Ethereum’s discovered worth higher band at $5.2K mirrors ranges noticed all over the 2021 bull marketplace height, elevating breakout expectancies

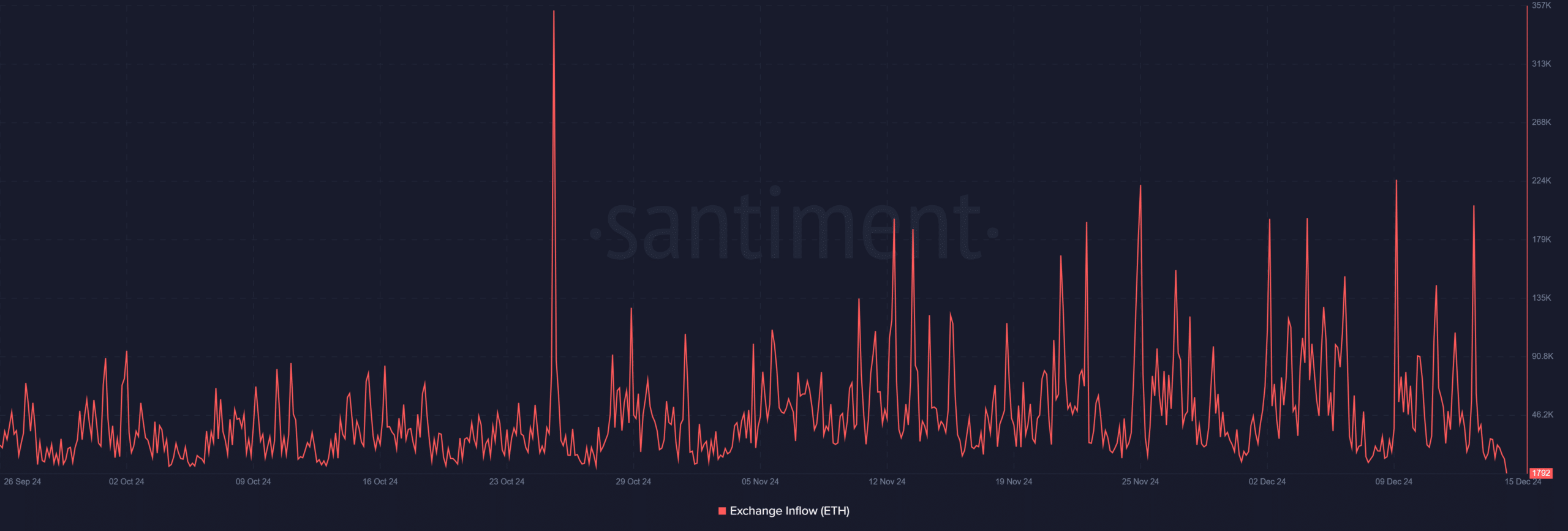

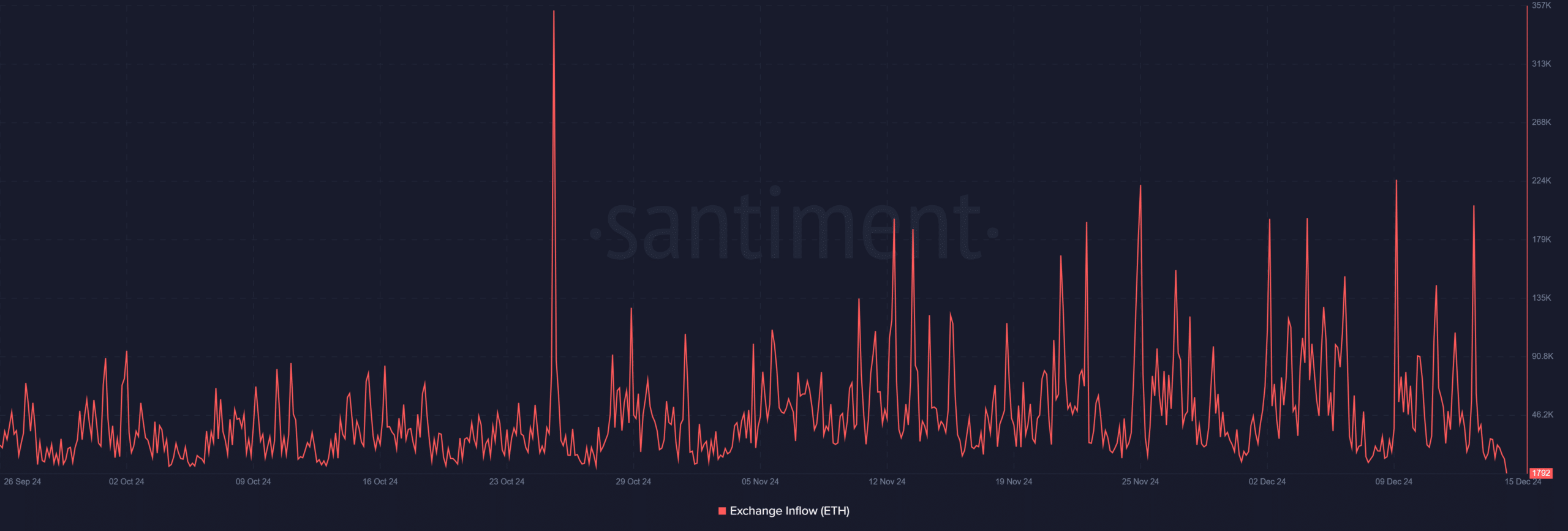

Emerging change inflows and higher task counsel the potential for profit-taking.

Ethereum [ETH] is teetering at the fringe of a significant breakout, with its discovered worth higher band hitting $5.2K — mirroring ranges remaining noticed all over the 2021 bull marketplace height.

On-chain metrics pointed to robust call for, fueling hopes of a rally past $5,000.

However as marketplace dynamics evolve, traders are left questioning: is Ethereum poised to reclaim its former glory, or are the prerequisites basically reshaping its trajectory?

How discovered worth will impact this present cycle

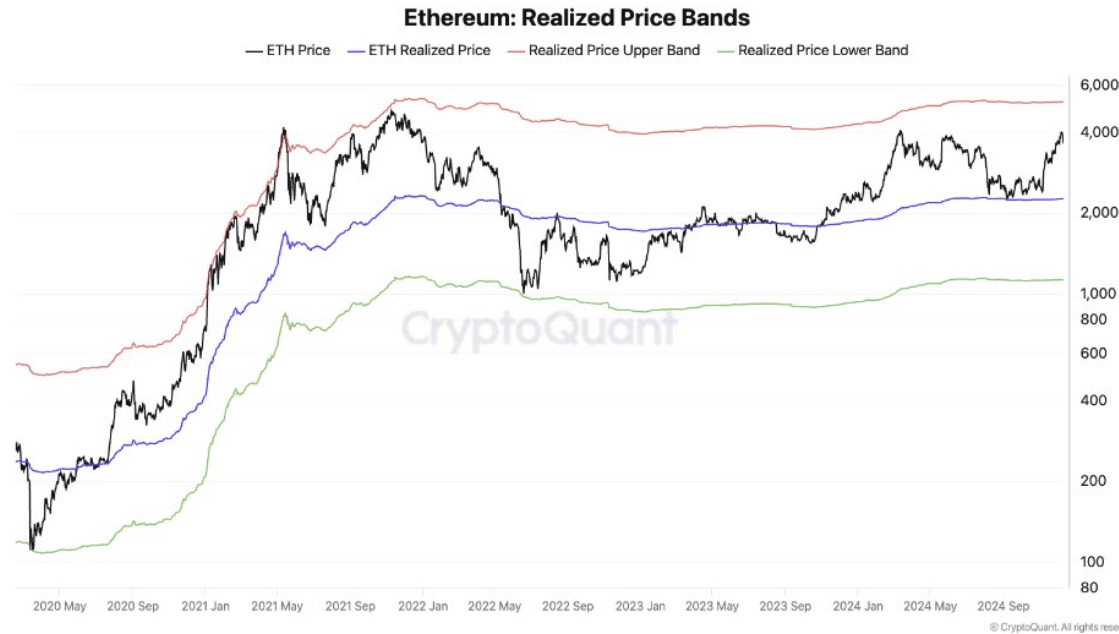

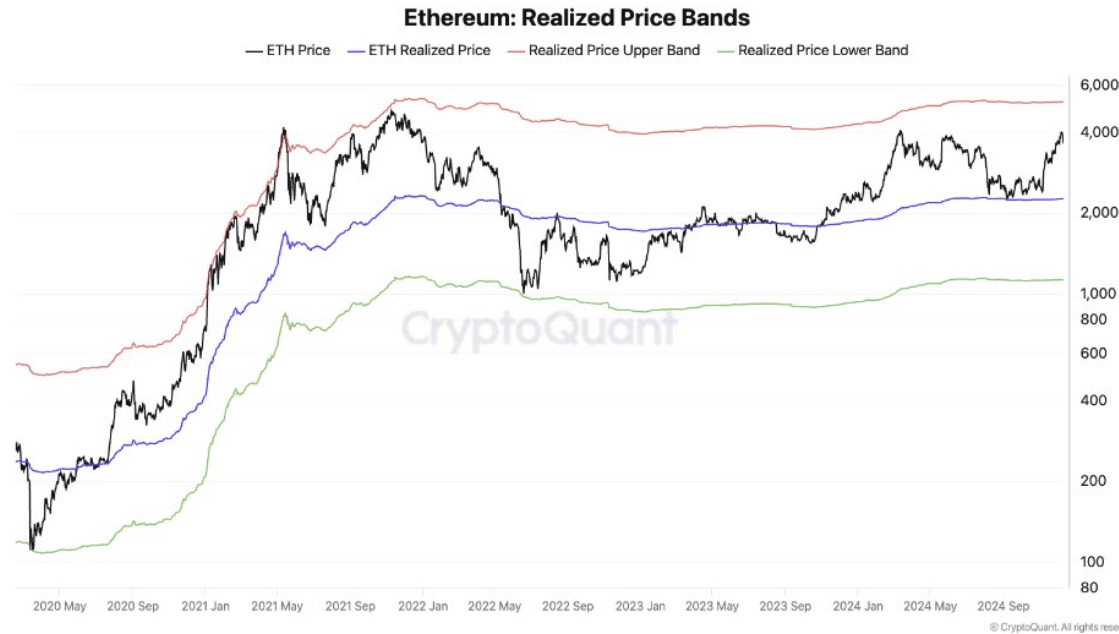

Supply: CryptoQuant

Supply: CryptoQuant

Ethereum’s discovered worth higher band, at $5.2K at press time, is a key marker in figuring out doable marketplace actions.

This metric, which tracks the common worth at which each and every unit of ETH remaining moved, performs a pivotal function in figuring out marketplace tendencies.

Consistent with AMBCrypto’s have a look at CryptoQuant knowledge, the present worth alignment mirrors the 2021 bull run’s height, when the discovered worth higher band coincided with a meteoric upward push.

Traditionally, those higher band ranges have signaled overheated prerequisites or robust bullish momentum, steadily previous important worth actions.

Benefit-taking forward?

Supply: TradingView

Supply: TradingView

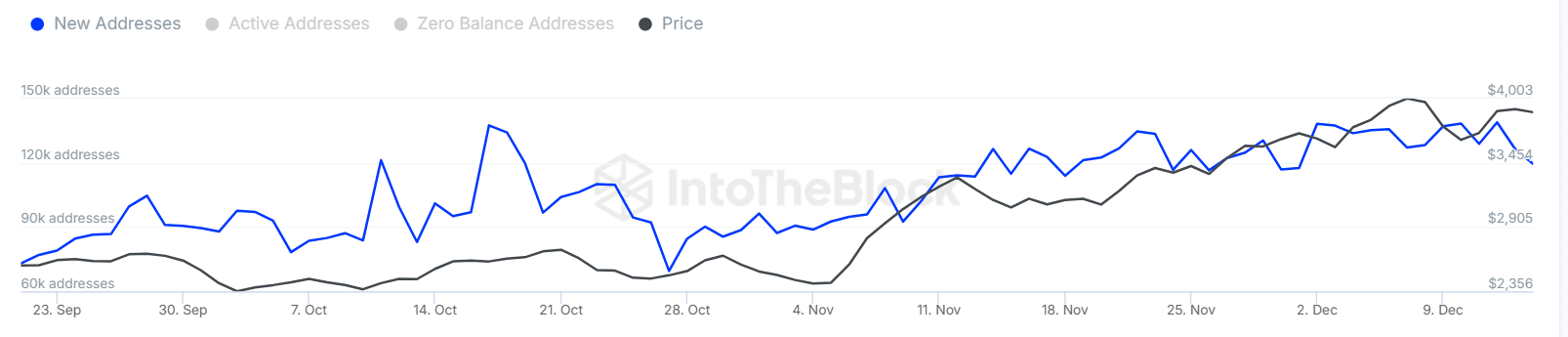

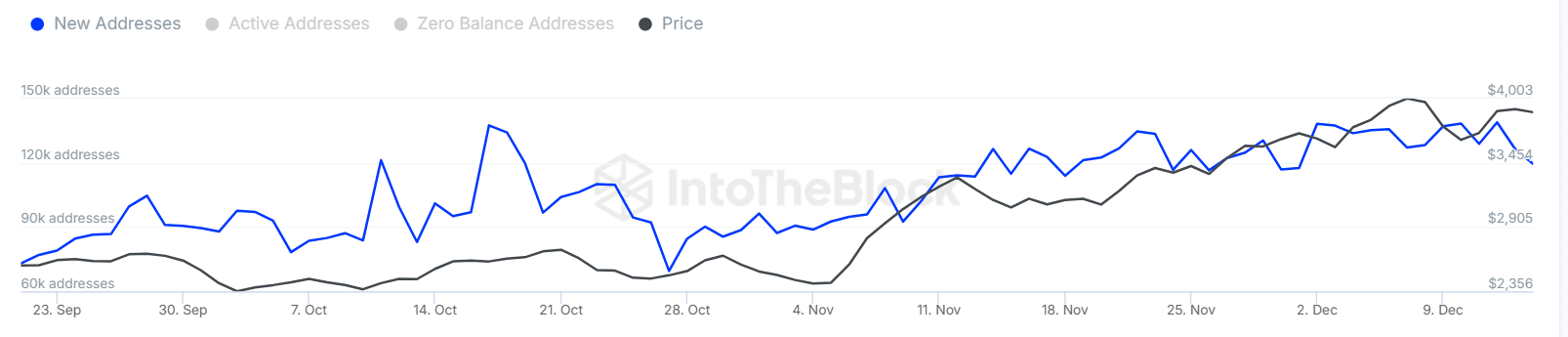

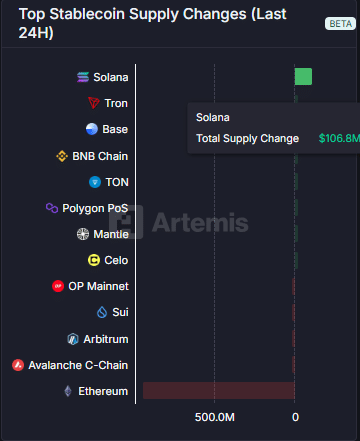

The marketplace is appearing blended indicators. The lively addresses chart unearths a 10-15% build up in person engagement during the last week, indicating heightened community task and investor participation.

Concurrently, buying and selling volumes have surged by way of just about 20%, reflecting higher liquidity and buying and selling momentum.

On the other hand, the spike in change inflows, up by way of 25%, raises considerations about doable profit-taking conduct.

Supply: IntoTheBlock

Supply: IntoTheBlock

Traditionally, such influx spikes sign that traders is also positioning belongings for sell-offs, in particular when paired with emerging task.

This trend aligns with earlier marketplace tops, the place higher engagement coincided with non permanent corrections.

Supply: Santiment

Supply: Santiment

The knowledge highlights a mild steadiness — whilst robust participation and buying and selling volumes sign optimism, inflows counsel warning. If inflows maintain, look ahead to doable downward drive.

Whether or not the marketplace consolidates or faces a correction depends upon the approaching classes’ worth resilience and broader sentiment shifts.

Marketplace sentiment and the trail ahead

Contemporary knowledge unearths a shift in sentiment as Ethereum approaches pivotal ranges. The surge in new addresses is counterbalanced by way of emerging change inflows, signaling that traders is also capitalizing on features.

Learn Ethereum’s [ETH] Worth Prediction 2024-25

With worth volatility expanding, a deeper correction may apply if marketplace individuals start to go out positions at those increased ranges.

As Ethereum faces key technical resistance, figuring out whether or not this surge is a sustainable rally or a last push ahead of a bigger retreat can be crucial for gauging marketplace balance.

:max_bytes(150000):strip_icc()/GettyImages-2207954605-cacf07fd067a4c8d8b234f534f0e554c.jpg)