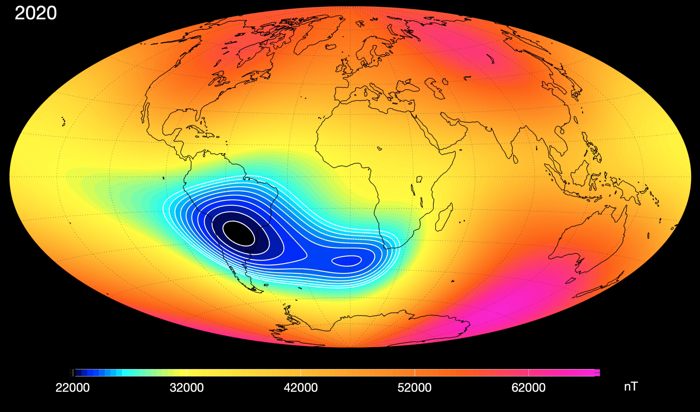

Stablecoin quantity on Ethereum fell to $40 billion, indicating the potential for main the cryptocurrency to a undergo section.

The MVRV Lengthy/Quick Distinction, along holders’ sentiment confirmed that ETH’s worth would possibly build up.

Stablecoin quantity at the Ethereum [ETH] blockchain has dropped from $84 billion to $40 billion, in step with knowledge from CryptoQuant. When the quantity of stablecoins will increase, it implies that call for for tokens on a blockchain would possibly build up.

Additionally, when this occurs, it strengthens the local cryptocurrency of the ecosystem. For Ethereum, the drop in quantity signifies that almost all ERC-20 tokens had been underperforming.

ETH holders don’t consider in bears

ERC-20 tokens discuss with the fungible tokens created the use of the Ethereum blockchain. Traditionally, if the stablecoin quantity plummets to $30 billion, ETH falls right into a undergo marketplace. Subsequently, the chance was once provide.

Supply: CryptoQuant

Supply: CryptoQuant

At press time, ETH’s worth was once $3,517, representing a 4.18% lower within the ultimate seven days. Whilst there were predictions that the fee would revisit $4,000, that has no longer came about in weeks.

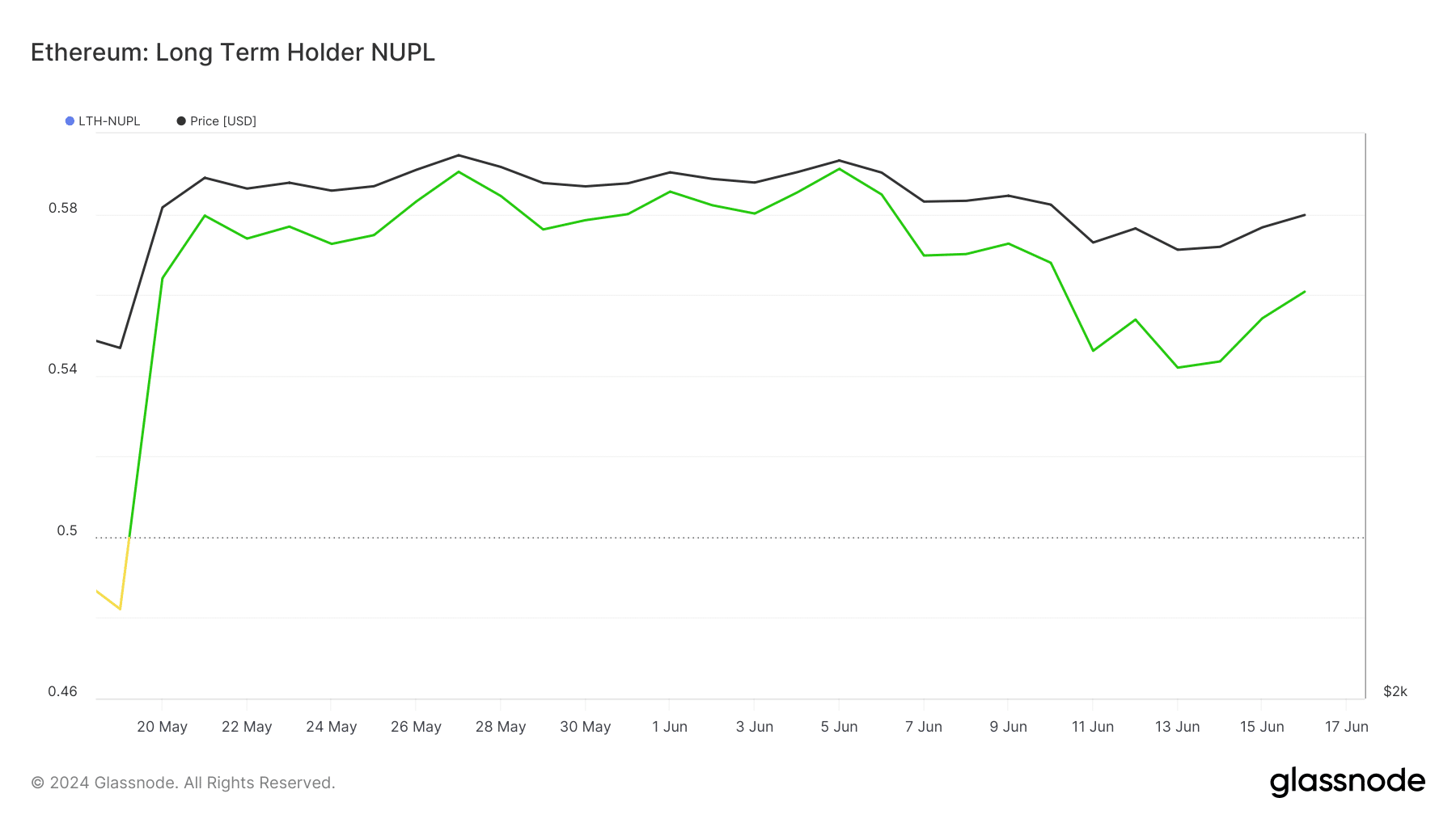

But even so this, AMBCrypto appeared on the LTH-NUPL. LTH-NUPL stands for Lengthy-Time period Holder- Internet Unrealized Benefit/Loss. This metric assess the conduct of long-term holders.

Most often, the metric considers UTXOs with a minimum of a lifespan of 155 days. Consistent with Glassnode, Ethereum’s LTH-NUPL was once within the trust (inexperienced) zone.

This means that holders of the token are satisfied that the fee would possibly build up.

If this conviction stays the similar within the coming weeks, then ETH would possibly no longer fall right into a cycle. As an alternative the cost of the token, subsidized by way of call for, might be having a look at hitting a brand new all-time prime.

Supply: Glassnode

Supply: Glassnode

Will emerging volatility lead the fee upper?

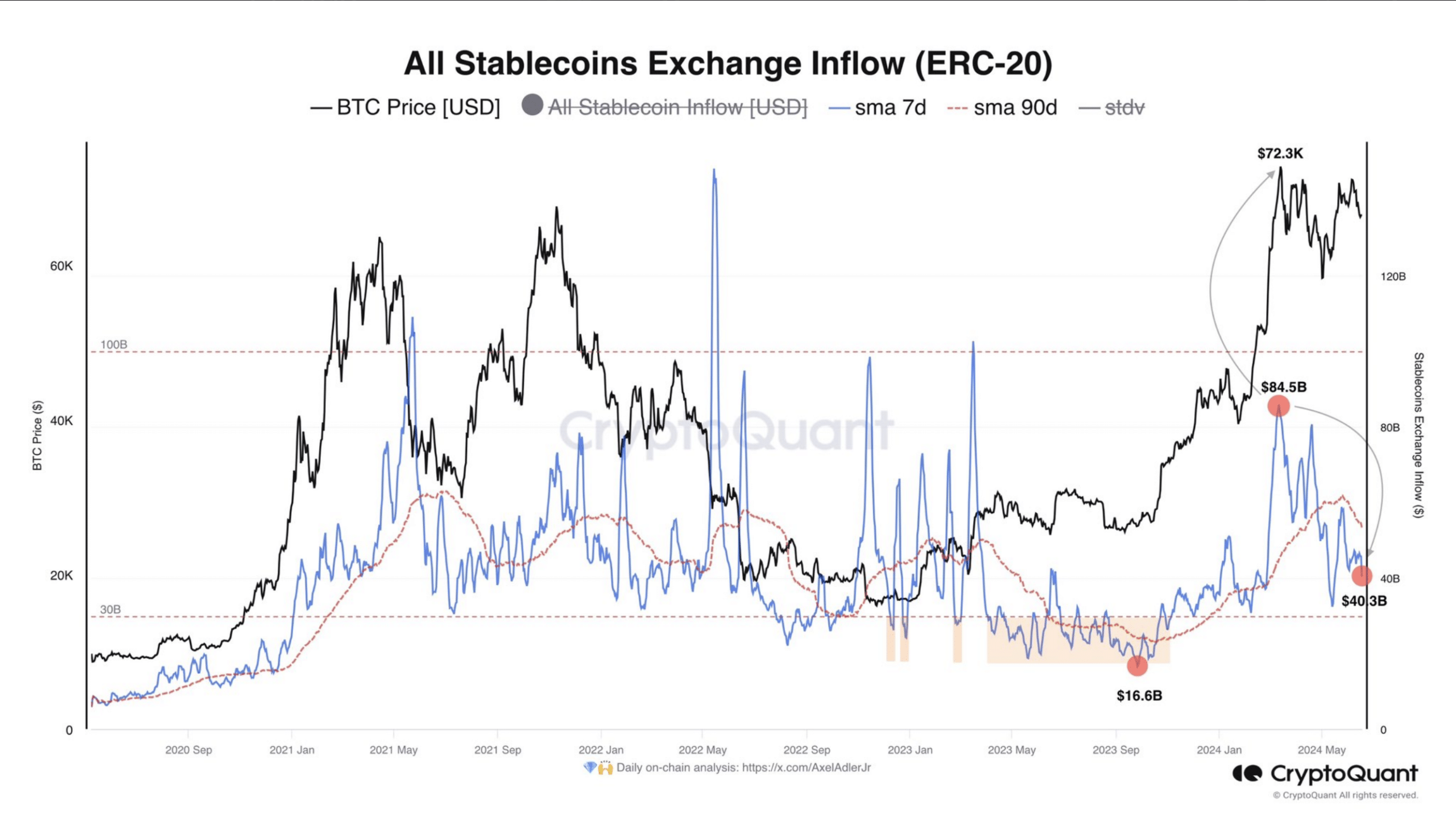

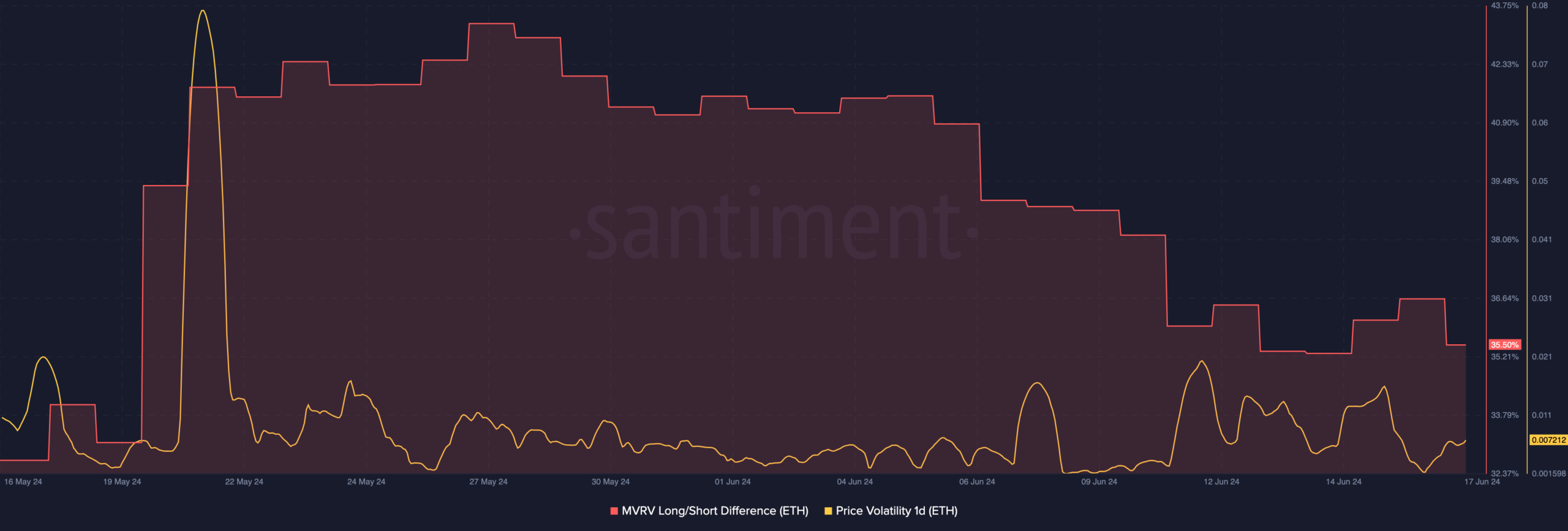

The Marketplace Worth to Discovered Worth (MVRV) Lengthy/Quick Distinction is every other metric that may inform if ETH is in a undergo zone or no longer.

When the studying of the metric falls into the unfavourable area, it implies that a cryptocurrency would possibly have dropped to the undergo marketplace.

However so long as the metric stays sure, the cryptocurrency is in a bull section. At press time, AMBCrypto seen that the MVRV Lengthy/Quick Distinction was once 35.50%.

Whilst this was once a lower from the studying ultimate month, it was once an indication that ETH has no longer succumbed to the undergo zone. Then again, one can not deny that it means that ETH’s worth would possibly fall.

But when it does, the worth of the cryptocurrency is not going to slip under $3,000. If this stays the case, ETH would possibly have a possibility at retesting $4,000 and past.

In the meantime, the one-day volatility has begun to extend. Volatility measures how fast worth can transfer in several instructions. When volatility build up with purchasing power, worth can soar to unbelievable figures.

Supply: Santiment

Supply: Santiment

Learn Ethereum’s [ETH] Worth Prediction 2024-2025

Then again, prime volatility will promoting power results in correction. For ETH, it stays unsure the place the fee would head subsequent.

Then again, one thing gave the impression virtually positive, holders would possibly no longer give in to bearish call for that power the fee less than anticipated.

![2024 noticed OM [Mantra] outperform the remaining, will 2025 be any other? 2024 noticed OM [Mantra] outperform the remaining, will 2025 be any other?](https://ambcrypto.com/wp-content/uploads/2024/12/om-2024.jpeg)