The Federal Reserve is not likely to chop rates of interest this week in spite of rising fear concerning the state of the U.S. financial system and the affect of President Trump’s business schedule.

Markets predict the Fed to deal with its pause on cuts, a transfer that will deprive them of stimulus following two weeks of sizable losses and that would incur the wrath of Trump.

Rate of interest futures contracts point out a 99-percent likelihood that the Fed will hang interbank lending charges secure at a variety of four.25 to 4.5 %, as measured by means of the CME FedWatch prediction set of rules.

“We think the Fed to carry charges secure for the second one consecutive assembly and, given heightened uncertainty, supply restricted steering concerning the coverage trail forward,” analysts for Deutsche Financial institution wrote in a Friday word to traders.

The pause on charge cuts may just instructed some Fed-bashing by means of President Trump, who has often broadcast his emotions concerning the Fed and its chair Jerome Powell in spite of the prison and institutional independence of the central financial institution.

After the Fed paused its charge cuts in January, Trump accused central bankers of failing “to forestall the issue they created with inflation.” He additionally mentioned he knew extra about rates of interest than chair Powell regardless that he later conceded that the pause was once the “proper factor to do.”

With markets teetering based on Trump’s converting business insurance policies and customers feeling down concerning the financial system, Trump may just direct frustrations at Powell, who has declined to reply to Trump’s complaint’s up to now.

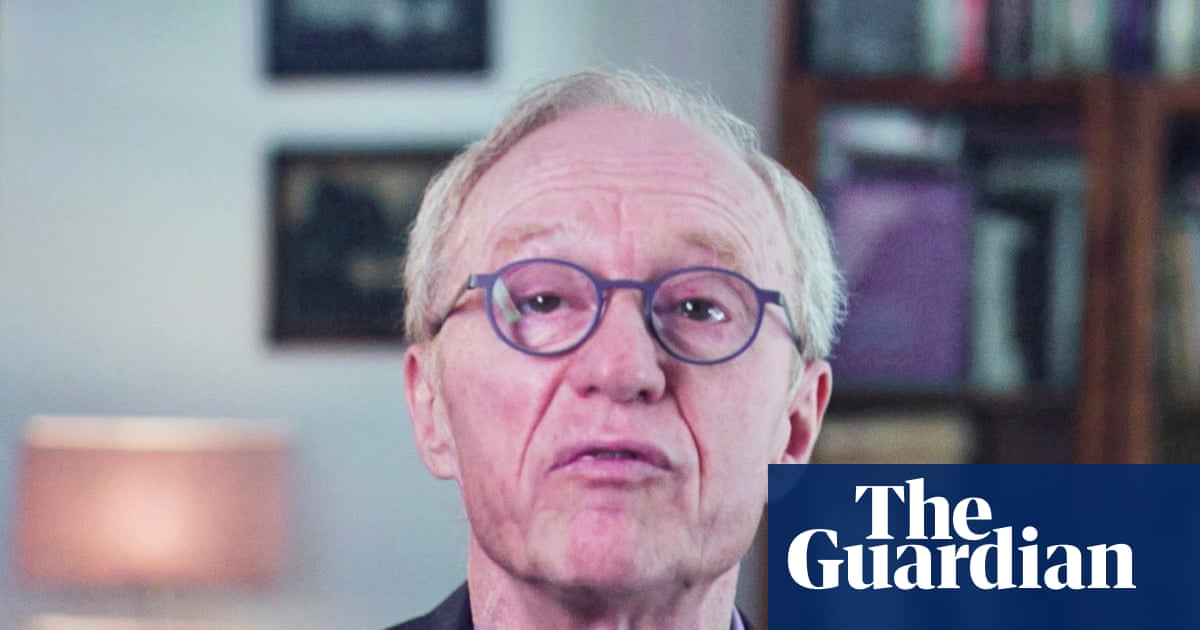

“I’m no longer going to have any, any reaction or remark in any respect on what the President’s mentioned. It’s no longer suitable for me to take action,” Powell all through a January press convention based on a query about Trump’s financial coverage calls for.

The Fed is ready to unlock its financial projections for later this 12 months at its assembly this week. Its final projections launched in December slashed the collection of quarter-point charge cuts anticipated in 2025 from 4 to 2 and delivered extra tough efficiency goals than up to now anticipated.

Analysts for Deutsche Financial institution and JP Morgan are predicting the Fed to deal with its two-cut state of affairs. Each banks see the inflation outlook emerging fairly and for enlargement projections to be pulled again.

“We think that median GDP enlargement expectancies for this 12 months might be revised down and for core PCE inflation might be revised up. Given this, we think no exchange within the median rate of interest forecast ‘dot’ for this 12 months, nonetheless in search of two 25-basis level cuts,” Michael Feroli wrote for JP Morgan.

Each the shopper worth index (CPI) and the non-public intake expenditures (PCE) worth index confirmed inflation easing in February. The CPI fell from a 3-percent annual build up to two.8 %, and the PCE worth index fell from 2.6 % to two.5 %.

Alternatively, worth will increase rose constantly in each indices in the course of the fourth quarter, and analysts suppose the Fed will nonetheless prioritize the chance of inflation over dangers to output by means of keeping up its pause on cuts.

“Recession dangers have overtaken stagflation dangers, leaving markets perplexed between steepening and knocking down,” analysts for BNP Paribas wrote in a Friday observation about this week’s Federal Open Markets Committee (FOMC) assembly by means of the Fed. “We expect the March FOMC assembly – just like the December FOMC assembly – may no longer percentage the marketplace’s view that enlargement dangers are dominating inflation dangers and as an alternative deliver again center of attention on heightened inflation fears.

Whilst the basics of the U.S. financial system are in excellent form, the blitz of tariff orders and next reversals from the Trump management were damn markets, weighing on industry and client sentiment, and knocking down Trump’s approval score at the financial system.

The Dow Jones Business Moderate was once up greater than part a % in Monday buying and selling however has misplaced greater than 6 % of its worth over the last month. The Same old and Deficient’s index of 500 firms is down just about 8 %.

Surveys of client and industry sentiment in contemporary weeks have proven really extensive downward motion. The College of Michigan’s survey of client sentiment confirmed year-ahead inflation expectancies spiking above 4 % whilst the New York Fed’s Survey of Client Expectancies confirmed expanding pessimism amongst families about their monetary possibilities.

President Trump’s approval score at the financial system has additionally sagged, with 56 % of respondents to a contemporary The Gentleman Report ballot appearing disapproval on his dealing with of the financial system.

World business hit a document $33 trillion in 2024 with orders surging within the fourth quarter forward of Trump’s anticipated price lists, in line with United International locations economists. Whilst world business volumes have remained solid to this point in 2025, the UN economists warn that “uncertainty looms.”

“Mounting geoeconomic tensions, protectionist insurance policies and business disputes sign most probably disruptions forward,” they wrote in a March world business replace. “Fresh transport developments additionally counsel a slowdown, with falling freight indices indicating weaker business process, in particular in provide chain-dependent sectors.”

Copyright 2025 Nexstar Media Inc. All rights reserved. This subject matter will not be printed, broadcast, rewritten, or redistributed.