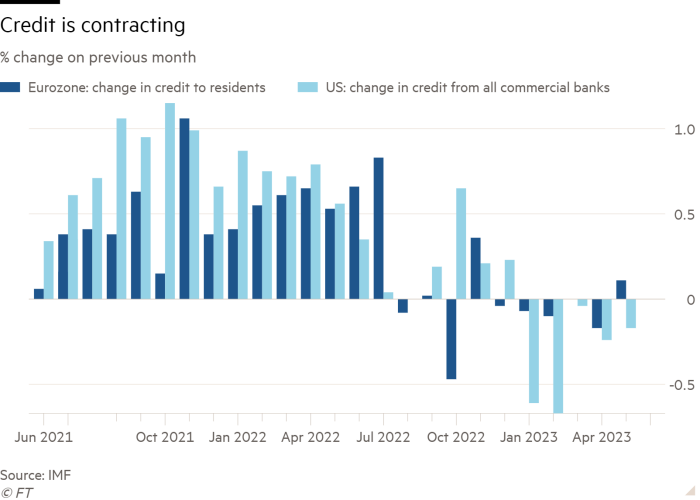

The spectre of a much broader warfare within the Heart East poses a recent danger to the worldwide economic system simply as the arena emerges from shocks precipitated by way of Covid-19 and the Ukraine battle, finance ministers and officers have warned.Broader regional tensions would have vital financial ramifications, they mentioned, as they rounded off conferences of the IMF and Global Financial institution in Morocco this week. The biannual occasions came about as Israel declared battle on Hamas and introduced a significant bombardment of the Gaza Strip. “If we face any escalation or extension of the warfare to the entire area we can face giant penalties,” Bruno Le Maire, France’s finance minister, informed the Monetary Instances, including that dangers ranged from larger power costs stirring inflation, to a decline in self belief. Kristalina Georgieva, the pinnacle of the IMF, warned of a “new cloud on no longer the sunniest horizon for the worldwide economic system”, encapsulating fears some of the delegates in Marrakech that the medium-term potentialities for the worldwide economic system are lukewarm. At the different aspect of the Atlantic, Jamie Dimon, leader govt of JPMorgan, known as this “probably the most unhealthy time the arena has noticed in a long time”. Kristalina Georgieva, the pinnacle of the IMF, warned of a ‘new cloud on no longer the sunniest horizon for the worldwide economic system’ © Filip Singer/EPA-EFE/ShutterstockHeading into the conferences, officers had expressed reduction that central banks had controlled to curb inflation with out scary outright recessions — sidestepping a possibility that the IMF flagged in April because it spoke of a imaginable “laborious touchdown” for the worldwide economic system. Central banks gave the impression to have tightened financial coverage, curbed credit score expansion, and cooled the labour marketplace “with out overdoing it”, mentioned Pierre-Olivier Gourinchas, the IMF leader economist previous to the development. However, as delegates convened, the temper darkened as the broader implications of the Israel-Hamas battle blended with underlying nervousness about continual vulnerabilities within the world economic system. The IMF’s research pointed to worsening longer-term expansion traits, as economies fight to boost productiveness, limitations to loose business mount amid worsening political tensions, and public debt rises around the globe.Notable within the IMF’s momentary forecasts — ready sooner than the violence within the Heart East broke out — was once a loss of obtrusive vibrant spots past a handful of nations corresponding to america or India. “There’s no accelerant right here,” mentioned Joyce Chang, head of world analysis at JPMorgan. “I don’t assume any individual appears like there’s a giant catalyst over the following yr or so.”You’re seeing a snapshot of an interactive graphic. That is possibly because of being offline or JavaScript being disabled for your browser.

Kristalina Georgieva, the pinnacle of the IMF, warned of a ‘new cloud on no longer the sunniest horizon for the worldwide economic system’ © Filip Singer/EPA-EFE/ShutterstockHeading into the conferences, officers had expressed reduction that central banks had controlled to curb inflation with out scary outright recessions — sidestepping a possibility that the IMF flagged in April because it spoke of a imaginable “laborious touchdown” for the worldwide economic system. Central banks gave the impression to have tightened financial coverage, curbed credit score expansion, and cooled the labour marketplace “with out overdoing it”, mentioned Pierre-Olivier Gourinchas, the IMF leader economist previous to the development. However, as delegates convened, the temper darkened as the broader implications of the Israel-Hamas battle blended with underlying nervousness about continual vulnerabilities within the world economic system. The IMF’s research pointed to worsening longer-term expansion traits, as economies fight to boost productiveness, limitations to loose business mount amid worsening political tensions, and public debt rises around the globe.Notable within the IMF’s momentary forecasts — ready sooner than the violence within the Heart East broke out — was once a loss of obtrusive vibrant spots past a handful of nations corresponding to america or India. “There’s no accelerant right here,” mentioned Joyce Chang, head of world analysis at JPMorgan. “I don’t assume any individual appears like there’s a giant catalyst over the following yr or so.”You’re seeing a snapshot of an interactive graphic. That is possibly because of being offline or JavaScript being disabled for your browser.

Janet Yellen, america Treasury secretary, mentioned she was once sticking together with her comfortable touchdown name, telling journalists this week she does no longer be expecting the warfare to be a “main most likely driving force of the worldwide financial outlook”.However officers wired the warfare got here at a time when the arena economic system was once in a delicate state.The worldwide economic system is now extensively anticipated to develop at a moderately vulnerable degree over the medium time period, coming in at simply 3.1 in step with cent in 2028. That compares with a five-year outlook of three.6 in step with cent expansion simply sooner than the pandemic, and four.9 in step with cent sooner than the onset of the monetary disaster.Greater than 80 in step with cent of economies are actually dealing with worse potentialities from 15 years in the past, consistent with the fund, for causes various from slower productiveness to a slowdown in inhabitants expansion.

Janet Yellen, america Treasury secretary, mentioned she was once sticking together with her comfortable touchdown name, telling journalists this week she does no longer be expecting the warfare to be a “main most likely driving force of the worldwide financial outlook”.However officers wired the warfare got here at a time when the arena economic system was once in a delicate state.The worldwide economic system is now extensively anticipated to develop at a moderately vulnerable degree over the medium time period, coming in at simply 3.1 in step with cent in 2028. That compares with a five-year outlook of three.6 in step with cent expansion simply sooner than the pandemic, and four.9 in step with cent sooner than the onset of the monetary disaster.Greater than 80 in step with cent of economies are actually dealing with worse potentialities from 15 years in the past, consistent with the fund, for causes various from slower productiveness to a slowdown in inhabitants expansion.  Added to that’s the fragmentation of the worldwide economic system into competing blocs — a procedure this is tricky to opposite and made all of the much more likely by way of geopolitical tensions. The IMF estimated previous this yr that mounting business limitations on my own may just cut back world financial output by way of up to 7 in step with cent over the longer term. Really helpful

Added to that’s the fragmentation of the worldwide economic system into competing blocs — a procedure this is tricky to opposite and made all of the much more likely by way of geopolitical tensions. The IMF estimated previous this yr that mounting business limitations on my own may just cut back world financial output by way of up to 7 in step with cent over the longer term. Really helpful On best of that come emerging fiscal dangers, as the worldwide public debt ratio climbs against 100 in step with cent of gross home product by way of the top of the last decade. This has revived issues over debt sustainability at a time that Chang described as “inconvenient”.Fresh jitters on the planet’s greatest monetary marketplace — US Treasuries — have been riding up world borrowing prices simply as central banks have been shrinking their steadiness sheets, and executive debt issuance was once on the upward push, she defined.Talking at probably the most ultimate panels of the yearly conferences, Christine Lagarde, president of the Eu Central Financial institution, underscored simply how difficult a suite of cases those headwinds posed.“There are some of these balls within the air,” she mentioned. We aren’t precisely certain the place they’ll land.” Further reporting by way of Martin Arnold in Frankfurt

On best of that come emerging fiscal dangers, as the worldwide public debt ratio climbs against 100 in step with cent of gross home product by way of the top of the last decade. This has revived issues over debt sustainability at a time that Chang described as “inconvenient”.Fresh jitters on the planet’s greatest monetary marketplace — US Treasuries — have been riding up world borrowing prices simply as central banks have been shrinking their steadiness sheets, and executive debt issuance was once on the upward push, she defined.Talking at probably the most ultimate panels of the yearly conferences, Christine Lagarde, president of the Eu Central Financial institution, underscored simply how difficult a suite of cases those headwinds posed.“There are some of these balls within the air,” she mentioned. We aren’t precisely certain the place they’ll land.” Further reporting by way of Martin Arnold in Frankfurt

Fears of wider Heart East warfare forged shadow over world economic system