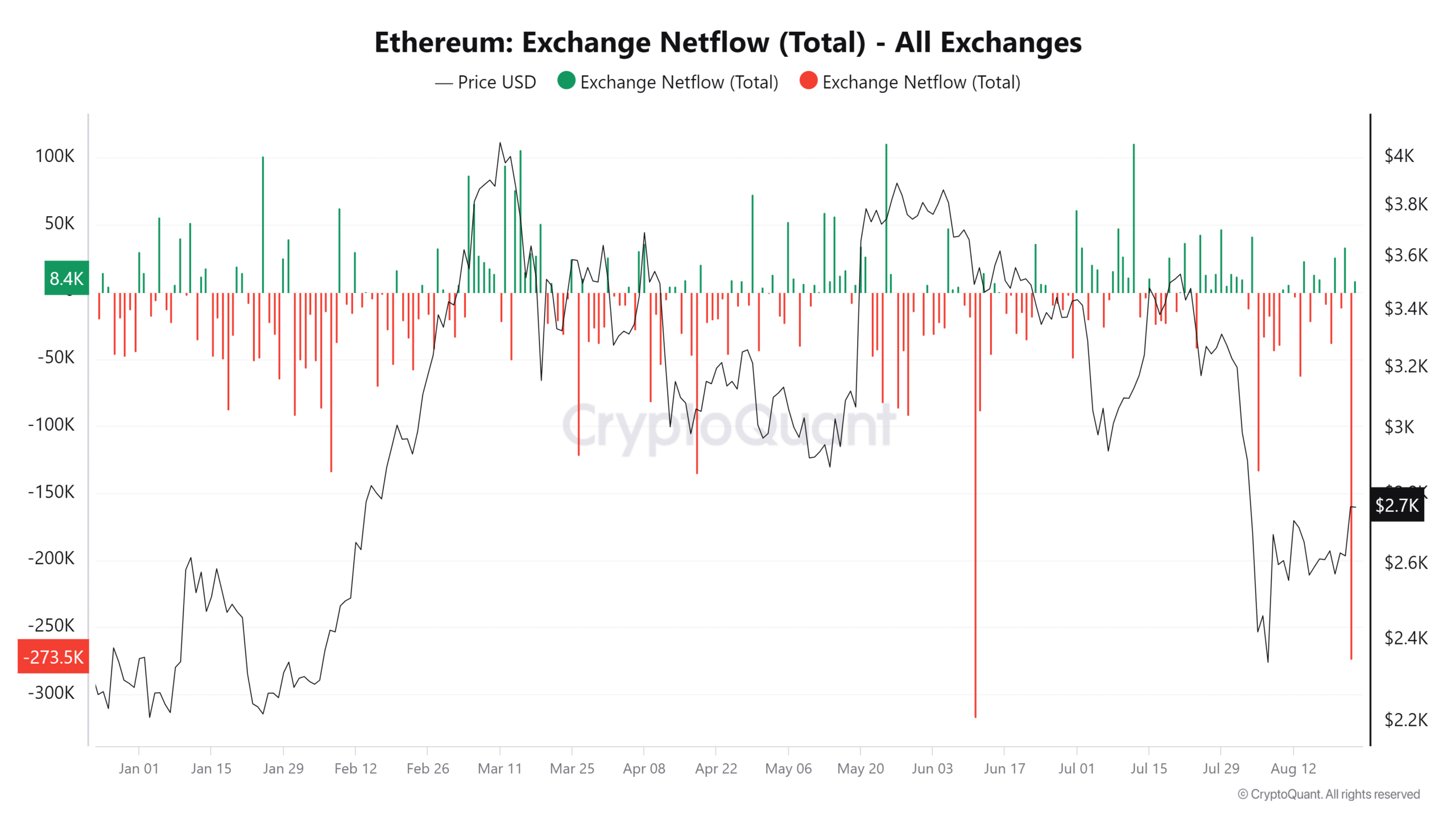

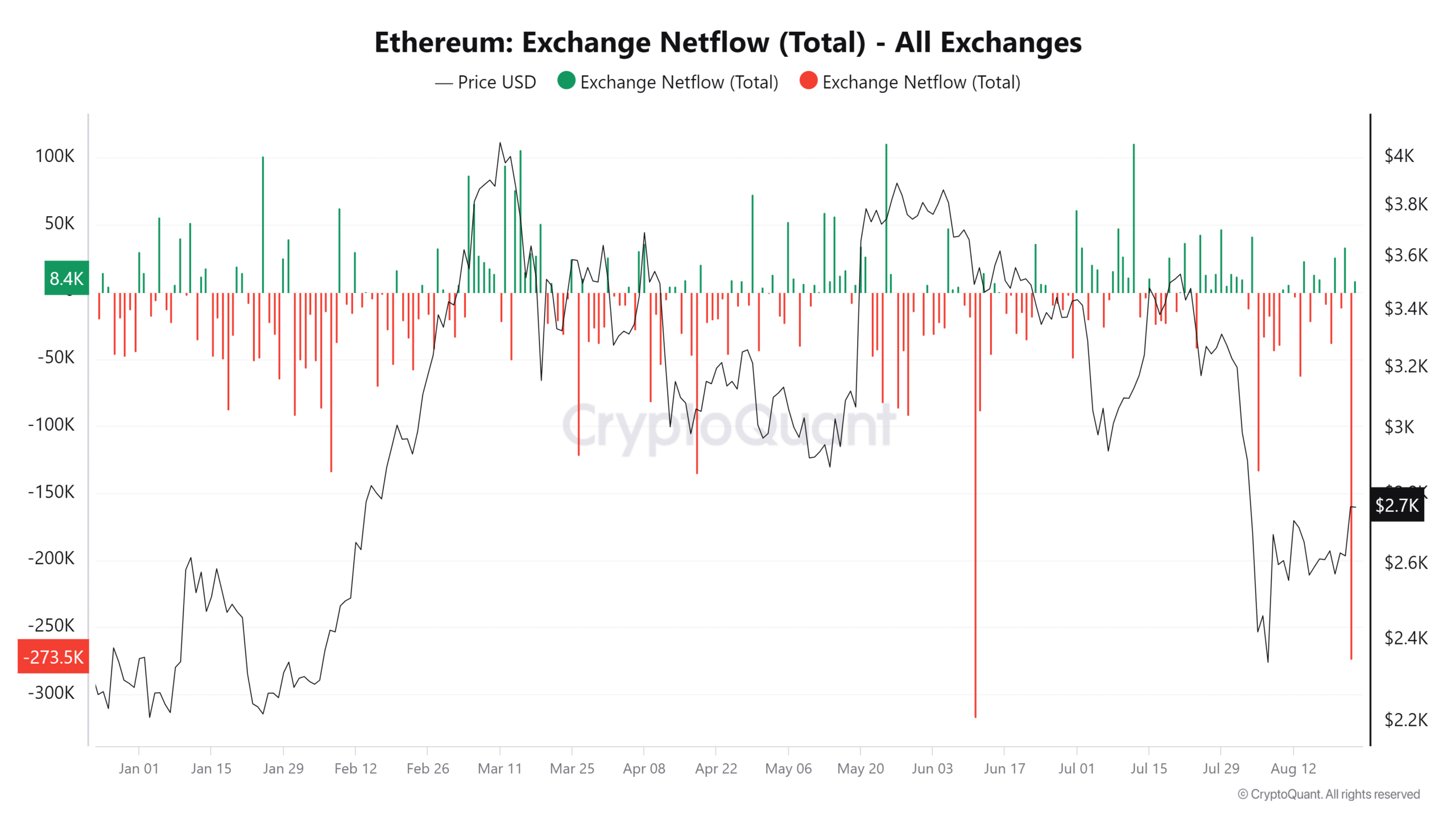

Supply: CryptoQuant

Supply: CryptoQuant

The netflow knowledge published considerable outflows too, with ETH noting the second-highest adverse netflows of the yr. In step with knowledge from CryptoQuant, the netflow on 23 August used to be -273,596 ETH, with the best adverse netflows recorded at -317,197 ETH in June.

This indicated that regardless of the Ethereum Basis’s massive switch, there used to be a better motion of ETH clear of exchanges. This most often alerts that traders are chickening out their holdings, perhaps to carry in chilly garage or take part in staking.

Such habits may also be interpreted as a bullish sign, as this is a signal of self assurance within the long-term price of ETH.

Social and quantity metrics see slight bumps

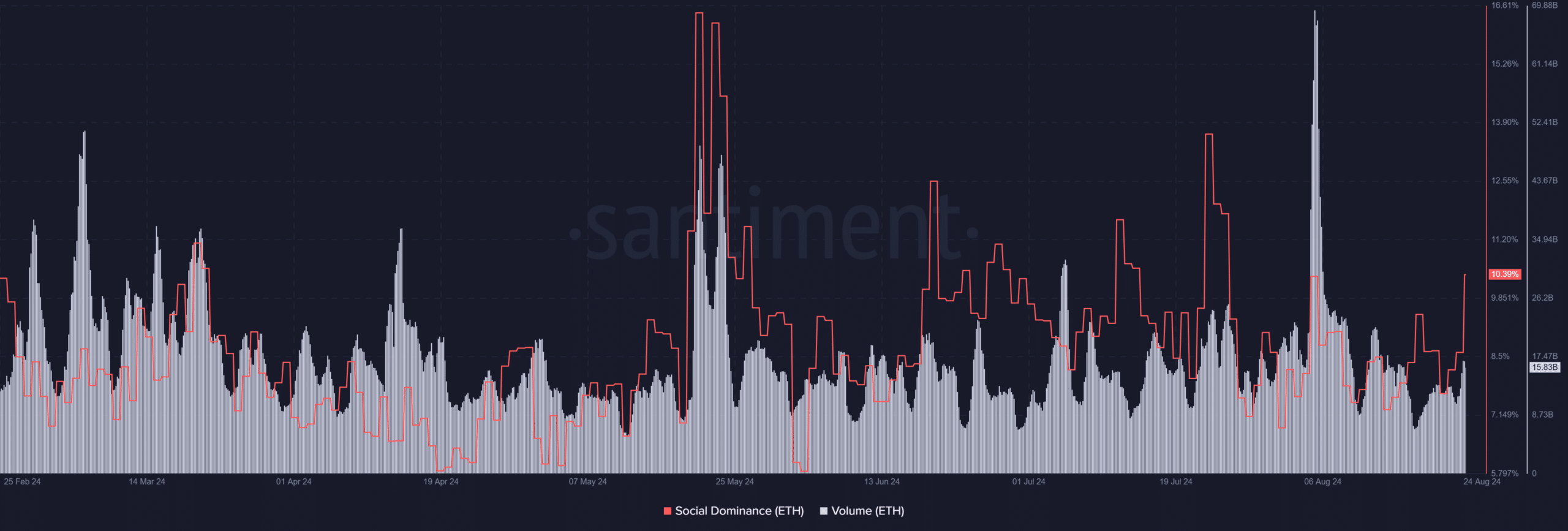

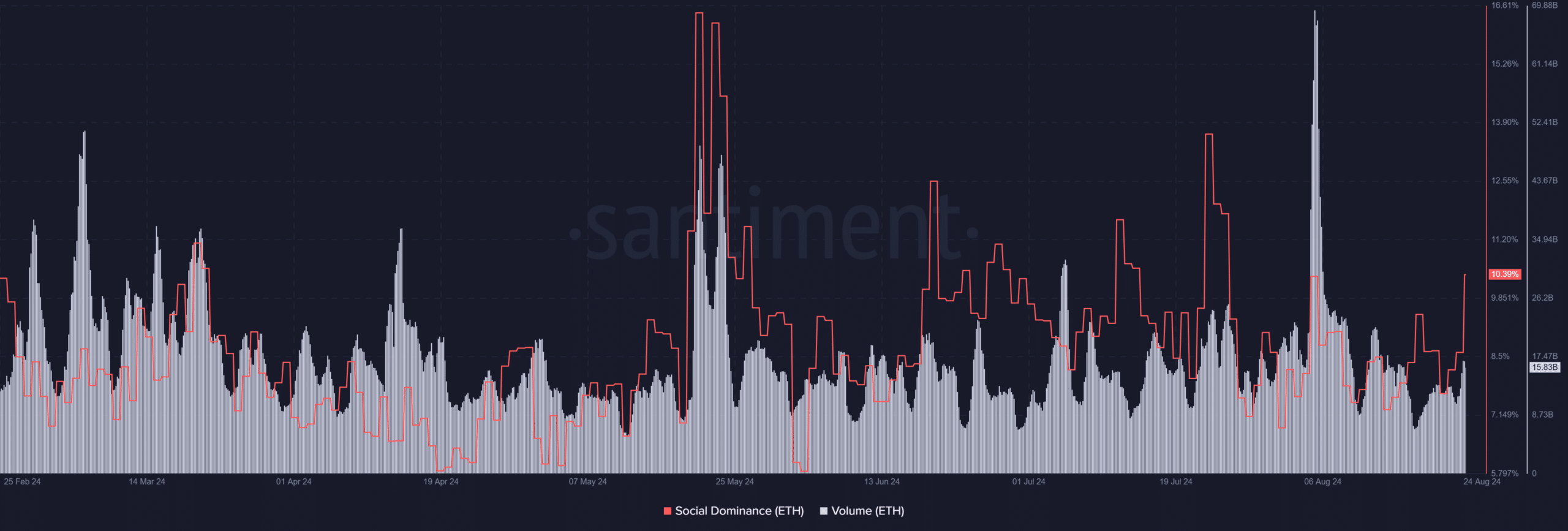

A contemporary research of Ethereum’s social dominance on Santiment published a notable hike during the last 24 hours. On the time of writing, Ethereum’s social quantity had risen to over 10%, indicating that it these days accounts for greater than 10% of the entire crypto-related discussions.

Moreover, its buying and selling quantity registered a slight hike right through the similar length. The amount climbed to roughly $15.8 billion, up by way of over $2 billion, in comparison to earlier days.

This uptick in quantity, coupled with the heightened social dominance, suggests a good development for Ethereum.

Supply: Santiment

Supply: Santiment

Remember that, those metrics are bullish signs.

The rising dialogue round Ethereum, mixed with emerging buying and selling task, are an indication that marketplace members are actively attractive with ETH. This would probably sign additional value appreciation if the craze continues.

ETH spikes by way of 5% at the charts

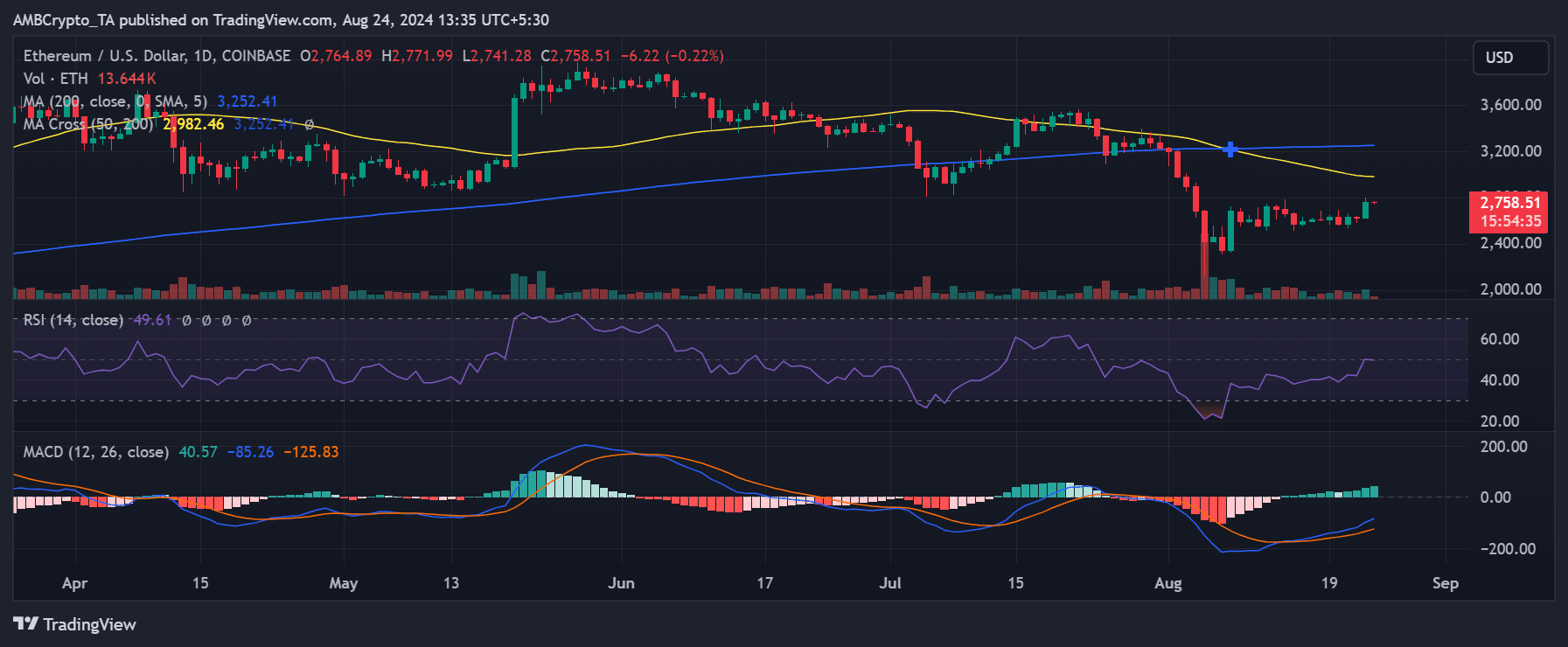

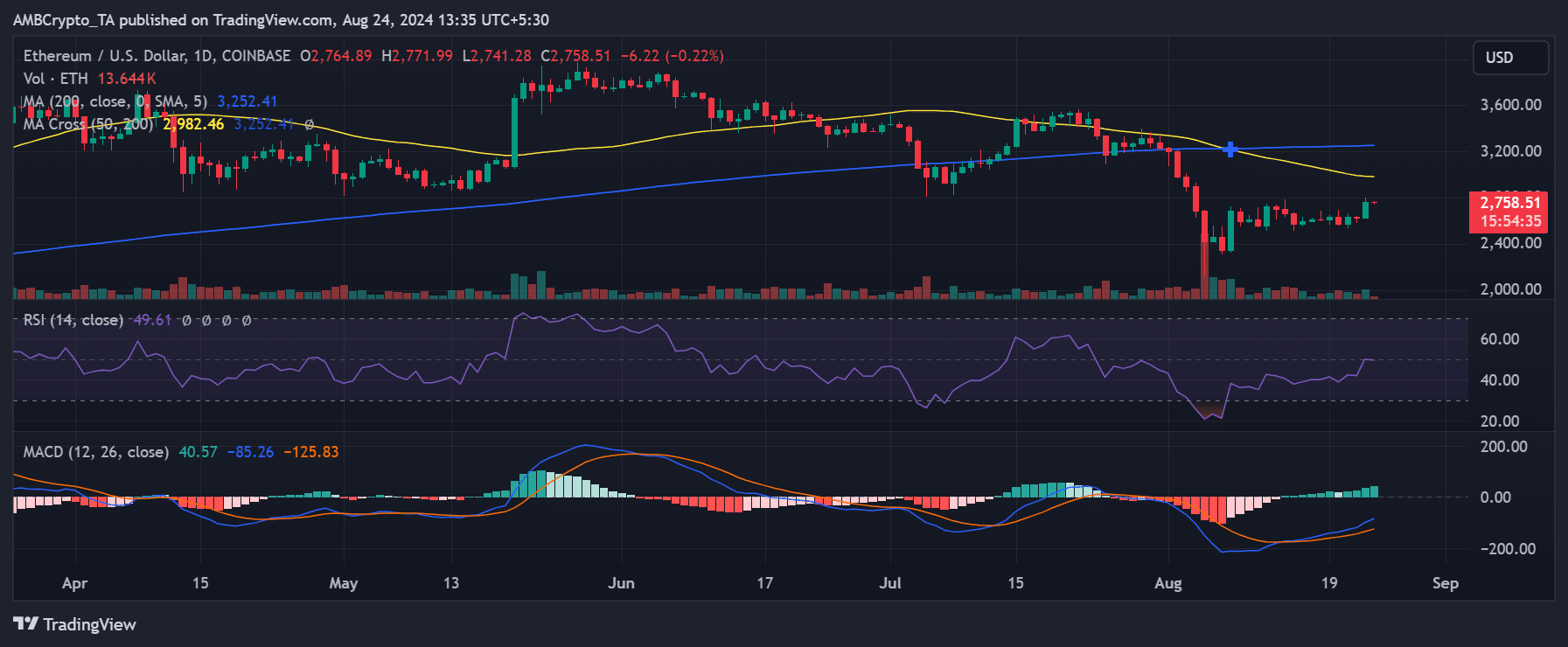

An research of Ethereum’s day-to-day value motion published a vital bout of appreciation within the ultimate buying and selling consultation.

In step with AMBCrypto’s research, its value hiked by way of 5.39%, with the altcoin buying and selling at $2,764. In spite of this notable acquire, then again, Ethereum’s broader bullish development is but to completely materialize.

This used to be evidenced by way of its transferring averages and Relative Energy Index (RSI).

Supply: TradingView

Supply: TradingView

Particularly, Ethereum continues to be buying and selling underneath each its non permanent and long-term transferring averages (yellow and blue strains). Those transferring averages are these days appearing as robust resistance ranges, combating additional upward motion in the fee.

Moreover, Ethereum’s RSI appeared to be resting at the impartial line – An indication that it used to be neither overbought nor oversold.

– Learn Ethereum (ETH) Value Prediction 2024-25

This positioning indicated that whilst Ethereum has noticed a non permanent value hike, it nonetheless faces important resistance from its transferring averages. A breakout above those resistance ranges can be important to verify the beginning of a extra sustained bullish development.

Subsequent: Toncoin value prediction – Will $7 fall for TON now after Bitcoin’s newest rally?