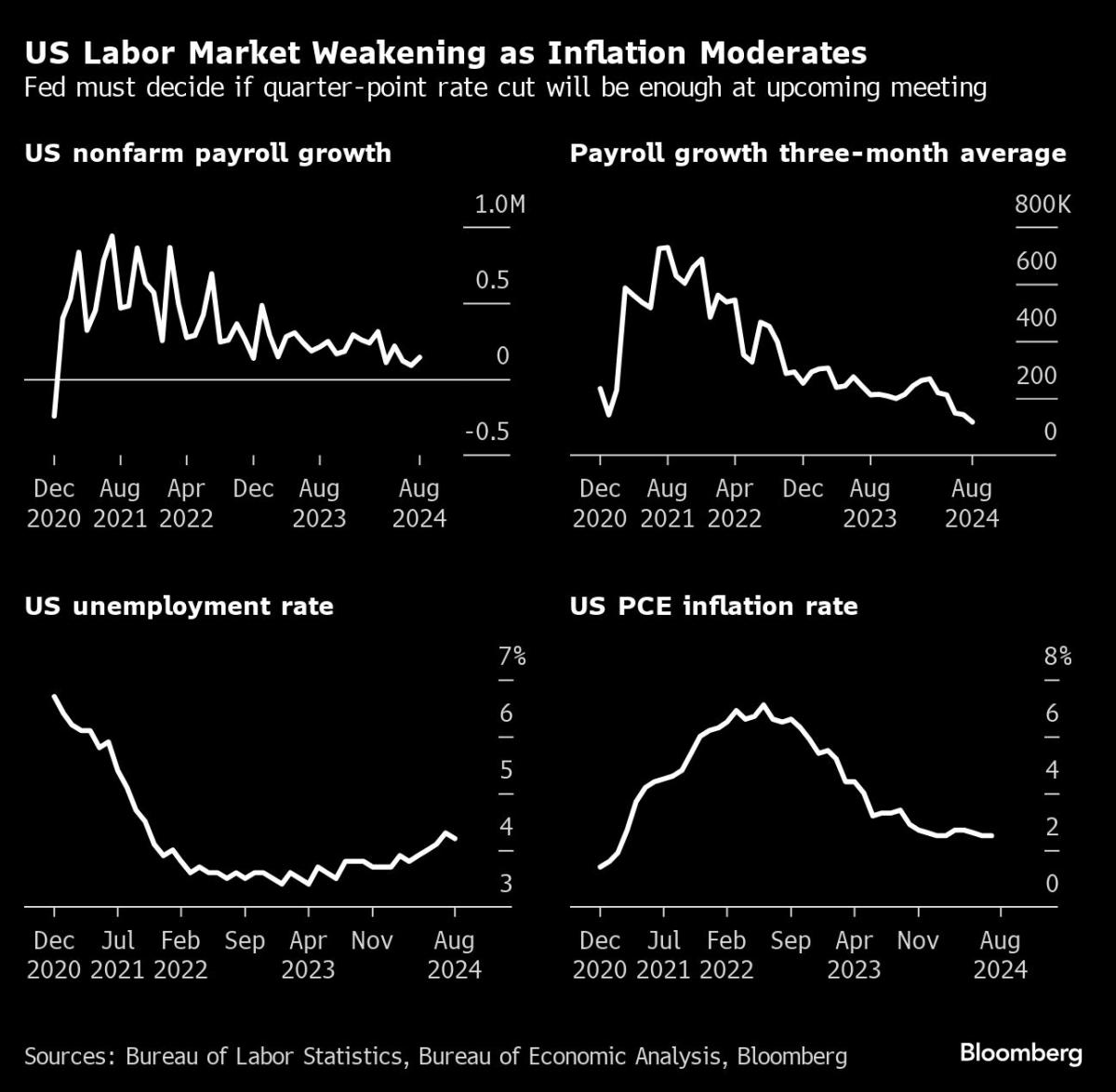

(Bloomberg) — The Federal Reserve is ready to start out unwinding its tightening marketing campaign this month as inflation cools and the hard work marketplace slows. The large query policymakers now face is whether or not a small interest-rate minimize will likely be sufficient to stay the financial system in growth mode.Maximum Learn from BloombergThe per 30 days jobs file Friday confirmed the tempo of hiring in america moderated during the last 3 months to the slowest for the reason that onset of the pandemic in 2020. Even so, the numbers left buyers skeptical as as to if Fed officers would go for an outsize charge minimize at their Sept. 17-18 assembly.The discharge units the desk for a heated debate between the ones like Fed Chair Jerome Powell, who’s open to a bigger minimize to make sure the central financial institution doesn’t fall in the back of the curve, and different officers who “are nonetheless waffling on 1 / 4 level,” consistent with Diane Swonk, leader economist at KPMG.The stakes are prime. Underneath Powell, the Fed made the error of shifting too past due to quash the worst bout of inflation for the reason that early Eighties, undermining the purchasing energy of American families. If they’re too gradual this time, they could power up unemployment and tip the financial system into recession.“Powell has were given to be fascinated about his legacy presently, and he’s in point of fact were given to nail this cushy touchdown,” Swonk stated.The selection dealing with Fed officers — whether or not to begin easing regularly or to front-load charge cuts — is certain to be contentious, as is frequently the case all through main turning issues for financial coverage.With maximum measures of monetary job now firmly trending down, some economists see extra chance in taking a wary means than in shifting aggressively. Emerging joblessness can temporarily transform self-perpetuating as shoppers rein in spending, in flip inflicting extra firms to let staff cross. Already, the unemployment charge has risen virtually a complete proportion level from remaining yr’s low, triggering a well-liked recession indicator referred to as the “Sahm rule.”“It raises some critical questions, now not near to this assembly, however over the following a number of months,” Chicago Fed President Austan Goolsbee stated Friday on CNBC. “How can we make the effort not to have issues grow to be one thing worse.”A separate Bureau of Exertions Statistics file printed on Sept. 4 confirmed process openings fell in July to the bottom degree for the reason that get started of 2021. The ratio of openings to unemployed American citizens — which shot as prime as two to 1 on the top of pandemic-era hard work shortages — has now returned to about one to 1.Tale continuesMarkets WhipsawedBoth releases adopted feedback from Powell on Aug. 23, who advised a convention in Jackson Hollow, Wyoming that he and his colleagues “don’t search or welcome additional cooling in hard work marketplace prerequisites.”“Powell is making an attempt to drag the Fed in a dovish path,” stated Tim Duy, leader US economist at SGH Macro Advisors. “If the financial system have been to all of a sudden gradual, your charges are too prime to regulate to that, to melt that blow.”Monetary markets have been whipsawed Friday after the roles file to start with led buyers to spice up bets for a half-point minimize. The ones bets have been pared again hours later when Fed Governor Christopher Waller instructed a half-point minimize is not likely sooner than the discharge of extra figures within the coming months.The federal government will post two extra per 30 days jobs experiences between the Fed’s September coverage assembly and policymakers’ subsequent accumulating on Nov. 6-7. Traders are recently hanging better-than-even odds on half-point cuts on the November and December conferences.“The Fed has a tendency to be sluggish,” stated Stephen Juneau, an economist at Financial institution of The us. “They don’t need to ship the unsuitable sign to the markets if job continues to be maintaining up, and extensively talking, america financial system nonetheless seems to be doing wonderful.”1 / 4-point minimize this month and two half-point cuts in November and December would depart the objective vary for the central financial institution’s benchmark at 4% to 4.25% — a degree nonetheless smartly above what maximum Fed officers deem “impartial,” protecting force on financial job.Inflation RiskSome Fed officers have signaled in fresh weeks they’re nonetheless fascinated with upside dangers to inflation if the central financial institution cuts charges too temporarily and offers a jolt to financial job. The Fed’s most popular measure of inflation, at 2.5%, stays a bit of above their 2% goal.The ones policymakers too can level to the craze in layoffs, that have remained low in spite of the slowdown in hiring.“Historical past shouts to us that loosening financial coverage upfront is a deadly gambit that may re-light inflation and entrench it within the financial system for lots of months and even years,” Atlanta Fed President Raphael Bostic stated in an essay printed on Sept. 4.For Powell, the slowdown within the hard work marketplace dangers upending what has, till now, been a exceptional feat for the Fed. In 2022 and 2023, it embarked at the maximum competitive tightening cycle in 4 a long time in a bid to curb inflation. Bringing it again to earth with out inflicting a recession could be a unprecedented fulfillment.And pulling that off would possibly rely on the following couple of charge choices.“You must be going now when the rise in unemployment is reasonably extra benign than looking ahead to it to transform so evident that you simply’re already too past due,” stated Neil Dutta, head of economics at Renaissance Macro Analysis.Maximum Learn from Bloomberg Businessweek©2024 Bloomberg L.P.

Fed Will have to Make a decision If Quarter-Level Minimize Will Be Sufficient for Employees