Ethereum’s alternate reserve used to be losing, signaling top purchasing force.

On the other hand, the RSI used to be resting within the overbought zone.

Ethereum [ETH] has been suffering to breach the $4k barrier for fairly a while now, as it’s getting rejected close to the resistance.

On the other hand, newest research published that the trail for ETH shifting in opposition to a brand new all-time top is beautiful transparent. Due to this fact, AMBCrypto investigated additional to determine whether or not that’s in truth the case.

Ethereum is heading in the right direction

ETH’s value registered a 7% value hike remaining week, pushing the token’s value close to $4k. On the time of writing, ETH used to be buying and selling at $3.05k with a marketplace capitalization of over $476 billion.

Within the interim, Ali Martinez, a well-liked crypto analyst, posted a tweet revealing that there used to be not anything fighting ETH from achieving new all-time highs. The one modest resistance zone forward used to be round $4,540.

However so long as the $3,560 call for zone holds, the chances prefer the bulls.

Will ETH contact $4.5k quickly?

Since Martinez’s tweet published the potential of ETH touching $4.5k, AMBCrypto assessed the token’s on-chain metrics to seek out the possibility of that taking place within the brief time period.

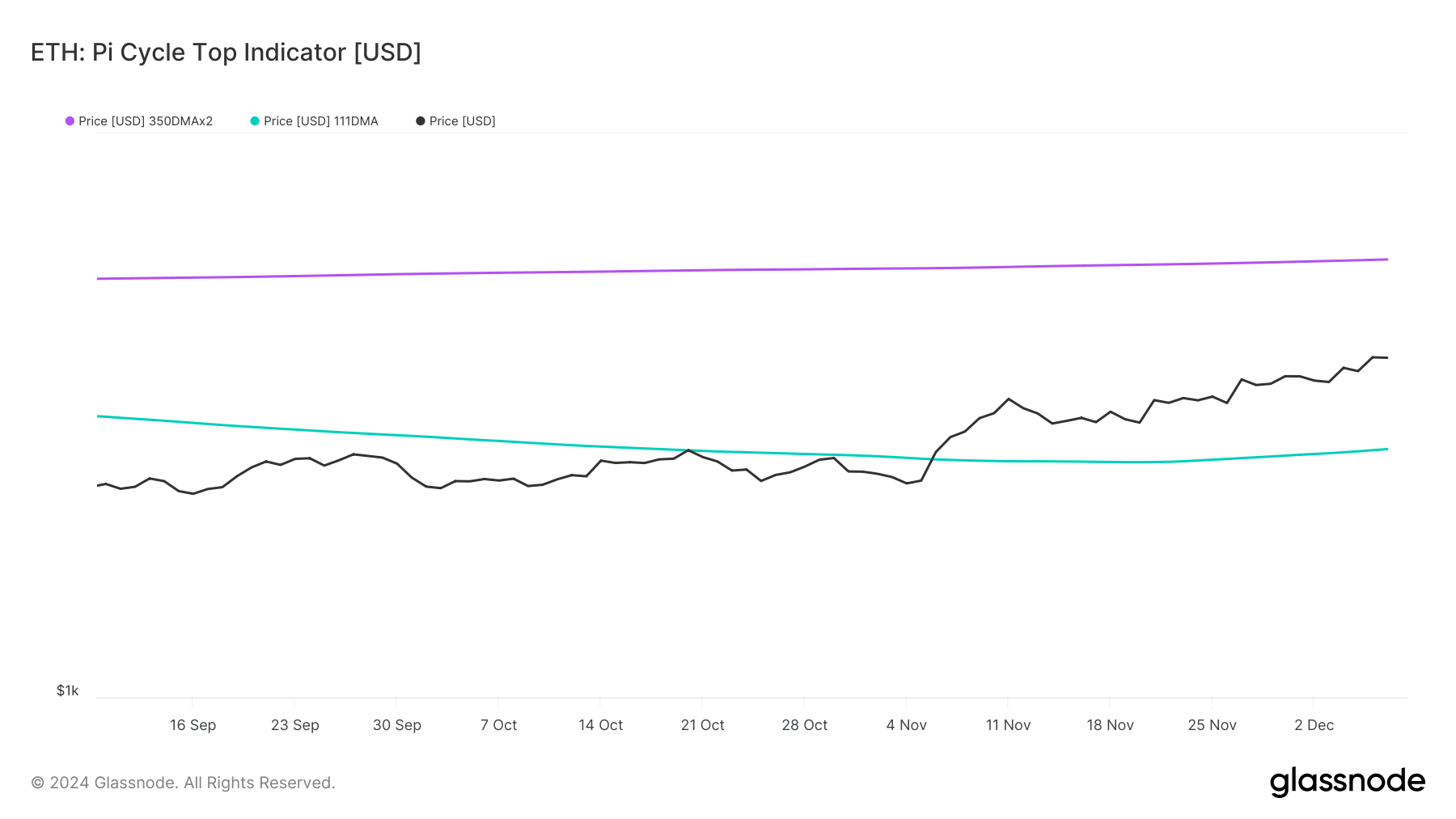

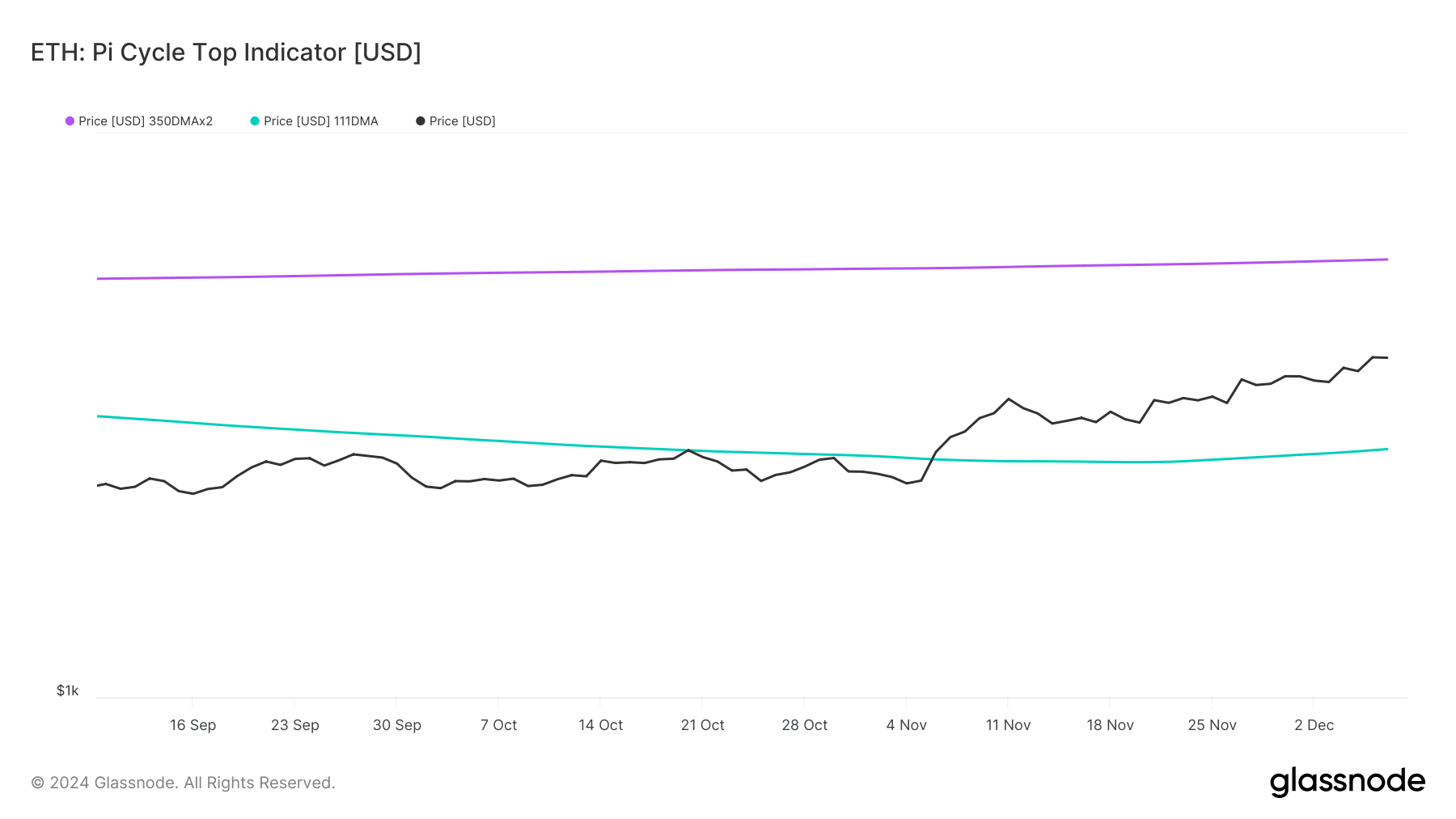

ETH’s Pi Cycle Most sensible indicator published that ETH used to be buying and selling neatly between its marketplace most sensible and backside. If the metric is to be believed, ETH’s imaginable marketplace most sensible used to be at $5.9k.

Due to this fact, it appeared most probably for ETH most sensible succeed in $4.5k quickly.

Supply: Glassnode

Supply: Glassnode

CryptoQuant’s information published that purchasing force at the token used to be emerging. This used to be obtrusive from ETH’s declining alternate reserve.

Moreover, Ethereum’s Coinbase top class used to be inexperienced, which means that purchasing sentiment amongst US traders used to be robust. On the other hand, a couple of metrics additionally regarded bearish.

For example, ETH’s taker purchase/promote ratio grew to become purple. Every time this occurs, it signifies that promoting sentiment is dominant within the derivatives marketplace. Extra promote orders are stuffed by way of takers.

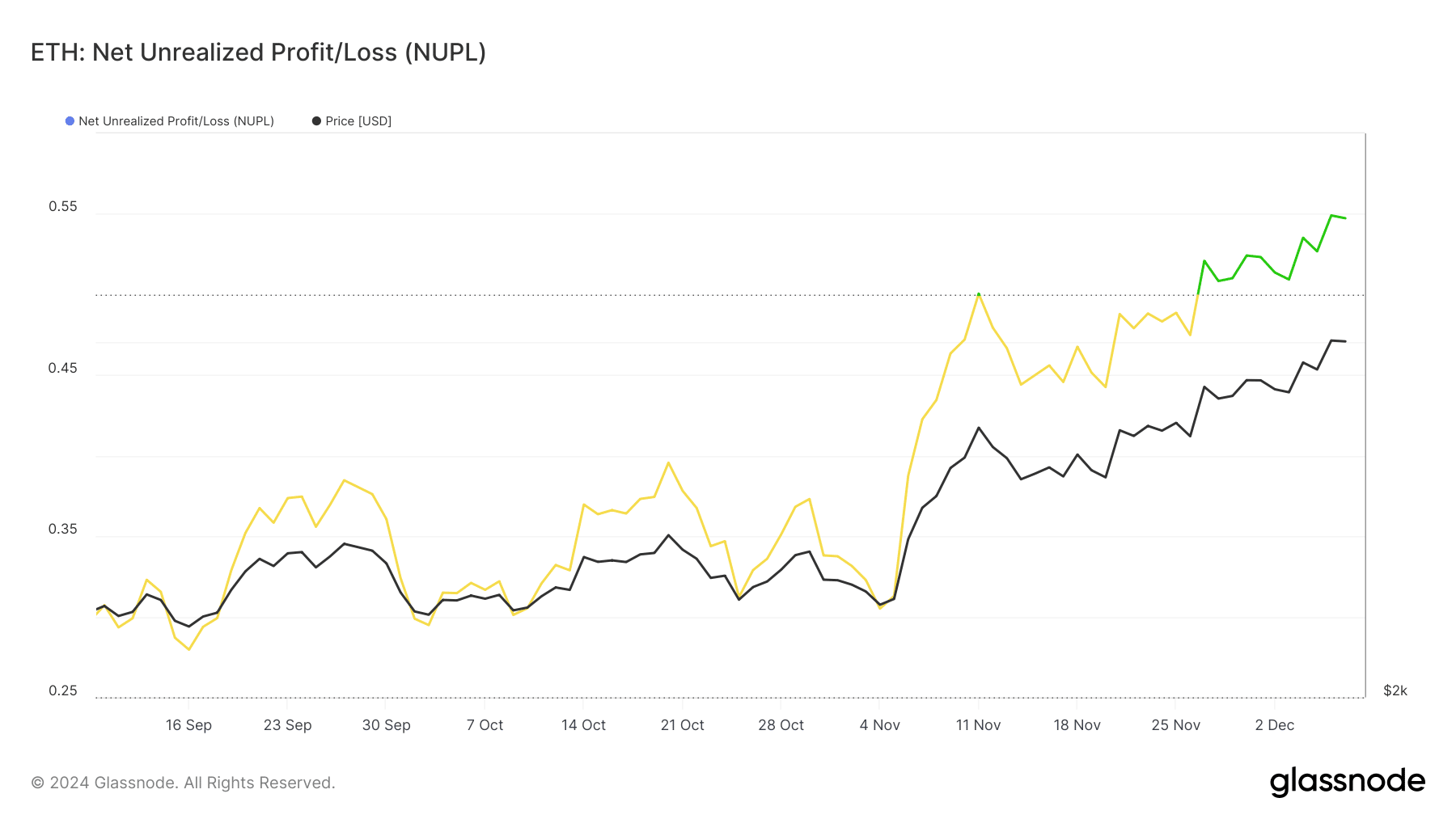

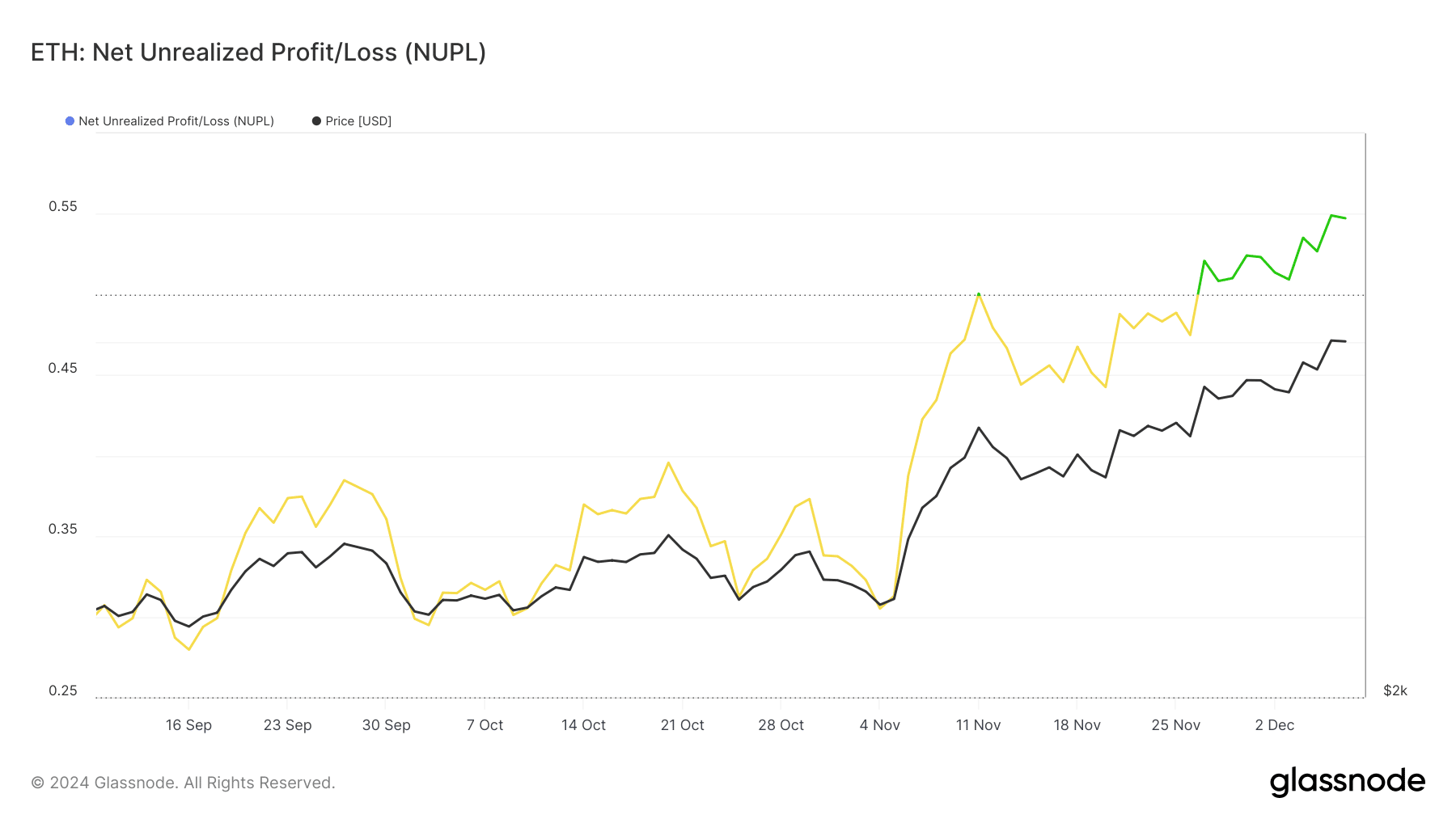

With the exception of this, ETH’s Web Unrealized Benefit/Loss (NUPL) entered the “trust” section.

For starters, the NUPL is the adaptation between Relative Unrealized Benefit and Relative Unrealized Loss. Traditionally, each time the metric reached this degree, it used to be adopted by way of value corrections.

If historical past repeats, then ETH may now not have the ability to pass above $4k within the momentary.

Supply: Glassnode

Supply: Glassnode

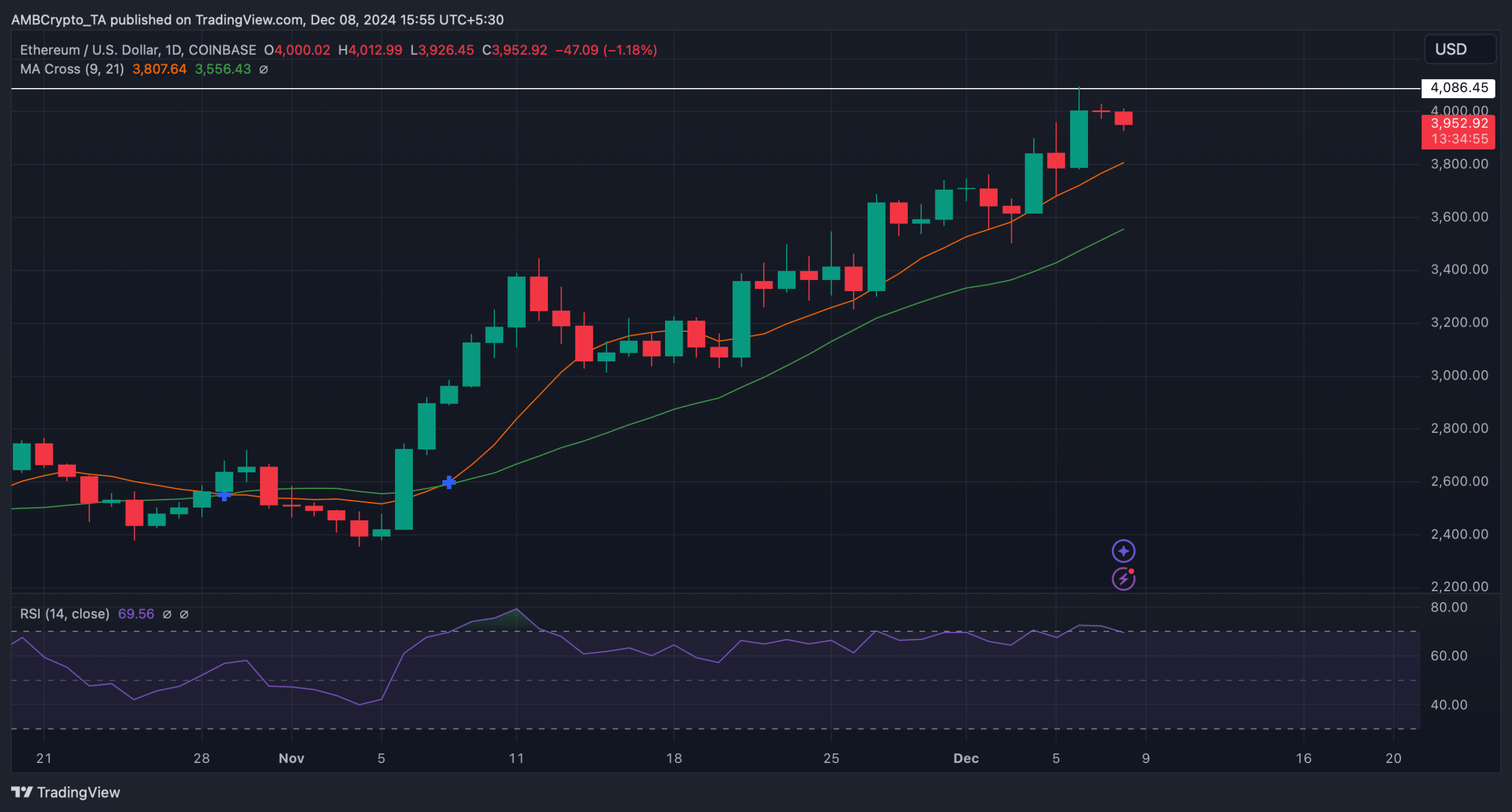

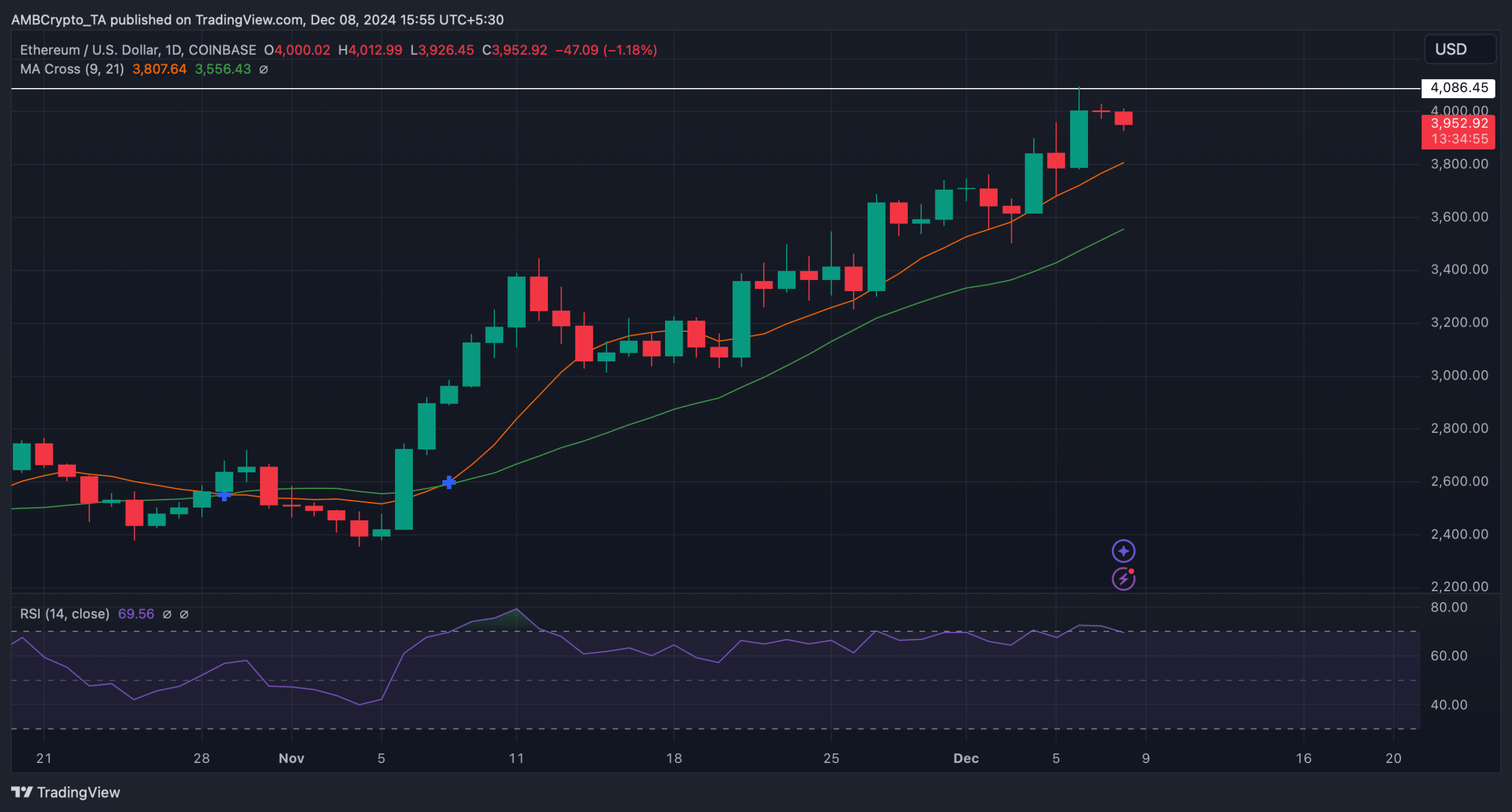

Hassle for ETH used to be a ways from over. The token’s Relative Power Index (RSI) used to be resting within the overbought territory.

Learn Ethereum’s [ETH] Value Prediction 2024–2025

This may encourage traders to promote their holdings, which has the prospective to push ETH’s value down within the coming days.

However, the MA Go indicator supported the bulls, because the 9-day MA used to be neatly above the 21-day MA.

Supply: TradingView

Supply: TradingView

Subsequent: How Bitcoin’s 2024 halving can lend a hand altcoins see their greatest rally but