ETH’s value favored via over 5% on 3 Would possibly

This contributed to a hike within the choice of brief positions liquidated

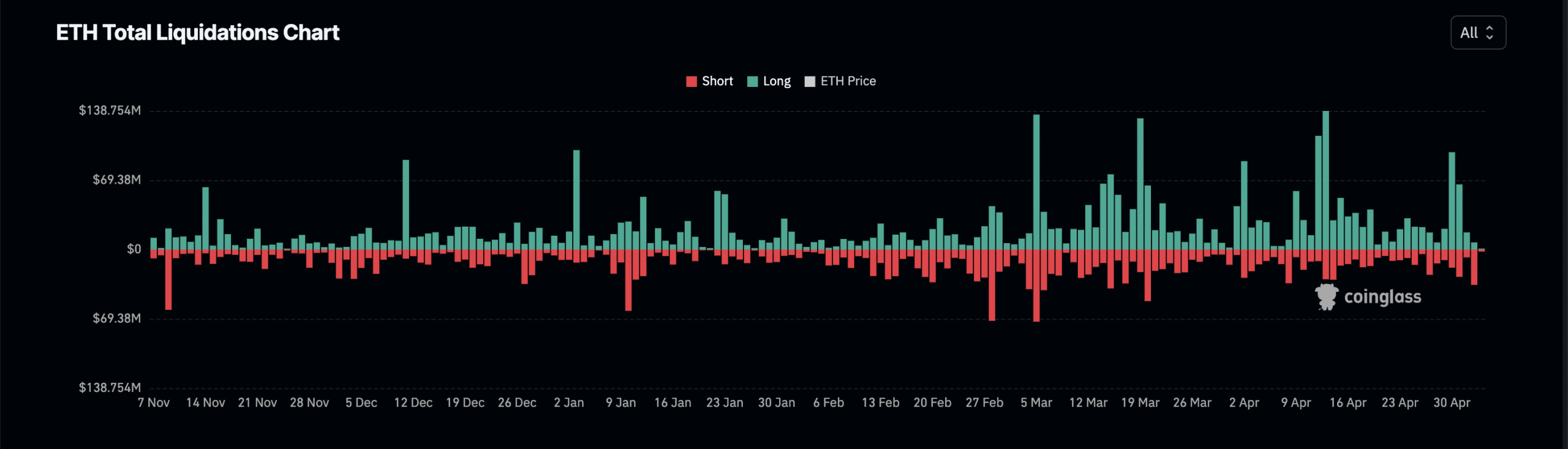

Ethereum’s [ETH] 7% value rally all over the intraday buying and selling consultation on 3 Would possibly led to brief liquidations on its derivatives marketplace to rally to a two-month top, in line with Coinglass.

Actually, the on-chain knowledge supplier went on to expose that on that day, $35 million price of ETH’s brief positions had been liquidated. When put next, lengthy liquidations totalled simply $7.16 million.

Supply: Coinglass

Supply: Coinglass

Liquidations occur in an asset’s derivatives marketplace when a dealer’s place is forcefully closed because of inadequate price range to deal with it. Quick liquidations happen when the price of an asset rises, and buyers who’ve open positions in prefer of a worth decline are pressured to go out their positions.

In line with Santiment’s knowledge, the altcoin closed on 3 Would possibly above $3000 after buying and selling under that value stage for the reason that starting of the month.

Derivatives marketplace buyers keep their palms

Nonetheless extending its beneficial properties at press time, ETH’s value was once up via over 5% within the ultimate 24 hours. On the time of writing, the market-leading altcoin was once valued at $3,104.

Right here, it’s price noting that Coinglass knowledge additionally prompt that the associated fee rally has no longer instigated any vital job in ETH’s derivatives marketplace. Actually, buying and selling quantity in that marketplace grew via simply 2%.

Learn Ethereum’s [ETH] Value Prediction 2024-25

In a similar way, the coin’s Futures open pastime recorded a minor 3% hike over the similar duration. ETH’s Futures open pastime was once $10.68 billion at press time. Moreover, ETH’s Choices quantity cratered via over 50% all over the duration below evaluate.

Choices buying and selling grants contributors the correct to shop for or promote an asset at a specified date. In most cases, when ETH sees a decline in its Choices quantity, it way that there’s much less hypothesis on its long term value actions as marketplace contributors wait to look the place the coin’s marketplace could be heading subsequent.

A mixed studying of the minor hike in ETH’s Futures buying and selling quantity and its declining Choices quantity means that the coin’s derivatives marketplace contributors have followed a “wait and notice” manner. Merely put, they don’t seem to be putting vital bets on the place its value may head subsequent.