Ethereum’s investment price has remained sure in spite of contemporary declines.

The ETH development has additionally remained bullish in spite of the associated fee declines.

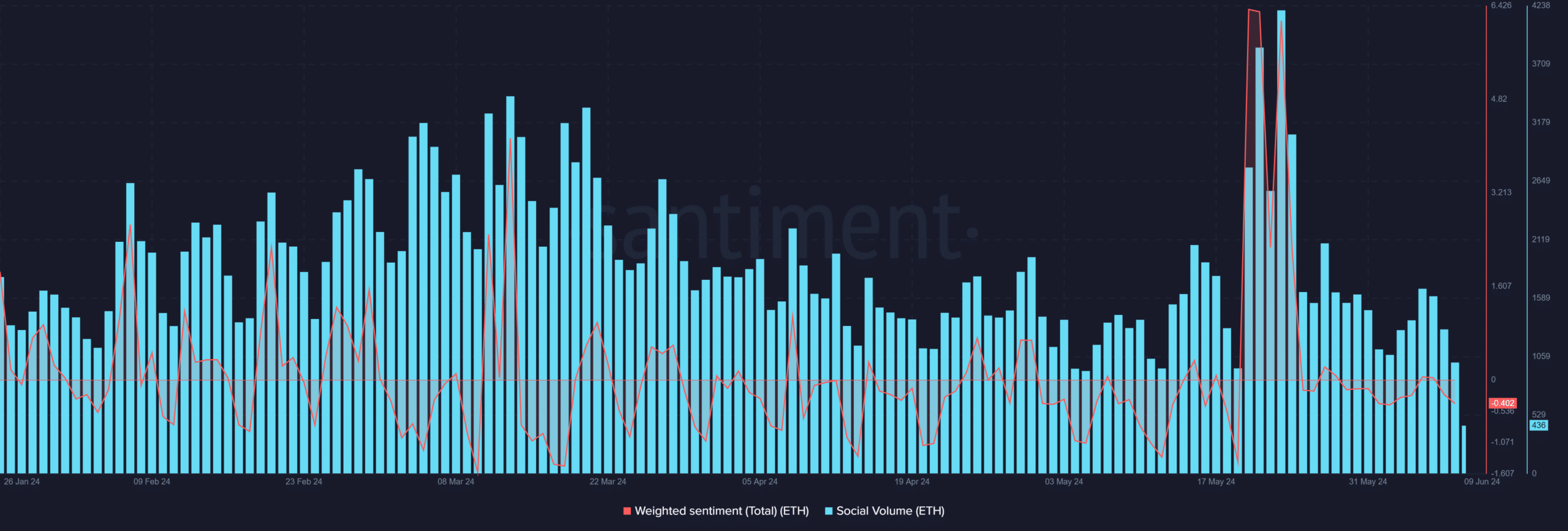

After the scoop of the Ethereum [ETH] spot ETF approval subsided, its weighted sentiment declined as smartly. Regardless of this decline, different metrics counsel that Ethereum could be poised for a favorable run as soon as spot buying and selling resumes.

Ethereum’s sentiment and social quantity declines

An research of the Santiment sentiment chart confirmed a decline in Ethereum’s sentiment. The chart indicated that weighted sentiment spiked to over 6% at the twentieth and twenty first of Would possibly.

It then in short declined to round 2% earlier than spiking over 6% once more on twenty third Would possibly. This spike coincided with the scoop of the ETH spot ETF approval, reflecting heightened dialog and sentiment throughout that duration.

Then again, after that spike, there were declines within the weighted sentiment, which has now became unfavourable. As of this writing, the weighted sentiment is round -0.4.

This means that unfavourable sentiment now outweighs the sure sentiment that Ethereum loved a couple of weeks in the past.

Supply: Santiment

Supply: Santiment

Moreover, an research of the social quantity confirmed spikes comparable to the will increase in weighted sentiment. The chart indicated that social quantity surged to 4,197 throughout the ones classes.

Then again, very similar to the weighted sentiment, it has since declined considerably. As of this writing, the social quantity used to be round 415.

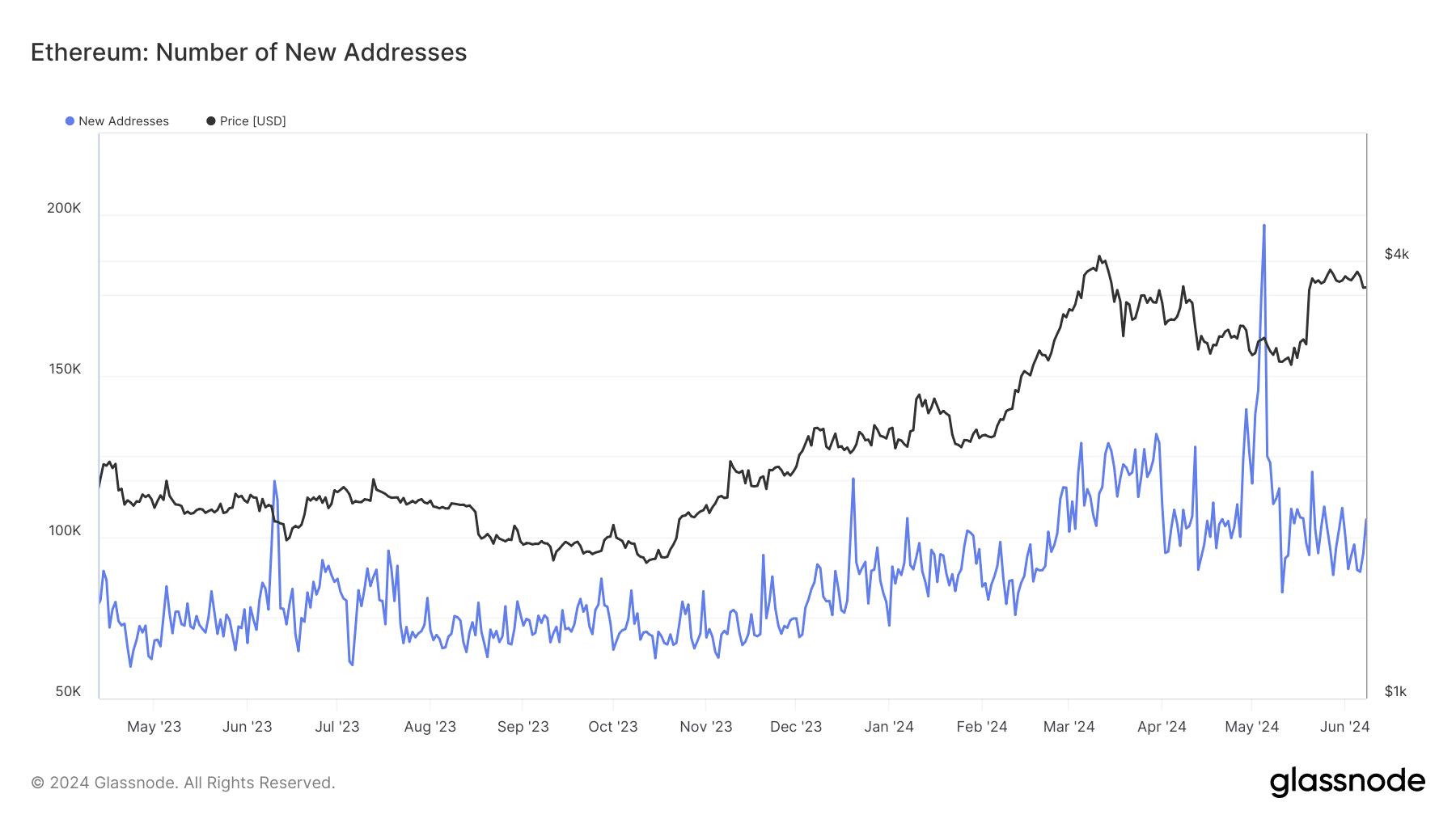

Ethereum’s development of latest addresses proceed

An research of the brand new addresses chart on Glassnode published that new addresses have persevered to drift in in spite of the susceptible sentiment. As of this writing, the selection of new addresses exceeds 105,000.

Supply: Glassnode

Supply: Glassnode

Even supposing there have been declines in the beginning of the month, an uptrend is now obvious. This means that extra addresses are being created even earlier than the spot ETH industry will get underway.

The selection of addresses may additional building up as soon as buying and selling begins.

Ethereum stays sure at the by-product aspect

An research of Ethereum’s weighted investment price on Coinglass confirmed that it has remained sure in spite of contemporary declines.

The chart indicated that the investment price used to be round 0.092% as of this writing. This means that consumers dominate the marketplace, and there’s a robust trust in a long run upward push in Ethereum’s worth.

– Learn Ethereum (ETH) Worth Prediction 2024-25

ETH sees slight will increase

As of this writing, Ethereum used to be buying and selling at round $3,690 after a nil.4% building up. AMBCrypto’s research of its day by day period of time worth development confirmed slight will increase during the last two days.

Those slight will increase adopted an over 3% decline on seventh June, which introduced Ethereum down from the $3,800 worth vary.

Supply: TradingView

Supply: TradingView