If issues appear too excellent to be true on Wall Boulevard, they most often are.

Kind of 3 many years in the past, the arrival of the web modified the expansion trajectory for company The united states. Since then, a large number of new applied sciences, inventions, and next-big-thing traits have come alongside promising to be the best factor since sliced bread. Alternatively, none have come on the subject of matching the game-changing attainable that connecting the sector by means of the web brough to the desk… till now.

The coming of man-made intelligence (AI) opens a vast choice of doorways in just about each sector and business. When discussing “AI,” I am speaking about using instrument and methods for duties that may usually be overseen or undertaken through people. Giving instrument and methods the power to be informed and evolve over the years with out human intervention is what provides AI such broad-reaching software.

Symbol supply: Getty Photographs.

In accordance with a record launched final yr through the analysts at PwC, AI can upload an estimated $15.7 trillion to the worldwide economic system through the flip of the last decade. That is a huge sum of money and a pie sufficiently big to permit for more than one winners.

However for the instant, no corporate has been a larger AI winner than semiconductor corporate Nvidia (NVDA 1.75%).

Nvidia has ridden its aggressive benefits to a much-needed inventory cut up

Briefly order, Nvidia’s graphics processing devices (GPUs) have develop into the usual in high-compute knowledge facilities. In step with a find out about performed through semiconductor research corporate TechInsights, Nvidia was once accountable for delivery 3.76 million of the three.85 million GPUs for AI-accelerated knowledge facilities in 2023. That is a fab 98% marketplace percentage and successfully borders on a monopoly.

There is completely no query AI-driven companies need Nvidia’s GPUs of their knowledge facilities to assist educate huge language fashions (LLMs) and oversee generative AI answers. That is it appears that evidently obvious when taking into account that about 40% of Nvidia’s internet gross sales are derived from “Magnificent Seven” participants Microsoft, Meta Platforms, Amazon, and Alphabet. Right through Meta’s first quarter, the corporate introduced plans to extend its capital expenditures, with the explicit concept of springboarding its AI ambitions.

Having the first-mover merit has additionally fueled Nvidia’s pricing energy. Call for for the corporate’s H100 GPU has totally crushed its skill to satisfy orders. Even with Taiwan Semiconductor Production beefing up its chip-on-wafer-on-substrate capability, Nvidia cannot fulfill all of its consumers. Because of this, it is been in a position to dramatically building up the promoting worth on its GPUs, which ended in a scorching-hot gross margin of 78.4% right through the fiscal first quarter (ended April 28).

Nvidia’s first-mover benefits in AI-accelerated knowledge facilities, coupled with the mountain of money drift it is producing from its high-priced H100 GPUs, helps to improve ongoing innovation, as effectively. In March, the corporate unveiled its Blackwell GPU structure, which is designed to additional boost up computing capability in knowledge processing, quantum computing, and generative AI.

Previous this month, CEO Jensen Huang unveiled Nvidia’s latest AI structure, which is known as “Rubin.” Rubin can be serving to to coach LLMs and function on a brand new central processor referred to as “Vera.” Whilst Blackwell is predicted to make it into consumers’ fingers later this yr, Rubin may not be making its professional debut on a industrial scale till 2026.

This mix of innovation, first-mover benefits, and otherworldly pricing energy, has despatched Nvidia’s percentage worth hovering through greater than 700% for the reason that get started of 2023. With the corporate’s stocks lately operating to effectively over $1,000 consistent with percentage, its board of administrators licensed and finished a 10-for-1 inventory cut up. Nvidia joined greater than a half-dozen different high-flying corporations in carrying out a inventory cut up in 2024.

On paper, you could not ask for a extra easiest gross sales ramp-up than what Nvidia has introduced. But if issues appear too excellent to be true on Wall Boulevard, they nearly at all times are.

Symbol supply: Getty Photographs.

Even supposing Nvidia maintains its compute benefits, shareholders can nonetheless lose

As an investor, you will have to be in the hunt for out companies that experience well-defined aggressive benefits, if no longer impenetrable moats. On the very least, Nvidia accounting for 98% of AI-GPUs shipped right through 2023 lands it within the former class.

However even though Nvidia keeps its aggressive GPU benefits, it will not be sufficient to stay its inventory from sooner or later tumbling.

As an example, it is well-documented that Nvidia is about to stand its first actual bout of exterior pageant from the likes of Intel (INTC -0.03%) and Complex Micro Units (AMD -0.17%). Intel’s AI-accelerating Gaudi 3 chip can be widely delivery to consumers right through the 3rd quarter. Intel claims that Gaudi 3 has inference and effort potency benefits over Nvidia’s H100.

In the meantime, AMD is ramping up manufacturing of its MI300X AI-GPU, which is designed as an instantaneous competitor to Nvidia’s extremely a hit H100. The MI300X is awesome to the Nvidia H100 in memory-intensive duties, equivalent to simulations.

Even supposing Blackwell and Rubin in the end blow Intel’s and AMD’s chips out of the proverbial water at the foundation of compute capability, GPU shortage suggests Intel and AMD can nonetheless be big-time winners. A vital backlog of Nvidia’s chips will have to roll out the pink carpet to exterior competition like Intel and AMD.

And it isn’t simply exterior competition which can be a possible downside for Nvidia. The corporate’s aforementioned most sensible consumers, which include round 40% of its gross sales, are all internally growing AI-GPUs for his or her knowledge facilities. This comprises Microsoft’s Azure Maia 100 chip, Alphabet’s Trillium chip, Amazon’s Trainium2 chip, and the Meta Coaching and Inference Accelerator (MTIA) from social media juggernaut Meta Platforms.

Are those AI chips lately a risk to Nvidia’s compute merit? No. However their mere presence as enhances to the H100 GPU gets rid of precious knowledge heart “actual property” and alerts that Nvidia’s most sensible consumers are purposefully lessening their reliance at the AI kingpin.

With extra AI-GPUs changing into to be had from Intel and AMD, and lots of the Magnificent Seven internally growing AI chips, the GPU shortage that has lifted Nvidia’s pricing energy into the stratosphere goes to ebb. The corporate’s 75.5% adjusted gross margin forecast (+/- 50 foundation issues) for the fiscal 2d quarter — a decline of 235 to 335 foundation issues from the sequential quarter — most likely alerts that those pressures are taking hang.

NVDA Gross Benefit Margin (Quarterly) knowledge through YCharts.

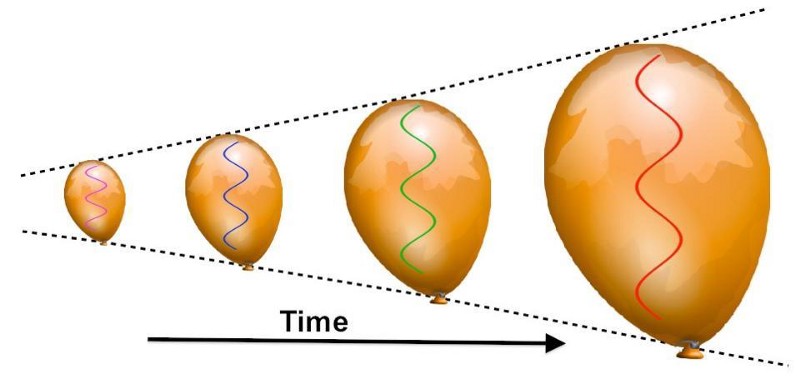

Moreover, each next-big-thing era, innovation, or development over the past 3 many years has succumbed to an early-stage bubble-bursting match. Buyers have persistently overrated how temporarily a brand new era, innovation, or development can be followed through companies and/or customers.

Even supposing AI looks as if the second one coming of the web when it comes to replacing the expansion arc for company The united states, maximum companies don’t have any well-defined recreation plans for a way they’ll deploy the era to support gross sales and earnings. We see this overzealousness repeated cycle after cycle with next-big-thing investments.

Thoughts you, this does not imply Nvidia may not be wildly a hit over the long term or that its inventory cannot additional building up in worth when taking a look again 10 or twenty years from now. However it does recommend that, even though Nvidia maintains its aggressive GPU merit, the immaturity of the era in its early levels has set Wall Boulevard up for some other bubble.

The chief of each next-big-thing innovation for 3 many years has noticed its percentage worth sooner or later decline through a minimum of 50%. I consider Nvidia’s shareholders are on target to undergo this identical sadness.

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of marketplace construction and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Sean Williams has positions in Alphabet, Amazon, Intel, and Meta Platforms. The Motley Idiot has positions in and recommends Complex Micro Units, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Production. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, quick August 2024 $35 calls on Intel, and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.