ETH has surged by way of 4.36% over the last month.

Ethereum was once experiencing an upward momentum, signaling extra positive factors if $2264 give a boost to holds.

Since hitting a neighborhood low of $2309, Ethereum [ETH] has noticed a powerful upward momentum. Thus, the new positive factors have outweighed the losses to show October inexperienced.

In reality, on the time of writing, Ethereum was once buying and selling at $2525. This marked a 2.44% building up over the last day. Similarly, ETH has surged by way of 4.36% on per thirty days charts with an extension to the bullish development by way of a 1.53% upward push on weekly charts.

Taking a look additional, the altcoin has noticed a surge in buying and selling actions. As such, its buying and selling quantity has greater by way of 35.51% to $12.43 billion.

As anticipated, those marketplace prerequisites have left crypto analysts speaking concerning the altcoin’s trajectory. One in all them is the preferred crypto analyst Guy of Bitcoin who has urged that the present bullish situation is legitimate if ETH holds above $2264.

Marketplace sentiment

Within the research, Guy of Bitcoin posited that ETH is shifting sideways, implying it’s in a consolidation vary.

Supply: X

Supply: X

In keeping with him, the present actions on worth charts display weak spot thus indicating a possible problem.

Due to this fact, the analysts argue that the bullish situation known is best legitimate so long as ETH trades above $2264.

With the altcoin keeping this stage, the use of the Elliot wave research, the possible subsequent transfer is Wave -C of iii at $3096. This signifies that the associated fee vary is inside the 3rd wave which is most powerful and has the possibility of additional positive factors.

On the other hand, if the altcoin fails to carry this stage and stories a breakdown, it’ll suggest that Wave -iv is shifting to the drawback.

What ETH charts say..

Unquestionably, the research equipped by way of Guy of Bitcoin provides a wary long term outlook. On the other hand, it’s crucial to counter-check and resolve what different marketplace signs suggest.

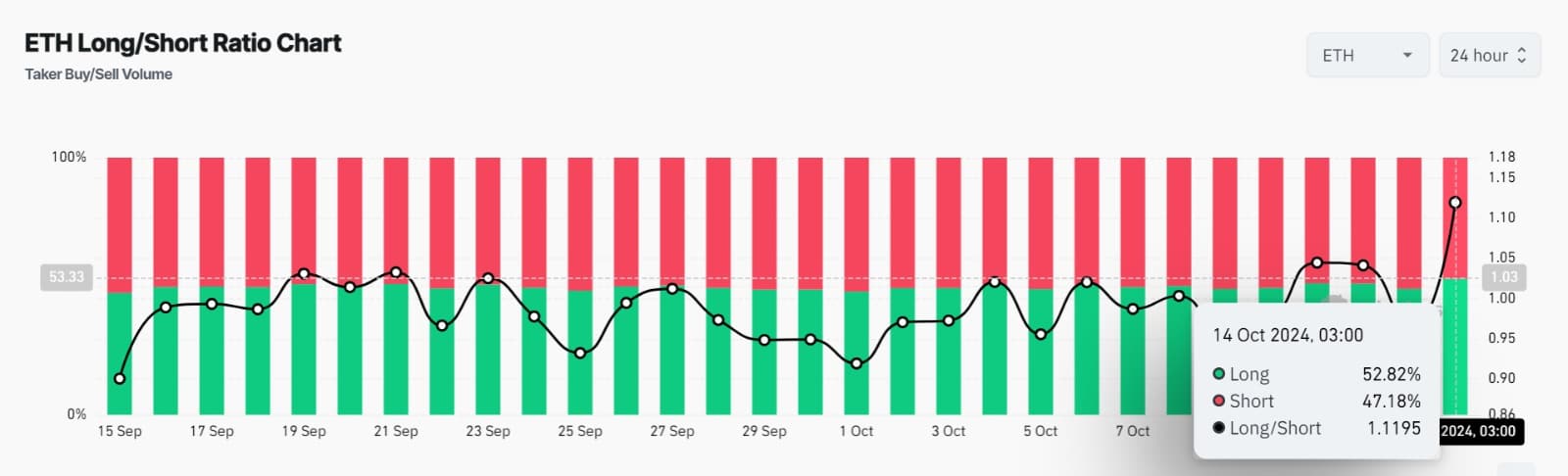

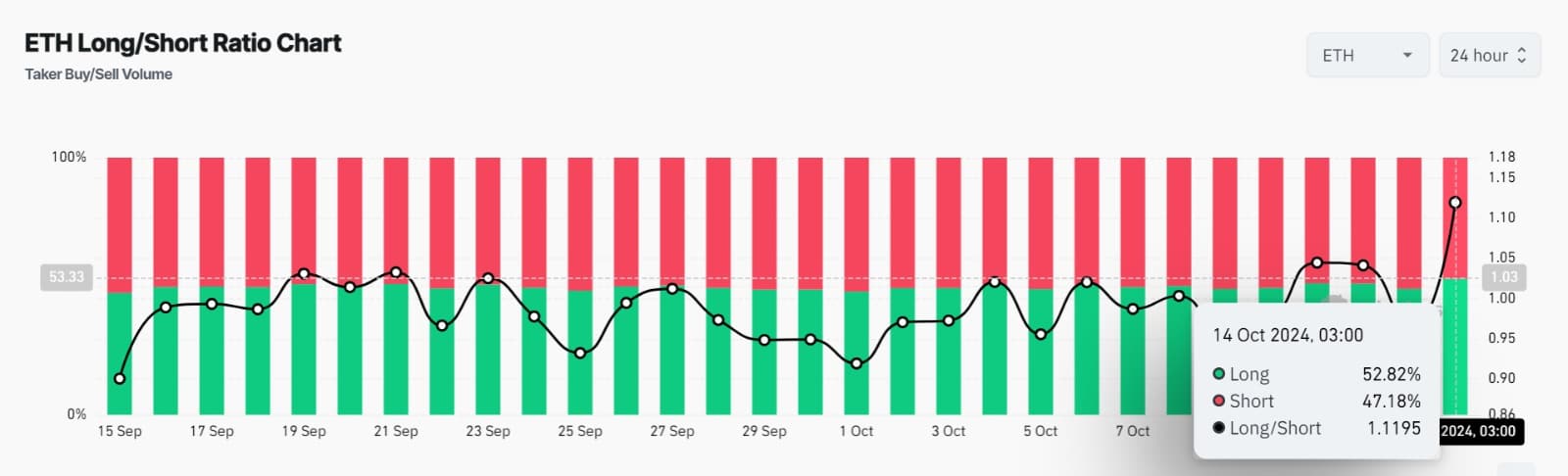

Supply: Coinglass

Supply: Coinglass

For instance, Ethereum’s Lengthy/Brief ratio has remained above over the last 24 hours. At press time, ETH’s lengthy/brief ratio was once 1.1195 signaling greater call for for lengthy positions.

As such, lengthy place holders are dominating the marketplace as they proceed to open new trades.

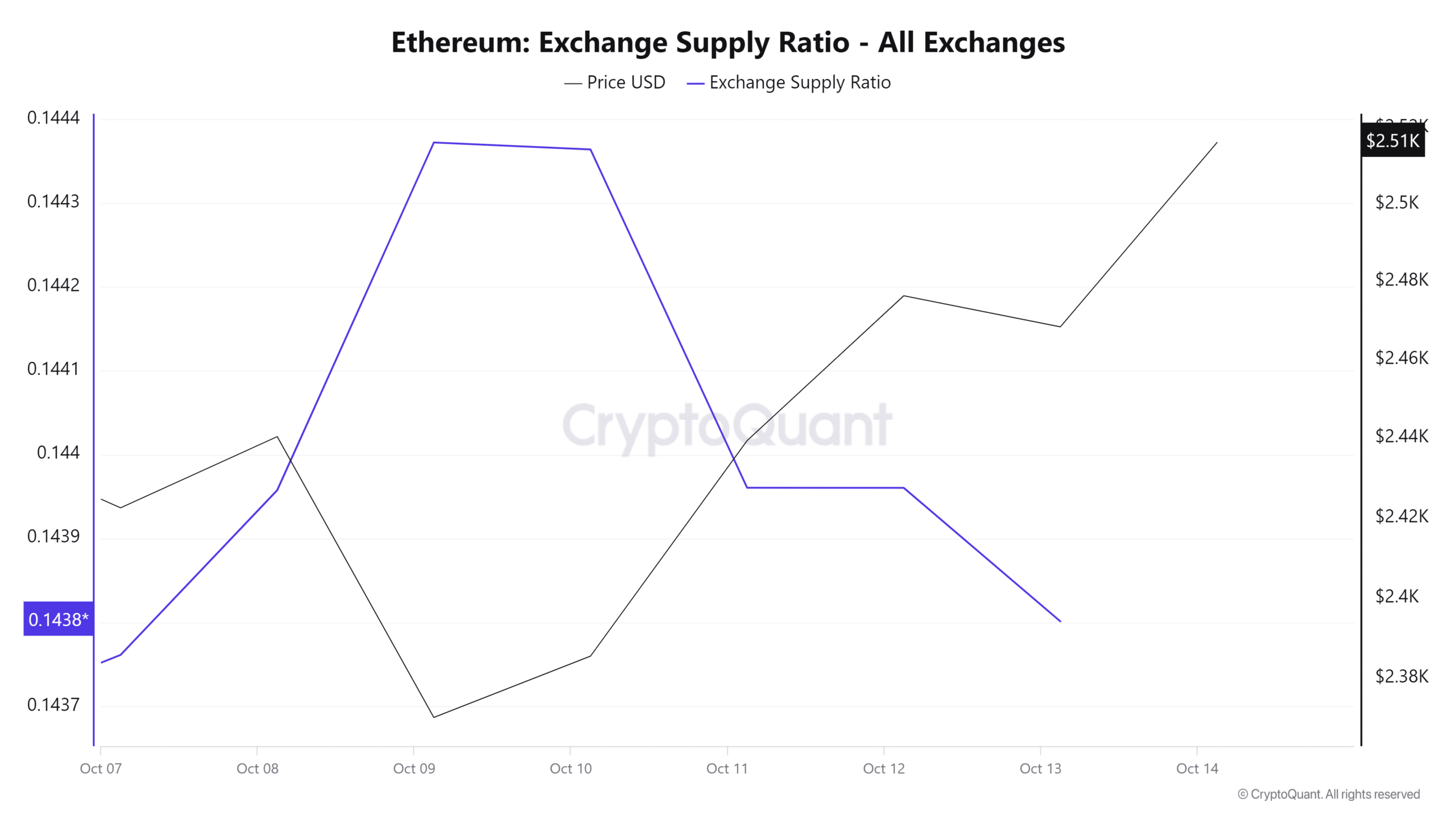

Supply: Cryptoquant

Supply: Cryptoquant

Moreover, Ethereum’s Provide change ratio has skilled a sustained decline over the last 5 days. A declining provide change provide signifies that buyers are opting to carry onto their ETH. This typically reduces tokens in provide leading to to provide squeeze.

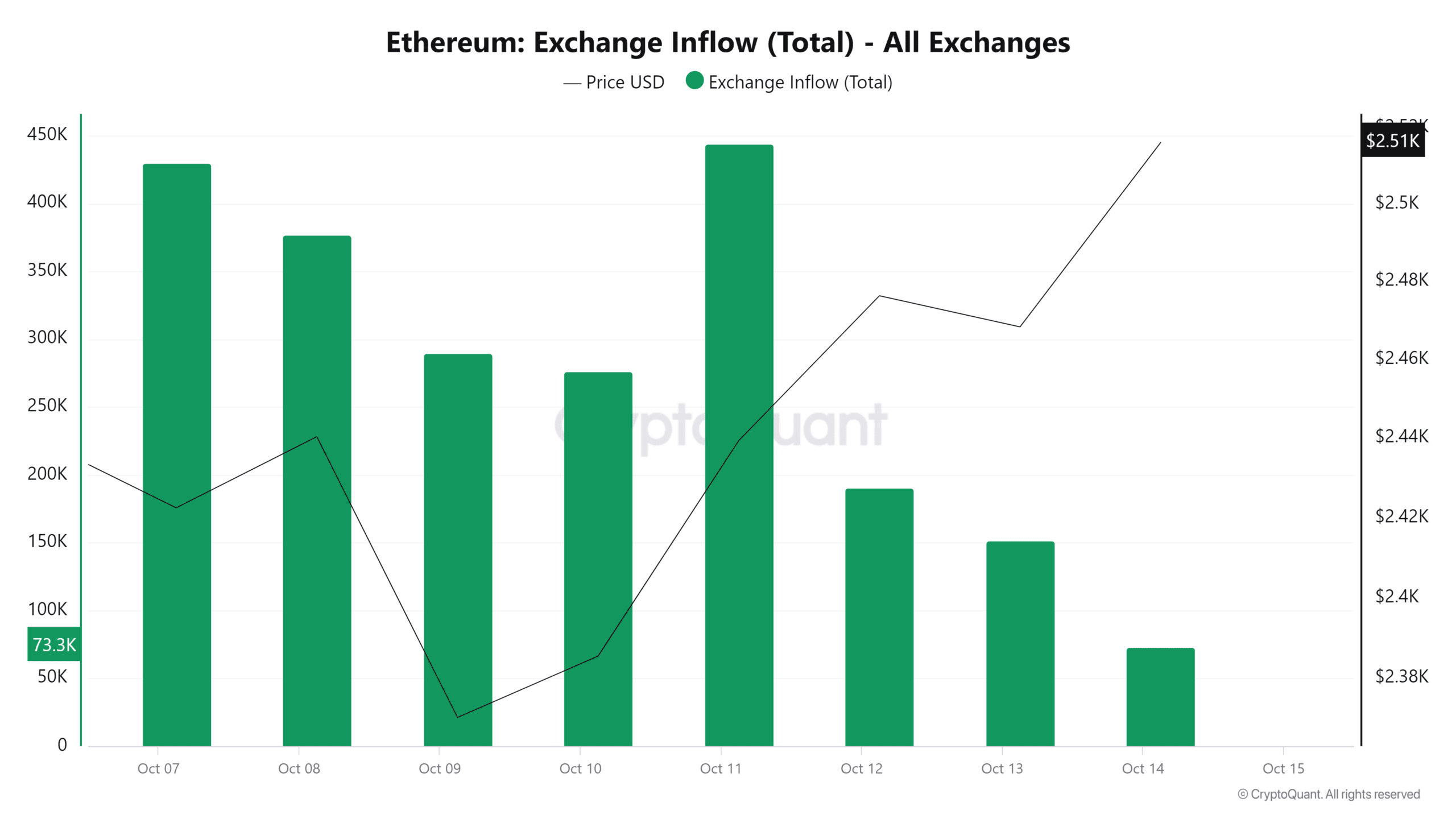

Supply: Cryptoquant

Supply: Cryptoquant

Learn Ethereum’s [ETH] Worth Prediction 2024–2025

After all, ETH change influx has declined for the ultimate 4 days signaling a shift in marketplace sentiment to keeping as illustrated by way of a decline within the provide change ratio.

Merely put, ETH is in a bullish section, and as seen by way of the analyst previous, that is legitimate so long as the $2264 give a boost to holds. Due to this fact, with sure marketplace sentiment and investor favorability, ETH will try a $2727 resistance stage within the brief time period.

Subsequent: Bitcoin mining: Can Russia’s new plant resolve power problems for miners?