Whales started to turn large passion in ETH together with retail traders.

The cost of ETH received considerably, and brief positions have been liquidated.

Ethereum [ETH] stagnated for rather a while underneath the $3,200 degree mark, then again, a up to date resurgence in passion has driven ETH previous its earlier worth ranges.

Whales transfer in

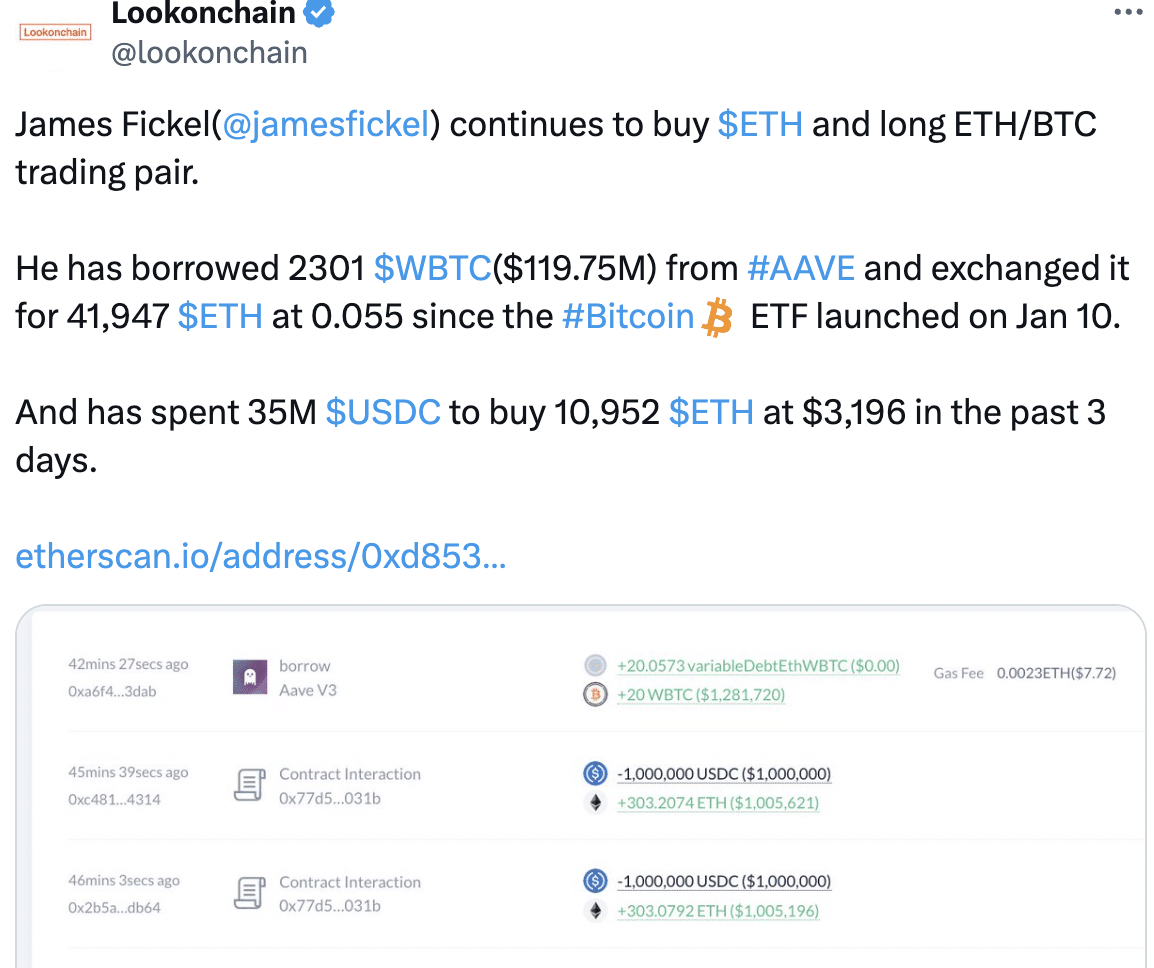

As according to Lookonchain’s knowledge, an important whale continued in buying ETH and getting into lengthy positions within the ETH/BTC buying and selling pair.

The investor borrowed 2301 WBTC (similar to $119.75M) from AAVE and transformed it into 41,947 ETH at a charge of 0.055, following the release of the Bitcoin ETF at the tenth of January.

Inside the remaining 3 days, the whale expended 35 million USDC to obtain 10,952 ETH at $3,196.

An important investor with really extensive capital hanging a large wager on ETH can spice up total self assurance within the cryptocurrency.

This will draw in different traders who may well be at the fence, resulting in a snowball impact of shopping for drive.

Supply: X

Supply: X

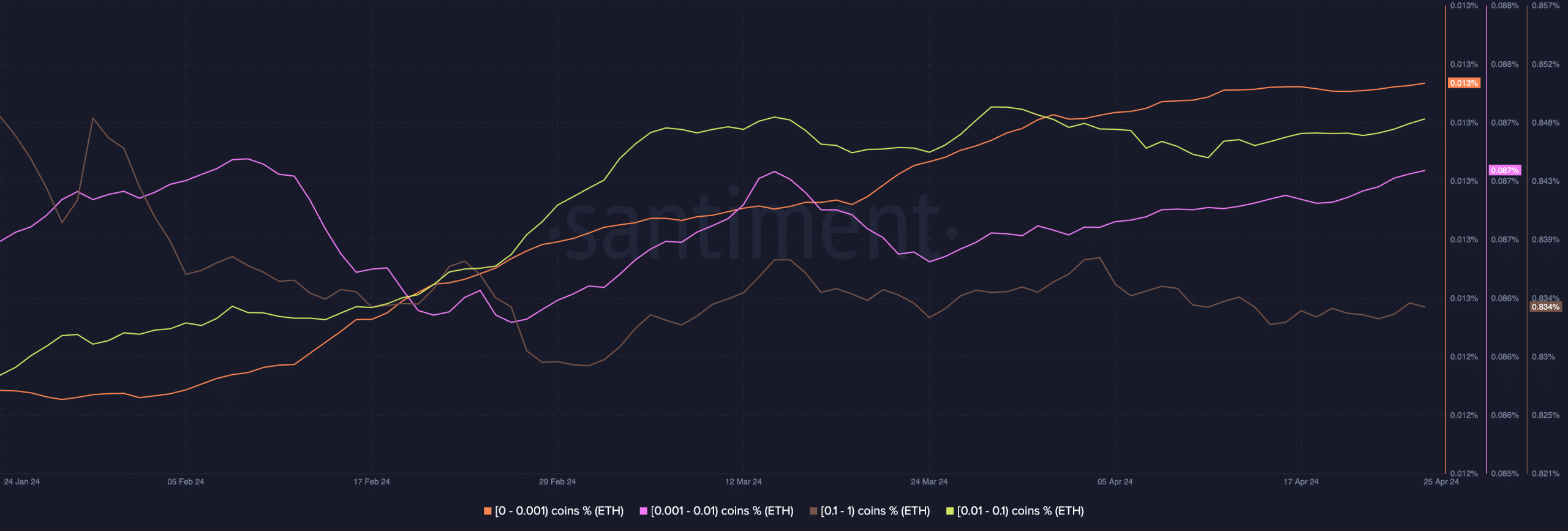

It wasn’t simply whales that have been appearing passion in ETH, retail traders’ call for for Ethereum was once additionally noticed to be rising.

Addresses protecting any place between 0.001 to at least one ETH had began to amass huge quantities of ETH, in line with AMBCrypto’s research of Santiment’s knowledge.

The passion showcased in ETH from each whales and retail traders instructed that sentiment throughout all sectors of the crypto marketplace is moderately bullish round ETH.

Supply: Santiment

Supply: Santiment

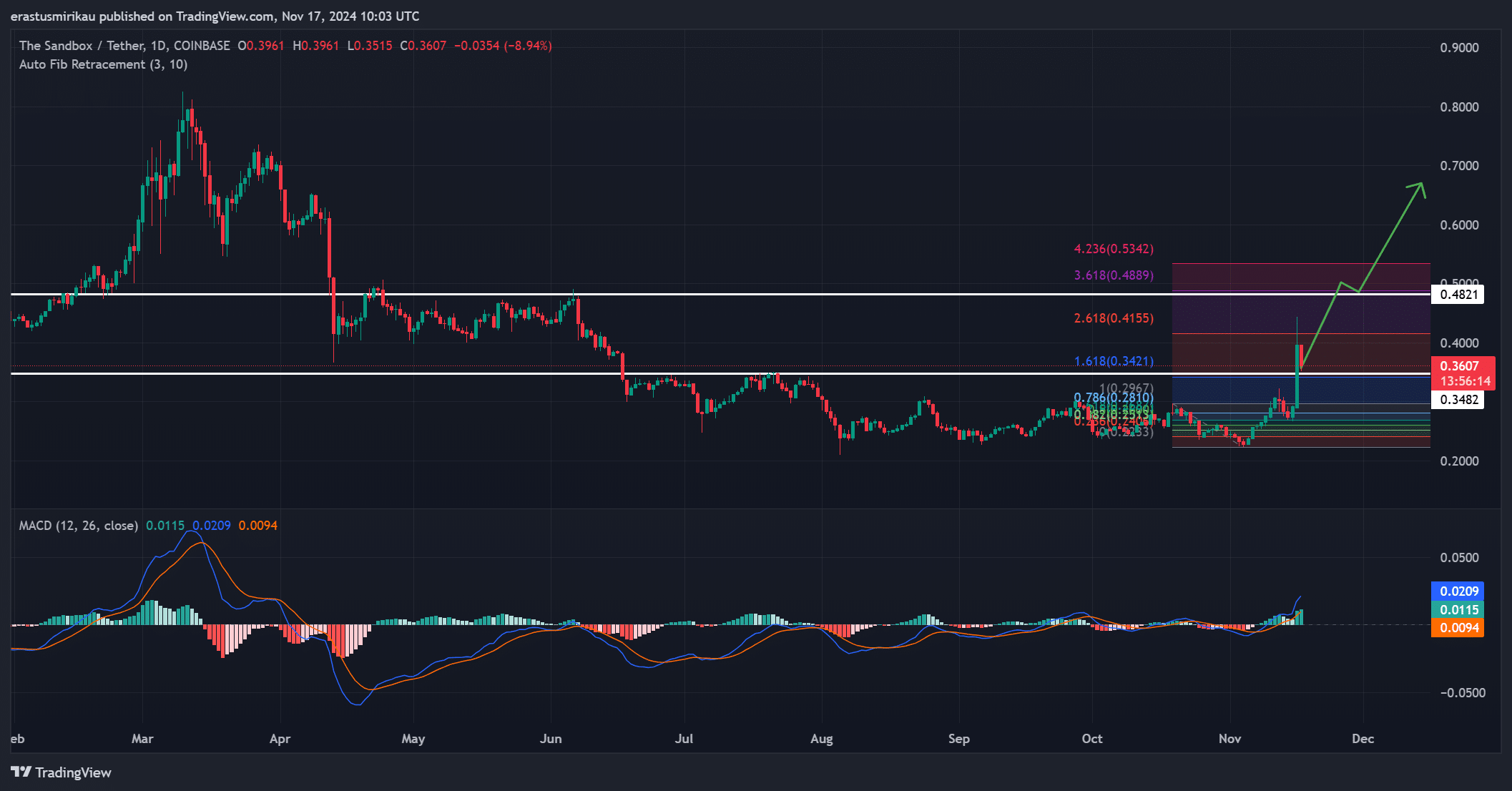

Because of those components, the cost of ETH surged considerably. At press time, ETH was once buying and selling at $3,311.78 and its worth had surged through 6.08% within the remaining 24 hours.

How are holders doing?

This transfer ended in extra bullish hypothesis round ETH ETF’s which added extra momentum to ETH’s rally.

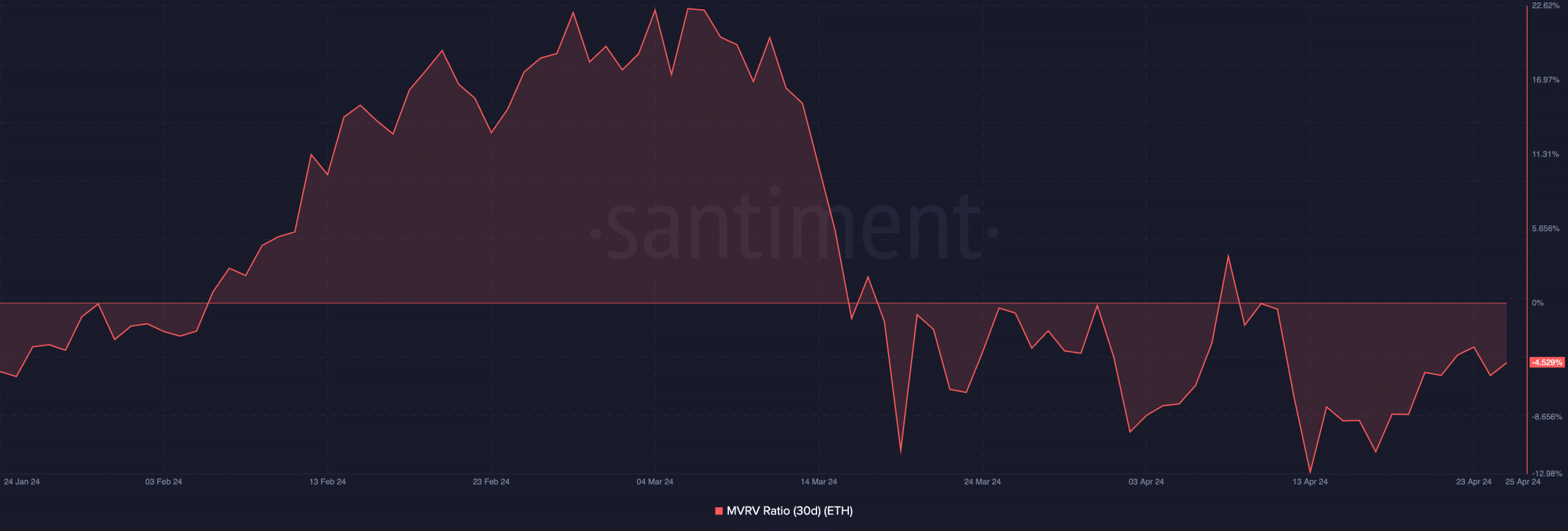

Unusually, in spite of the new surge in worth, the MVRV ratio for ETH remained unfavourable, indicating that almost all holders remained unprofitable.

Learn Ethereum’s [ETH] Value Prediction 2024-25

It may be secure to think that those holders may look ahead to costs to realize additional ahead of indulging in benefit taking.

Supply: Santiment

Supply: Santiment

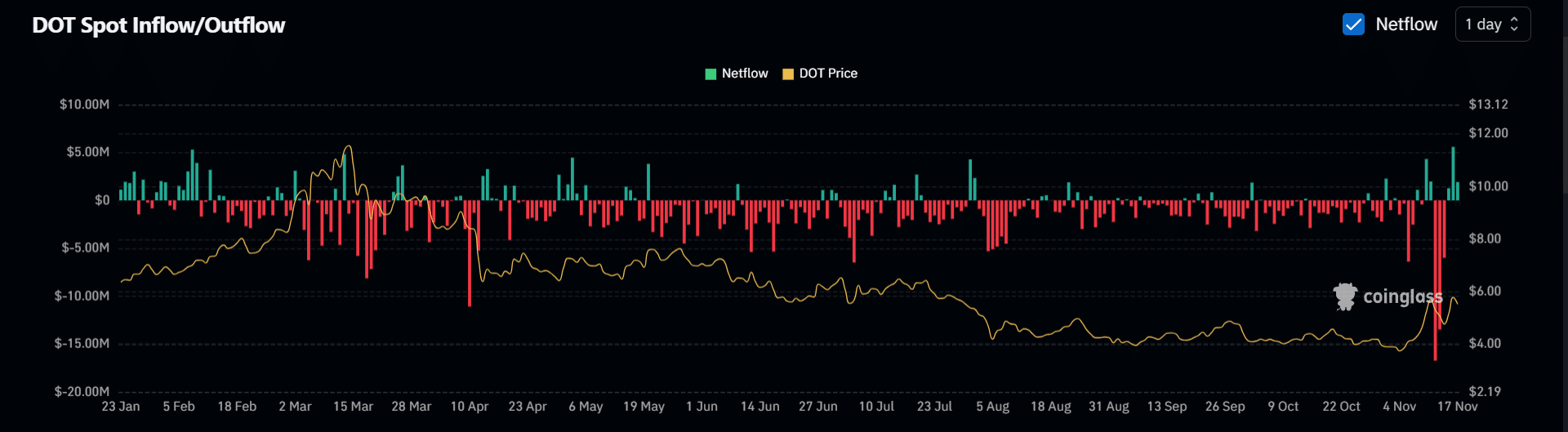

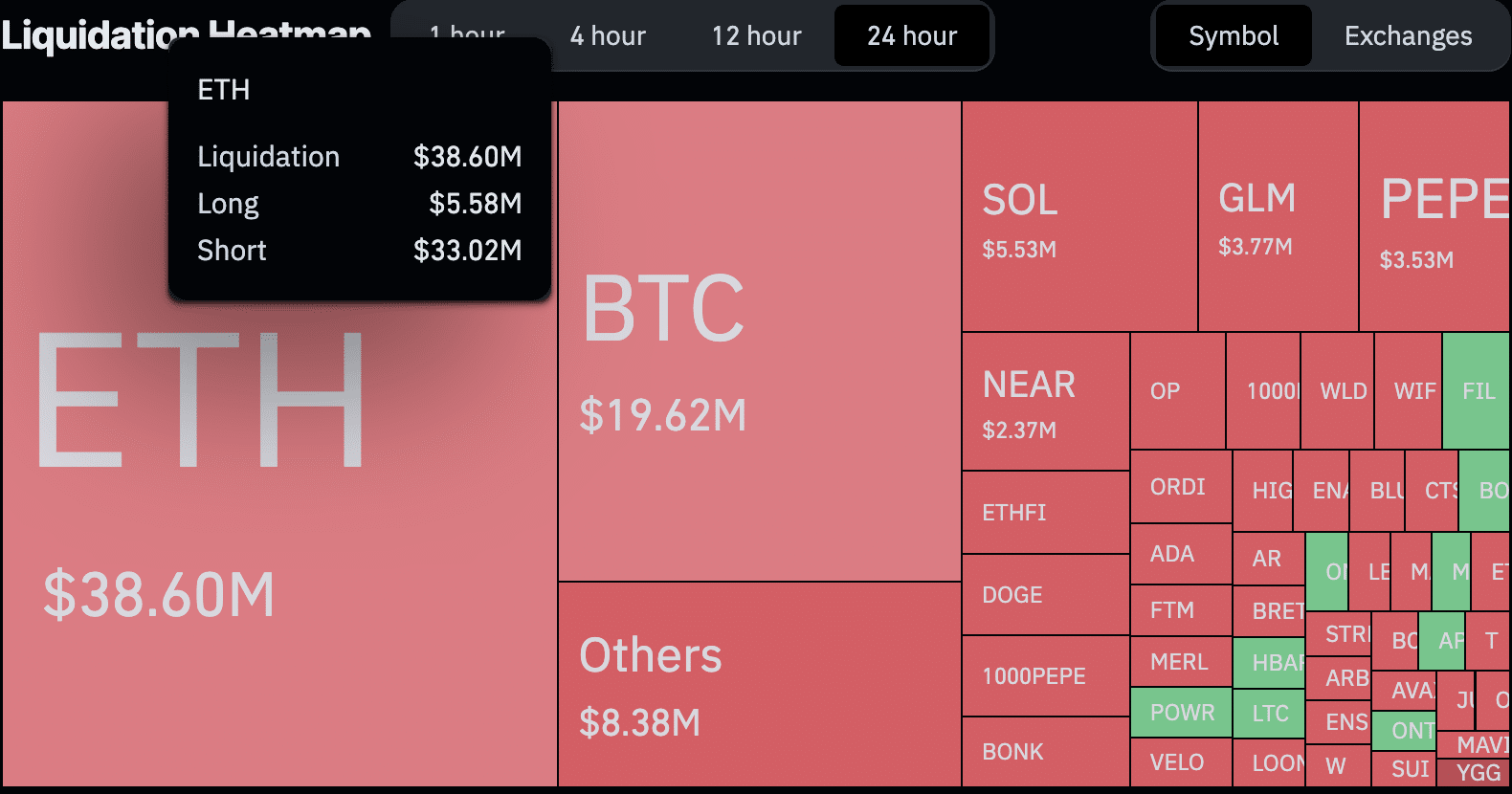

The surprising uptick in ETH’s worth additionally led to a lot of brief positions to get liquidated amounting to $33.02 million.

Supply: Coinglass

Supply: Coinglass