ETH’s shifting averages stay vital resistance ranges.

ETH now hangs on impartial on its RSI.

Ethereum [ETH] skilled a spike previously week, sparking optimism amongst buyers and buyers who believed it might sign the beginning of a much-needed certain pattern.

Then again, this optimism briefly pale as Ethereum’s value tapered off, failing to care for the upward momentum. In consequence, marketplace actions round Ethereum have develop into much less thrilling, with the preliminary enthusiasm giving method to warning.

Ethereum sees muffled value tendencies

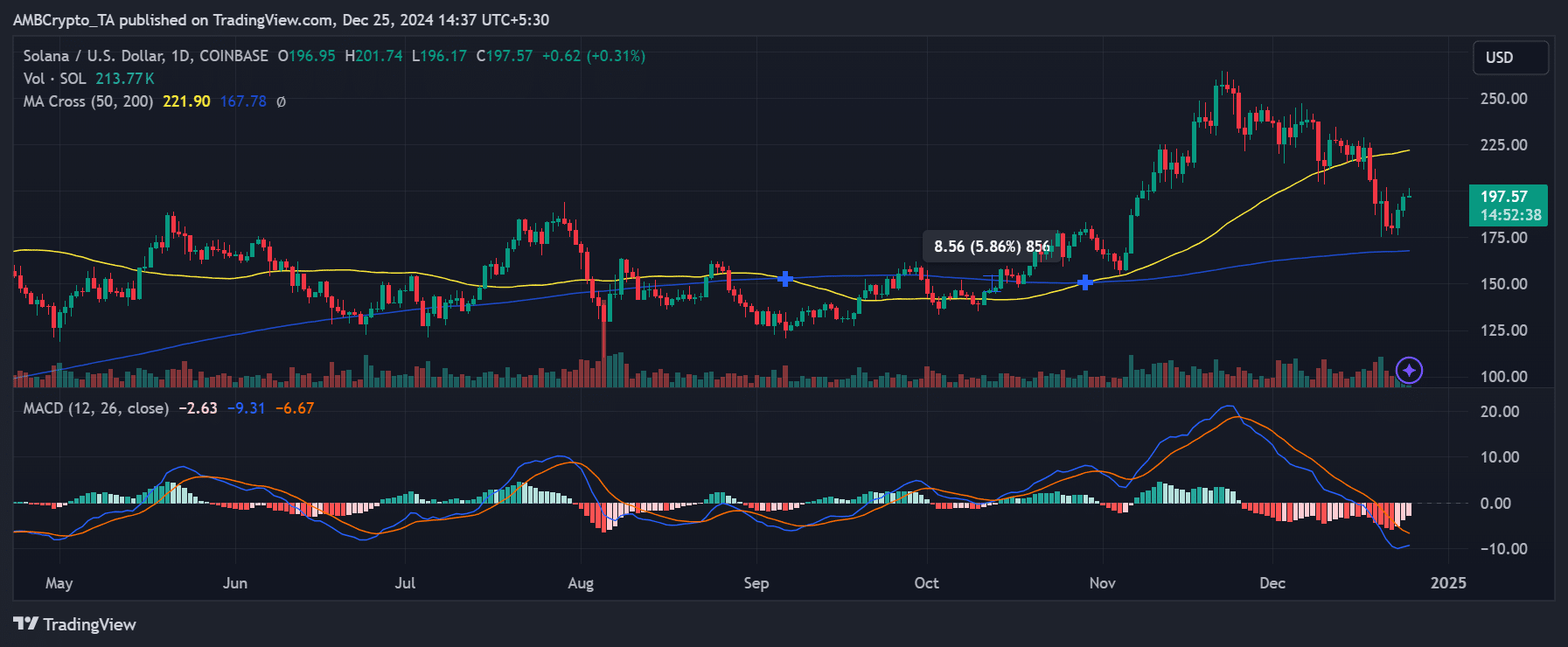

Research of Ethereum’s day by day chart signifies that the asset skilled a quite uneventful pattern till a vital spike on twenty third August. This spike noticed ETH’s value build up through over 5%, emerging from roughly $2,623 to round $2,764.

Supply: TradingView

Supply: TradingView

Then again, the momentum briefly pale, with the next buying and selling consultation turning in just a modest 0.1% build up. As of this writing, Ethereum is buying and selling at round $2,754, reflecting a slight decline of about 0.5%.

The research means that the bullish pattern, sparked through the preliminary spike, has stalled as Ethereum’s value failed to assemble enough momentum to proceed upward.

The Relative Power Index (RSI) research presentations it’s these days soaring round its impartial line, indicating a loss of sturdy directional momentum available in the market.

Moreover, the short-moving moderate (yellow line) stays a vital resistance degree at round $2,900, which Ethereum has but to breach. The long-moving moderate (blue line) is situated as the following vital resistance degree, round $3,200.

For Ethereum to determine a sustained bullish pattern, it could want to conquer those resistance ranges. Till then, the associated fee might proceed to combat to wreck out of its present vary, with the bullish momentum placing within the stability.

Ethereum sees much less liquidation

A up to date research of Ethereum’s liquidation pattern over the last few days signifies that there hasn’t been a vital liquidation pattern for a number of weeks.

The one notable task happened on twenty third August when ETH’s value noticed a 5% build up. That day, liquidations spiked to roughly $50 million, with brief positions in particular affected. Information presentations that brief liquidations accounted for over $34 million.

The quite low quantity of liquidations in contemporary days means that buyers are exercising better warning of their positions, most likely because of the present marketplace uncertainty.

Development stays certain

One certain facet of Ethereum is the continuing favorable marketplace sentiment, as evidenced through its constantly certain investment price. The research presentations that Ethereum’s investment price has remained above 0, indicating that consumers are nonetheless dominant.

Learn Ethereum (ETH) Value Prediction 2024-25

The certain investment price means that lengthy positions proceed to be triumphant, with buyers keen to pay a top rate to care for their lengthy bets on Ethereum.

This dominance of lengthy positions displays self belief amongst marketplace contributors in Ethereum’s attainable for long run value appreciation in spite of the new loss of momentum and the wary conduct noticed in liquidation tendencies.

Subsequent: Vitalik Buterin hails Ethereum for this giant improve, main points right here