ETH, at press time, was once checking out the 0% Fibonacci point

Its day by day energetic addresses have remained above 400,000 too

Ethereum [ETH] recorded main bouts of depreciation over the previous few weeks, pushing its value smartly under $3,000 – A degree it had maintained for a while. Now, whilst there was a contemporary rally, this uptick was once no longer enough to revive it above the aforementioned point.

Taking into account the fashion of different signs and marketplace dynamics, ETH will have some volatility forward.

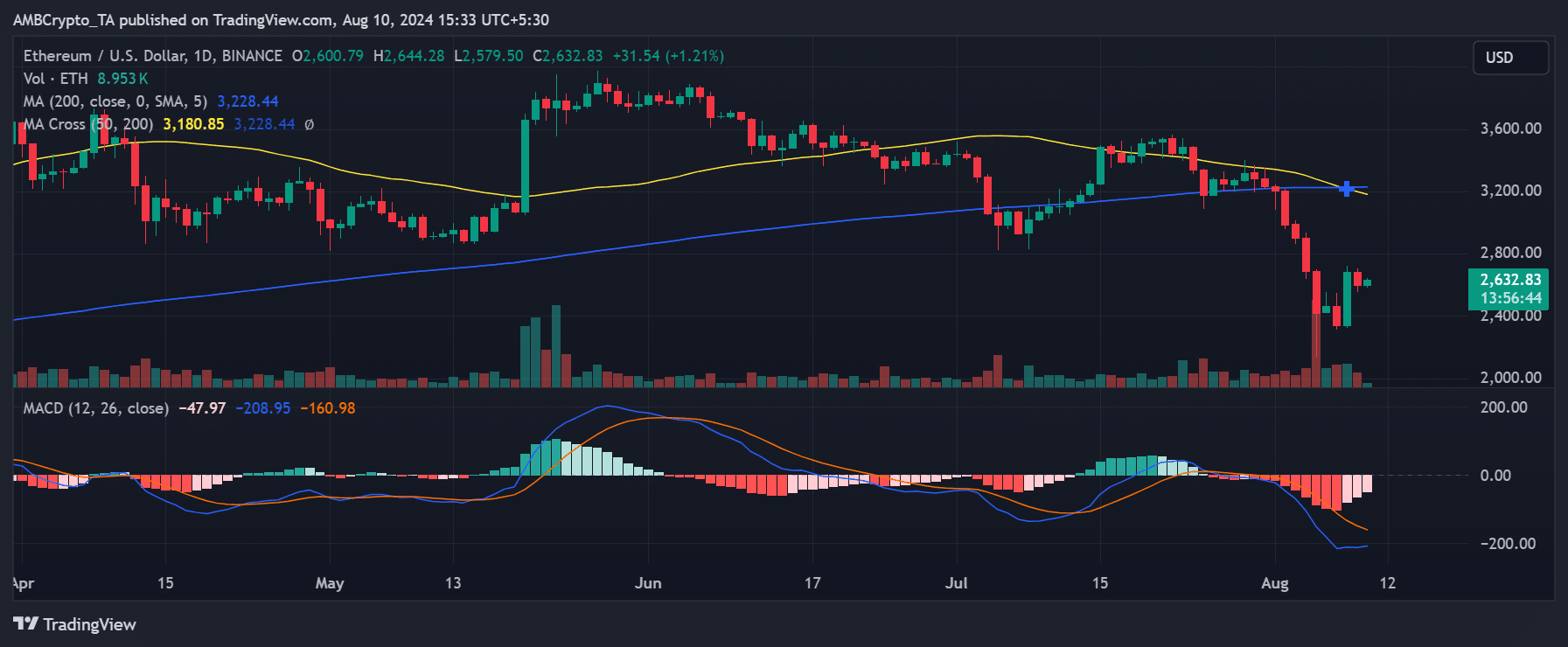

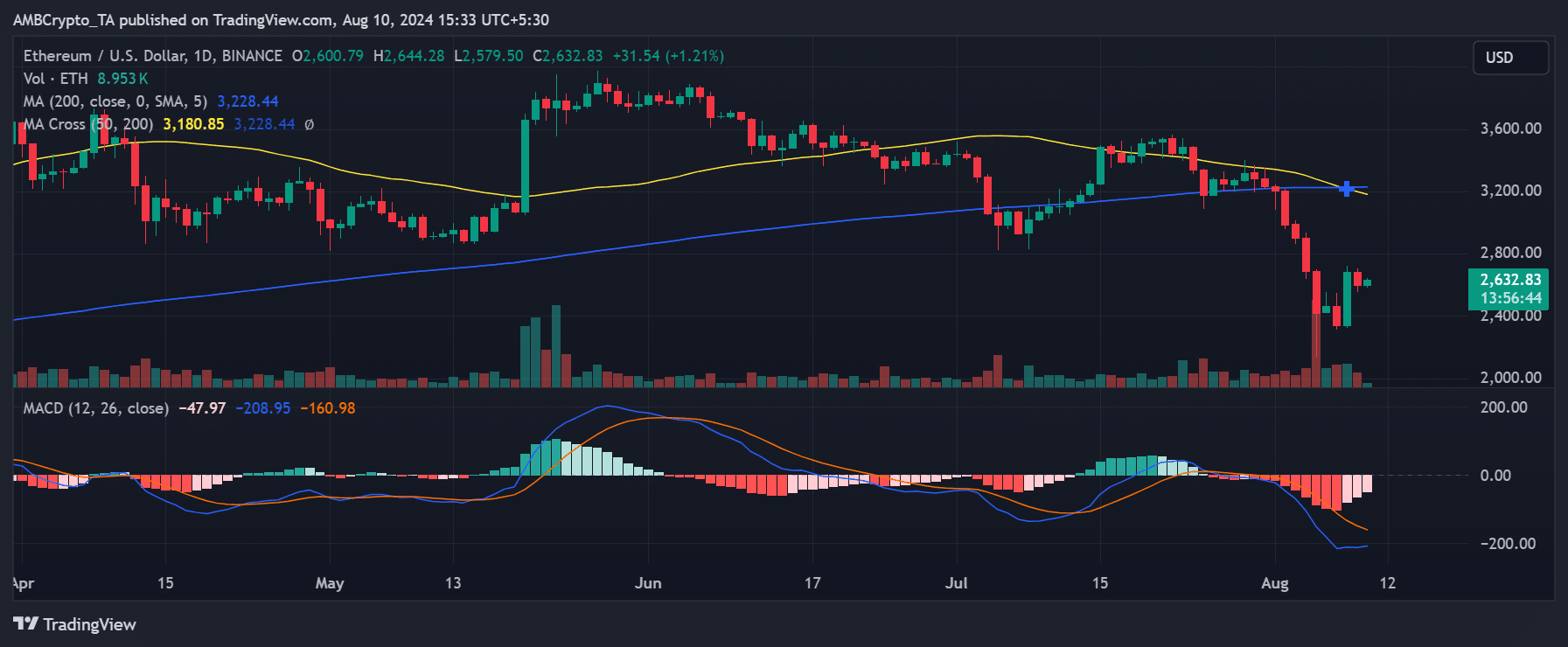

Ethereum sees a loss of life go

The new value pattern of Ethereum, in spite of a notable build up of 14.56% on 8 August, has ended in a relating to technical formation referred to as a loss of life go.

This development emerged extra strongly following a three.10% decline on 9 August, which introduced the associated fee right down to roughly $2,601. A loss of life go happens when a shorter-term shifting reasonable (depicted right here via the yellow line) crosses under a longer-term shifting reasonable (the blue line), signaling attainable long-term bearish sentiment out there.

Supply: TradingView

Supply: TradingView

Moreover, the Transferring Moderate Convergence Divergence (MACD) research indicated that ETH’s momentum was once unfavourable. On the time of writing, the MACD line was once located under the sign line.

Then again, there appeared to be delicate indicators that this downward momentum could also be shedding energy. The MACD histogram confirmed indicators of convergence, that means the unfavourable bars had been turning into much less pronounced. This may well be indicative of weakening bearish momentum, which would possibly precede a marketplace reversal.

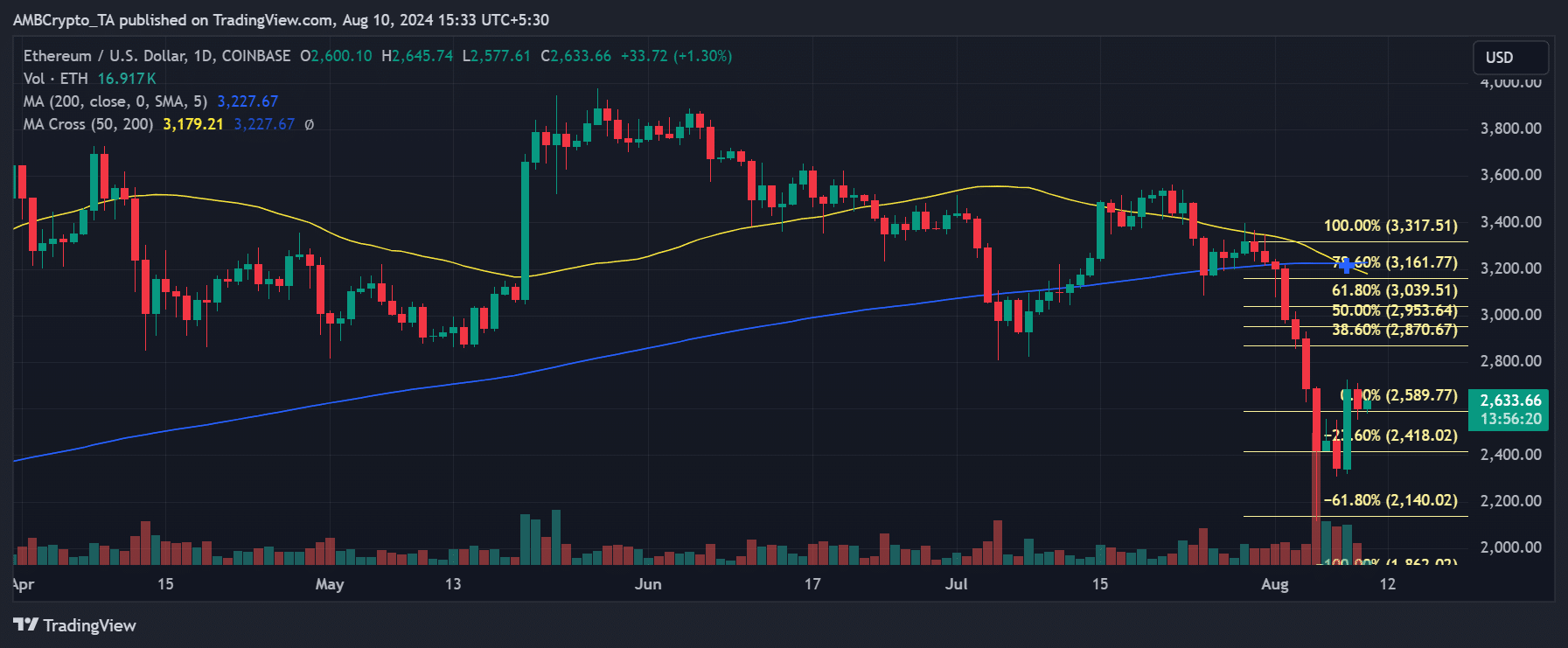

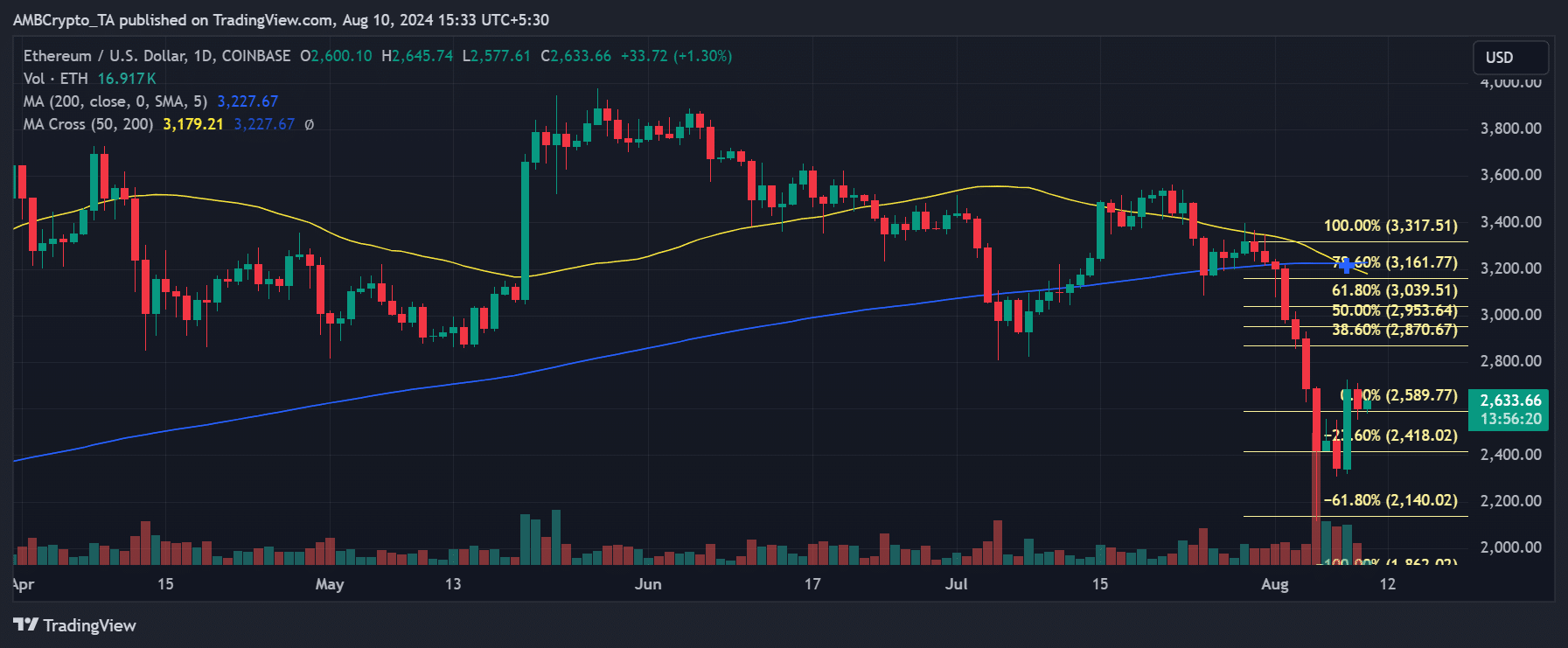

The endure and bull case for ETH

An research of Ethereum the use of the Fibonacci Retracement indicator pointed to a number of attainable value developments. On the time of writing, the associated fee had bounced off the lows close to $2,140 – the -61.8% Fibonacci retracement point. It was once then checking out the 0% Fibonacci retracement point at roughly $2,589.77.

If the associated fee stays above the 0% point ($2,589.77), it will check the following resistance ranges at $2,870.67 (38.6% retracement) and $2,953.64 (50% retracement). Additionally, a a hit breakout above the 50% point might result in an extra restoration in opposition to the 61.8% retracement point at $3,039.51, and doubtlessly upper.

Supply: TradingView

Supply: TradingView

Conversely, if the associated fee fails to carry above the 0% Fibonacci point and faces rejection, it could revisit decrease toughen ranges.

A drop under $2,418.02 (23.6% retracement) may just set the degree for a retest of the hot low close to $2,140. If bearish momentum intensifies, Ethereum would possibly even fall under $2,140, leading to new decrease lows.

Ethereum’s loss of life crosses within the final 3 years

Right here, it’s value declaring that Ethereum has noticed a loss of life go for the 3rd time within the final 3 years. The primary example took place on 27 January 2022, when Ethereum was once buying and selling at roughly $2,500. Following this loss of life go, the associated fee declined to about $1,500 over the following few months prior to improving with a golden go on 10 February 2023.

The second one loss of life go took place on 2 September 2023, when Ethereum was once valued at round $1,600. Then again, this go was once short-lived, with Ethereum briefly rallying and forming a golden go on 21 November 2023.

After this golden go, Ethereum famous important uptrends, with the altcoin hitting the $4,000-level in early 2024.

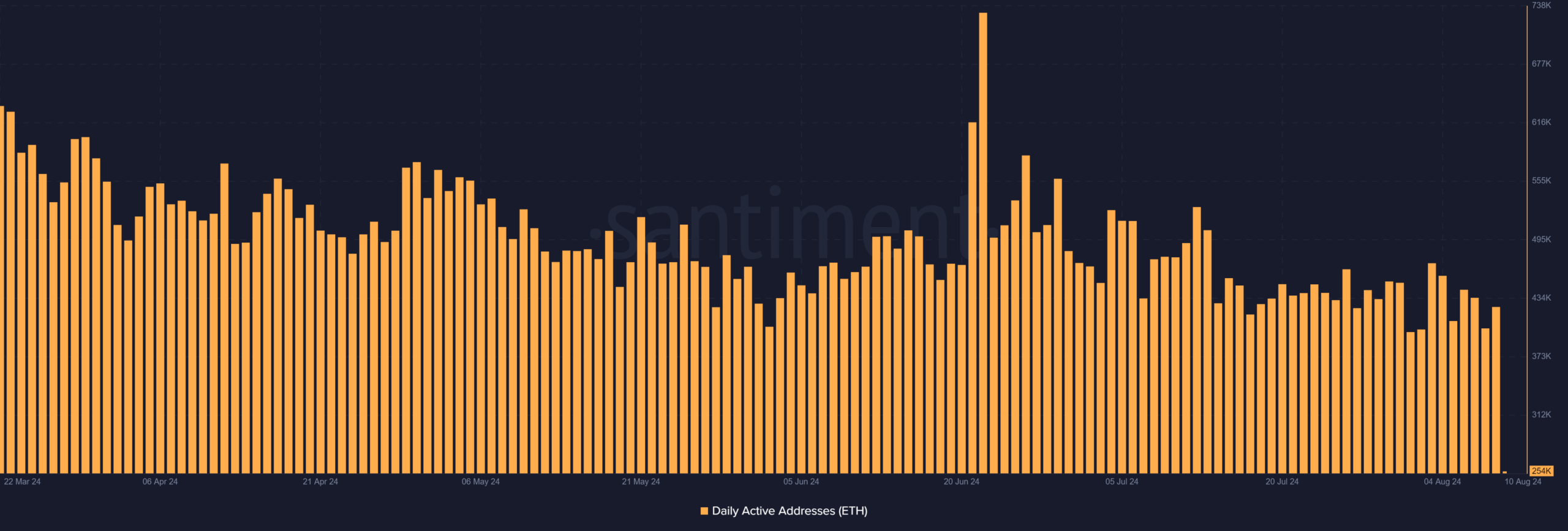

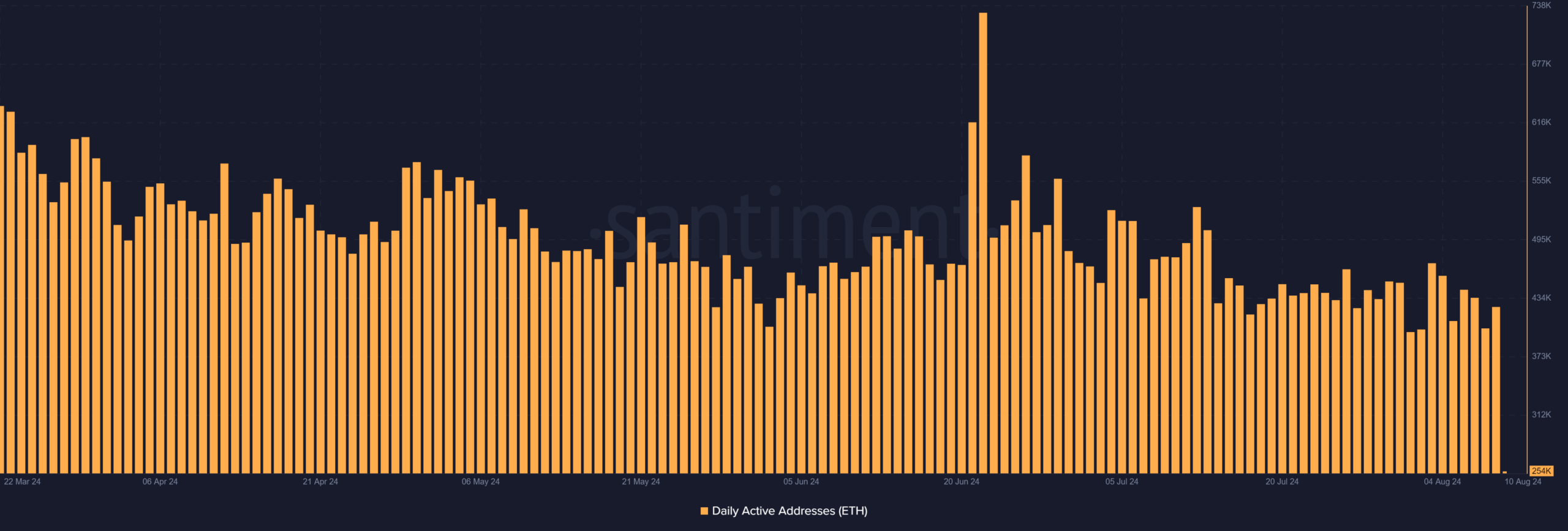

Ethereum energetic addresses keep respectable

An research of Ethereum’s day by day energetic addresses chart on Santiment published a slight decline during the last few days.

In spite of this drop, on the other hand, the choice of energetic addresses has remained above the 400,000-threshold. On 3 August, energetic addresses had been over 470,000, however via 9 August, this quantity had fallen to round 425,000. At press time, the choice of energetic addresses stood at over 230,000.

Supply: Santiment

Supply: Santiment

– Learn Ethereum (ETH) Value Prediction 2024-25

If day by day energetic addresses proceed to say no, this might result in diminished community task and extra downward force at the value.

Conversely, if energetic addresses stabilize or upward push and the associated fee breaks above key resistance ranges, Ethereum may just see a extra sustained restoration.

Subsequent: Assessing if MATIC’s value is in spite of everything able for a rally to $1.5

:max_bytes(150000):strip_icc()/GettyImages-1231124954-fac4ab8390b34b8690301febddb0a92b.jpg)