Dealers have taken over Ethereum value route, suggesting that value would possibly fall under $3,000.

The only-day Discovered Cap dropped, indicating that the marketplace would possibly lose self belief if the rage persists.

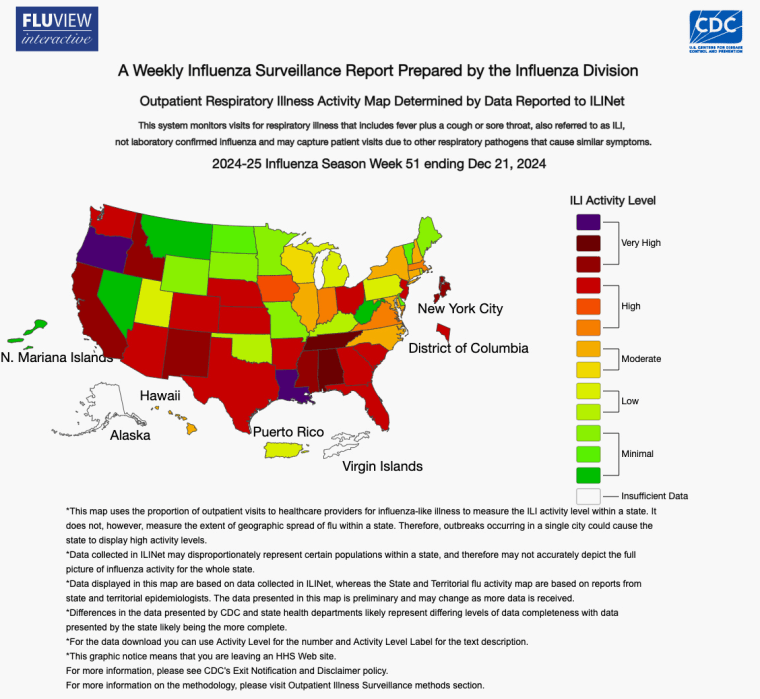

The cost of Ethereum [ETH] dangers falling under $3,000 for the second one time in a couple of days. This used to be in step with the knowledge AMBCrypto bought from the Cumulative Quantity Delta (CVD).

At the day-to-day chart ETH/USD, the spot CVD had dropped to the unfavourable area. The CVD tracks the adaptation between the purchasing and promoting quantity of a cryptocurrency over a while.

Consumers fight to maintain the drive

When the price is certain, extra holders are purchasing than the ones promoting. Maintaining because of this the cost of the cryptocurrency would possibly building up within the momentary. On the other hand, when it’s unfavourable, it signifies that dealers are dominant.

Supply: TradingView

Supply: TradingView

In a scenario like this, it turns into tough for costs to extend. At press time, the cost of the altcoin used to be $3,012. Earlier than that, ETH had tried to turn $3,100, however bears rejected the transfer.

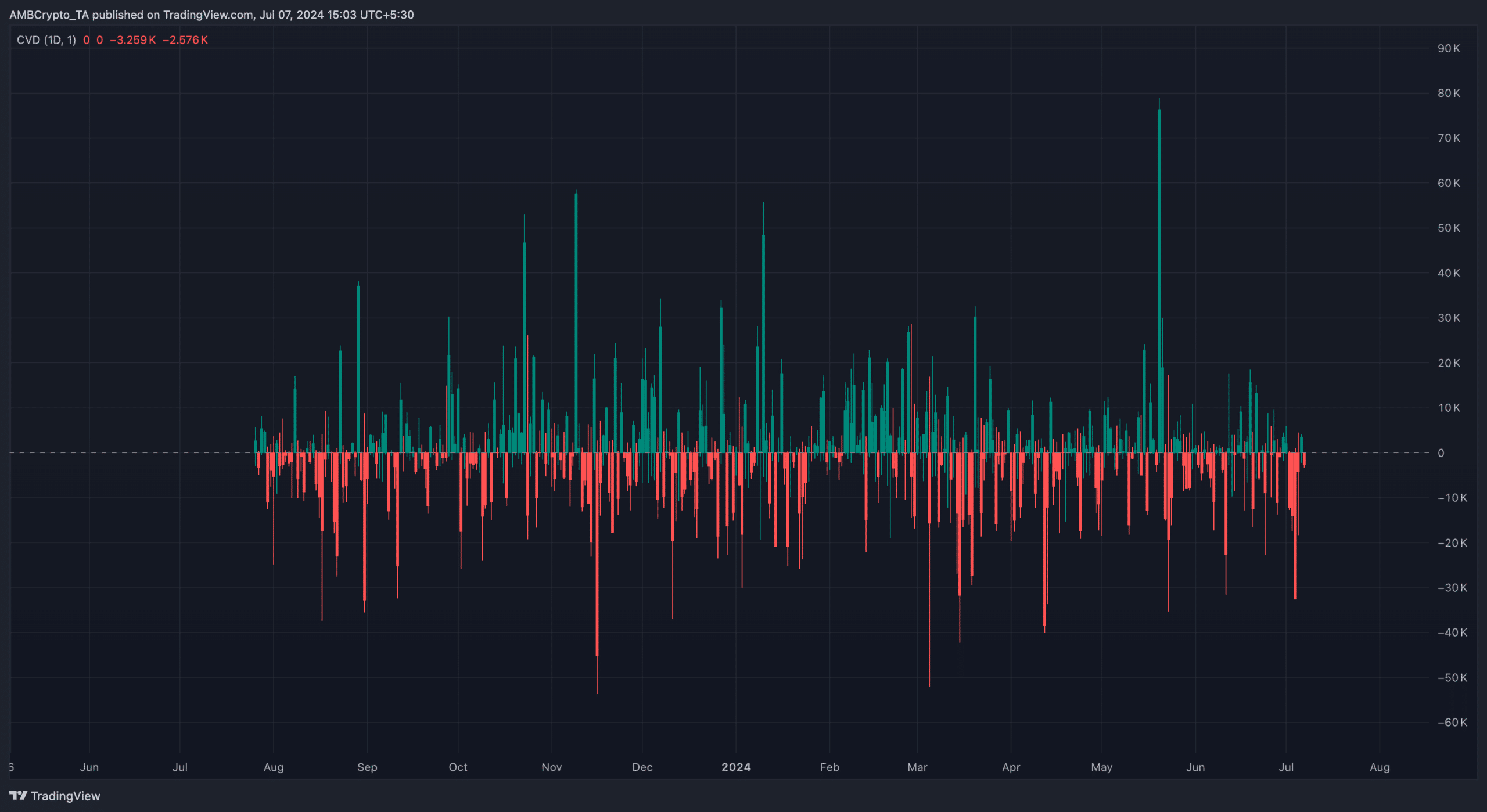

On the other hand, except for the CVD, different metric printed that it will take a while prior to the cryptocurrency totally recovers.

Considered one of such datasets is the Imply Coin Age (MCA). The MCA is the typical age of cash on a blockchain. When it will increase, it signifies that previous cash are transferring again into circulate, thereby, expanding the potential for a sell-off.

However a lower within the coin age means that holders are refraining from promoting. As a substitute, they’re opting to stay their belongings in non-custodial wallets.

Extra previous cash, extra drawback

As of this writing, ETH’s 90-day MCA had moved from 36.50 to 37.12. This building up implies a upward push in buying and selling job involving the cryptocurrency.

For the reason that value fell from the price at the sixth of July, it means that lots of the alternate led to a sale.

If this continues, the cost of ETH may just slip under $3,000. Additionally, if purchasing drive fails to check up with the rise, the associated fee would possibly drop to $2,881 find it irresistible did at the fifth.

Supply: Santiment

Supply: Santiment

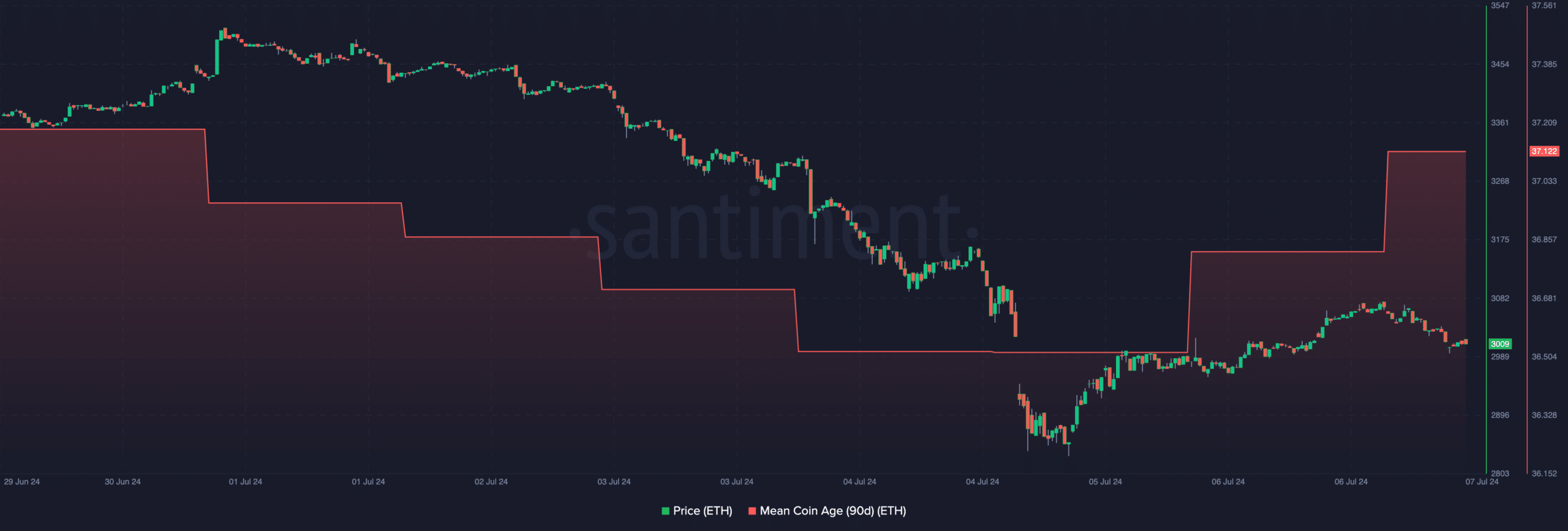

Along with the above, the Discovered Cap aligned with the forecast. Discovered Cap represents that the price of each and every coin when it remaining moved in comparison to its buying and selling worth.

As a measure of the collective price foundation, the one-day Discovered Cap dropped to $559.45 million. This lower means that ETH had plunged some holders into unrealized losses.

If this persists, the wider marketplace would possibly lose self belief in Ethereum, in all probability prompting low call for for the cryptocurrency. Must this be the case, the associated fee would possibly fall as mentioned previous.

Supply: Santiment

Supply: Santiment

Is your portfolio inexperienced? Take a look at the Ethereum Benefit Calculator

Apparently, this lower additionally gifts a purchasing alternative so long as ETH stays in a bull marketplace.

On the other hand, the culmination of this transformation would possibly no longer replicate in a couple of days or even weeks. However in the long run, ETH’s value appears more likely to soar.