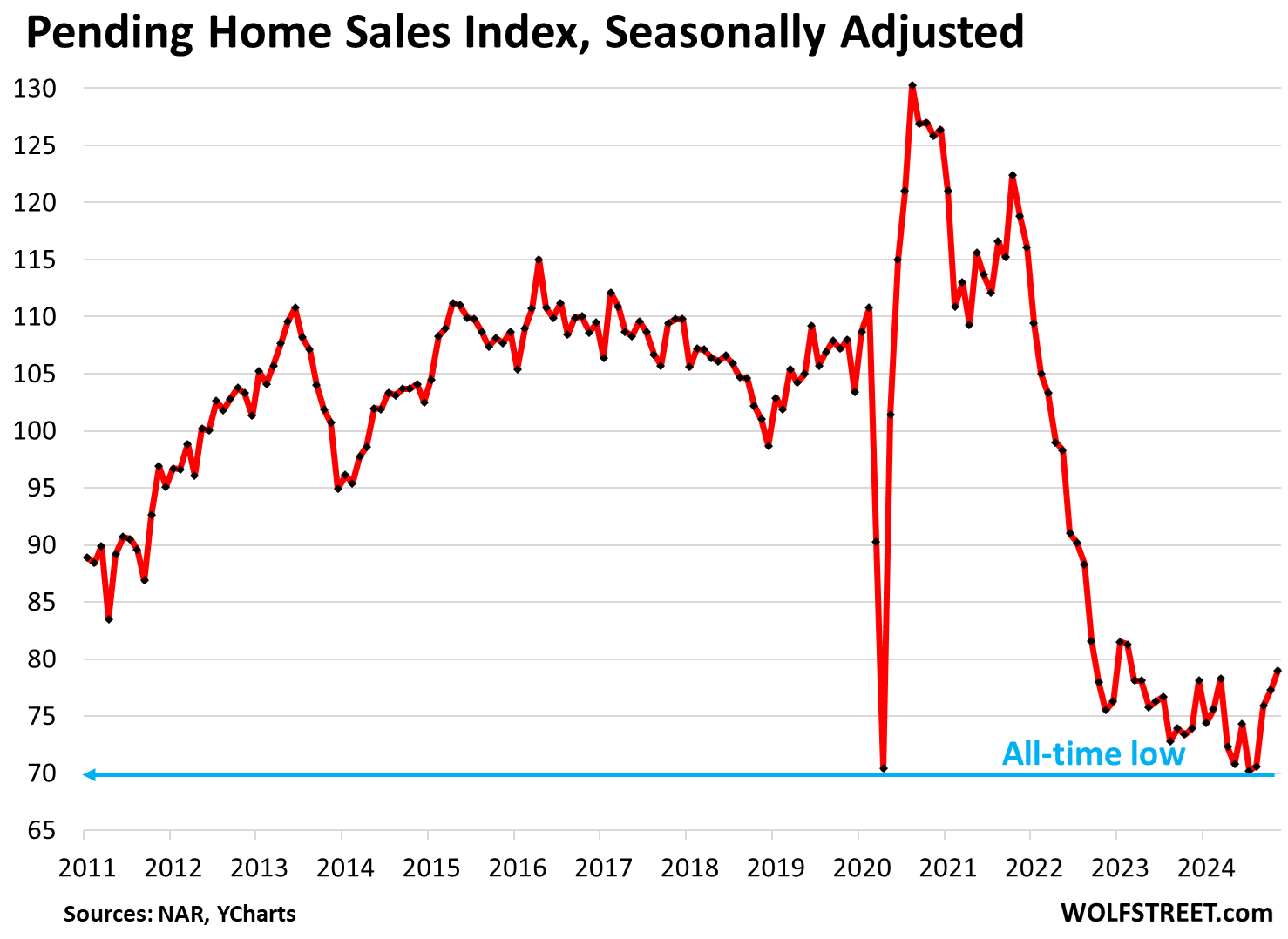

Federal Reserve officers expressed self assurance that inflation is easing and the exertions marketplace is powerful, making an allowance for additional rate of interest cuts albeit at a steady tempo, in line with mins from the November assembly launched Tuesday.The assembly abstract contained more than one statements indicating that officers are pleased with the tempo of inflation, even if through maximum measures it stays above the Fed’s 2% purpose.With that during thoughts, and with conviction that the roles image continues to be moderately forged, Federal Open Marketplace Committee contributors indicated that additional charge cuts most likely will occur, even though they didn’t specify when and to what level.”In discussing the outlook for financial coverage, individuals expected that if the knowledge got here in about

as anticipated, with inflation proceeding to transport down sustainably to two p.c and the financial system

final close to most employment, it will most likely be suitable to transport regularly towards a extra impartial stance of coverage over the years,” the mins stated.The FOMC voted unanimously on the assembly to take down its benchmark borrowing charge through 1 / 4 proportion level to a goal vary of four.5%-4.75%. Markets be expecting the Fed may just minimize once more in December, even though conviction has waned amongst issues that President-elect Donald Trump’s plans for price lists may just stoke inflation upper.The assembly concluded two days after the contentious presidential election marketing campaign resulted within the Republican rising because the victor and set to start out serving his 2d time period in January.

There was once no point out of the election within the mins, save for a body of workers notation that inventory marketplace volatility rose prior to the Nov. 5 effects and fell after. There additionally was once no dialogue of the consequences of fiscal coverage, in spite of anticipation that Trump’s plans, which additionally come with decrease taxes and competitive deregulation, can have really extensive financial affects.Then again, contributors did be aware a normal degree of uncertainty about how stipulations are evolving. As well as, they expressed uncertainty over the place the velocity cuts would want to forestall prior to the Fed hit a “impartial” rate of interest that neither boosts nor restrains enlargement.”Many individuals seen that uncertainties in regards to the degree of the impartial interest rate difficult the evaluation of the level of restrictiveness of economic coverage and, of their view, made it suitable to cut back coverage restraint regularly,” the mins stated.Conflicting alerts on inflation and the uncertainty over Trump’s insurance policies have brought about investors to cut back their outlook for rate of interest cuts forward. The market-implied chance of a charge trim in December has drifted beneath 60%, with an expectation of simply three-quarters of a proportion level in discounts during the finish of the 2025.Committee contributors seemed to spend a lot of the assembly speaking about growth on inflation and a in most cases solid financial outlook.Policymakers in contemporary days have expressed self assurance that present inflation readings are being boosted through refuge price will increase which might be anticipated to sluggish because the tempo of hire rises eases and makes its means during the knowledge.”Virtually all individuals judged that, even though monthly actions would stay unstable, incoming knowledge in most cases remained in keeping with inflation returning sustainably to two p.c,” the file stated.

“Individuals cited more than a few elements prone to put proceeding downward drive on inflation, together with waning trade pricing energy, the Committee’s still-restrictive financial coverage stance, and well-anchored longer-term inflation expectancies,” it added.Policymakers were expressing worry concerning the exertions marketplace. Nonfarm payrolls rose simplest 12,000 in October, even though the meager achieve has been attributed basically to storms within the Southeast and exertions moves.Officers indicated that the state of the exertions marketplace is in most cases forged.”Individuals in most cases famous … that there was once no signal of speedy deterioration in exertions marketplace stipulations, with layoffs final low,” the mins stated.

Fed officers see rate of interest cuts forward, however simplest ‘regularly,’ assembly mins display