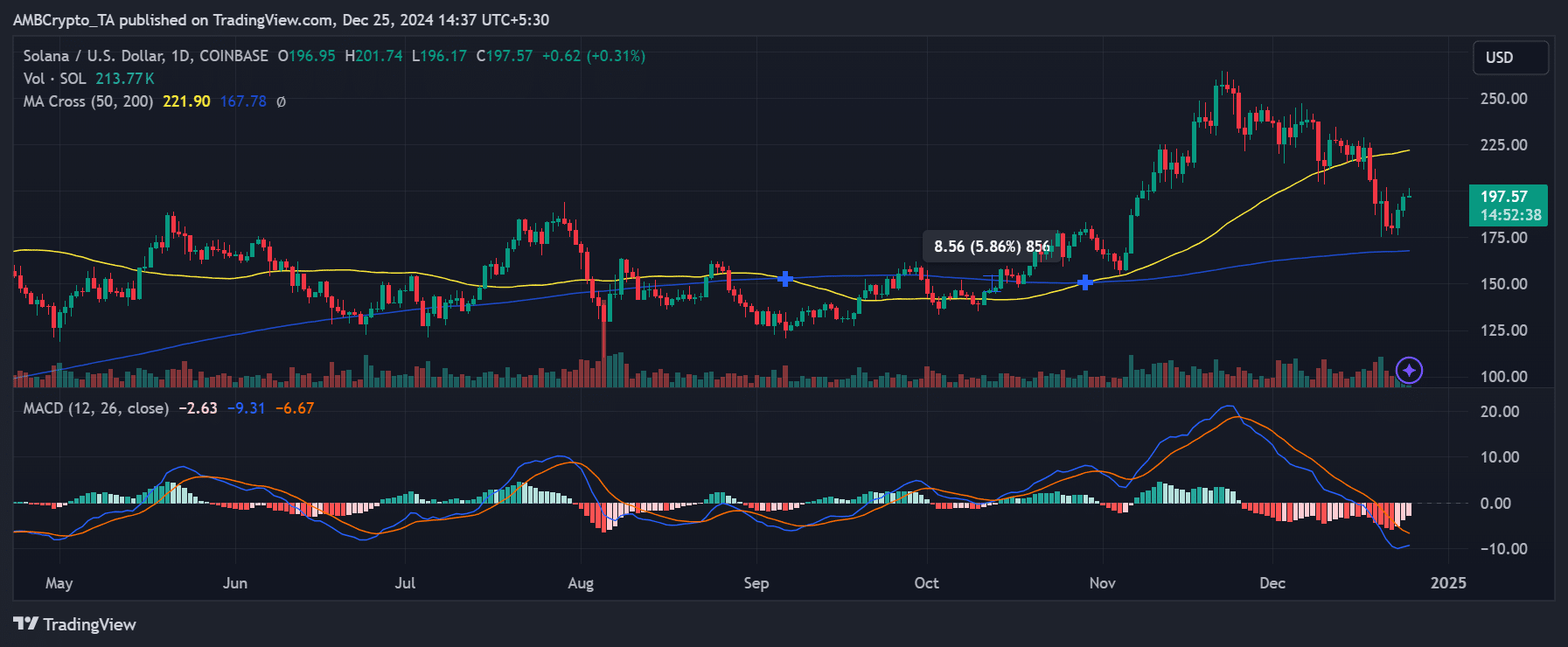

The on-chain metrics confirmed bulls have been keen to head lengthy.

The age fed on metric signaled warning whilst different metrics confirmed.

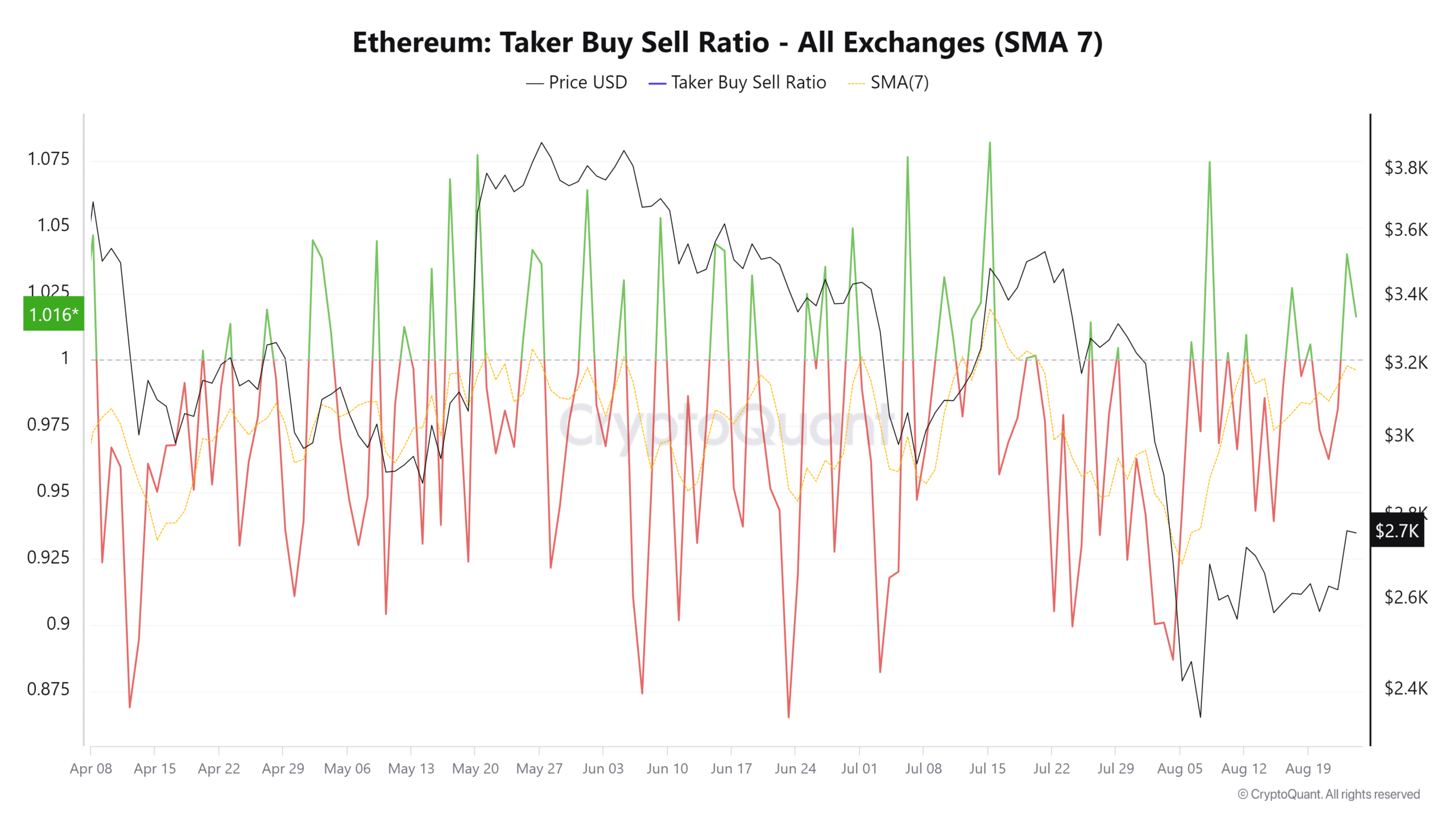

The taker purchase/promote ratio shot skyward for Ethereum [ETH] over the last couple of days. This metric tracks the taker purchase quantity to promote quantity ratio. Values beneath 1 point out bearish sentiment.

Supply: CryptoQuant

Supply: CryptoQuant

Taker refers back to the nature of the order positioned, being a marketplace order somewhat than a prohibit order. This implies those buyers are keen to pay a slight top class to execute the industry at marketplace costs. Therefore, this ratio is helping gauge sentiment.

Ethereum on methods to restoration

At the thirty first of July, Ethereum was once buying and selling at $3.2k. Because the twentieth of July, the taker purchase/promote ratio has been destructive, appearing bearish sentiment was once dominant. After the unload at the fifth of August, the marketplace soar inspired lengthy positions.

The metric’s spikes at the eighth of August and at the twenty third of August, whilst bullish, will not be indicative of a sustained restoration.

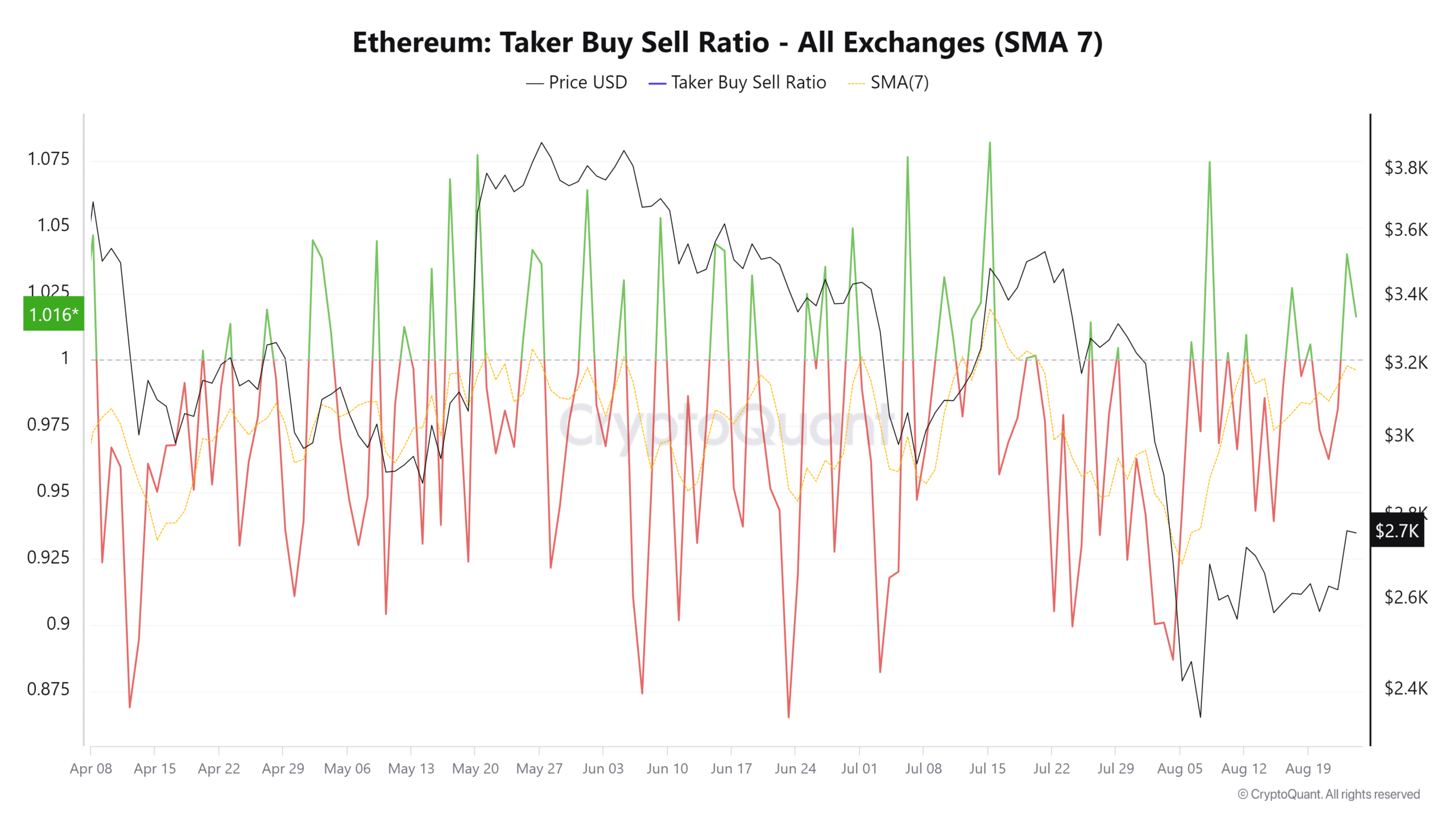

Supply: CryptoQuant

Supply: CryptoQuant

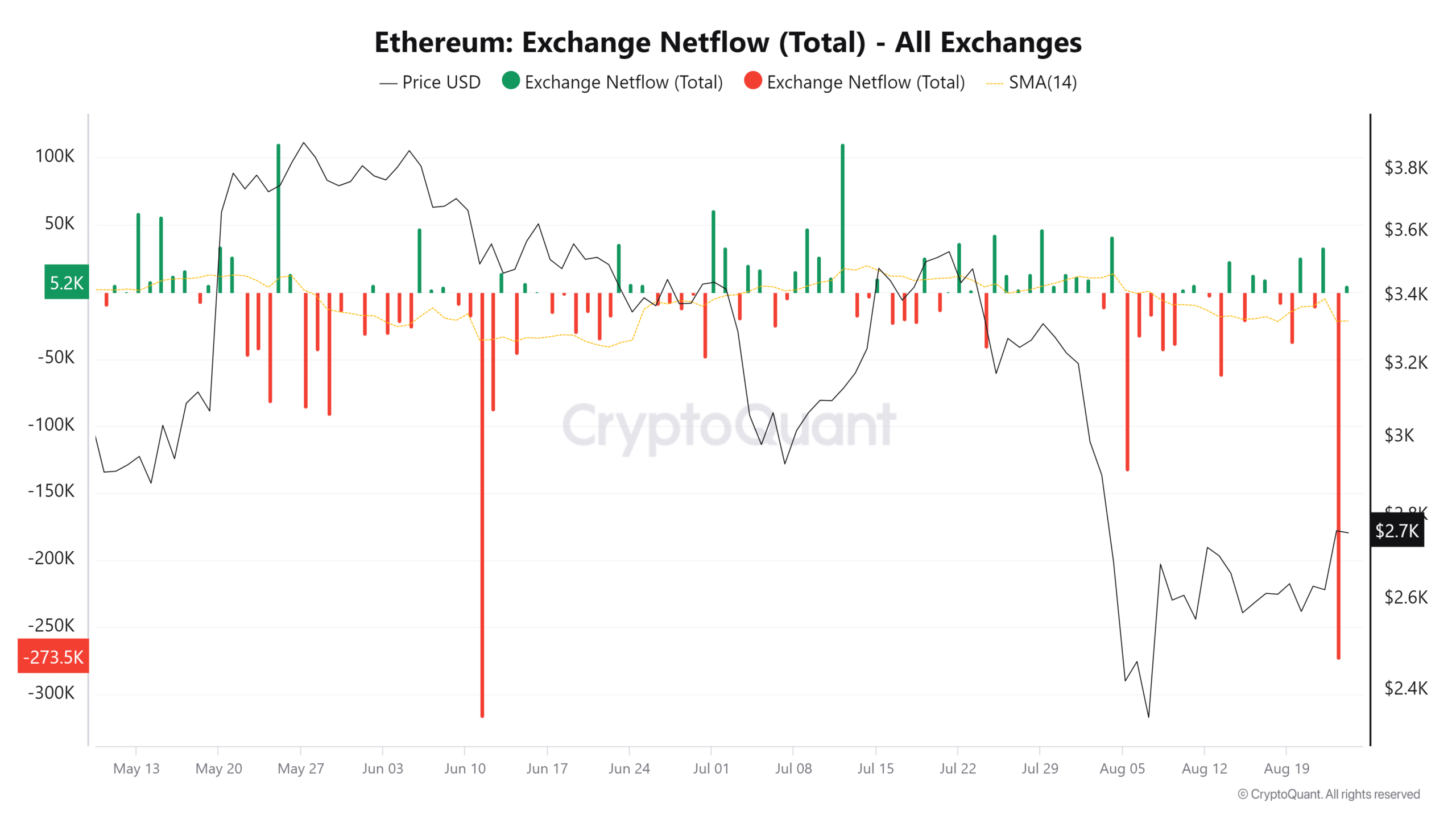

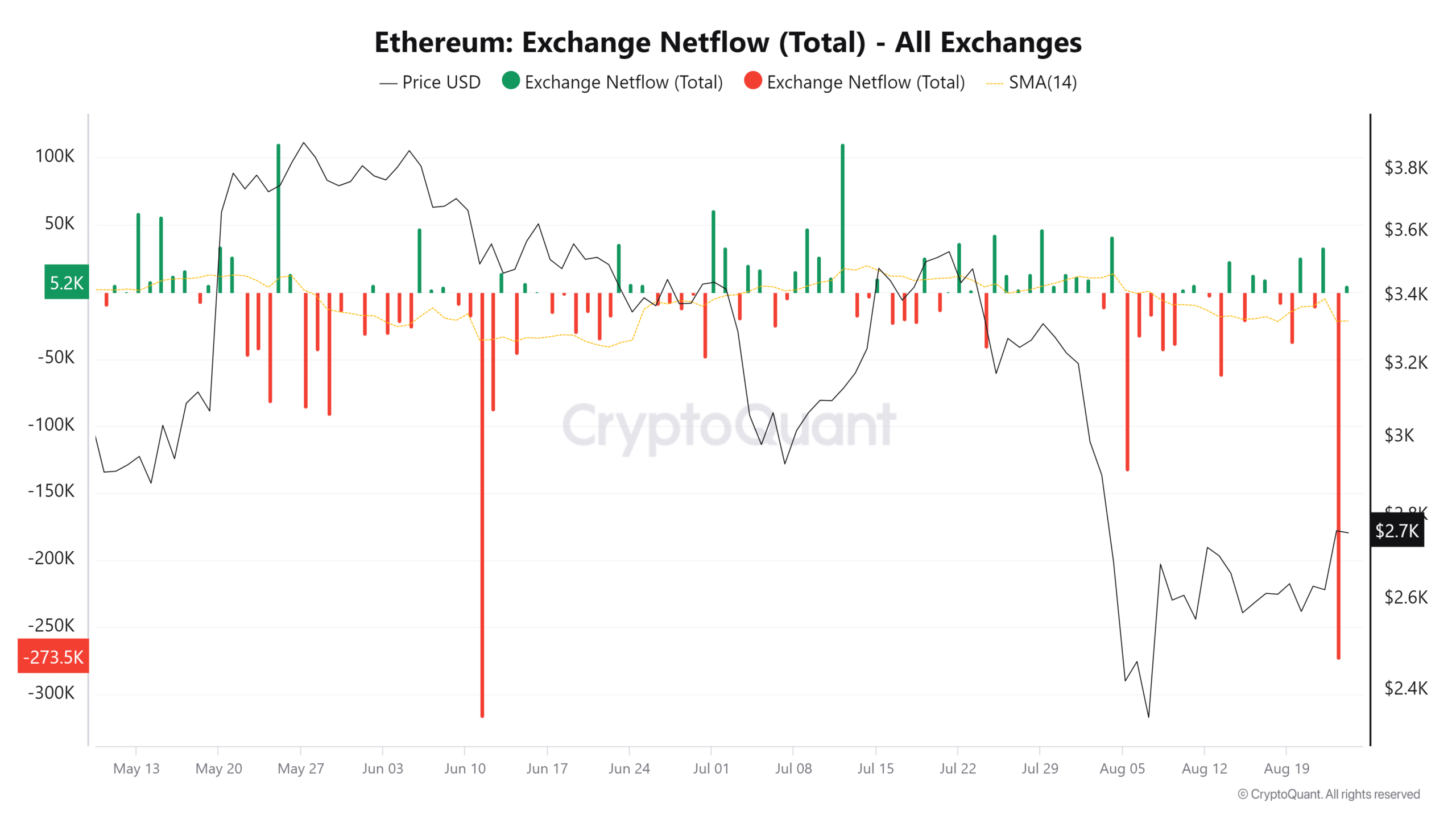

The float of Ethereum from exchanges may shed extra gentle in this. At the twenty third, there was once an enormous outflow of ETH that indicated accumulation. The 14-day easy shifting reasonable has resumed the downtrend it was once on after the early August value drop.

This was once an encouraging signal and may push costs towards the $3k resistance zone.

Must buyers wait for a breakout previous $3k?

Supply: Santiment

Supply: Santiment

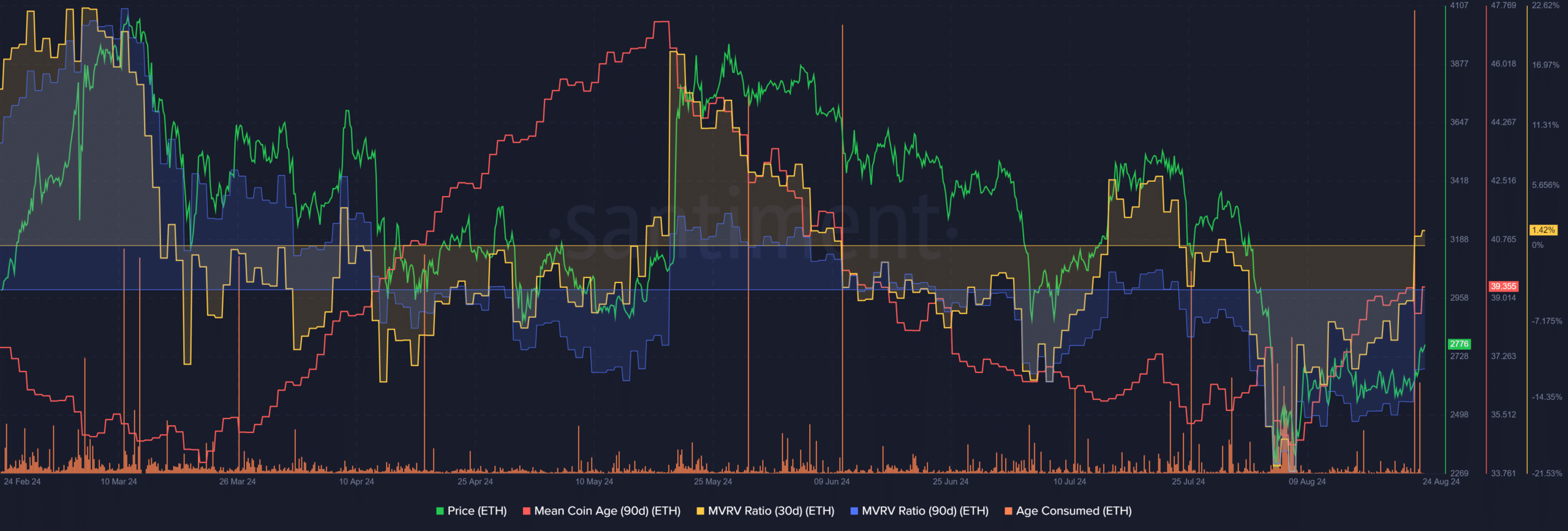

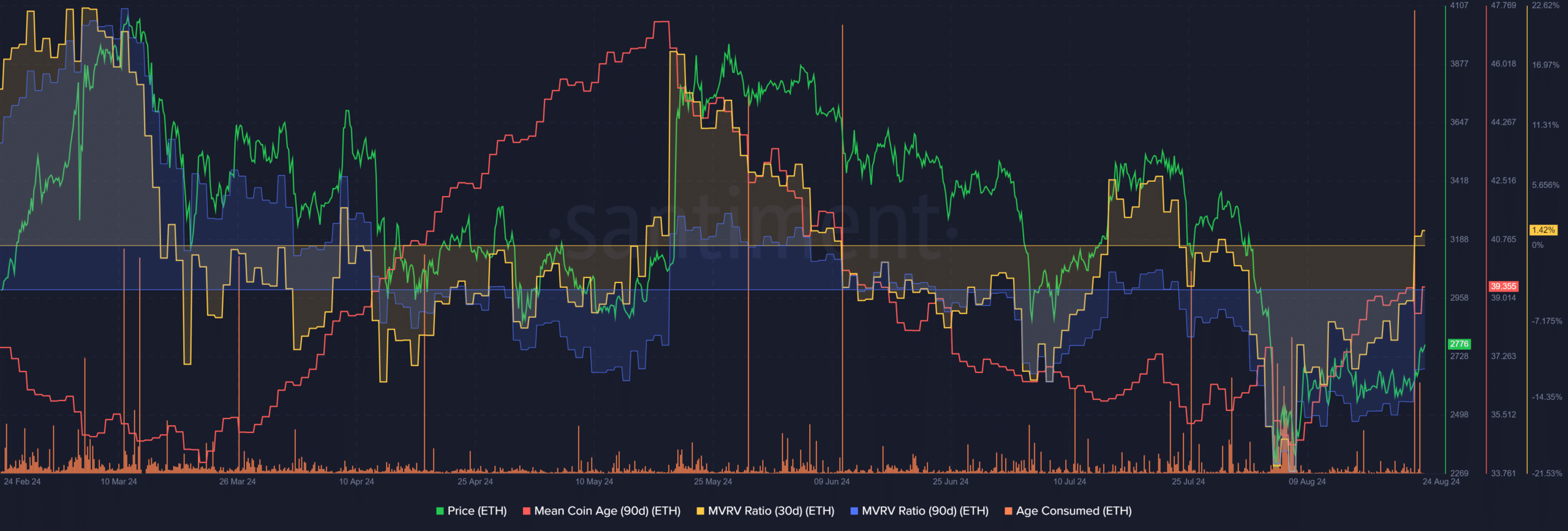

The 30-day MVRV stepped into the sure territory to signify temporary holders at a marginal benefit. The 90-day MVRV was once nonetheless deeply destructive. In the meantime, the imply coin age has trended upper over the last 3 weeks.

This signaled network-wide accumulation, reinforcing the bullish concept from the netflows metric. Then again, the age-consumed metric noticed an enormous spike to turn greater token motion.

Is your portfolio inexperienced? Test the Ethereum Benefit Calculator

The drop within the community gasoline charge intended the ETH provide may flip inflationary through the years, and may negatively affect ETH over the longer term.

Such actions normally sign a wave of promoting. Investors will have to be cautious of promoting drive over the weekend and workout warning right through Monday’s buying and selling consultation.

Subsequent: PEPE nears key stage: What does a 13% building up imply for holders?