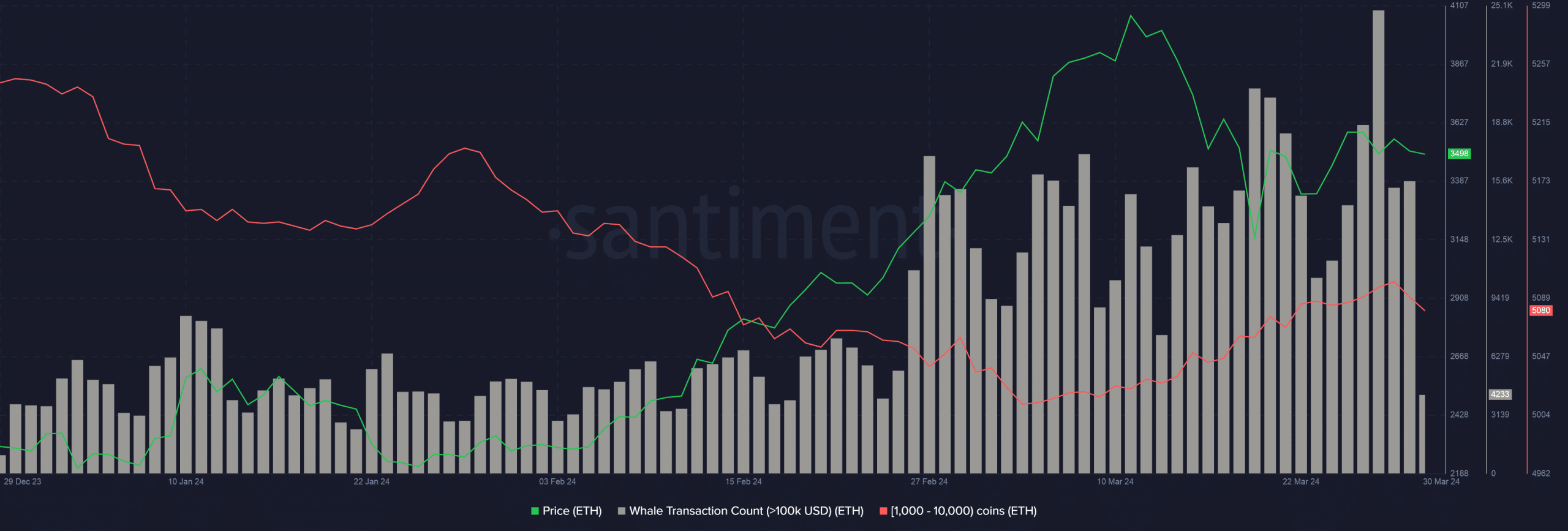

Whale transactions value over $100,000 rose considerably in March.

The optimism might be flowing from CFTC labelling ETH as a commodity.

In spite of essential occasions just like the Dencun Improve, Ethereum [ETH] underperformed in March, with only a marginal building up of 0.79% over the 30-day length. The second one-largest cryptocurrency confronted solid resistance on the $4,000 mark, shedding to $3.500 as of this writing.

However the droop didn’t deter huge traders of the coin, who endured so as to add Ethereum publicity to their portfolios.

Whales believe ETH to head giant

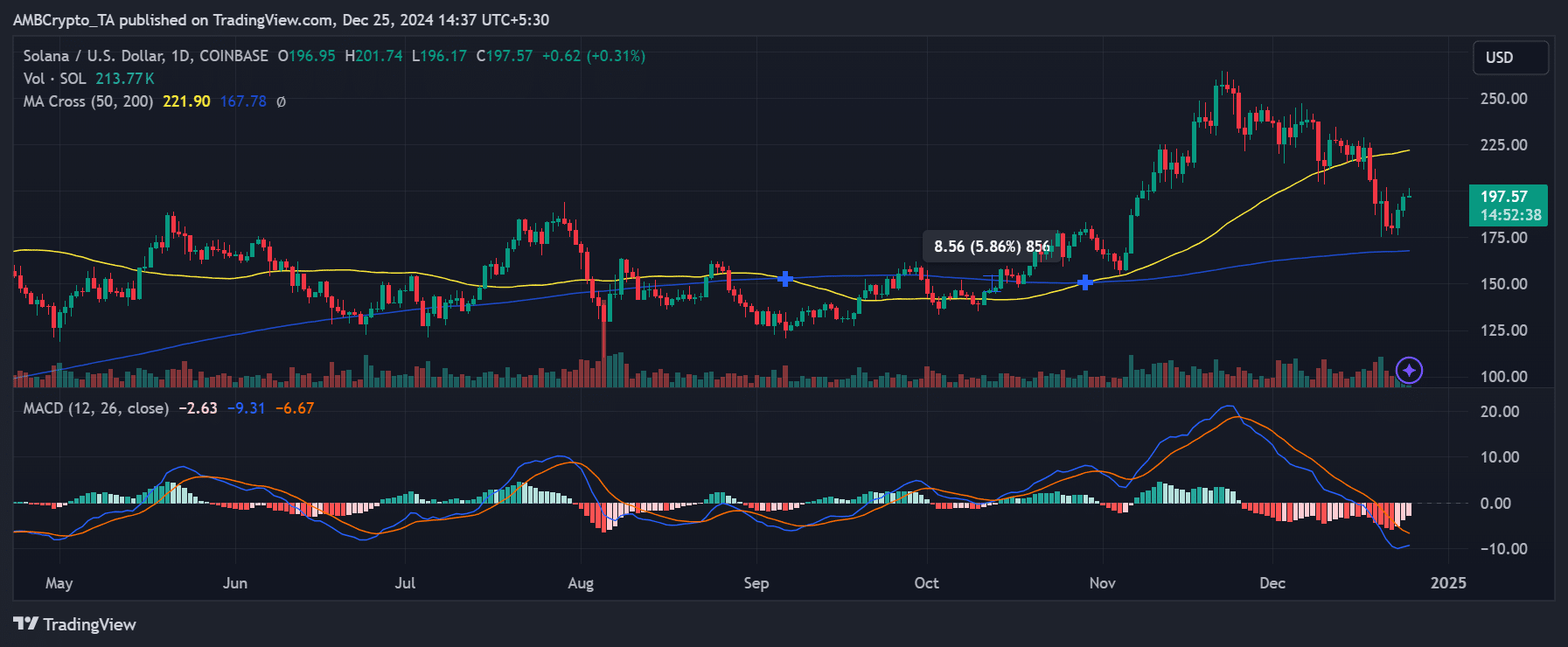

Consistent with AMBCrypto’s research of Santiment’s information, whale transactions value over $100,000 rose considerably during the month. Those transactions led to a pointy building up in small whale wallets which normally dangle between 1,000 – 10,000 cash.

Supply: Santiment

Supply: Santiment

This nature of accumulation is referred to as “purchase the dip.” The method comes to purchasing property right through brief worth drops to get pleasure from possible long run worth will increase.

Pushed by way of analysis and industry acumen, this plan is in most cases followed for fundamentally-strong property with long-term enlargement possible.

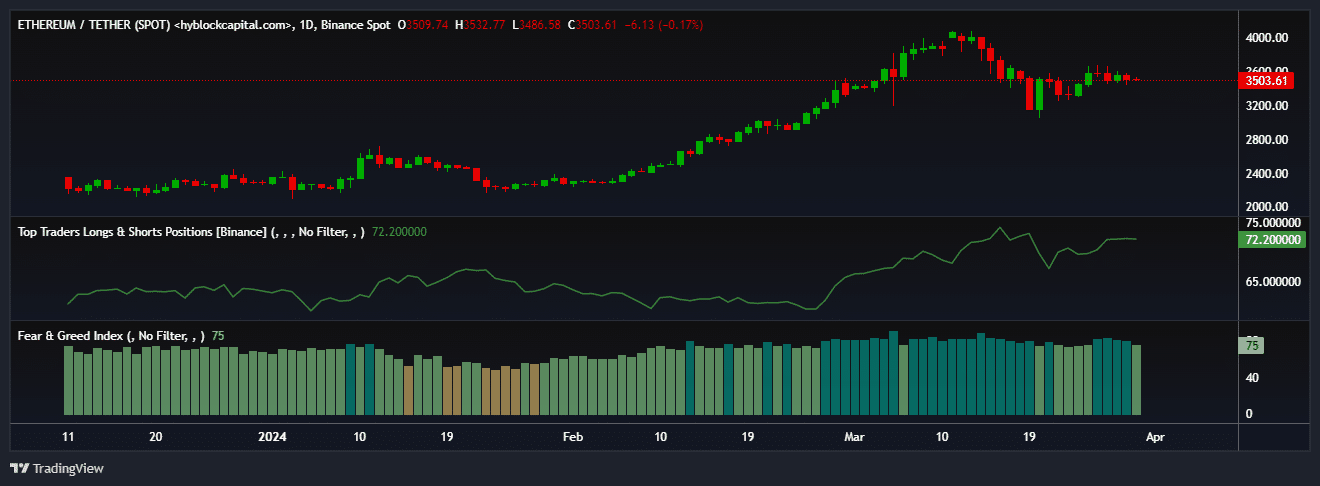

The extent of bullishness was once additionally mirrored within the expanding lengthy publicity within the derivatives markets. As in step with AMBCrypto’s research of Hyblock Capital’s information, about 72% of overall whale positions on crypto trade Binance had been having a bet on ETH to upward push.

Supply: Hyblock Capital

Supply: Hyblock Capital

Whales’ bullish technique perceived to had been picked up by way of the wider marketplace. The overall temper was once considered one of “Greed” as in step with the Concern and Greed Index. Normally, such sentiments result in FOMO, drawing in additional traders and including to the purchasing power.

However what was once motivating whales to be bullish on ETH?

Probabilities of spot ETF approval making improvements to?

In contemporary weeks, numerous pessimism had set in surrounding the approval of Ether spot ETFs. The percentages had been getting decreased because of expanding chance of the U.S. Securities and Alternate Fee (SEC) deeming Ether as a safety.

Is your portfolio inexperienced? Take a look at the ETH Benefit Calculator

On the other hand, U.S. derivatives marketplace regulator, Commodities Futures Buying and selling Fee (CFTC) referred ETH as a commodity within the contemporary KuCoin lawsuit.

This may have rekindled traders’ hopes that an Ether spot ETF would ultimately see the sunshine of day. If licensed, spot ETFs have the prospective to do for ETH what Bitcoin has been witnessing since mid-January.